Underrated Ideas Of Tips About Common Stock In Cash Flow Statement

During stock splits, for instance, a company issues.

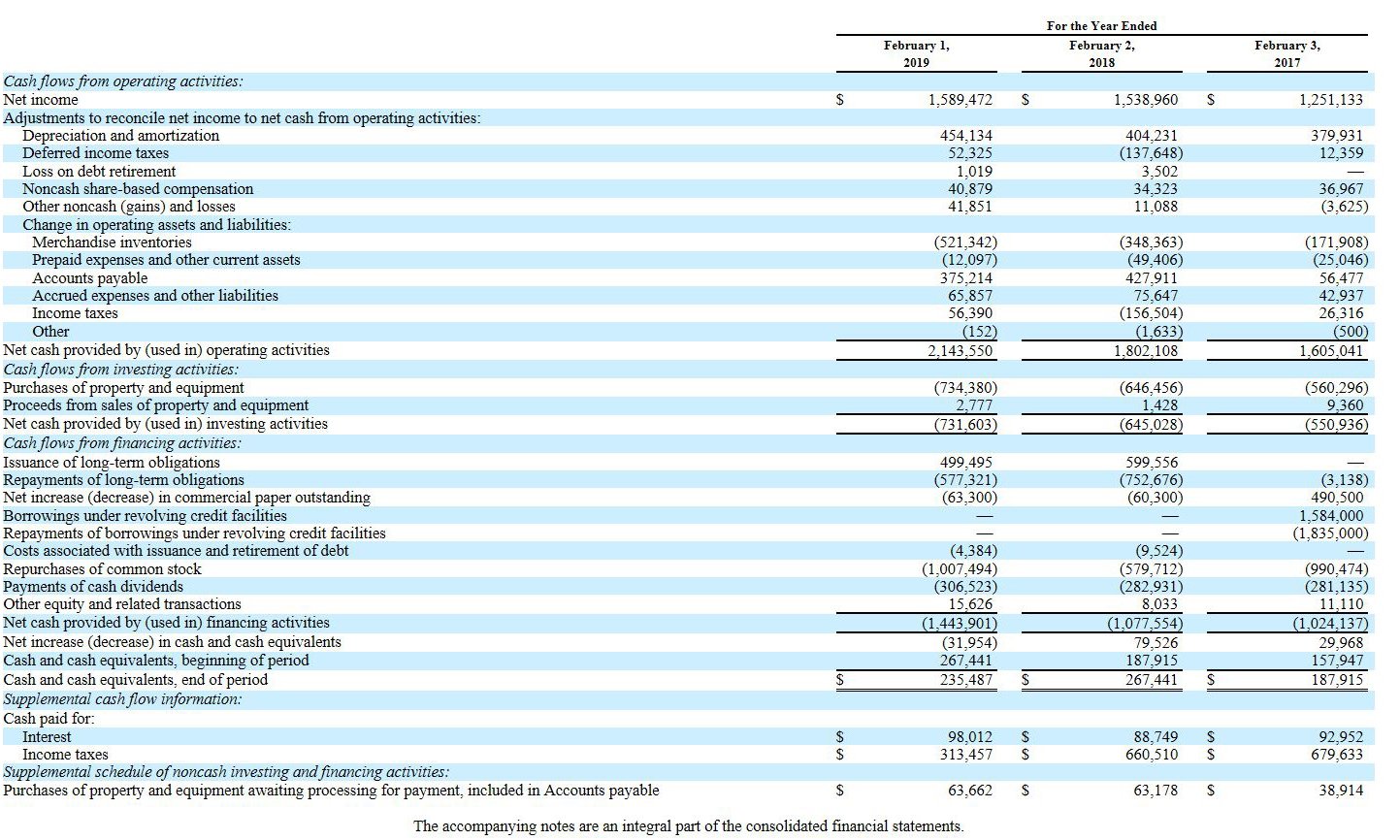

Common stock in cash flow statement. The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time. The three common sections of a company’s cash flow statement are cash flows from operating expenses, cash flows from investing activities, and cash flows from financing activities. The largest line items in the cash flow from financing activities statement are dividends paid, repurchase of common stock, and proceeds from the issuance of debt.

Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in less than 10 months, according to. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

It tells you how cash moves in and out of a company's accounts via three main channels: It reflects certain captions required by asc 230 (bolded), and other common captions. In example corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $ (260,000) + $90,000.

