Underrated Ideas Of Tips About Need For Ifrs

In this way, the need for the ifrs framework guarantees a more prominent level of duty presented in the financial announcing and revelation framework.

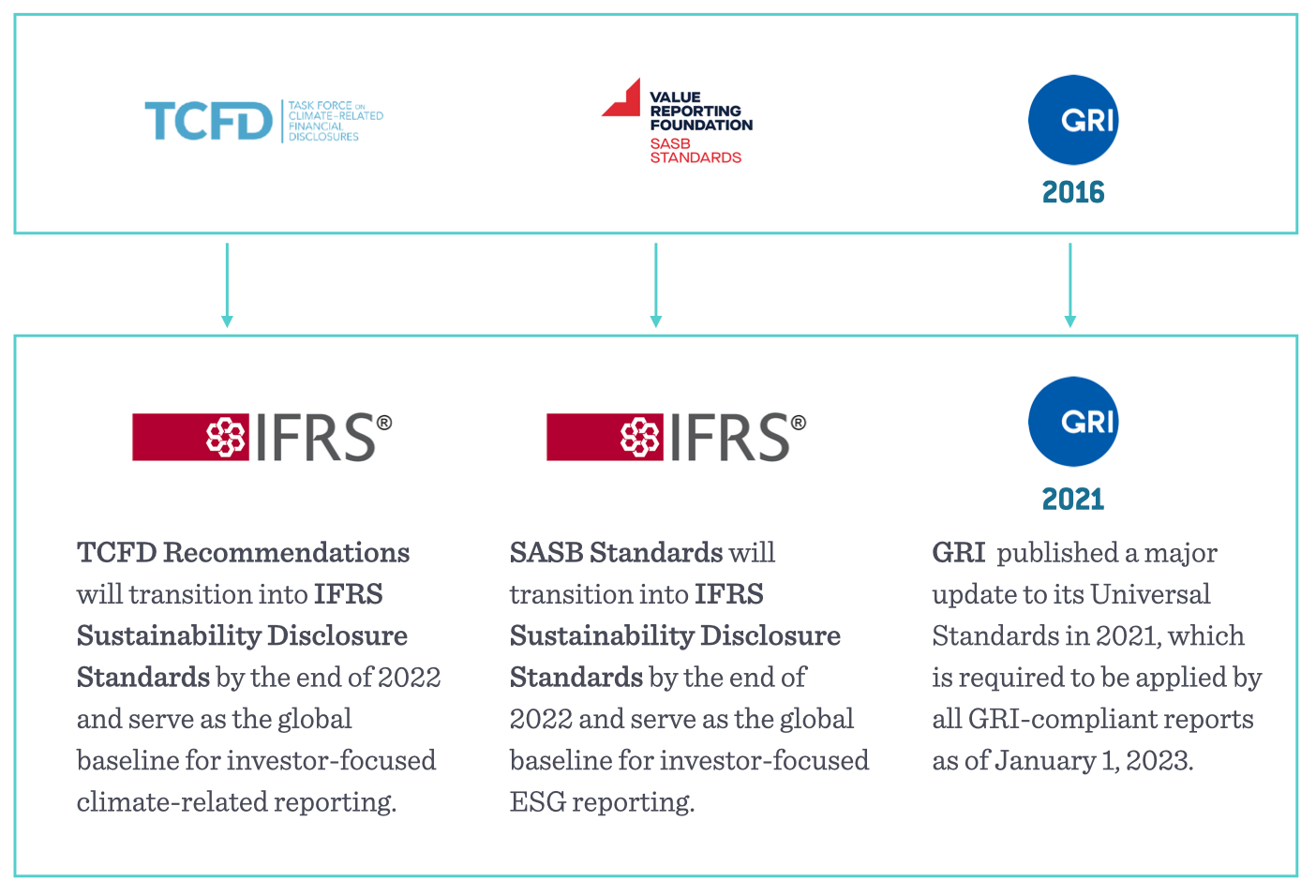

Need for ifrs. Find an overview of international financial reporting standards. The issb is responsible for developing ifrs sustainability disclosure standards, to provide a truly global baseline of sustainability disclosures to further inform economic and. (b) assist preparers to develop consistent accounting policies when no standard applies to a particular transaction or other event, or when a standard allows a choice of accounting policy;

