Great Tips About Bad Debts Debit Or Credit In Trial Balance

The account is decreased or removed on the debit side of the account.

Bad debts debit or credit in trial balance. Why is provision for doubtful debts created? All assets (cash in hand, cash at bank, inventory, land and building, plant and machinery etc.) sundry debtors; The trial balance lists all of the ledger, both general journal and special, accounts and their debit or credit balances.

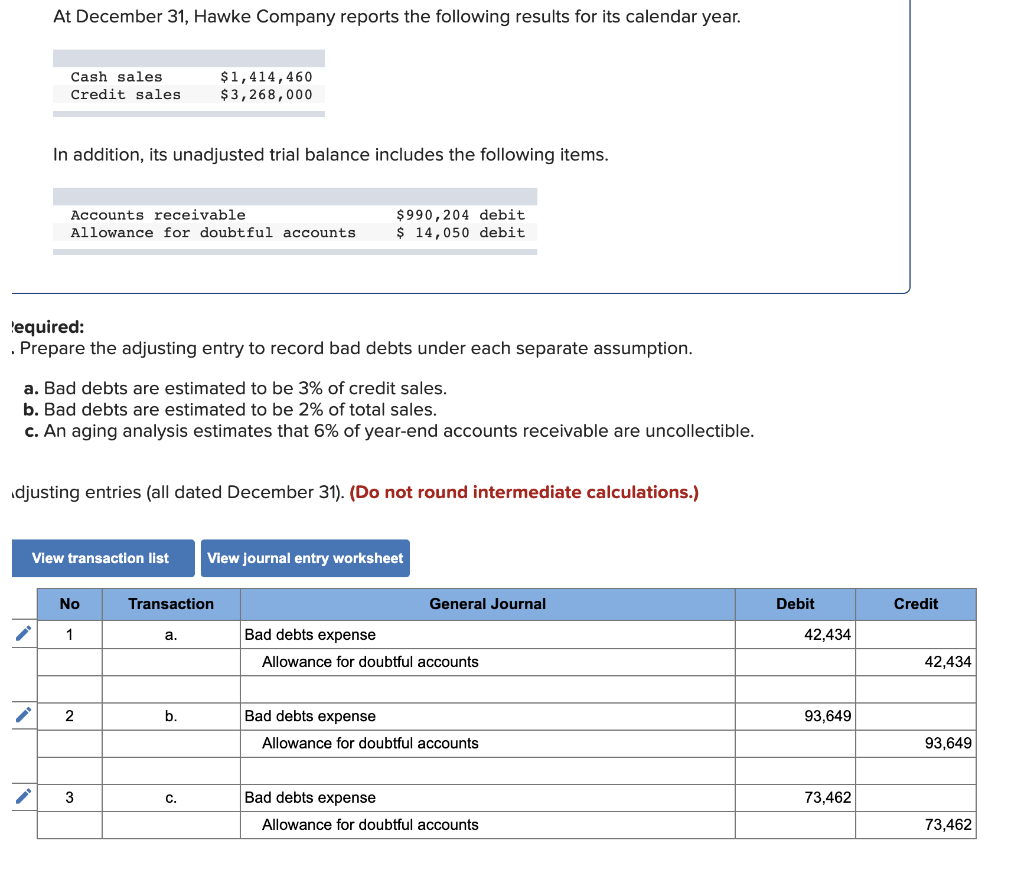

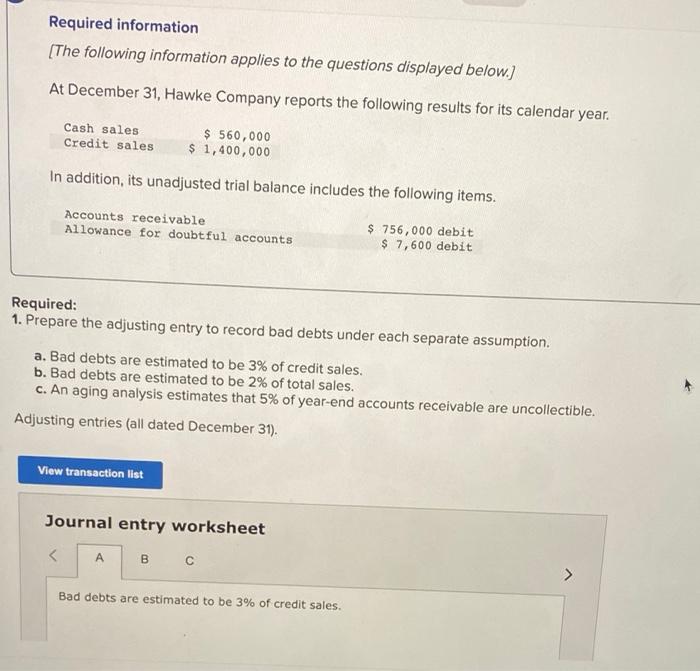

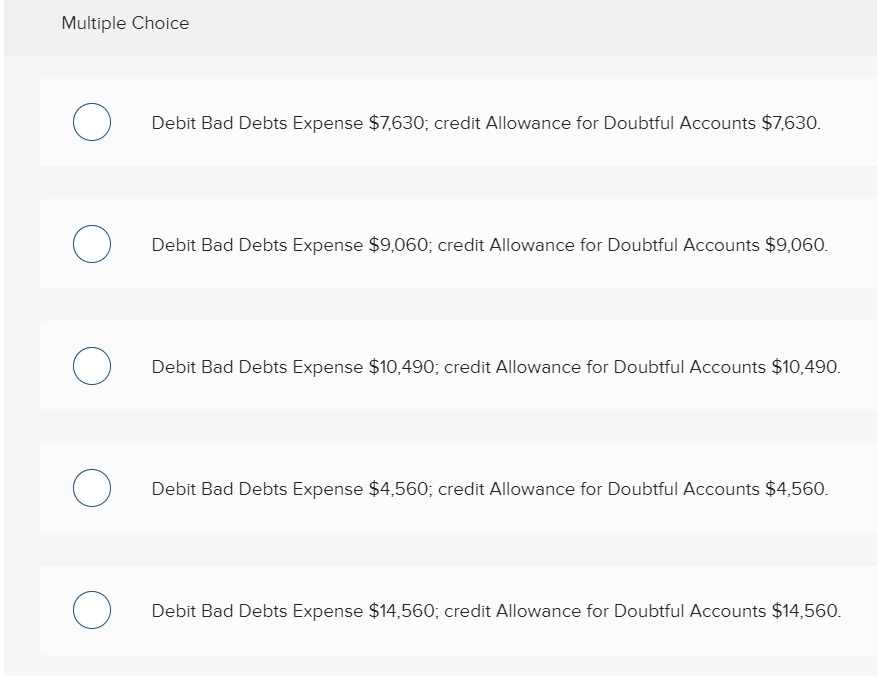

The rule to prepare a trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. Identify when the trial balance is performed; When you decide to write off an account, debit allowance for doubtful accounts and credit the corresponding receivables account.

