Neat Tips About Balance Sheet Of A Company

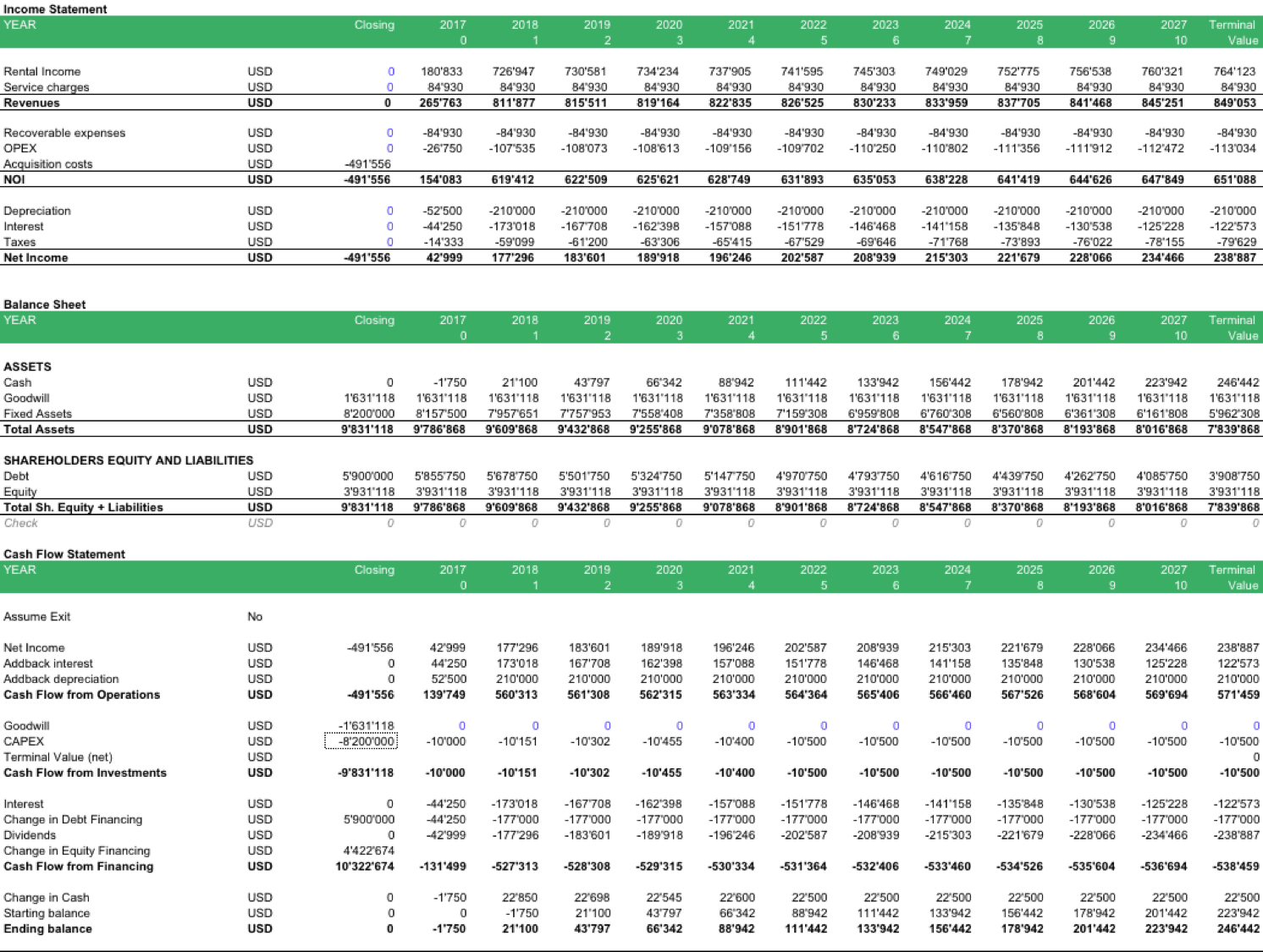

Along with the income statement and cash flow statement, the balance sheet completes the trifecta of business reports crucial to managing a company’s success.

