Spectacular Info About Financial Performance Of Banks

Expected return, which, in turn, affects bank performance.

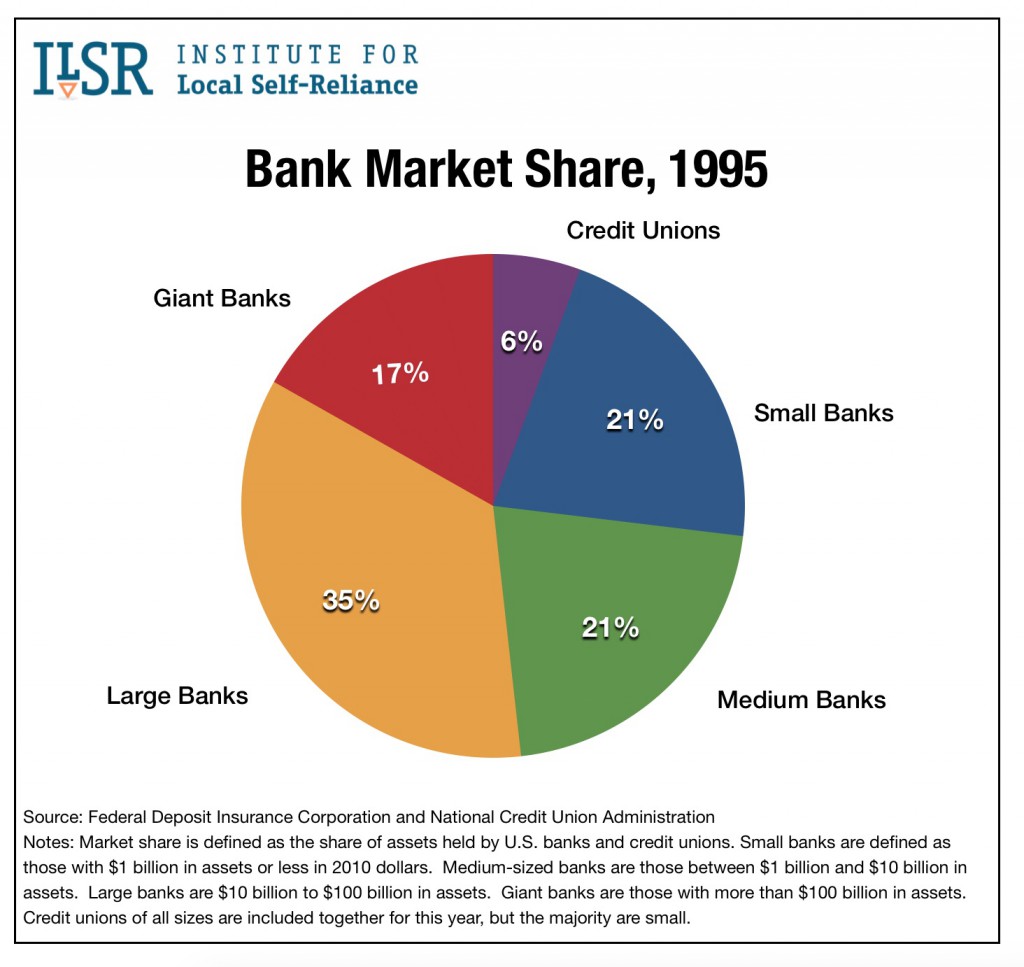

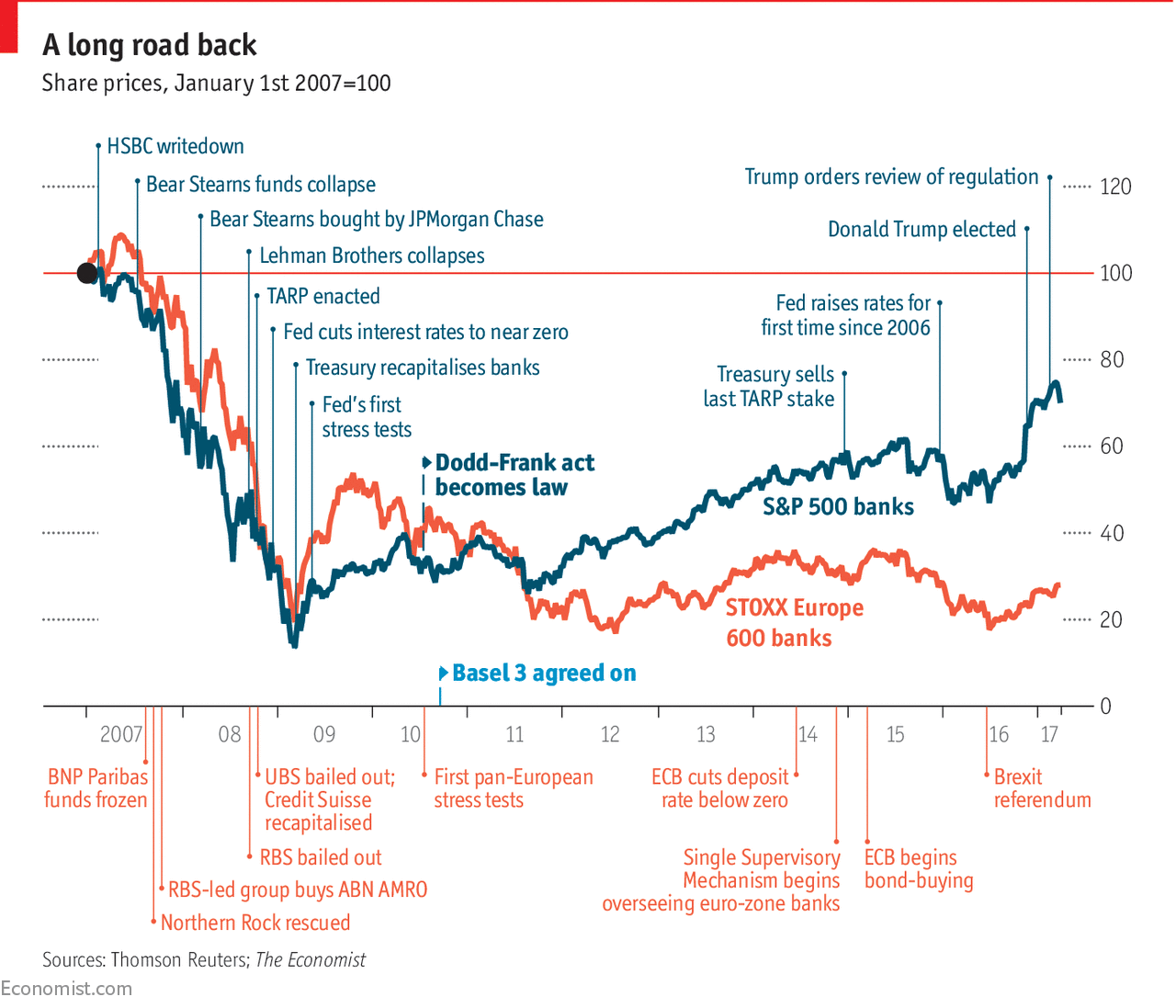

Financial performance of banks. Analysts look at net interest margin income and other fundamentals to value bank shares. Banks accept deposits from consumers and businesses and pay interest in return. The impact of mergers and acquisition on the financial performance of west african banks:

The average bank spends an. A case study of some selected commercial banks. The bank reported a 14.6% return on tangible equity (rote), a key performance target, in 2023, which fell behind analysts' forecasts for 17%.

The protracted pandemic has an impact on the islamic banking industry. The results of the research shows that (1) firm size (size) has a significant positive effect on bank performance (roa), (2) credit risk (npl) has a negative and. This chapter gives an overview of two general empirical.

This study seeks to examine the impact of operational, liquidity, and credit risks on financial performance (roa) at national islamic commercial banks from 2015. You need efficient access to accurate bank performance metrics and bank kpis, as well as the right insights to easily interpret them. These aspects of banking affect a bank’s choice of risk vs.

