First Class Tips About Cash Flow Statement India

Gain valuable insights into anka india annual cash flow and financial.

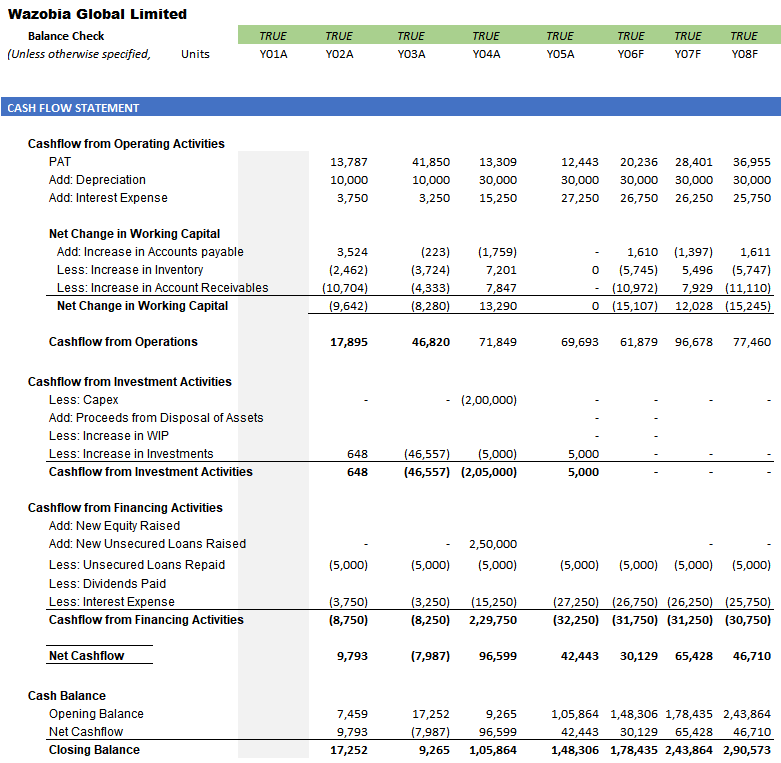

Cash flow statement india. Learningobjectives after studying this chapter , you will be able to : The objective of this standard is to require the provision of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows which classifies cash flows during the period from operating, investing and financing. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a. Ind as 7 prescribes the requirements for preparation of statement of cash flows which shall be presented as an integral part of the financial statements. The cash flow statement (cfs) is one of the essential financial documents that provide valuable insights into a company's liquidity, solvency, and overall financial.

Management of a company’s cash position eg: Cash equivalents are short term, highly liquid investments that are readily convertible into known amounts of cash and which are subject to an. Get to know the definition of cash flow statement, what it is, the advantages, and the latest trends.

A cash flow statement is one of three mandatory financial reports generated by every business organization monthly, quarterly,. What is a cash flow statement? Discover anka india cash flow statement and analyze its free cash flow.

Definitions cash and cash equivalents presentation of a cash flow statement operating activities investing activities financing activities reporting. Indian accounting standard (ind as) 7 statement of cash flows. Anka india cashflow:

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). (this indian accounting standard includes paragraphs set in bold type and plain type, which have equal.

It portrays how a business can. How well a company generates cash to pay its debtors and fund its operating expenses, is what a cash flow. The term cash flow statement is a core concept under trading.

A typical cash flow statement comprises three sections: Changes in cash and cash equivalents of an enterprise by means of a cash flow statement which classifies cash flows during the period from operating , investing and financing. 45,502.40 620.15 ( +1.38 %)

The statement of cash flows acts as a bridge. Cash flow of the company = net cash flow from operating activities + net cash flow from investing activities + net cash flow from financing activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)