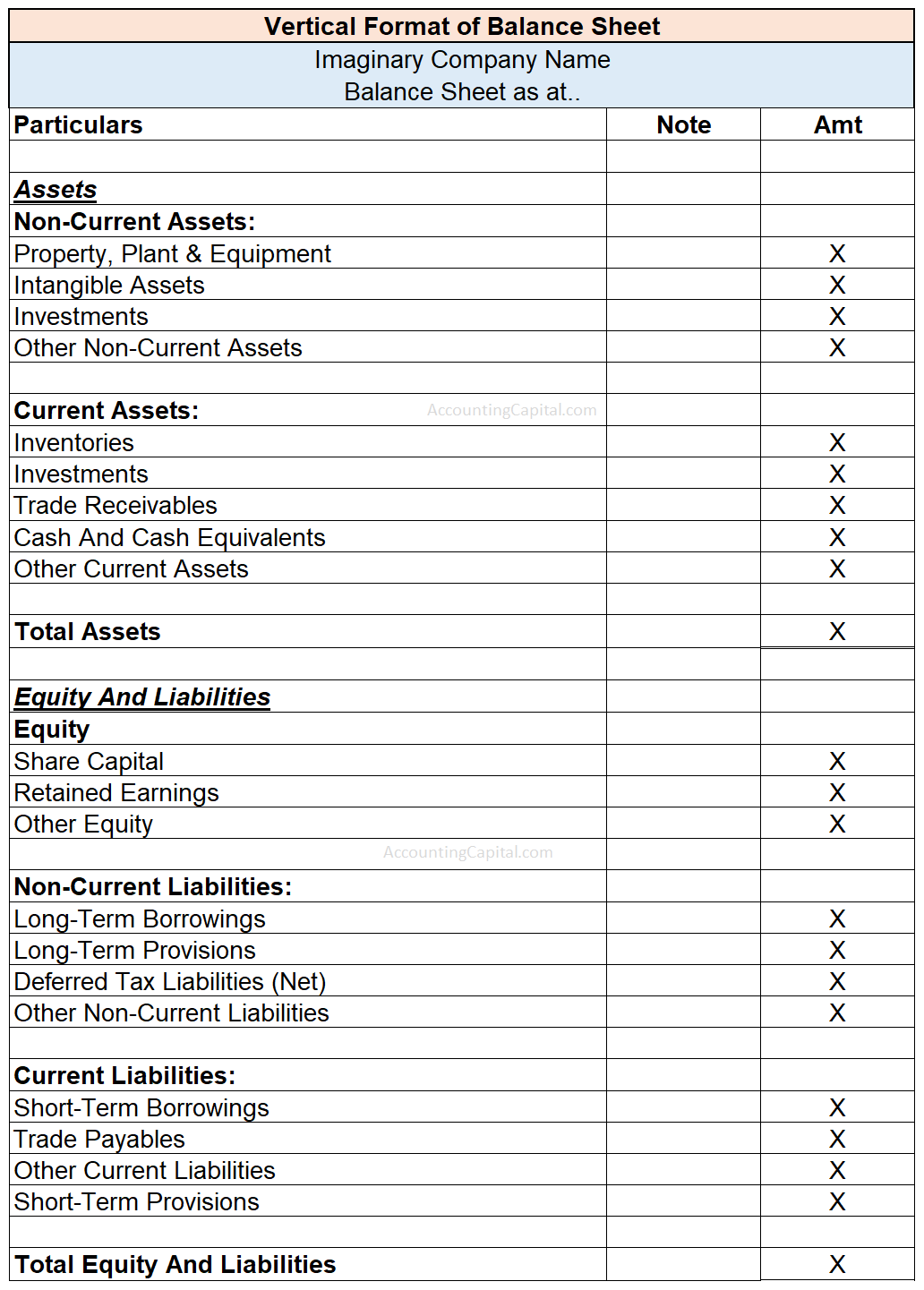

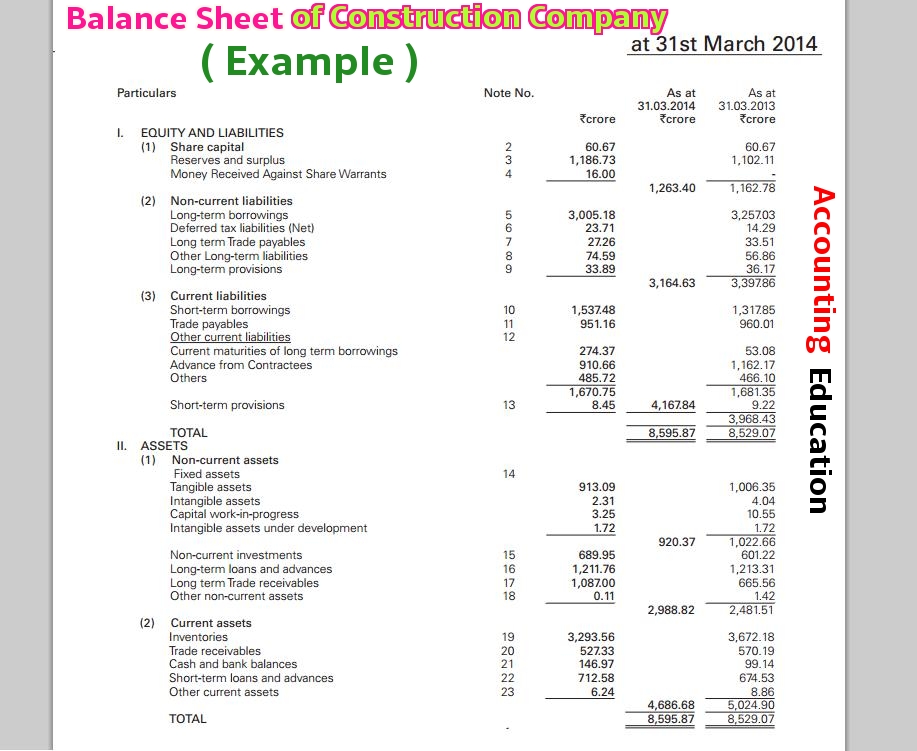

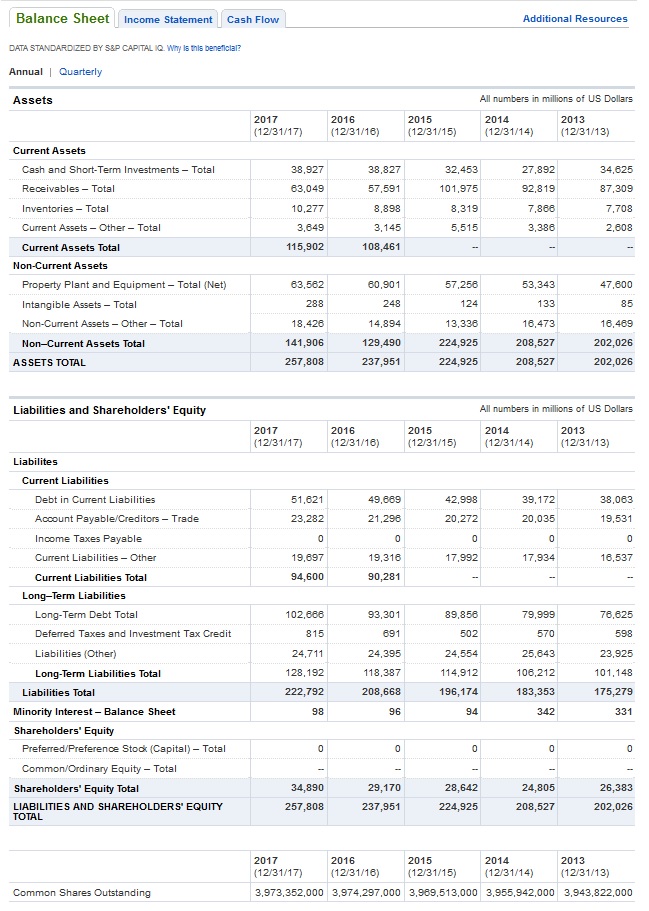

