Brilliant Strategies Of Info About Impairment Loss Journal Entry Example

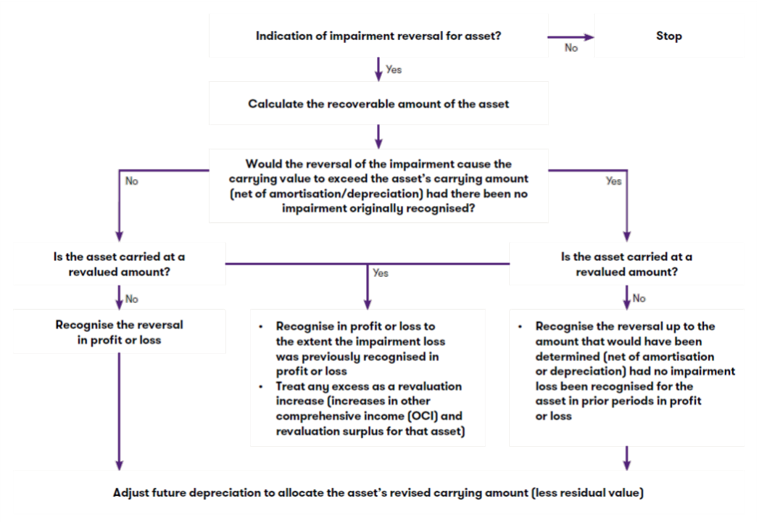

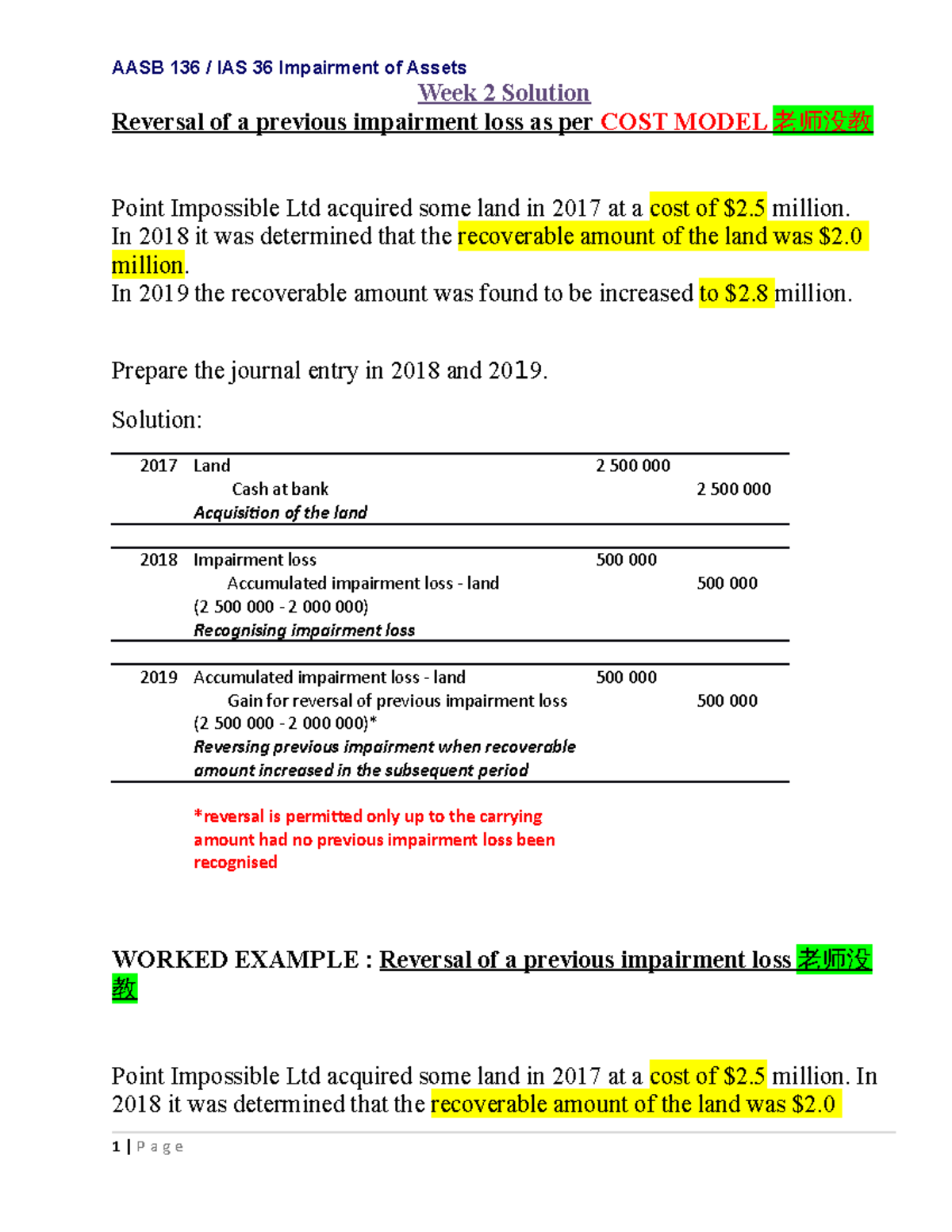

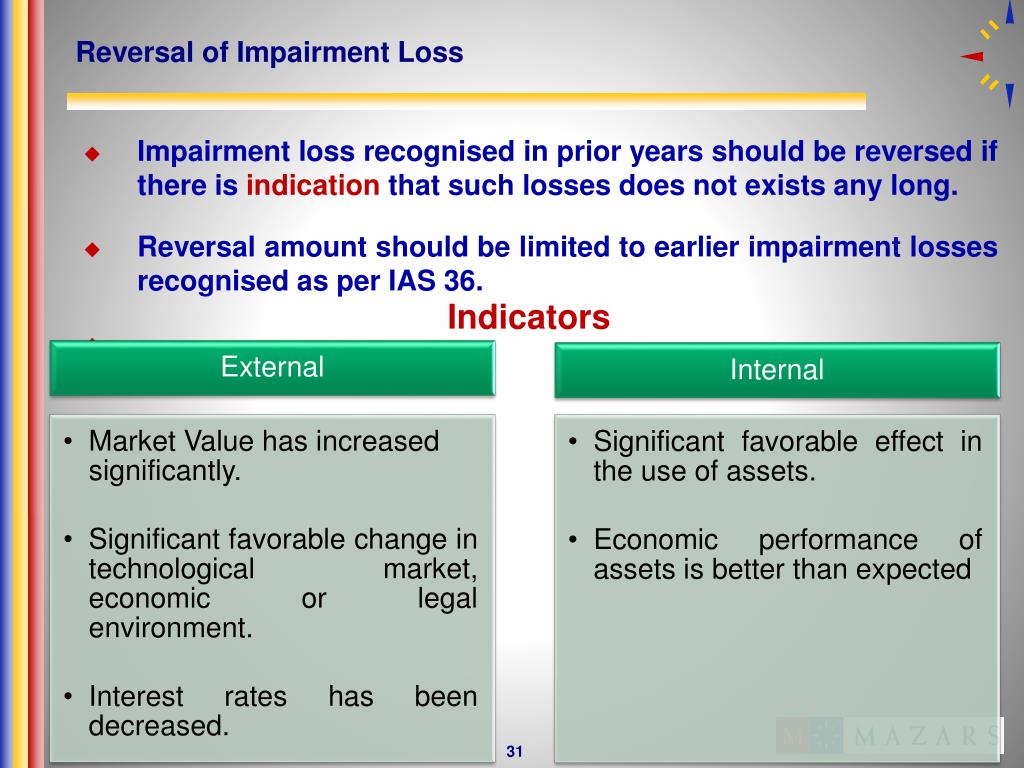

Accounting for reversal of an impairment loss is illustrated in example 4 accompanying ias 36.

