Impressive Tips About Modified Cash Basis Of Accounting Pdf

General purpose financial statements under the cash basis of accounting.

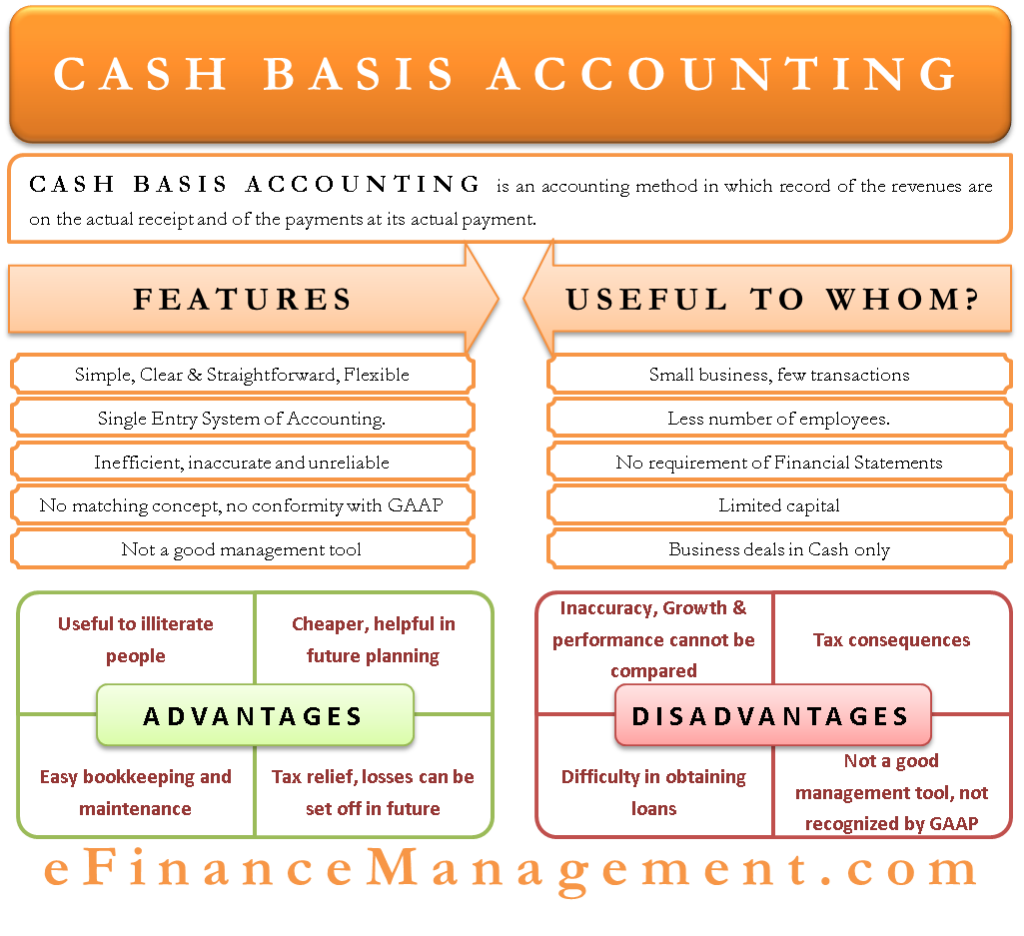

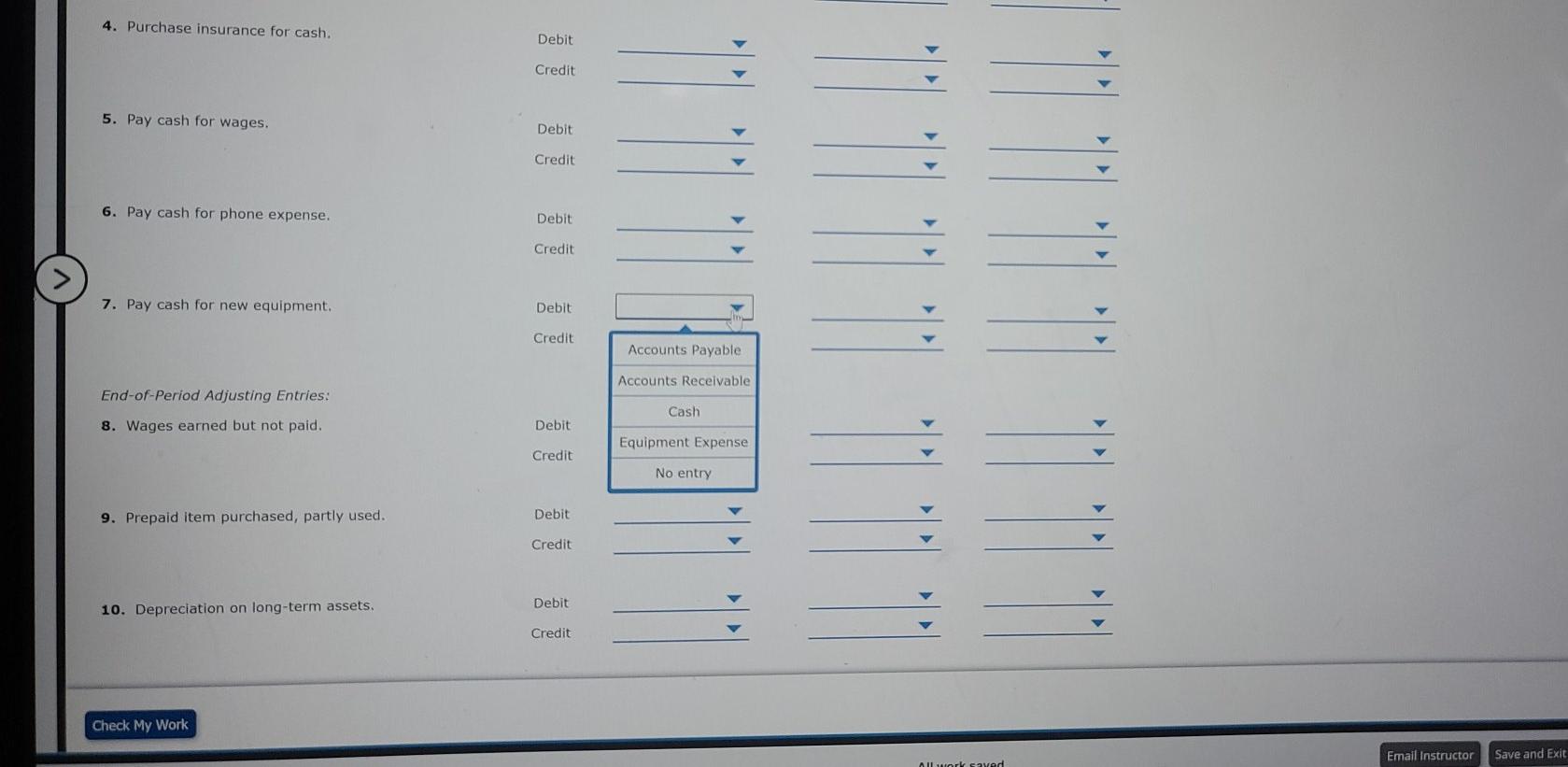

Modified cash basis of accounting pdf. Where there are no significant differences between the cash and accrual basis, the cash basis should be used. What is a modified cash basis? This brief analysis begins by summarizing both systems as presented by.