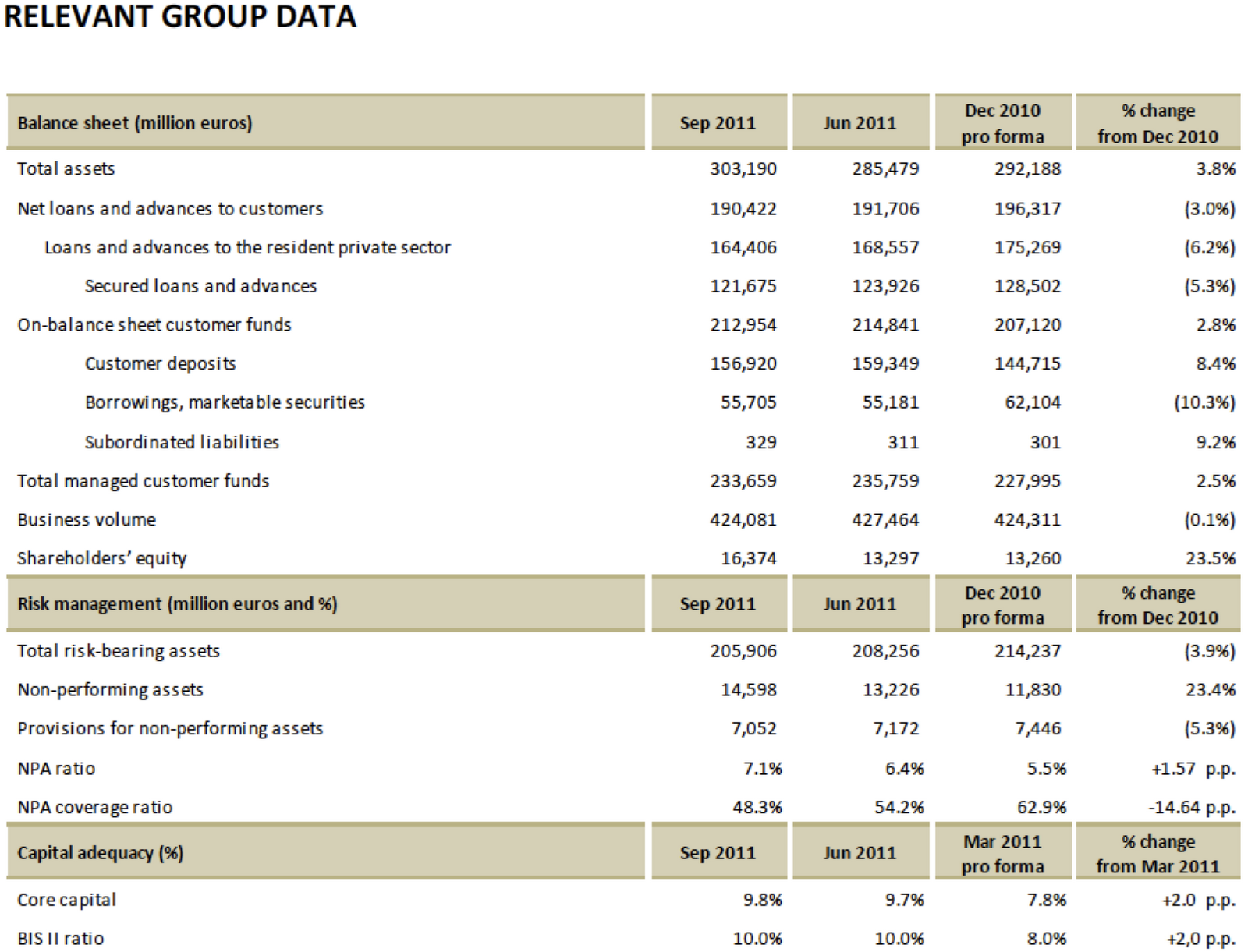

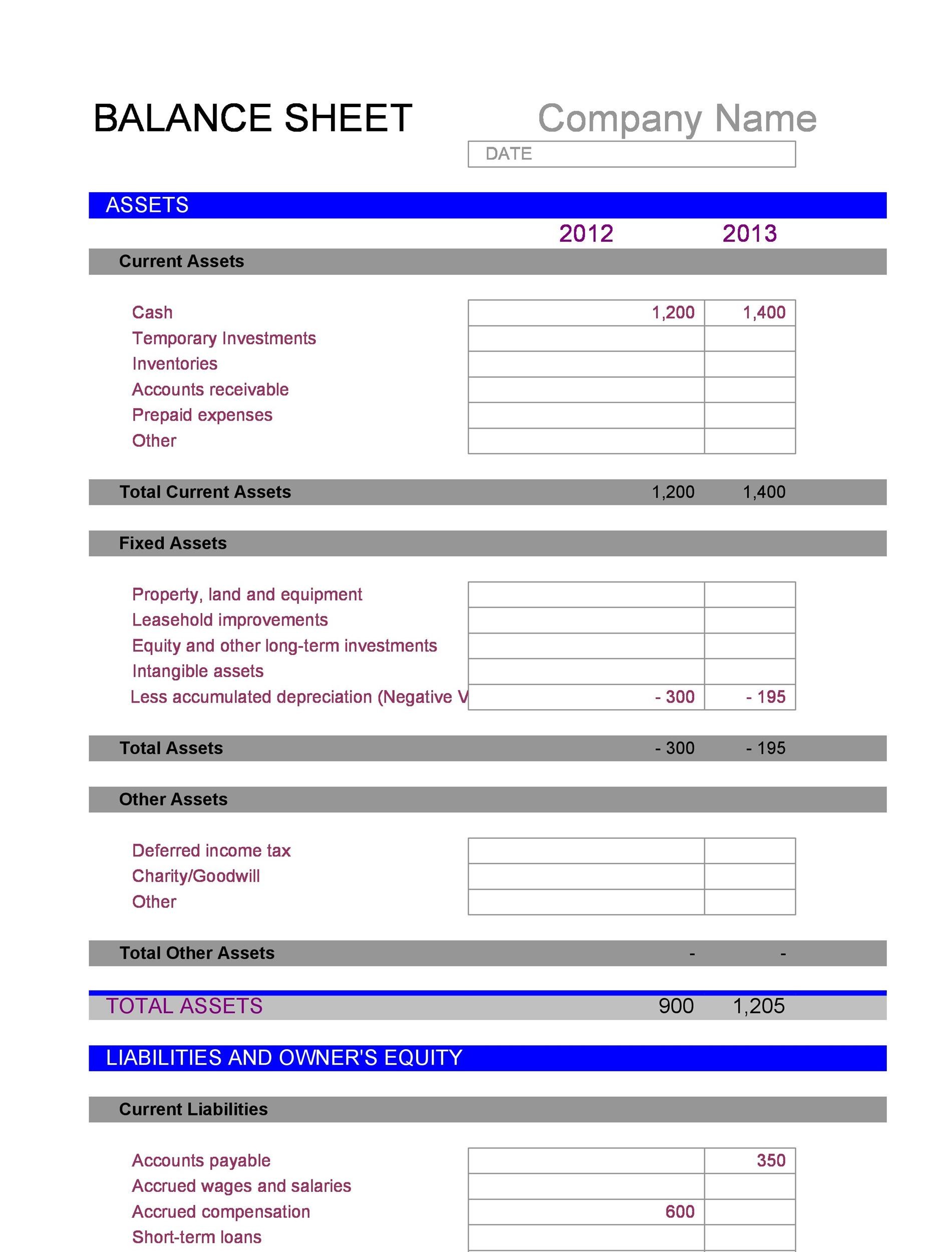

Balance sheet of a company. A balance sheet is a financial statement that contains details of a company’s assets or liabilities at a specific point in time. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. Balance sheets provide the basis for.

