Build A Info About Balance Sheet Opening

The sync option in the opening balances page sync all your data created before your opening balance date and adjust your balances accordingly.

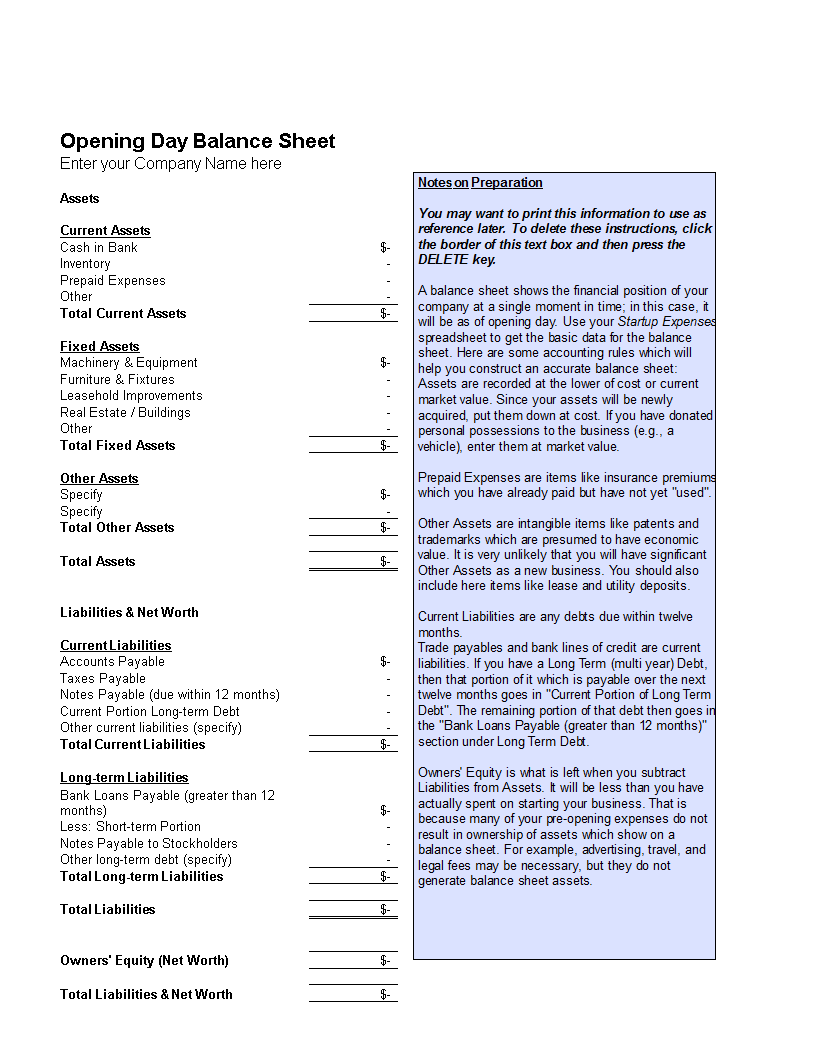

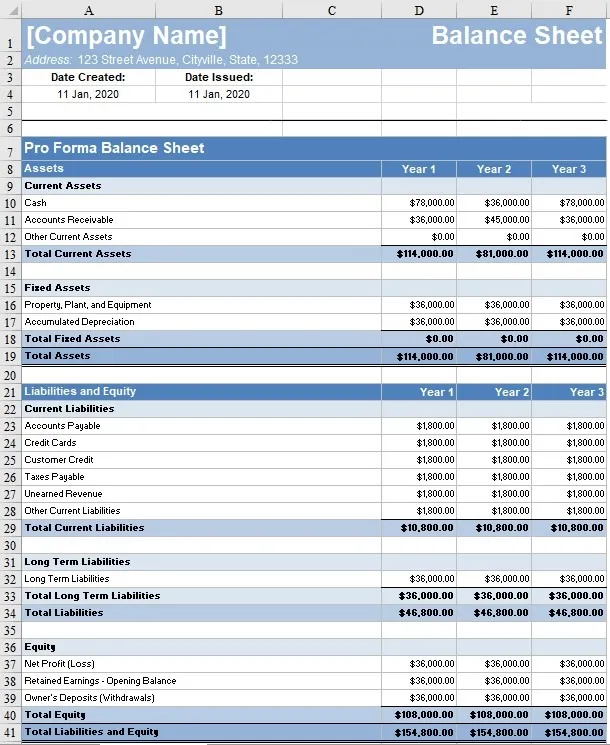

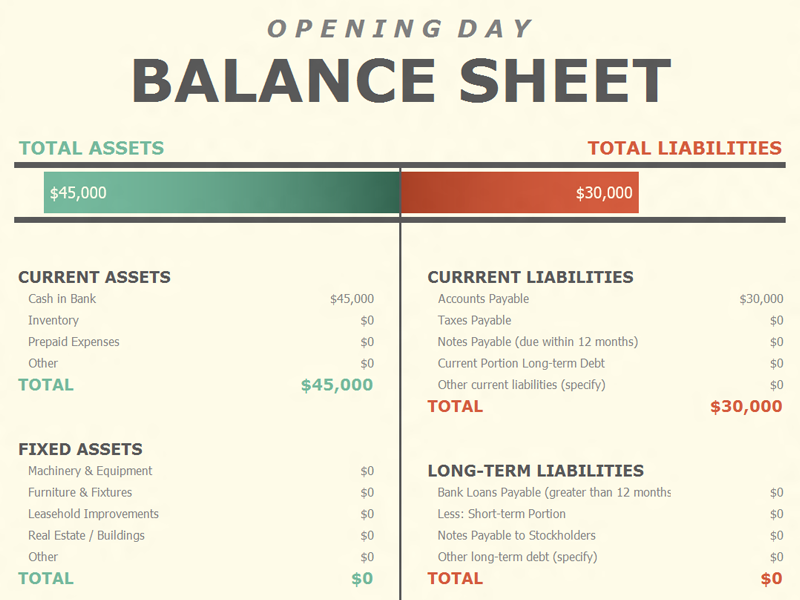

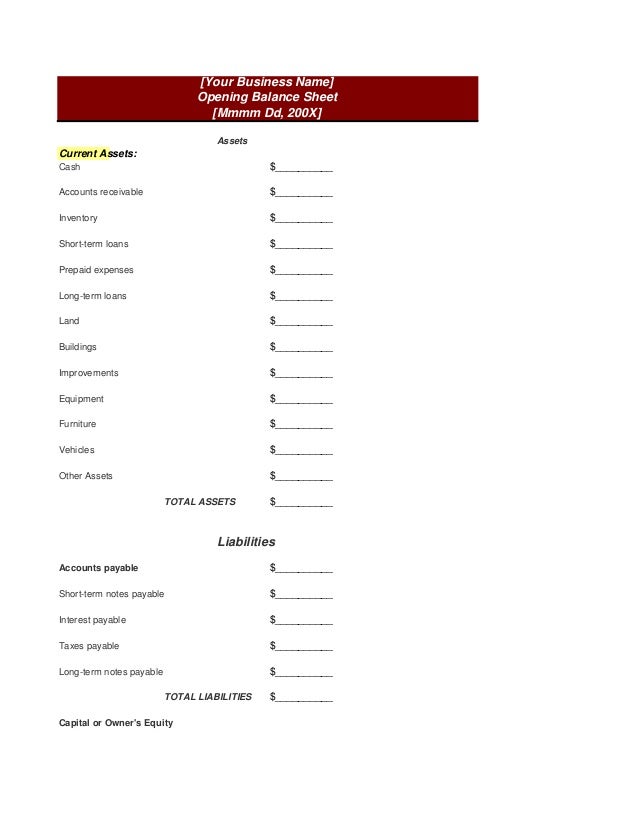

Balance sheet opening balance. The group, posting results that showed operating profit hit a record last year, said its leverage ratio fell to 1.2 in the fourth quarter from 1.5 a year earlier, and launched a share buyback. Your opening balance sheet will list all of your company assets and liabilities. The opening balance is usually that balance that is brought forward at the beginning of an accounting period from the end of a previous accounting period.