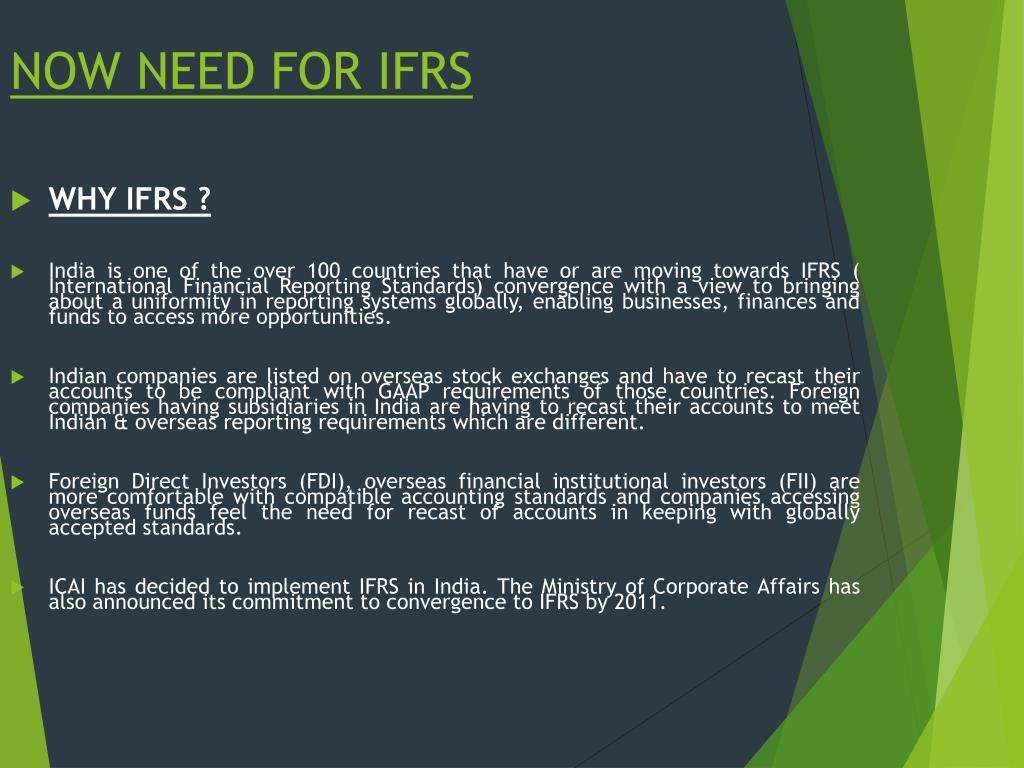

What are ifrs and its purpose? The ifrs foundation intends to include a mix of geographic. In preparation for the adoption of ind as 117, the equivalent to ifrs 17 'insurance contracts', the insurance regulatory and development authority of india (irdai) has announced the reconstitution of its expert committee dedicated to the implementation of indian accounting standards (ind as) and.

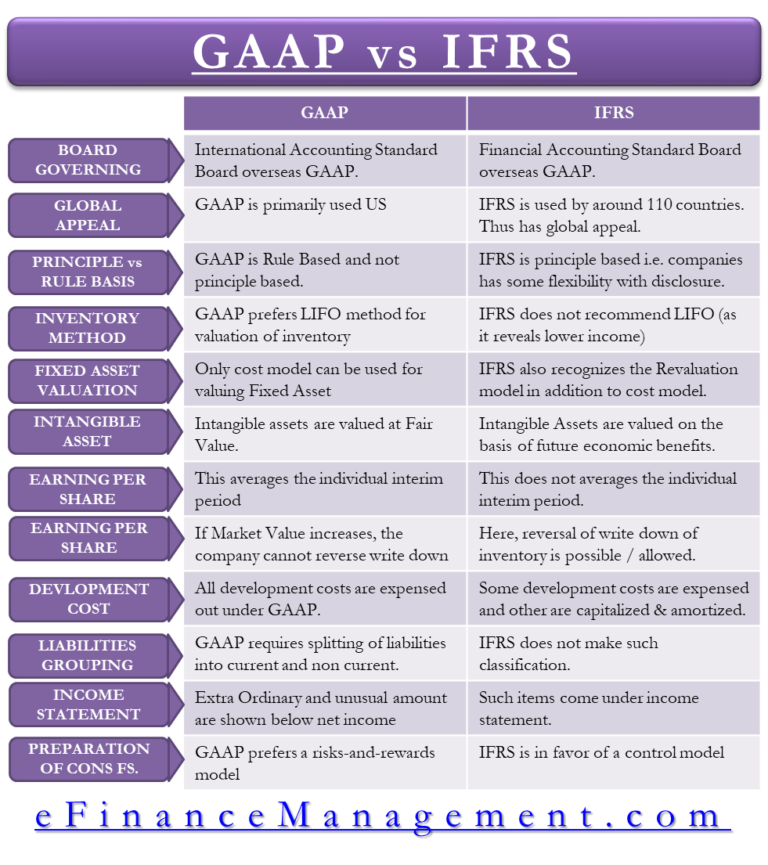

To ensure a general understanding of best accounting practices to make the financial statements reliable, comparable & transparent to standardize financial accounting & reporting across the globe to promote foreign investment & spur industrial growth Ifrs 8 requires particular classes of entities (essentially those with publicly traded securities) to disclose information about their operating segments, products and services, the geographical areas in which they operate, and their major customers. Register with us to receive free access to the hmtl and pdf files of the current year's consolidated issued ifrs accounting standards and ifric interpretations (part a), the conceptual framework for financial reporting and ifrs practice statements, and available translations of standards.

