Can’t-Miss Takeaways Of Tips About Amortization On Income Statement

The purpose of amortization is to match the expenditure to the revenue that it helped earn.

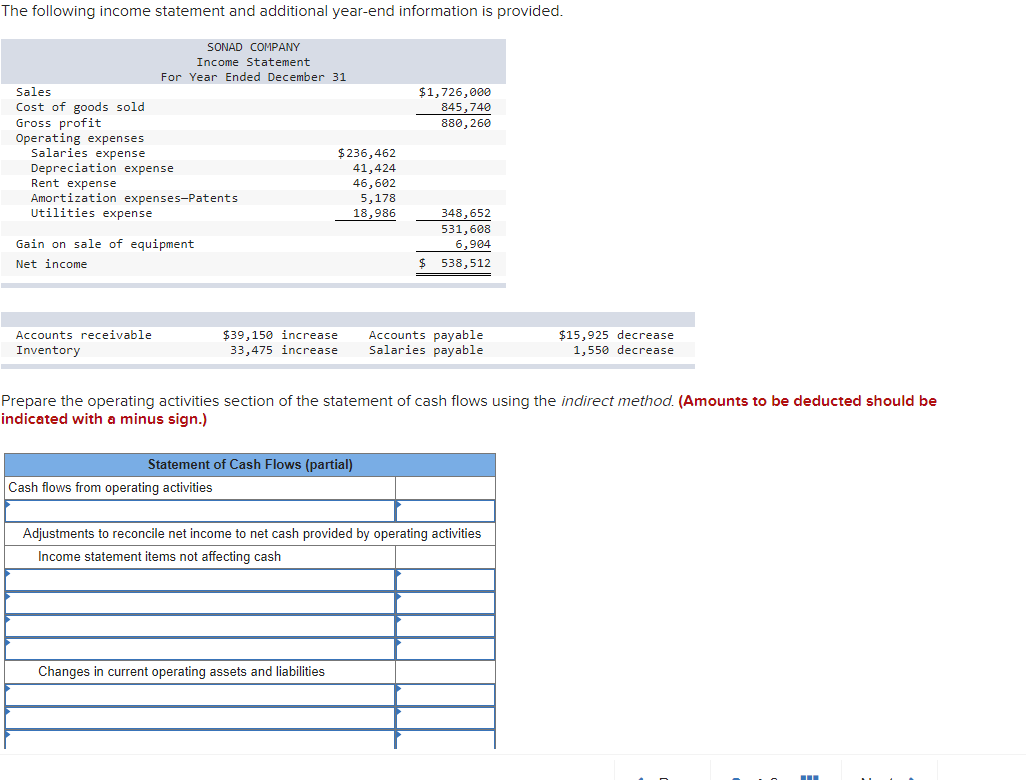

Amortization on income statement. One way that amortization affects your income statement is by reducing your net income. However, since they are not transactions that normally occur in. 5.1 the income statement;