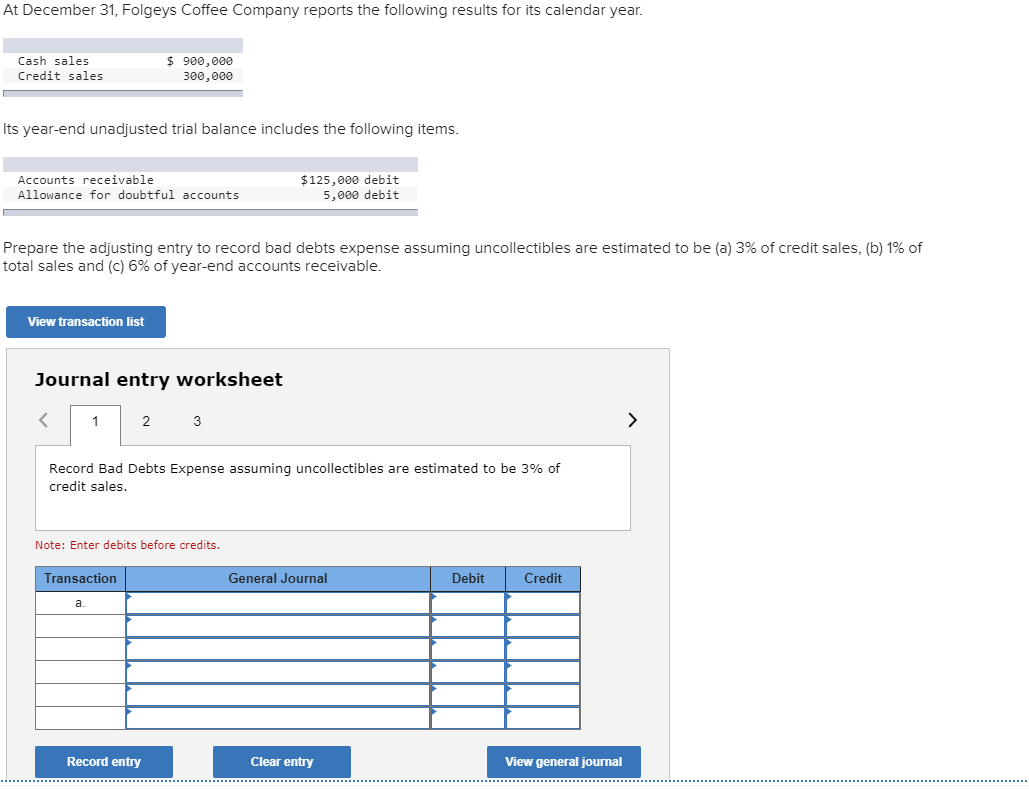

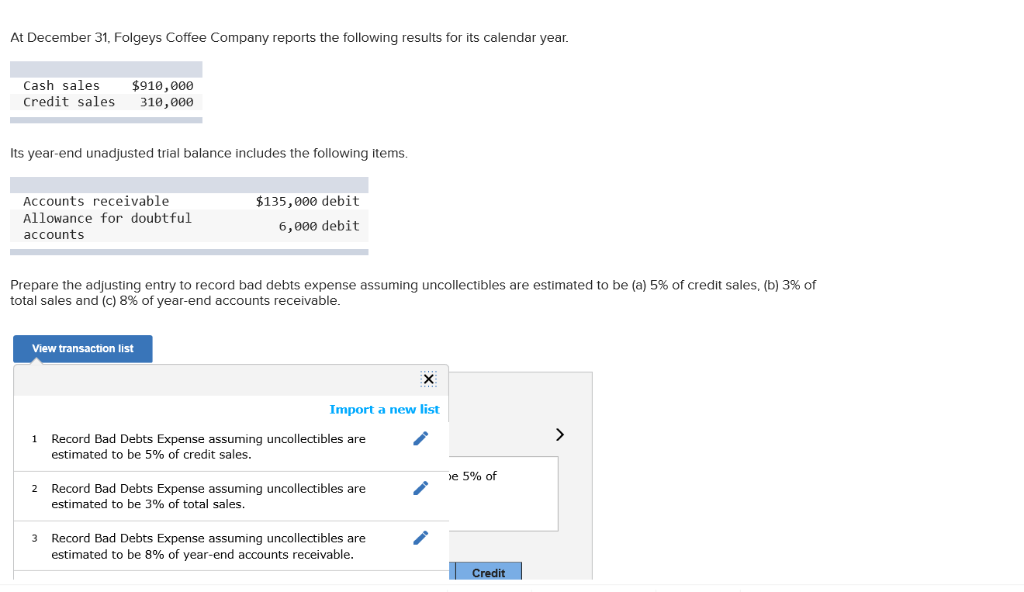

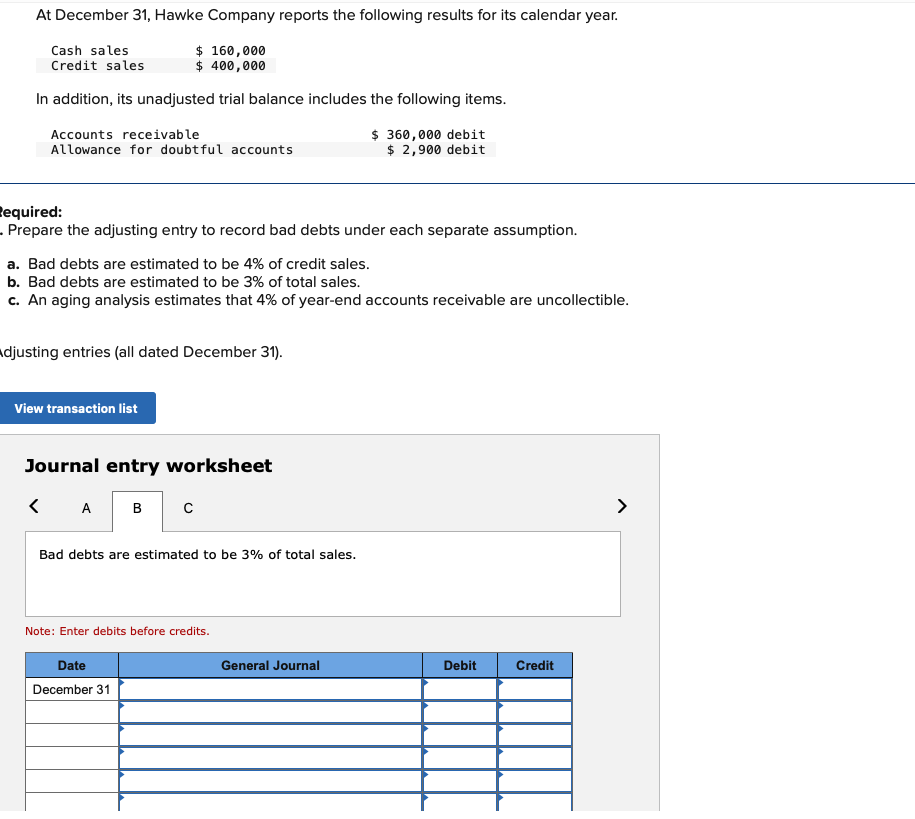

Is bad debts a debit or credit in trial balance?since bad debts are written off at the time of occurrence during the accounting period, bad debts account appears inside the trial balance. This means listing all accounts in the ledger and balances of each debit and credit. In such case, all that is to be done is to transfer bad debts account to the debit side of profit and loss