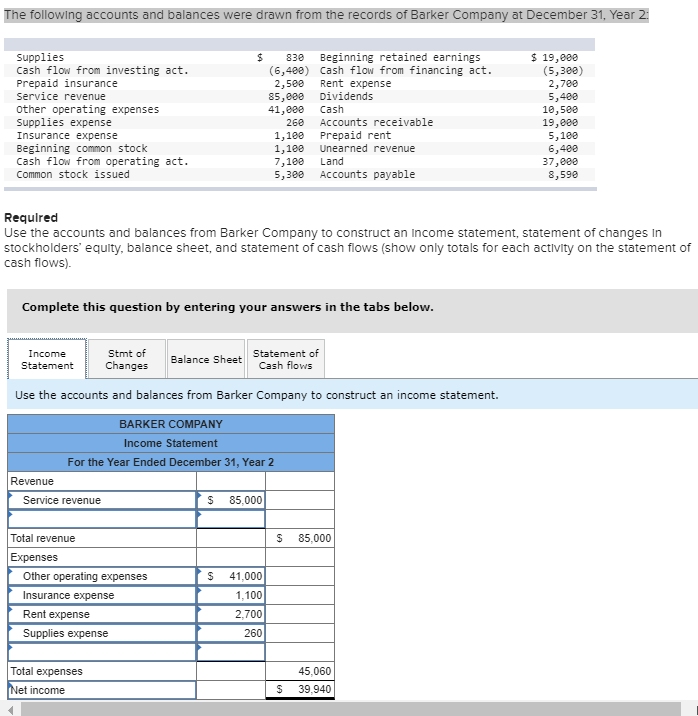

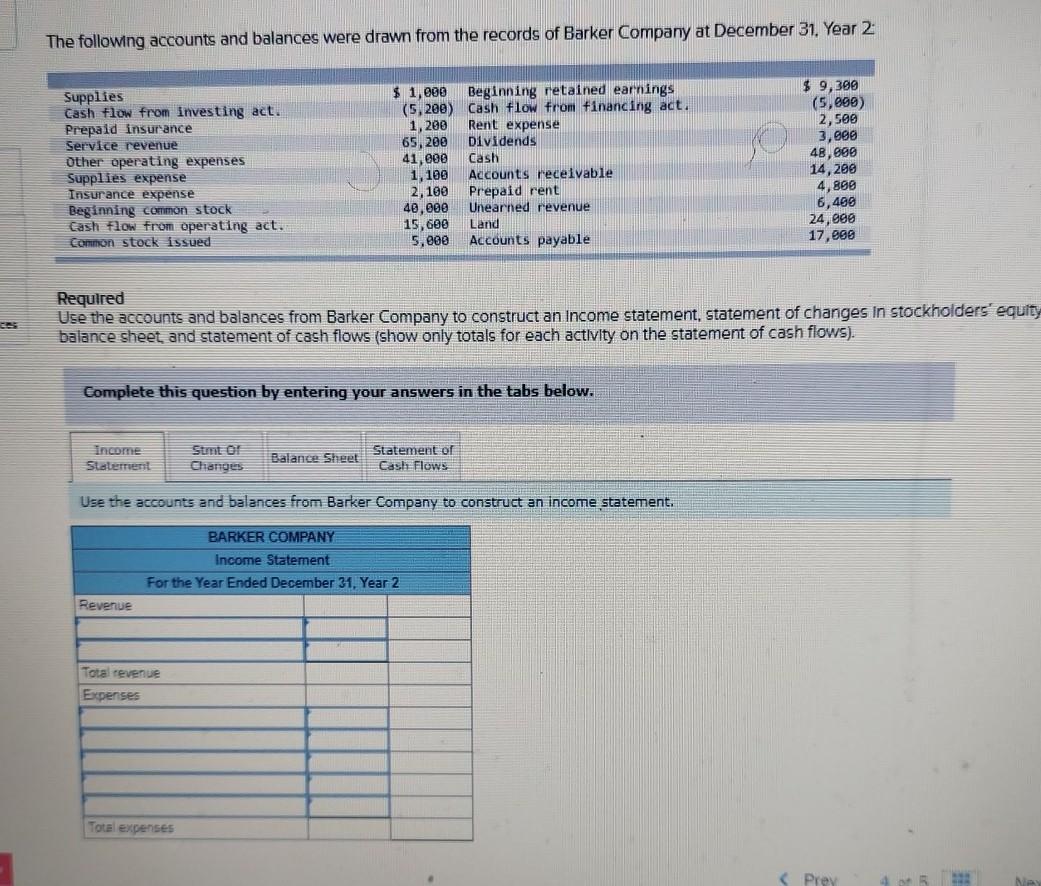

Financials in millions cny. Record adjusted ebitda margin fourth. The statement of cash flows is prepared by following these steps:.

Let’s take a closer look at each one. Common stock should be recognized on its settlement date (i.e., the date the proceeds are received and the shares are issued). How issuing common stock can increase cash flows.

Although issuing common stock often increases cash flows, it doesn't always. Detailed cash flow statements for jianpu technology inc (jtchy), including operating cash flow, capex and free cash flow. Now that you understand what comprises a cash flow statement and why it’s important for financial analysis, here’s a look at two common methods used to calculate and prepare the operating activities section of cash flow statements.

Dividend payments are a common outflow in this section, as are stock buybacks. Upon issuance, common stock is generally recorded at its fair value, which is typically the amount of proceeds received. Using the indirect method, operating net cash flow is calculated as follows:.

If a company issues new common stock, it is included in this part of the cash flow statement. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

During stock splits, for instance, a company issues new shares that it. Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities. Financials are provided by nasdaq data link and sourced from audited reports submitted to the securities and exchange commission (sec).

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Figure 16.2 issuance of a share of common stock for cash. The cfs highlights a company's cash management, including how well it generates.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)