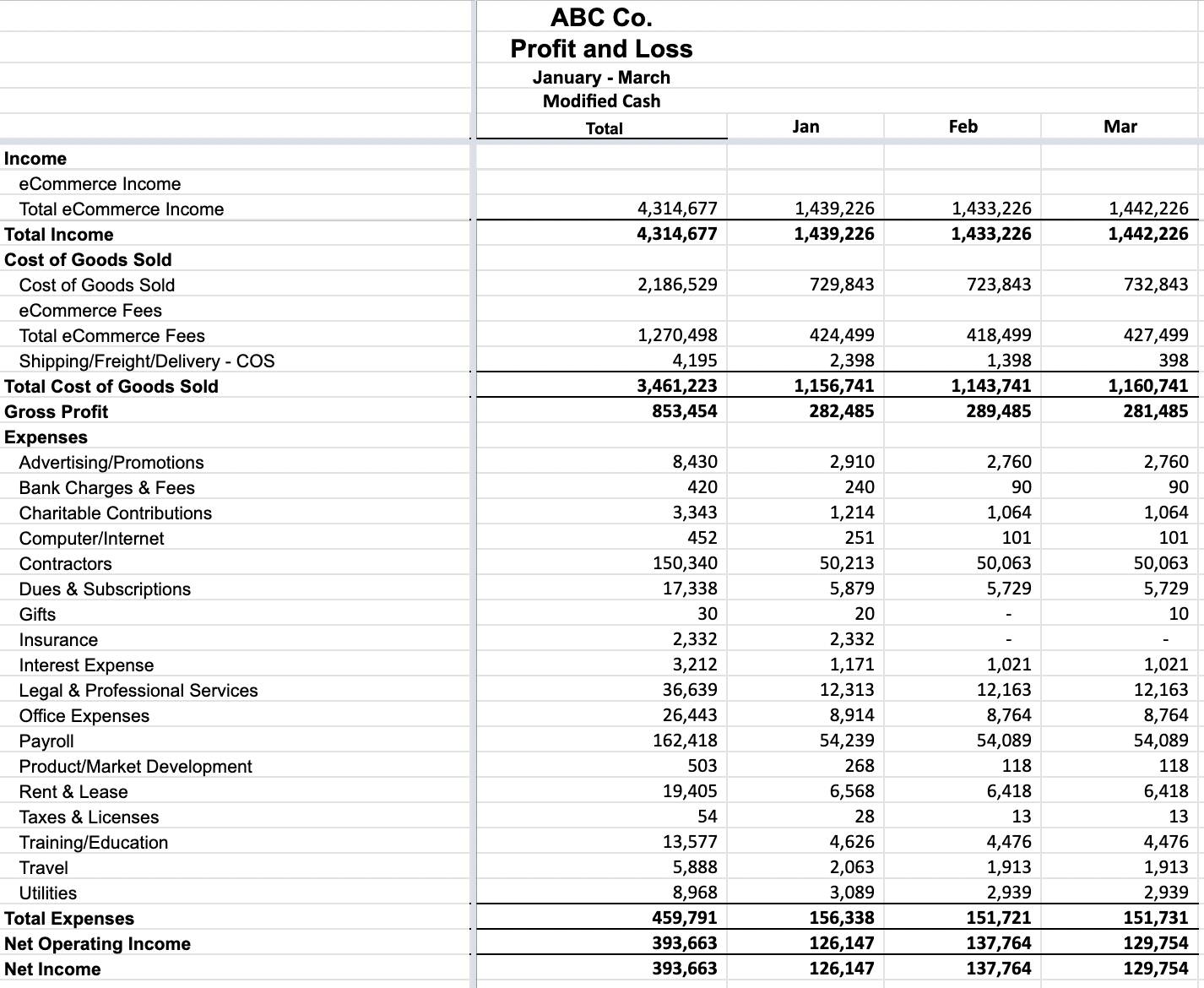

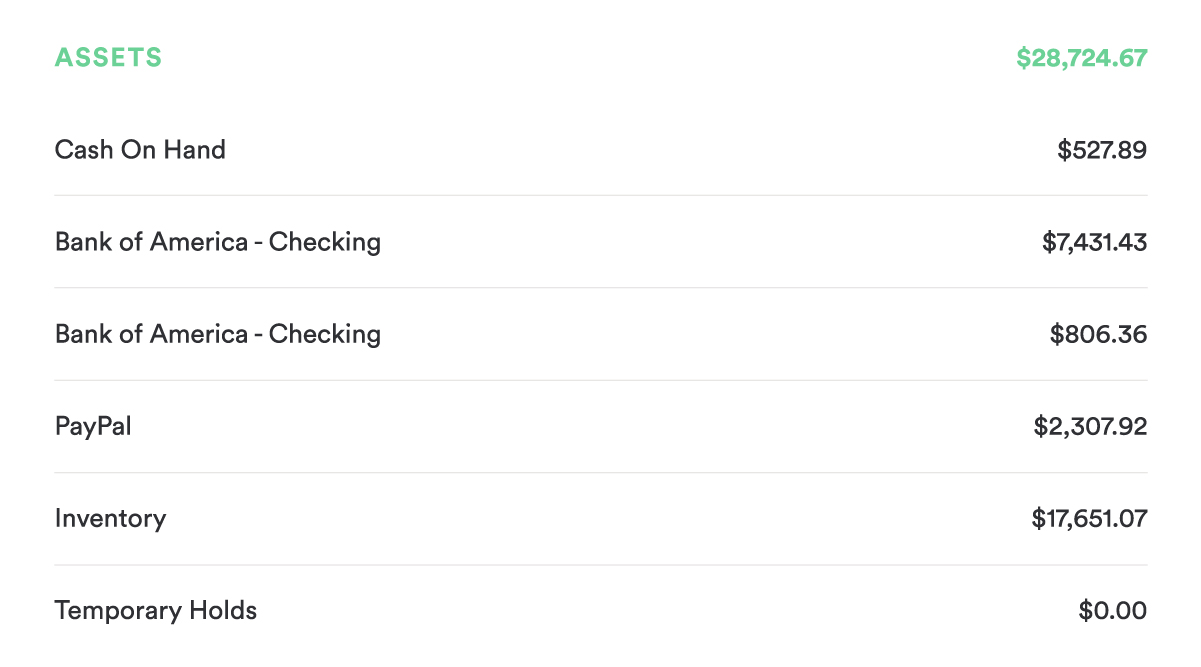

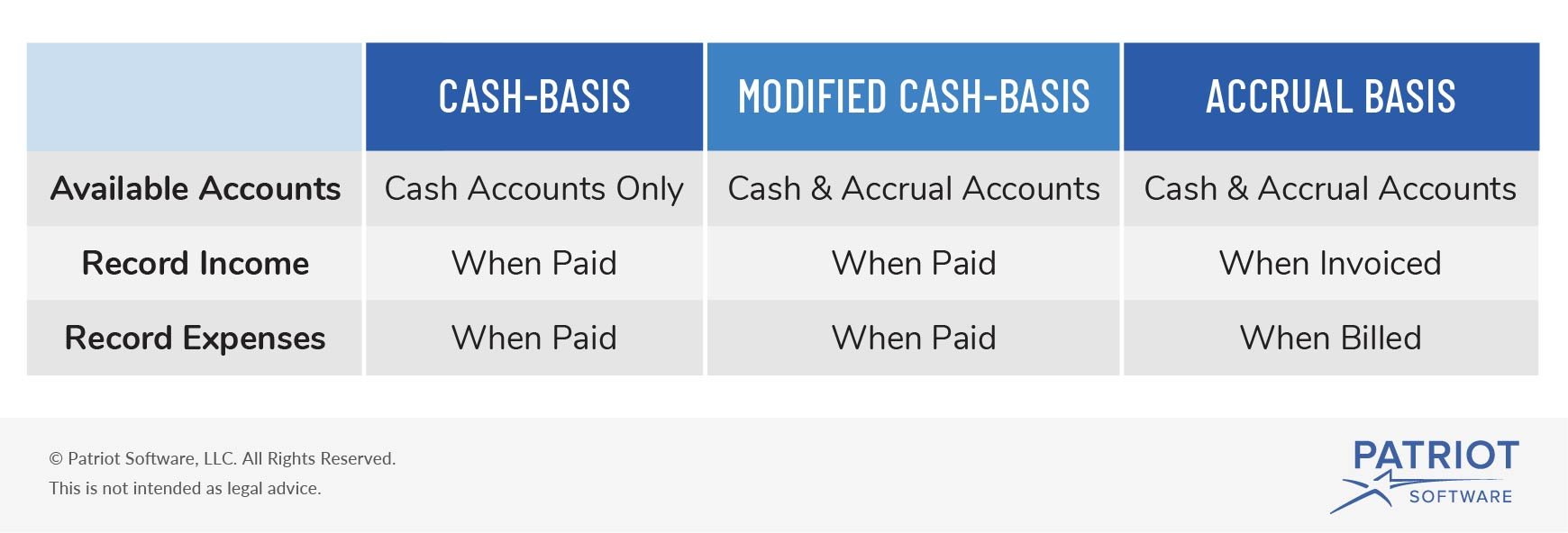

The modified cash basis provides financial information that is more relevant than can be found with cash basis record keeping, and generally does so at less cost. Modified cash basis accounting is an accounting method that combines aspects of both cash and accrual accounting, in which companies record revenues. Enhanced creditworthiness and financing opportunities.