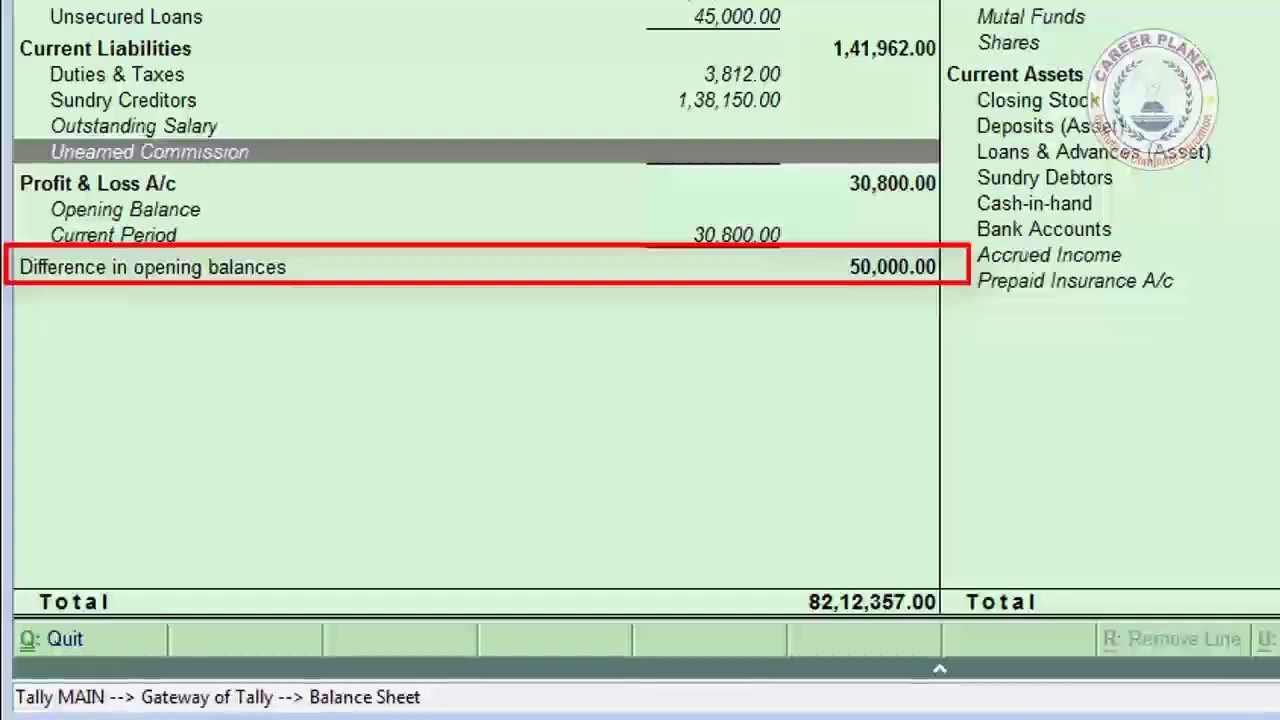

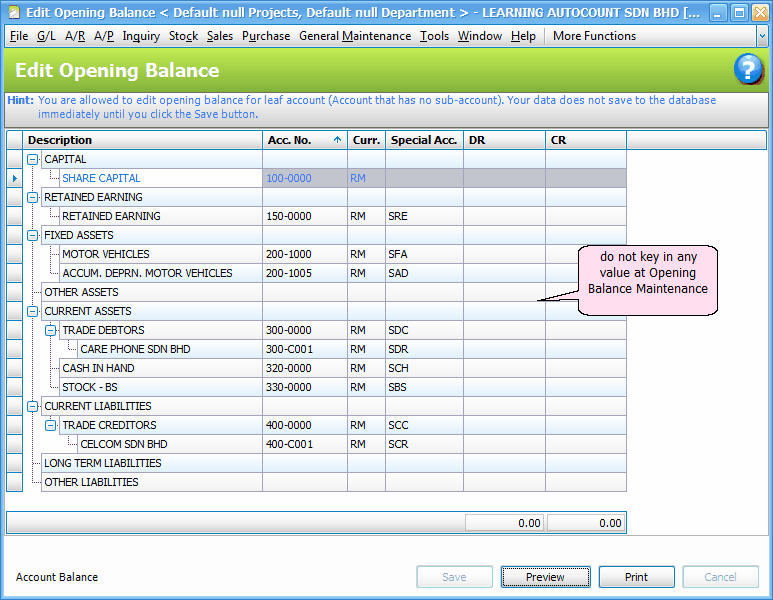

Debit obe, credit owner/partner equity. At that point obe should be zero, and it should stay that way. These are accounts reported on a balance sheet under assets, liabilities, and equity.

Let’s consider a practical example to illustrate the opening balance calculation. Creating an opening balance sheet. It is allowing up to $95 billion in treasury and mortgage bonds to.