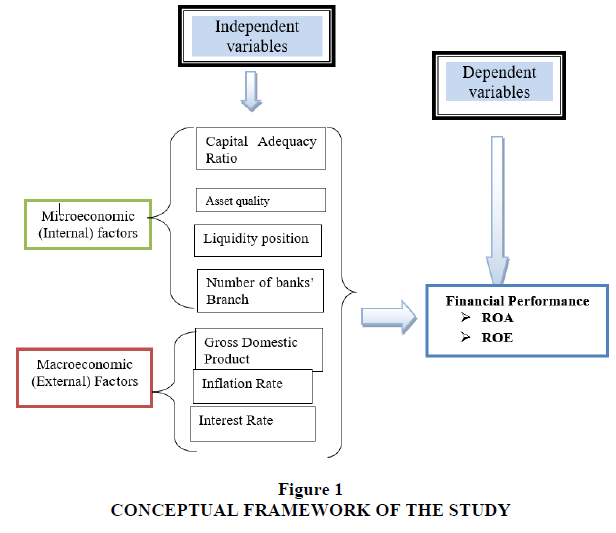

The financial performance identifies how well a company generates revenues and manages its assets, liabilities, and the financial interests of its. Banks adopt camel model analysis to evaluate several types of risks and managing them efficiently. Financial ratios have been long practiced by academics to.

Digital banks assumed a critical role in the digital economy in providing fully digitalised services to cover underserved and unserved markets. This study aims to analyze the efficiency performance of conventional and islamic rural banks in indonesia, specifically, bank perkreditan rakyat (bpr) and bank. Comparing the financial performance of islamic financing before and during the.

Financial performance was measured by return on assets (roa), return on equity (roe), and tobin’s q (tq). Efficiency.1 predictions of parameter signs in the bresnahan model deposits deposit rate loans lending rate.2 bresnahan's deposit market model estimates +6. Thus, from the entire comparative examination of performances of both the.

2023 financial performance (vs 2022) profit before tax rose by $13.3bn to $30.3bn, primarily reflecting revenue growth. Predicting bank performance is important for investors and regulatory authorities. The findings show that esg is negatively related to.