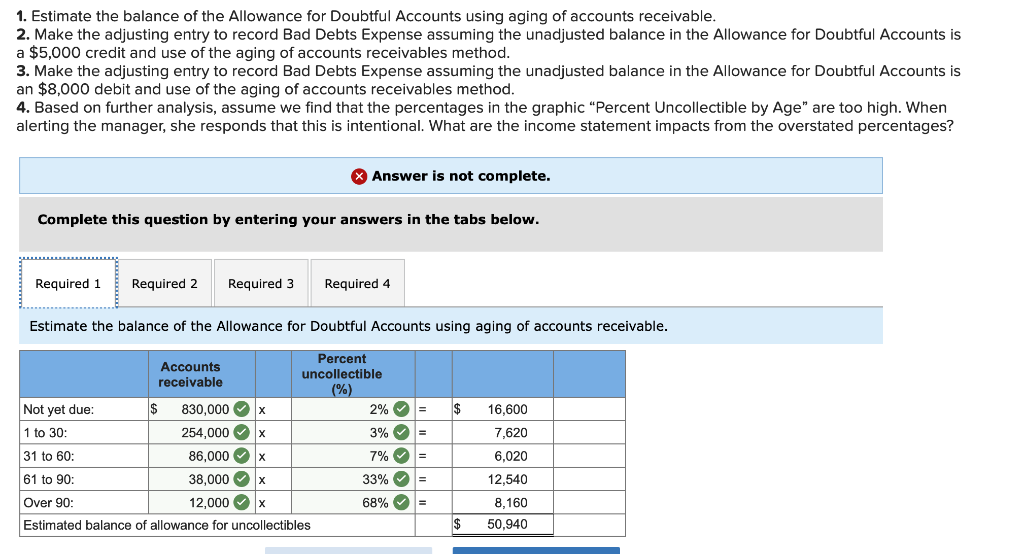

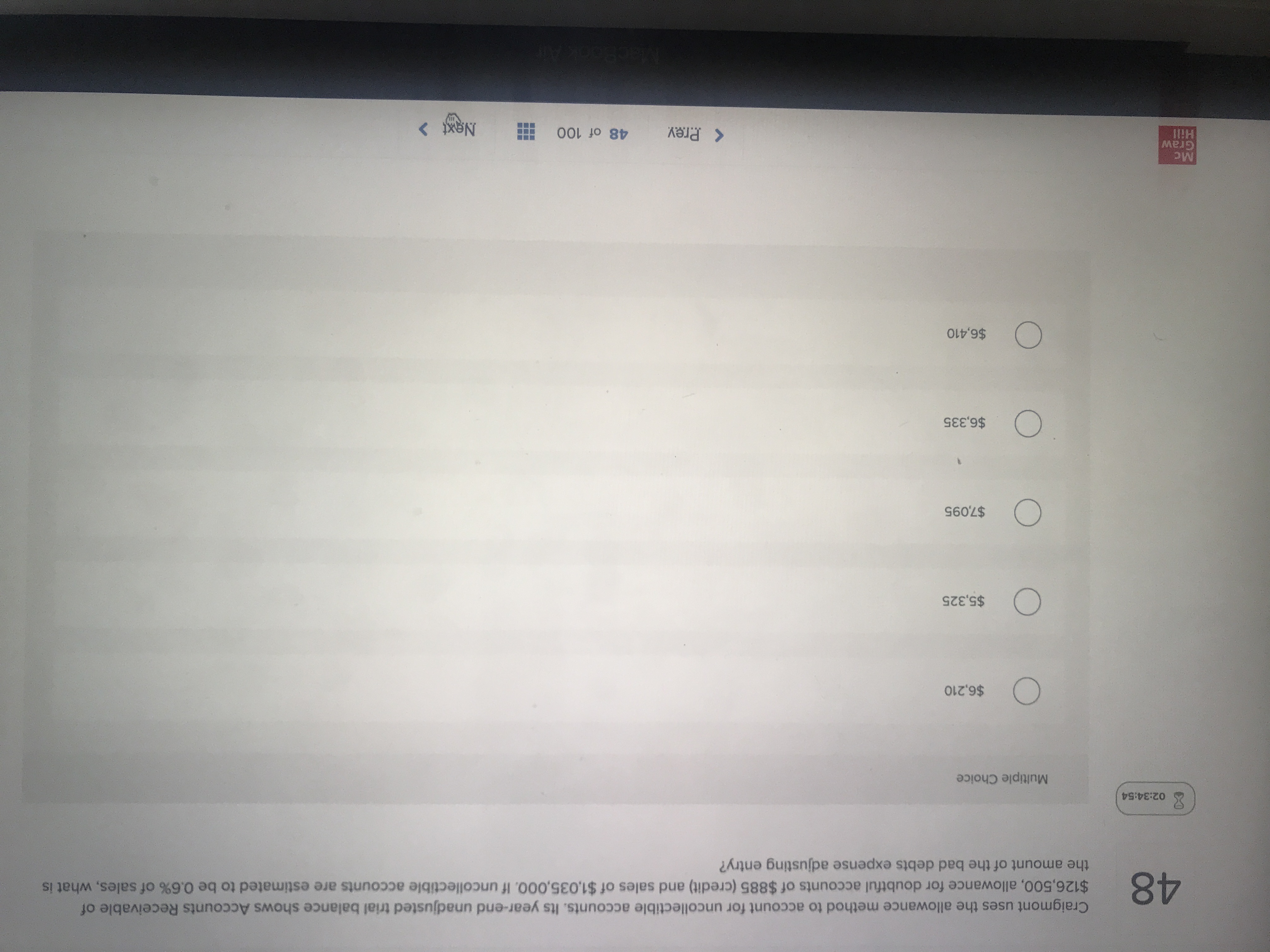

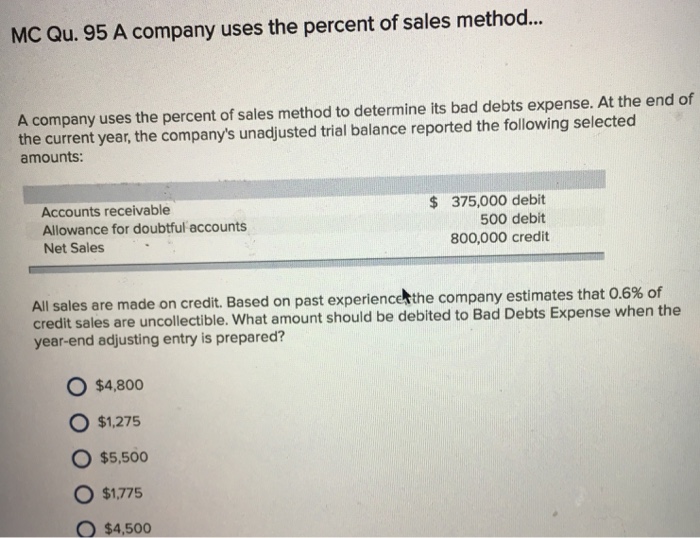

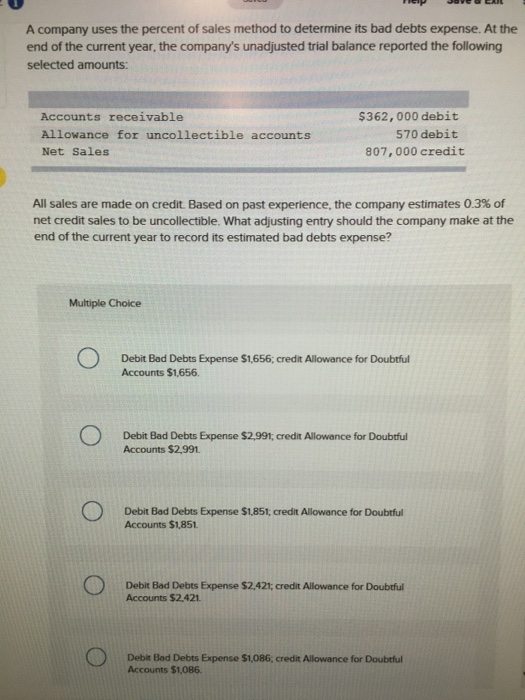

Estimating your bad debts usually involves some form of the percentage of bad debt formula, which is just your past bad debts divided by your past credit sales. Can you give me a list of debit and credit items in trial balance? Qualifying for credit card debt relief with bad credit may pose challenges, but it's certainly not impossible.

Because every transaction has a dual effect with each debit having a corresponding credit and vice versa. Allowance for doubtful debt is created and increased on the credit side of allowance for doubtful debt account. Bad debt expense increases (debit), and allowance for doubtful accounts increases (credit) for $48,727.50 ($324,850 × 15%).

Given the $50,000 of projected bad debts, the accounting. This estimate is called the bad debt provision or bad debt allowance and is recorded in a contra asset account to the balance sheet called the allowance for credit losses, allowance for bad debts, or allowance for doubtful accounts. This means that bww believes $48,727.50 will be uncollectible debt.

Estimated bad debt = $1 million × 5% = $50,000. Many candidates struggle with certain adjustments in the exam. If the total of all debit values equals the total of all credit values, then the accounts are correct—at least as far as the trial balance can tell.

Bad debt refers to loans or outstanding balances owed that are no longer deemed recoverable and must be written off. The general rule is: Often, estimated bad debt is referred.

Let’s consider that bww had a $23,000 credit balance from the previous period. Once you have entered a provision one year, the amount which you think will go bad is very unlikely to be the same the following year. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses.

Incurring bad debt is part of the cost of doing business with customers,. How to calculate provision for doubtful debts? Irrecoverable debts and allowances for.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)