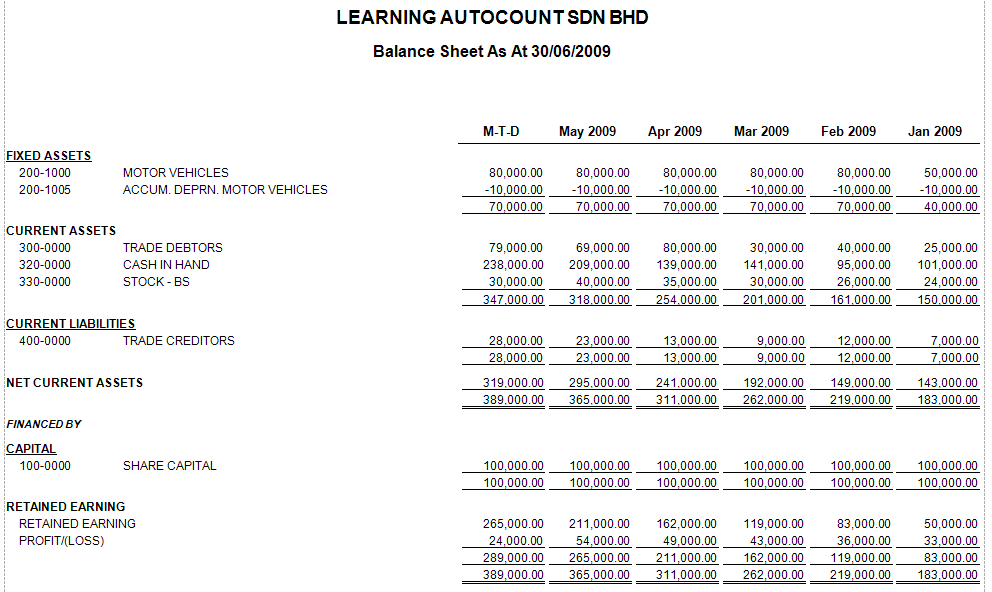

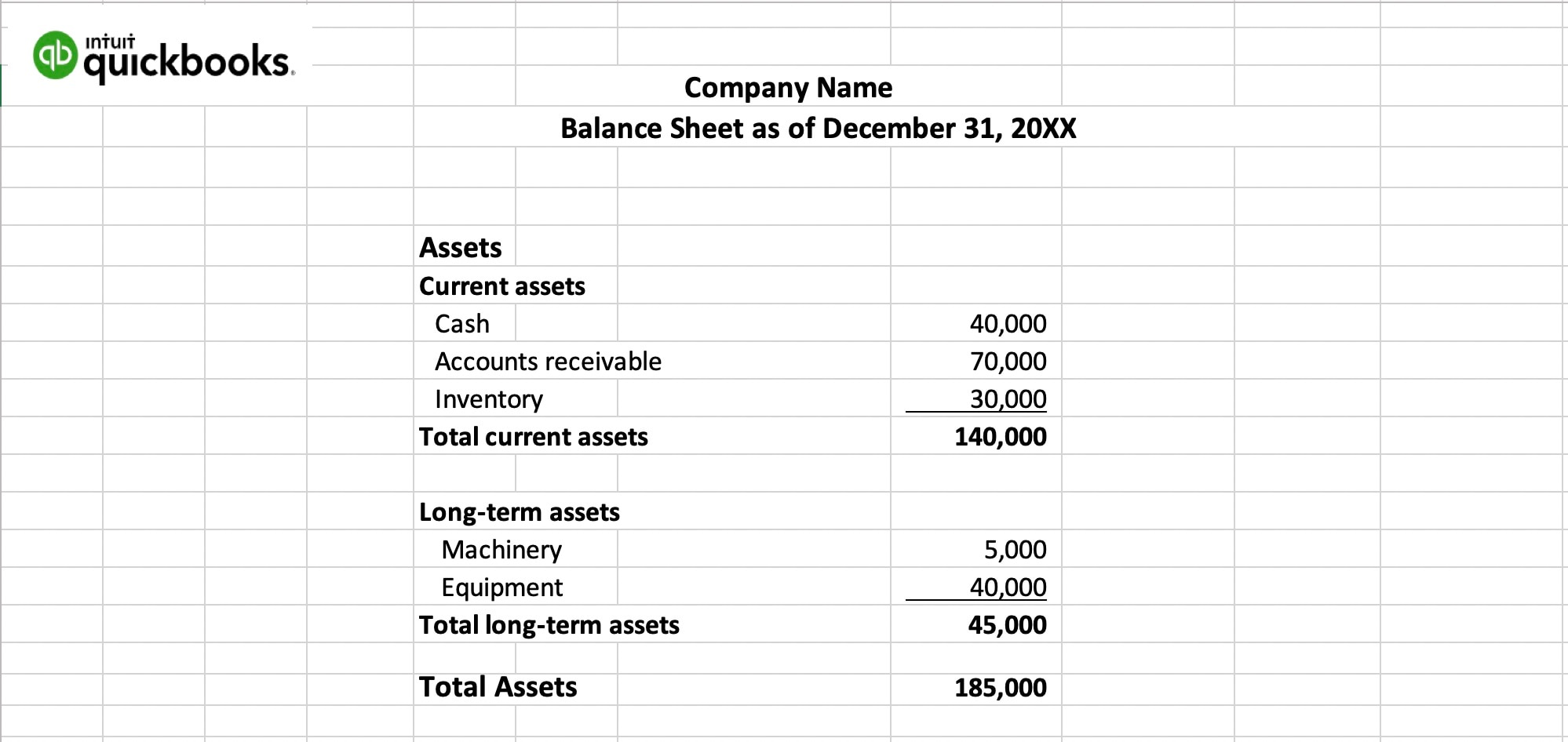

Your opening balance is how much money your business has at the start of a specified accounting period. In this case, the last entry in the old accounts is the opening balance in the new accounts. The company’s balance sheet is an accounting report that shows a company’s assets, liabilities, and shareholders’ equity.

