Can’t-Miss Takeaways Of Tips About Unrealised Gains And Losses Accounting Treatment Ifrs

Ifrs 9 generally has no requirements regarding the income statement presentation of gains and losses from a hedging instrument.

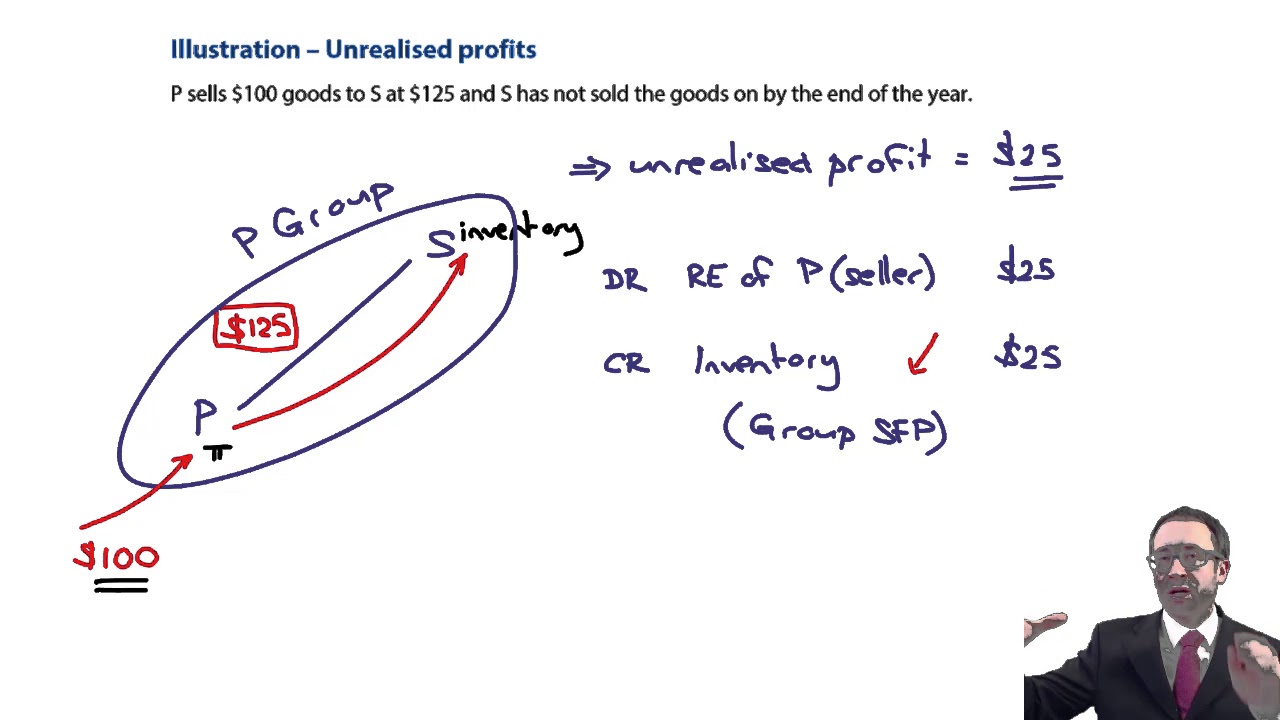

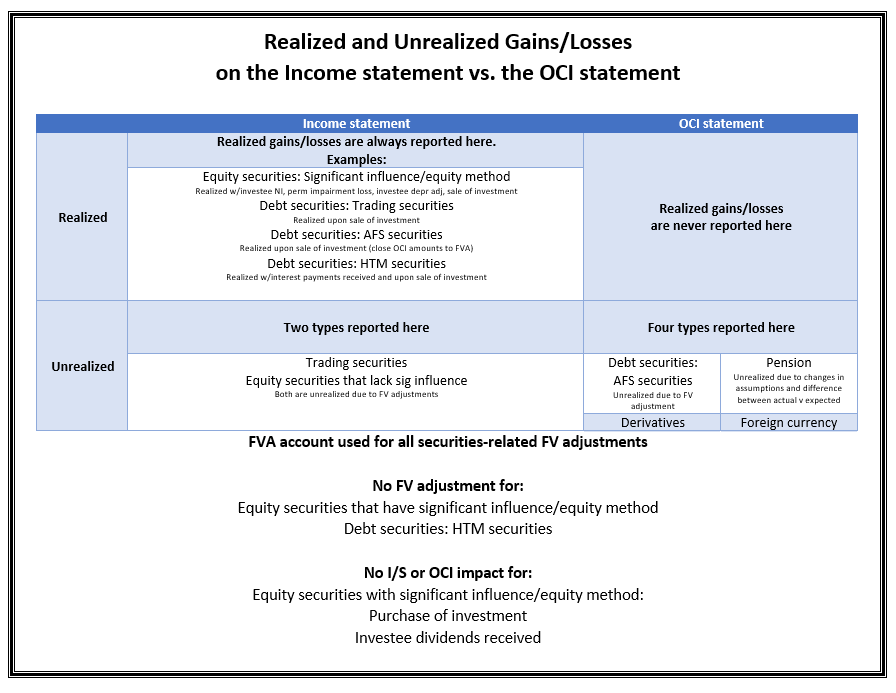

Unrealised gains and losses accounting treatment ifrs. The feedback discussed in this paper is an extract from agenda paper 21b of the december 2020 board meeting of feedback that relates to classification of gains or losses on. The amendments, recognition of deferred tax assets for unrealised. Business context realized gains and losses are profits or losses arising from completed transactions.

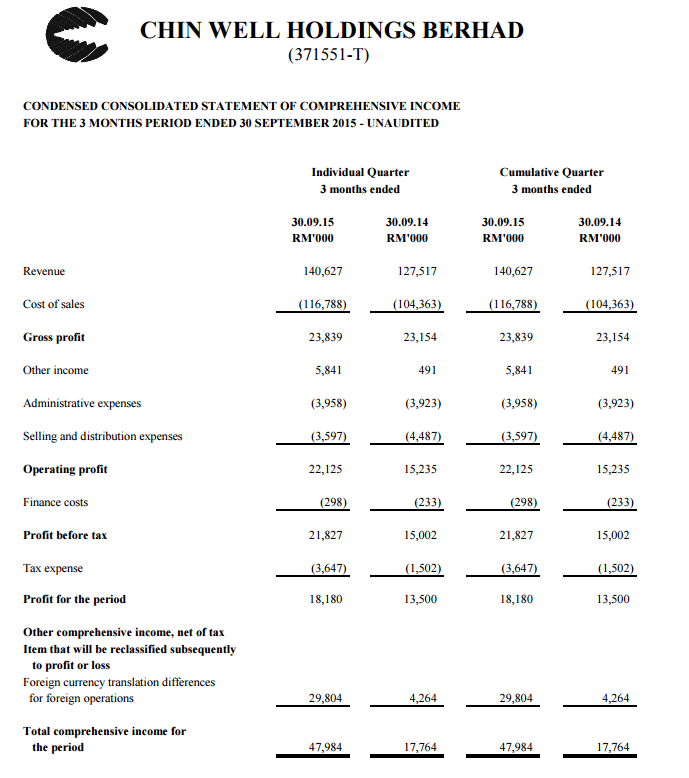

Unrealised gains and losses arising during the holding period are not recognised in the p&l. Accounting standards, ifric interpretations and other guidance applicable to 31 december 2023 year ends ; The iasb observed that the main reason.

The staff introduced the paper by explaining that the purpose of staff papers 2 and 2a is to develop an approach on how to clarify the accounting for dtas for. It means that the customer has already settled. The accounting treatment depends on whether the securities are classified into three types, which are given below.

In january 2016 the international accounting standards board issued amendments to ias 12 income taxes. Does an unrealised loss on a debt instrument measured at fair value give rise to a dtd when the holder expects to recover the carrying amount of the asset by. In accordance with ias 12, the unrealised gains and losses.