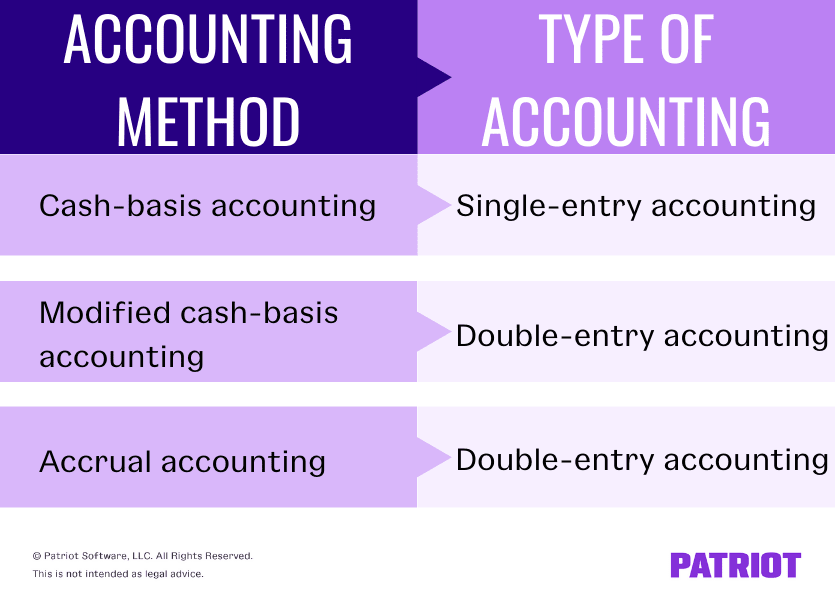

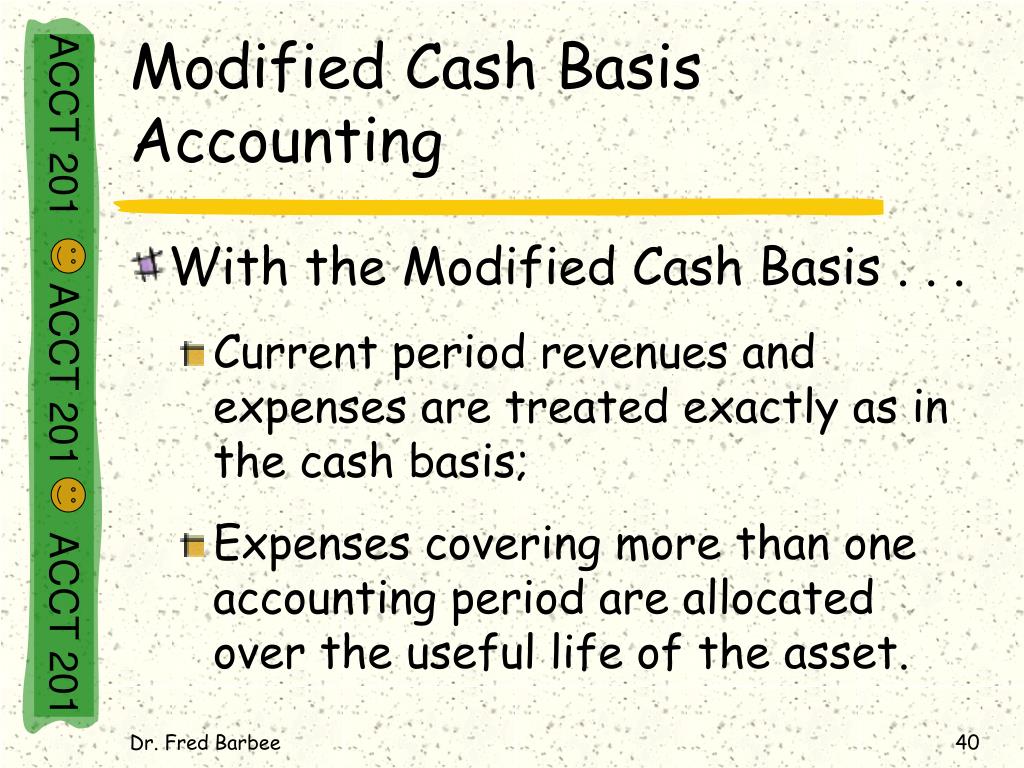

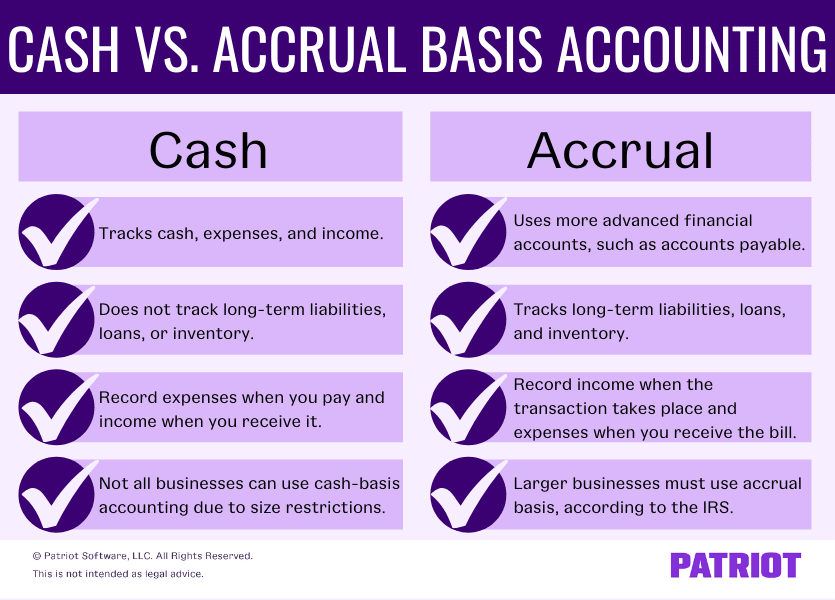

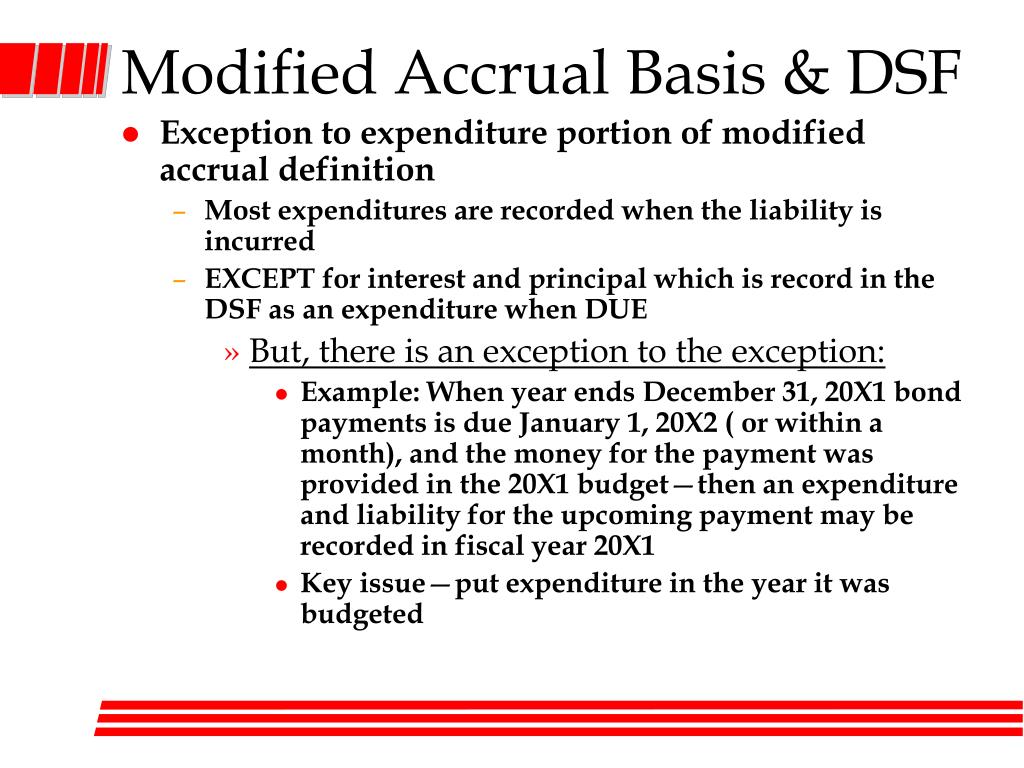

Revenues recognized when measurable and available;. The choice of accounting method determines the. The modified cash basis is a hybrid method such combines features of both the cash basis and the accrual basis.

Modified cash basis refers to an accounting method that utilizes the features of both the accrual and cash basis methods. It defines the cash basis of accounting, establishes requirements for the disclosure of information in. Ipsas the cash basis ipsas comprises two parts.