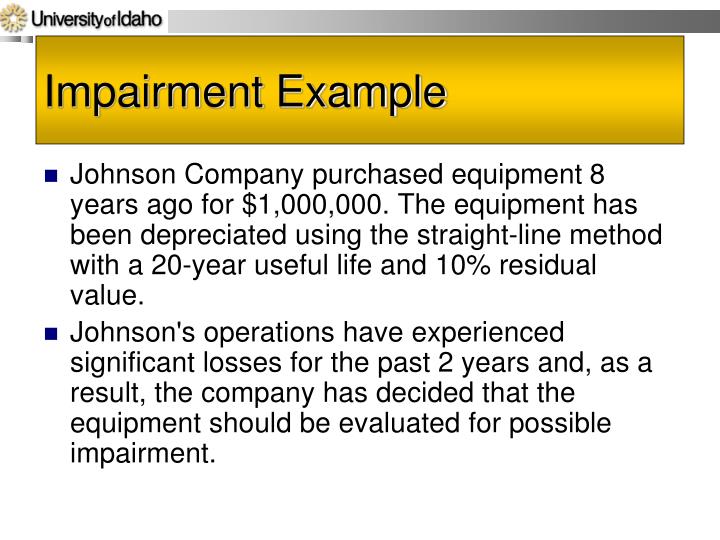

Impairment loss journal entry example. To arise or spring as a growth or result; Recognition of impairment loss. This asset is recorded on the books with a cost of $30,000 and accumulated depreciation of $10,000.