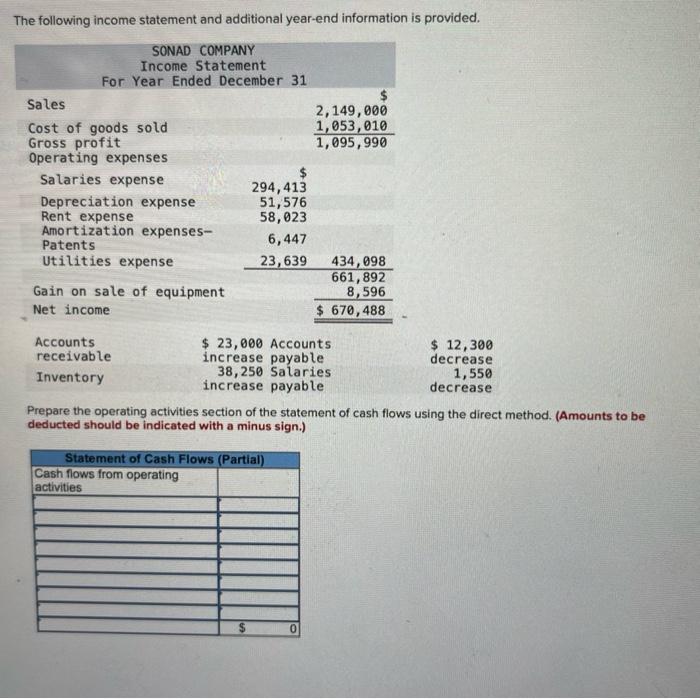

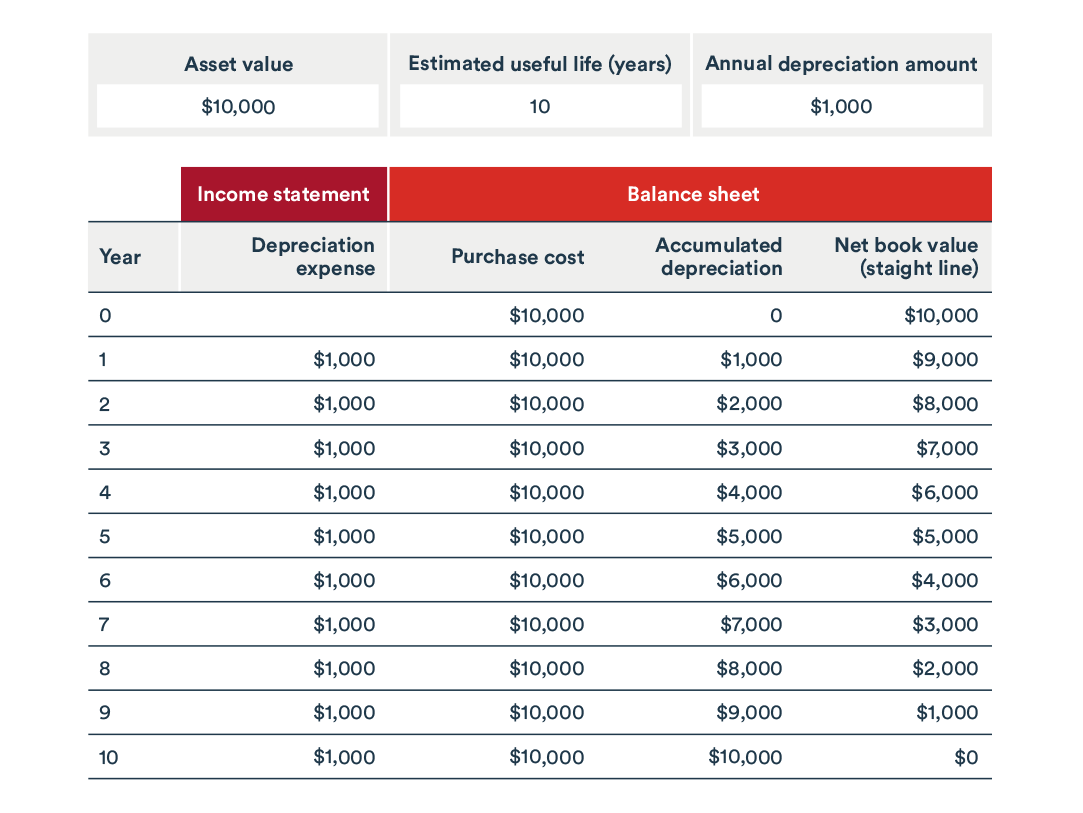

For the december income statement at the end of the second year, the monthly depreciation is $1,000, which appears in the depreciation expense line item. There would be no increase in equity as you have not gained anything. What is depreciation and amortization on the income statement?

It takes net income and adds back items such as depreciation and amortization. Each year, the income statement is hit with a $1,500 depreciation expenses. The concept is again referring to adjusting value overtime on a company’s balance sheet, with the amortization amount reflected in the income statement.