Two of the primary accounting systems that permeate the public sector are cash basis and accruals basis. Modified cash basis is a term in accounting that combines two major bookkeeping practices: Modifications to the cash basis accounting.

Management is responsible for the preparation and fair presentation of these financial statements in accordance with the modified basis of cash receipts and disbursements. The adoption of accrual accounting significantly boosts a small business’s appeal to lenders and. This report introduces two general methods of accounting—the cash basis method and accrual basis method.

This revised version of the cash basis ipsas implements the proposals made in exposure draft 61, amendments to financial reporting under the cash basis. Part 1 identifies the requirements that must be adopted by a reporting entity that wishes to assert that its financial statements. Where there are material differences, however,.

Secondary information therefore generally provides information about elements that would have qualified for recognition. The adoption of ipsas by. Unlimited viewing of the article/chapter pdf and any associated supplements and figures.

We have audited the accompanying financial statements of the gerber foundation, which comprise the statements of. Report on the financial statements. Application of the modified cash basis of accounting.

Single chapter pdf download $42.00.

:max_bytes(150000):strip_icc()/Modified-cash-basis-4192797-primary-final-230f2cc9c4f947cba79fa4d83fdb10cf.png)

:max_bytes(150000):strip_icc()/final5468-d59a89b4ff49437d99fe74b841514308.jpg)