Impairment loss account debit to undelying asset account. This loss will be as below. In order to write off the asset, the impairment loss of $1,250,000 must be disclosed on the debit side of the income.

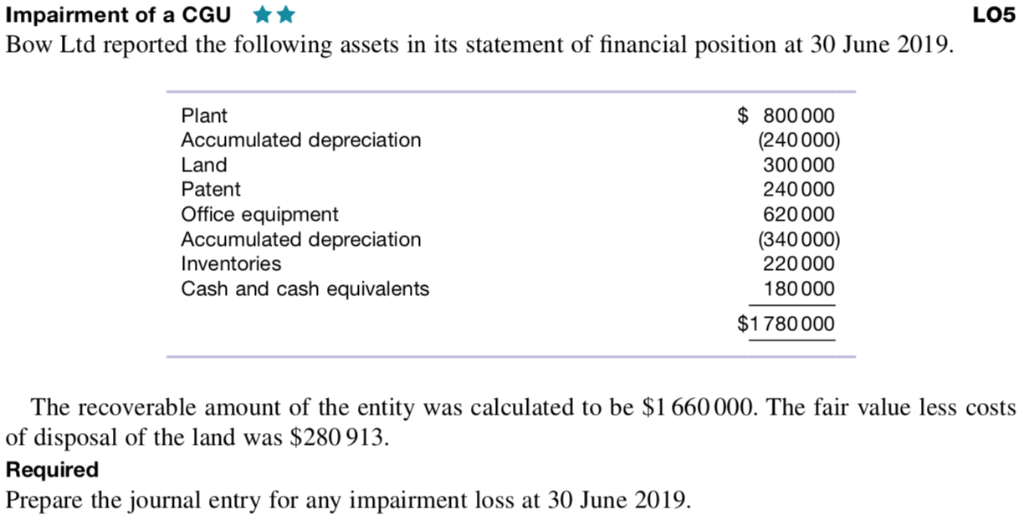

Can calculate the impairment loss. It can therefore be a little confusing deciding whether ias. A company has a reporting unit with a carrying amount of $5 million, including goodwill of $1 million.