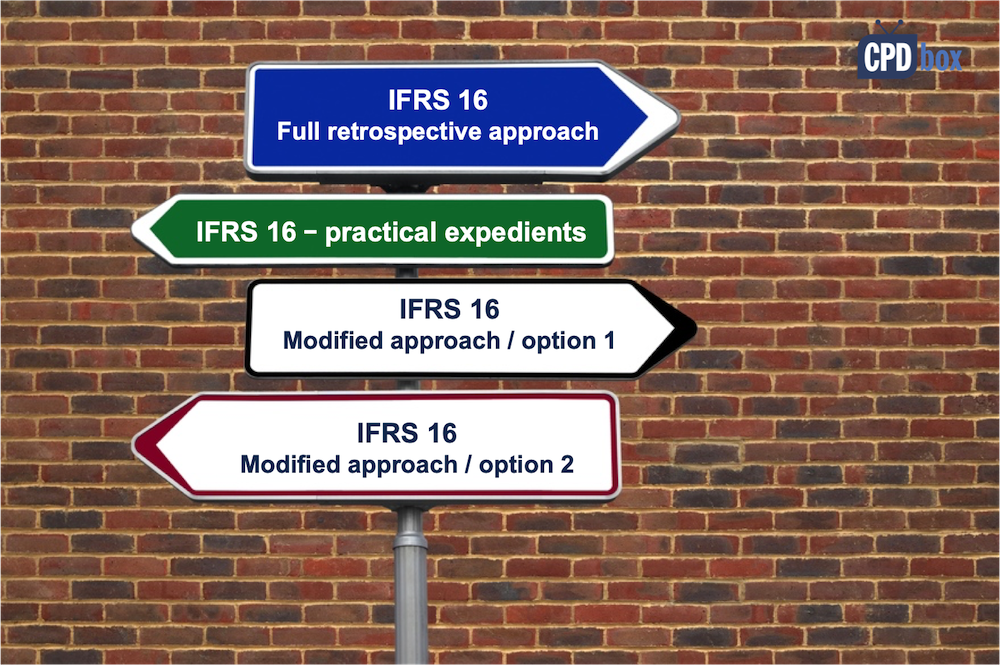

The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months or less or the underlying asset has a low value. Ifrs 15 was issued in may 2014 and applies to. It is a set of rules and guidelines that every firm has to adhere to ensure their financial statements are consistent with other firms worldwide.

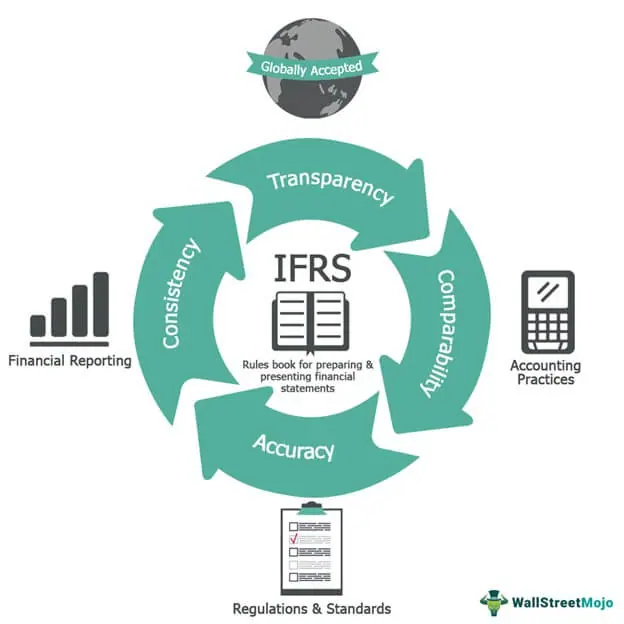

The ifrs foundation is seeking members to join the ifrs sustainability reference group (srg) from 2024. 3353113), and is registered as an overseas company in england and wales (reg no: As the name suggests, its purpose is effective, efficient, and accurate reporting of financial statements using standard accounting principles to ensure transparency, consistency, growth, and interest of public services.

It strengthens accountability by reducing the information gap between providers and users of the capital. With this second survey, efrag invites users of financial statements to provide their views on the usefulness of information as a result of the. International financial reporting standards enquiries call @ +971 45 570 204 / email us :

As a source of globally comparable information, ifrs accounting standards are also of vital importance to regulators around the world. Ifrs 16 specifies how an ifrs reporter will recognise, measure, present and disclose leases. The term ifrs is an acronym for international financial reporting standards.

International financial reporting standards (ifrs) are a set of accounting rules for the financial statements of public companies that are intended to make them consistent, transparent, and. Some ifrs standards and amendments are adopted by the european union (eu) with an effective date later than that established by the iasb. Ifrs is the abbreviation for international financial reporting standards.

Ifrs 15, revenue from contracts with customers, is a new standard that outlines a single comprehensive framework for entities to use in accounting for revenue arising from contracts with customers.it supersedes current revenue recognition guidance including ias 18, revenue and ias 11, construction contracts and related interpretations. And ifrs accounting standards contribute to economic efficiency by helping investors to identify opportunities and risks across the world, thus improving capital allocation. Benefits of ifrs standards:

Backing this up is information about the board and an analysis of the use of ifrs standards around the world. However, its requirements of when and if to undertake an impairment. However, ias 36 ‘impairment of assets’ requires assets to be carried at no more then their revalued amount and any difference to be recorded as an impairment.