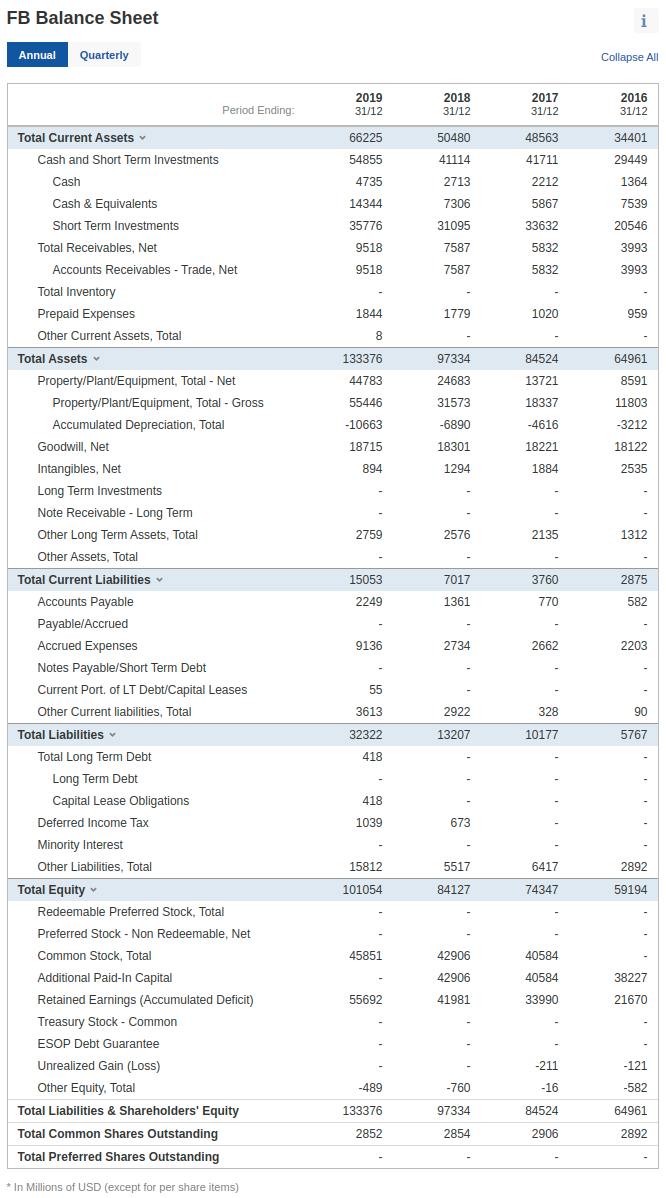

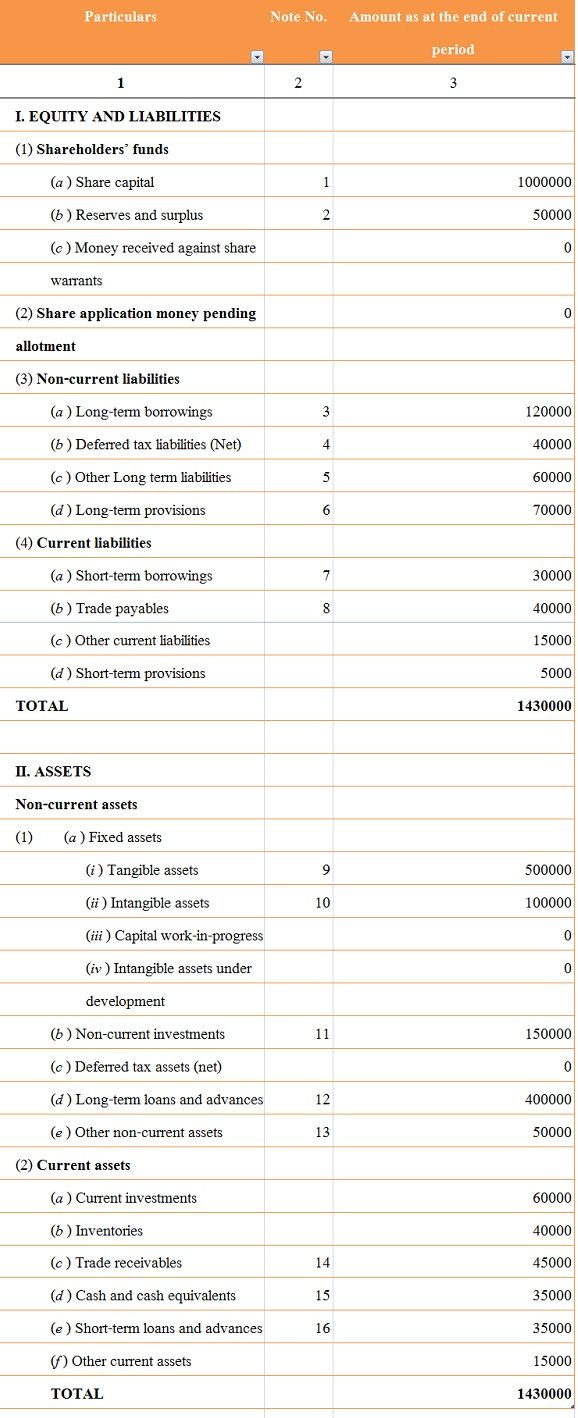

Property, plant, and equipment (also known as pp&e) capture the company’s tangible fixed assets. The company’s balance sheet is an accounting report that shows a company’s assets, liabilities, and shareholders’ equity. It is one of the three core financial statements ( income statement and cash flow statement being the other two) used for evaluating the performance of.

This typically means they can either be sold or used by the company to make products or provide services that can be sold. The most liquid of all assets, cash, appears on the first line of the balance sheet. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth).