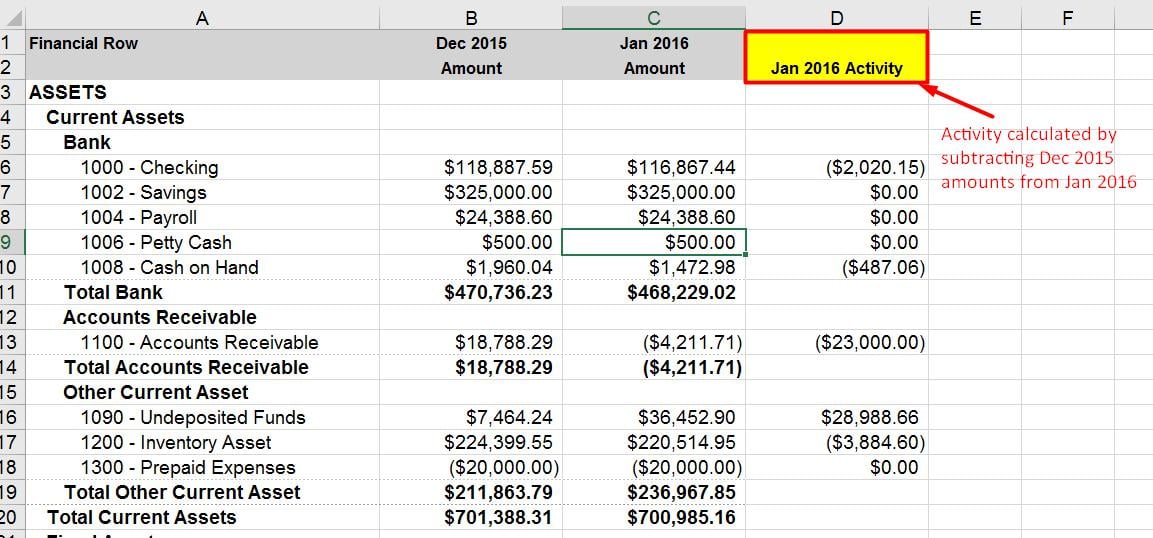

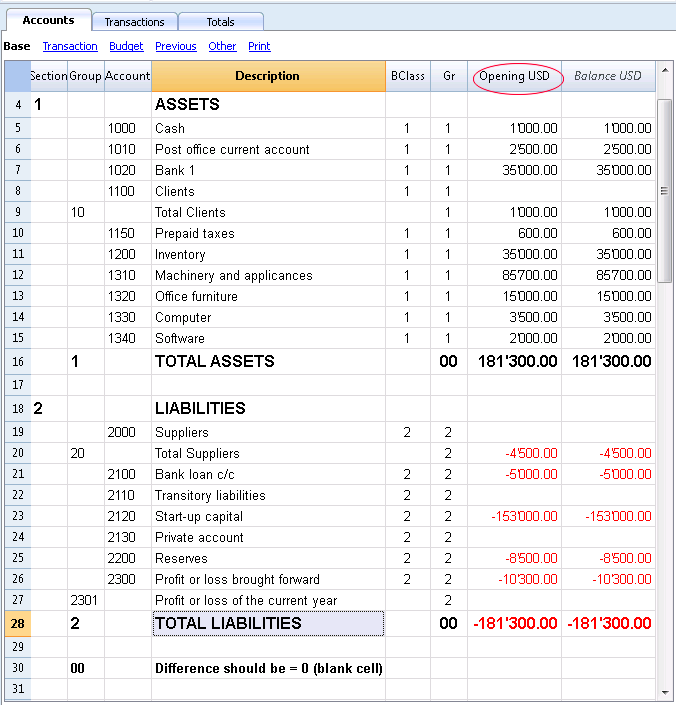

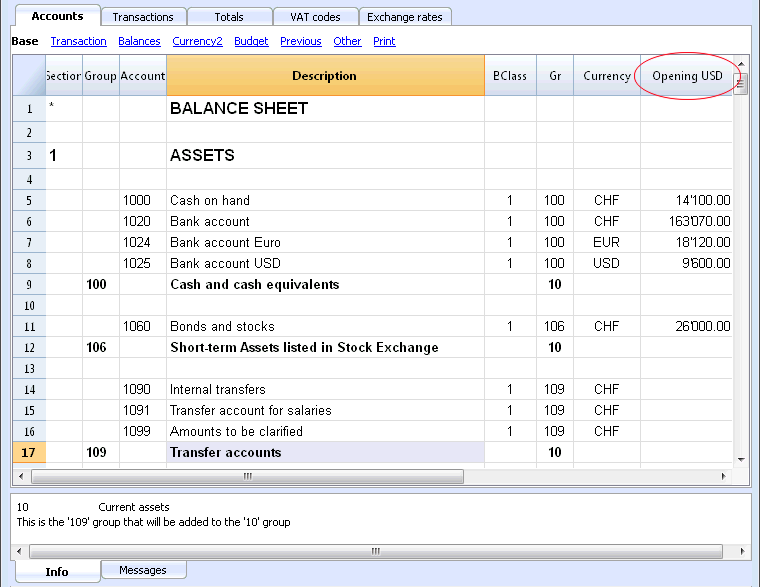

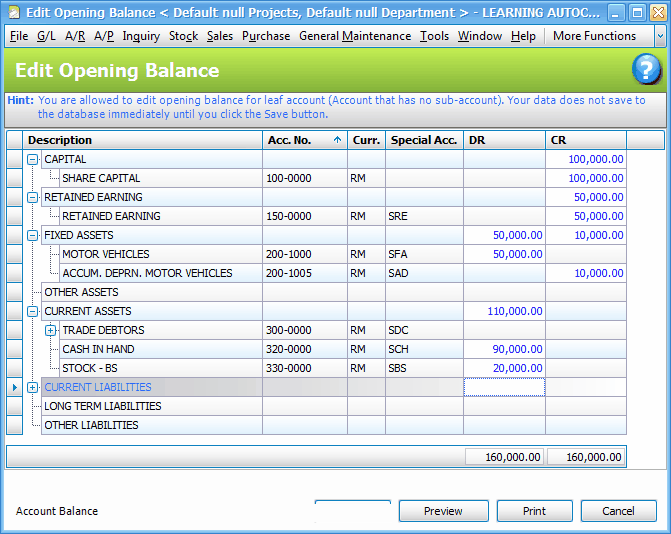

This template support video show you how to enter opening balance sheet account balances in our accounting templates. These amounts can never be uneven. While this equation is the most common formula for balance sheets, it isn’t the only way of organizing the information.

The fed has been reducing the size of its holdings since 2022. In this example, xyz mart’s opening balance for the accounting period is $60,000. These balances are usually carried forward from the ending balance sheet for the.

It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near $9 trillion reached in early 2022.

This means your assets equal liabilities plus owner's equity. For life insurers, the opening balance sheet position will have a significant influence on. The opening balance is the amount of capital or fund in a company’s account at the start of a new financial period.

The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide stimulus beyond the near zero. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. The closing balance is the amount remaining in an account at the end of an accounting period.

Based on provisional unaudited data. Fed minutes suggest officials are seeking smallest balance sheet possible. What is an opening balance sheet?