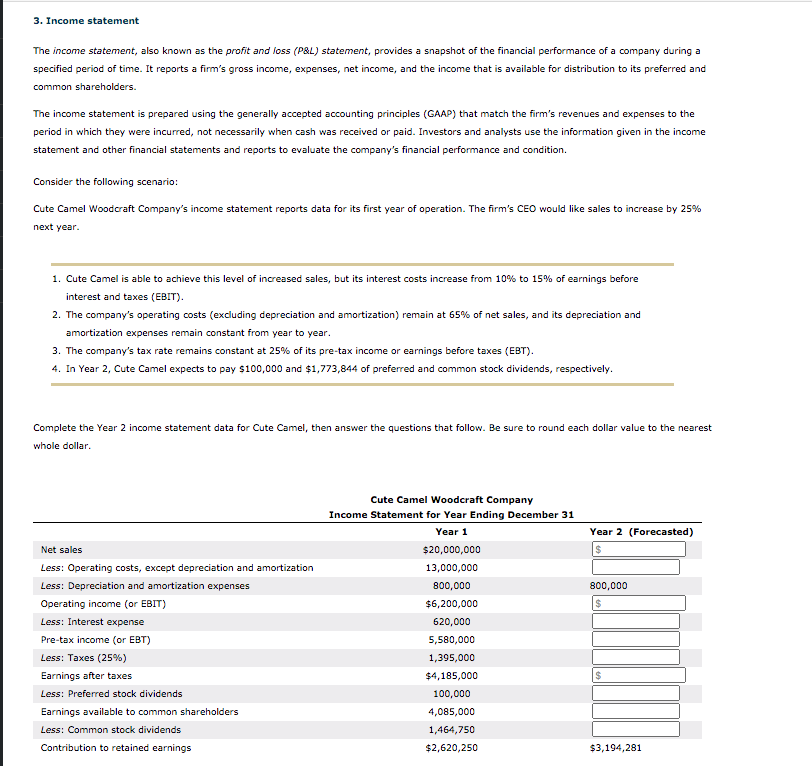

It will also discuss noncash items. Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use. Gains and losses are reported on the income statement.

Understanding depreciation, depletion, and amortization (dd&a) accrual accounting. 5.4 the statement of owner’s equity; December 07, 2023 what is amortization?

When the income statements showcase the amortization expense, the value of the intangible asset is reduced by the same amount. The interest on the loan will be reported as expense on the income statement in the periods when the interest is incurred. Dd&a charges can be found on a company's net income statement.

This lesson focuses on the elements and limitations of the income statement and the effects of gaap on the income statement. The practitioner knows that the client had only five. 5.3 the relationship between the balance sheet and the income statement;

Example of a loan principal payment. Depreciation expense and accumulated depreciation depreciation expense is an income statement item. That expense is offset on the balance sheet by the increase in accumulated.

4.8.1 amortization of an intangible asset; Specifically, amortization occurs when the depreciation of an intangible asset is split up over time, and depreciation occurs when a fixed asset loses value over time. The client receives a refund of $100,000 related to an erc claim for 2020.

As a general rule, retirement. Depreciation represents the cost of capital assets on the balance. This continues till the asset is sold or.

![[Solved] Can someone please explain? The balance shee](https://media.cheggcdn.com/study/495/49565683-5152-4e24-9ac7-d3a8fb46b066/image)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/Amazon4-8ae1cf9e4d2e49f08002f3eacc6f081b.JPG)

:max_bytes(150000):strip_icc()/Walmart202010KIncomestatement-365d4a49671b4579a2e102762ada8029.jpg)

/Depreciation-and-Amortization-on-Balance-Sheet-58a8d3265f9b58a3c912d552.jpg)

:max_bytes(150000):strip_icc()/Amazon3-88916bd66a244178b1f977a1d758dda0.JPG)