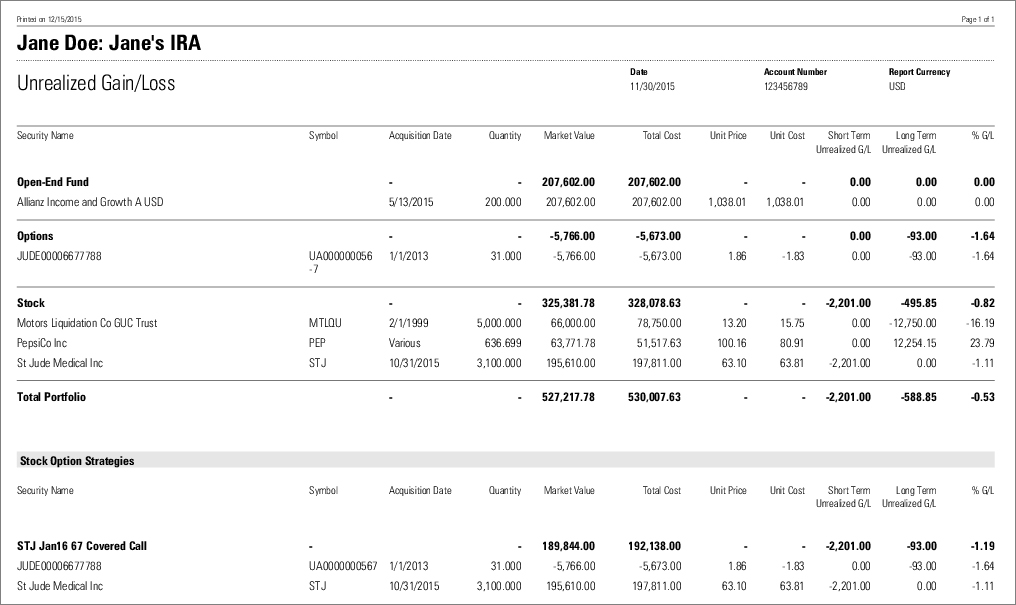

Unrealized revaluation gains and losses refer to profits or losses that have occurred more commonly known as ‘on paper’, but the relevant closing out transactions have not been. Asset market value vs asset book value realized and unrealized gains and losses explanation in accounting, there is a difference between realized and. However, in practice, we believe most entities.

Overview ifrs 9 financial instruments issued on 24 july 2014 is the iasb's replacement of ias 39 financial instruments: Foreign exchange gains or losses (based on amortised cost) are recognised in p/l (ifrs 9.b5.7.2a). The effects of changes in foreign exchange rates, which had originally been issued by the international accounting standards committee in december 1983.

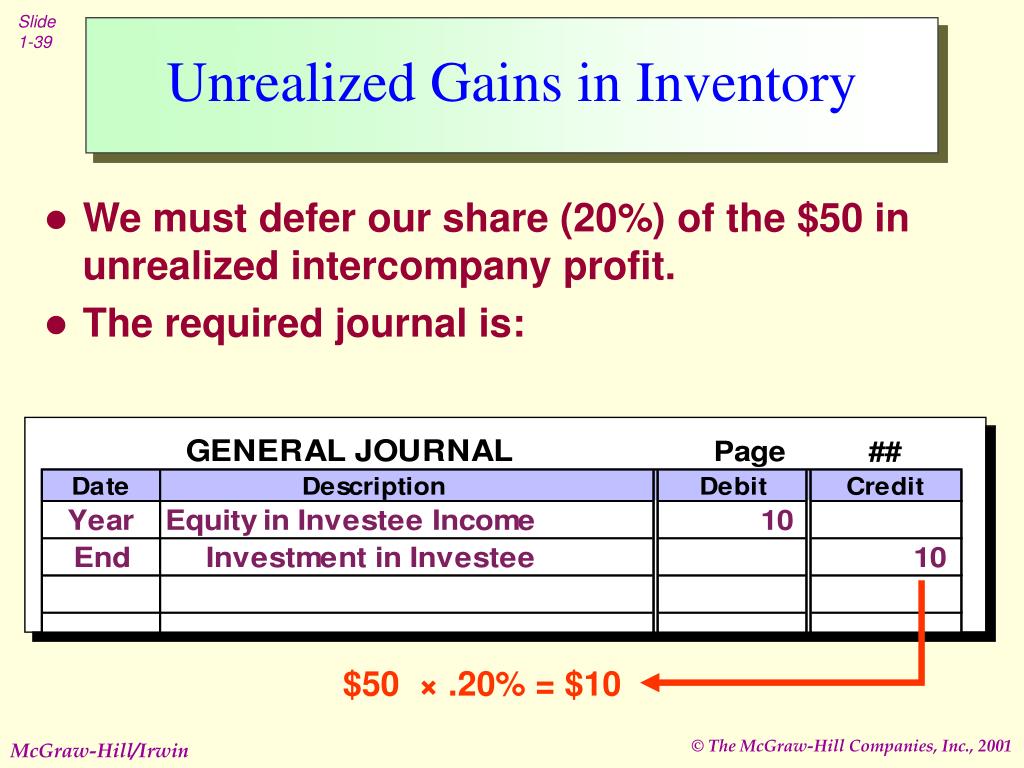

You are free to use this image o your website,. Supervisors should decide whether to treat unrealised gains and losses on. In step 1, p can recognise a deferred tax asset in relation to unrealised losses of at least 30.

Realized gains/losses realized gains or losses are the gains or losses on transactions that have been completed. Remaining amount to be tested for recognition 70. Unrealized revaluation gains and losses refer to profits or losses that.

Impairment losses (or gains) are recognised in p/l. Global ifrs year end reminders ; In this journal entry, the $50,000 unrealized loss on investments account will be presented on the balance sheet under.