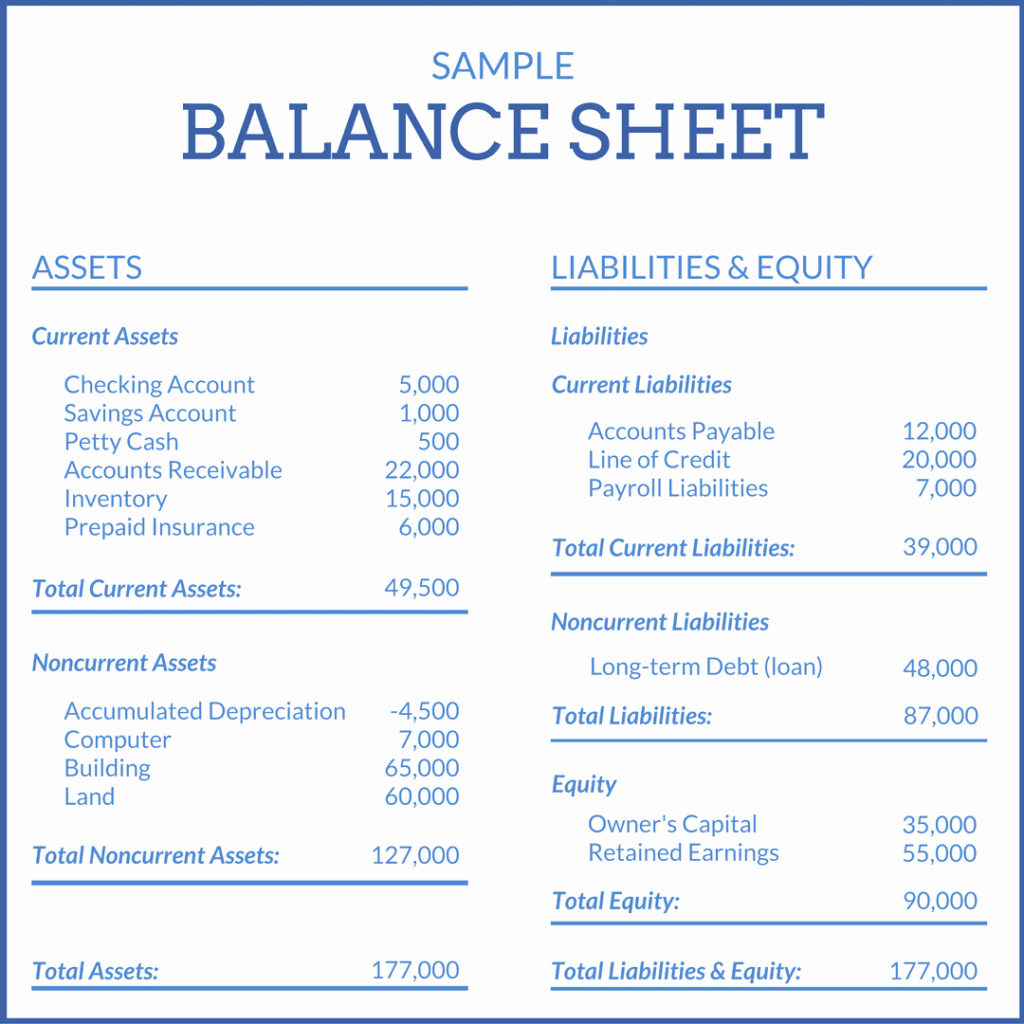

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.the main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. This financial statement is used both internally and externally to determine the so. The balance sheet has been described as a snapshot of a company's financial condition.

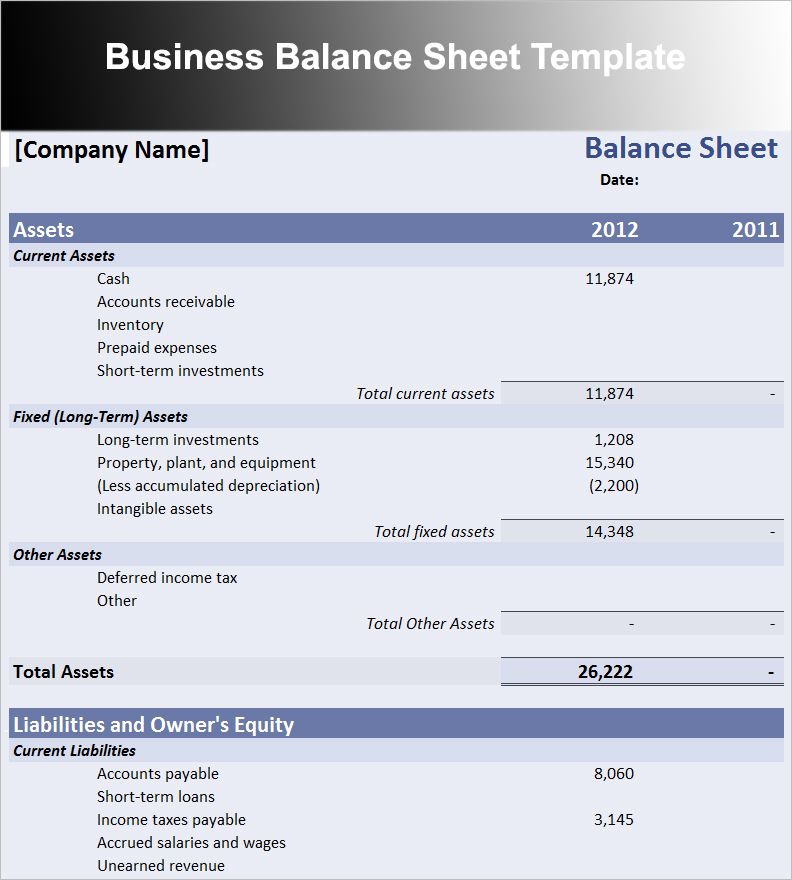

You can think of it like a snapshot of what the business looked like on that day in time. Determine the reporting date and period. How the balance sheet is structured current assets.

Minerals resources boss chris ellison has hit back at his critics. It reports a company’s assets, liabilities, and equity at a single moment in time. To read a balance sheet, you need to analyze your business’s assets,.

This made the older, lower. These offer an inside look at a company. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle.

It adheres to the fundamental accounting equation: The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Assets are things that a company owns that have value.

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Download the sample template for additional guidance, or fill out the blank version to provide a financial statement to investors or executives. The balance sheet includes things owned (assets) and things owed (liabilities).

Assets are things that a company owns. It can be understood with a simple accounting equation: It helps evaluate a business’s capital structure and also calculates the rate of returns for its investors.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)