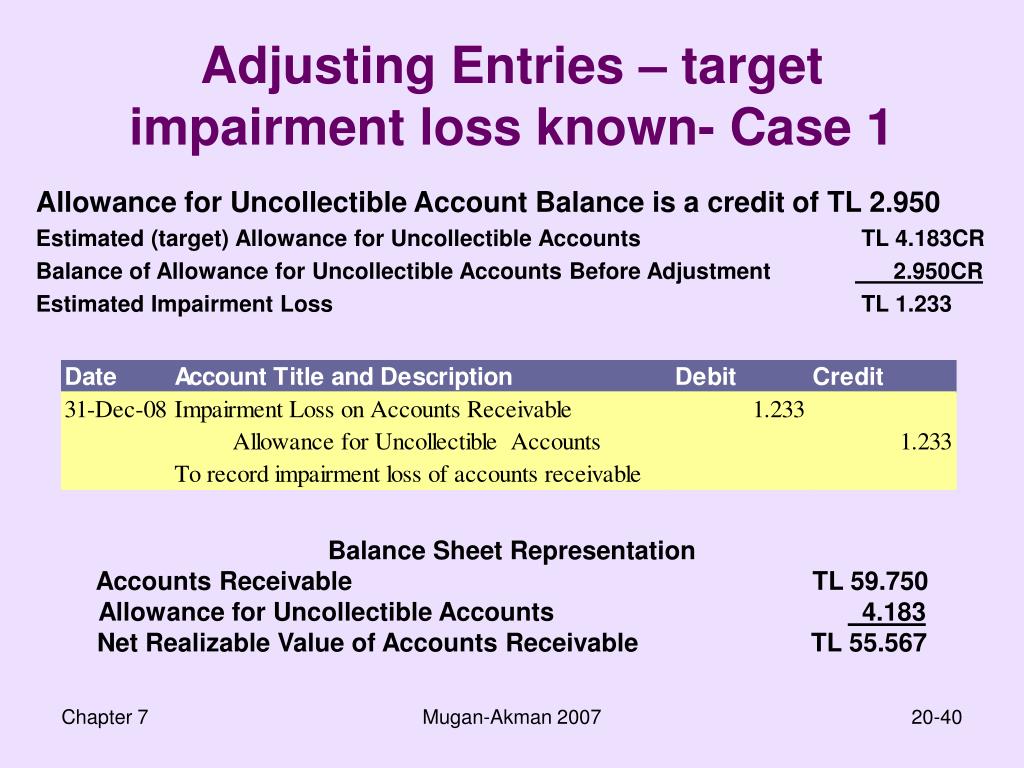

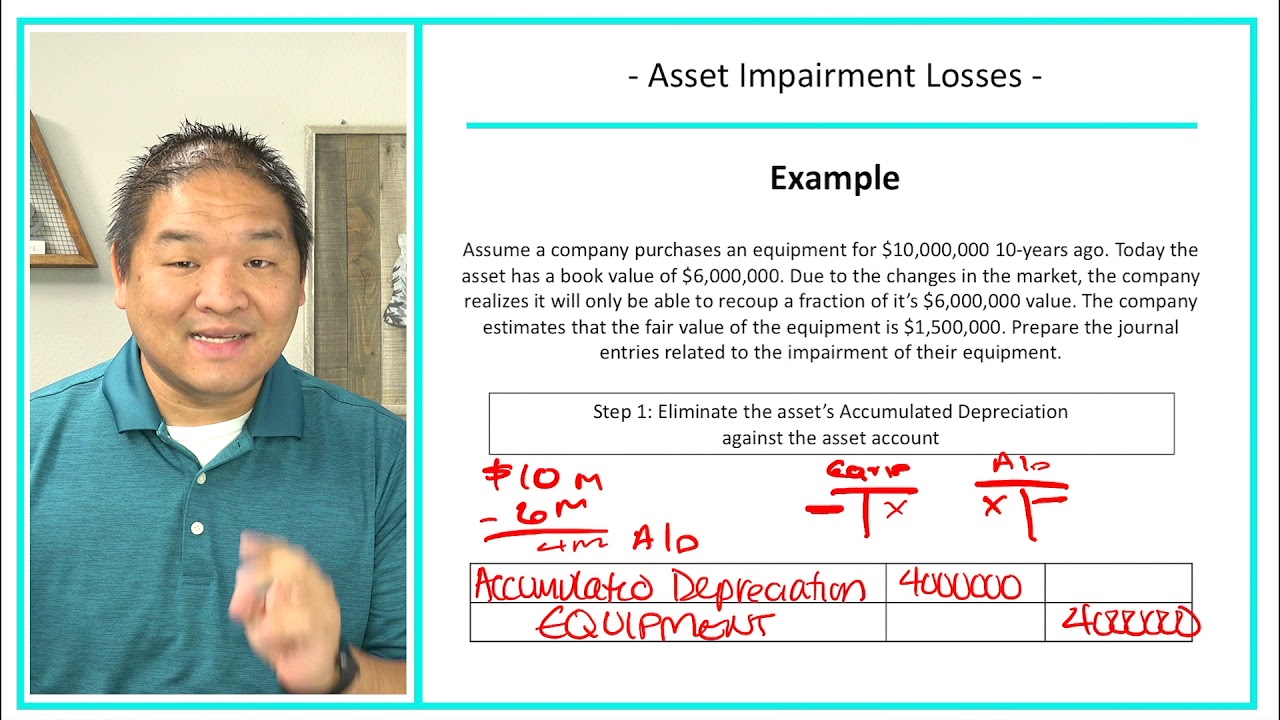

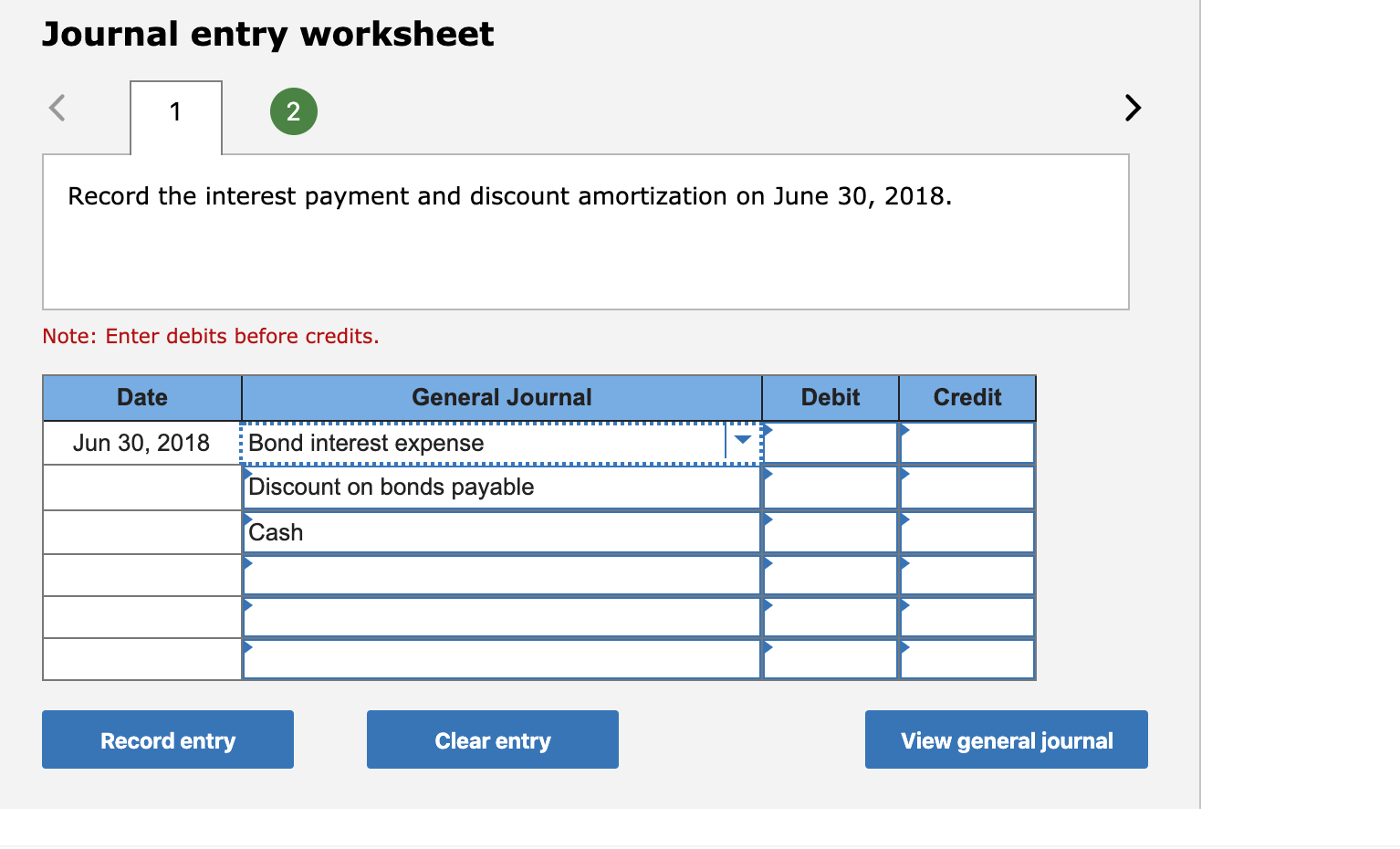

The fair value of the reporting unit is determined to be $4.5 million. The double entry to record an impairment loss is by debiting to the impairment loss account in p&l in the period and then credited to the accumulated impairment losses account in the balance sheet. This impairment loss needs to be written off so that the asset’s value is not overstated on the balance sheet of hightech express.

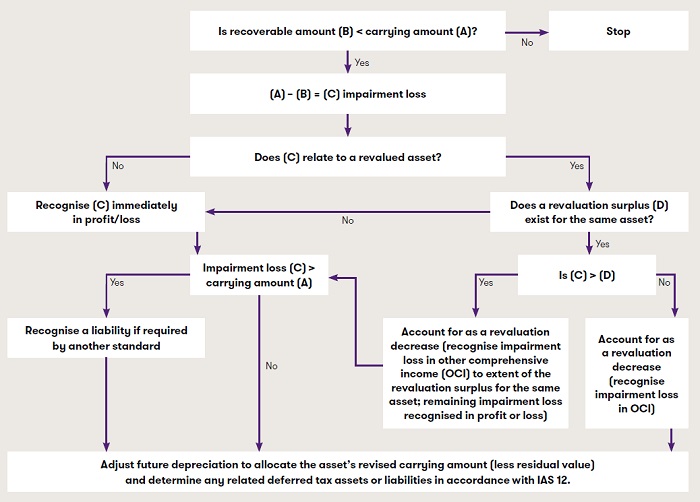

In this journal entry, total expenses on the income statement increase while total assets on the balance sheet decrease. The company can make the fixed asset impairment journal entry by debiting the impairment losses account and crediting the accumulated impairment losses account. Under ifrs, the impairment, if any, is worked out by directly comparing the carrying amount with the higher of the fair value less cost to sell (which is zero in this case) to the value in use (which is $113.72 million).

For example, on december 31, after using the discounted cash flow analysis, the company abc finds out that the goodwill that comes from the previous purchase of one of its subsidiaries has been impaired by $1,000,000. To be added as increase, profit, or. During the annual review of asset impairment conditions, a company’s management team decides that there is evidence of impairment of a particular asset.

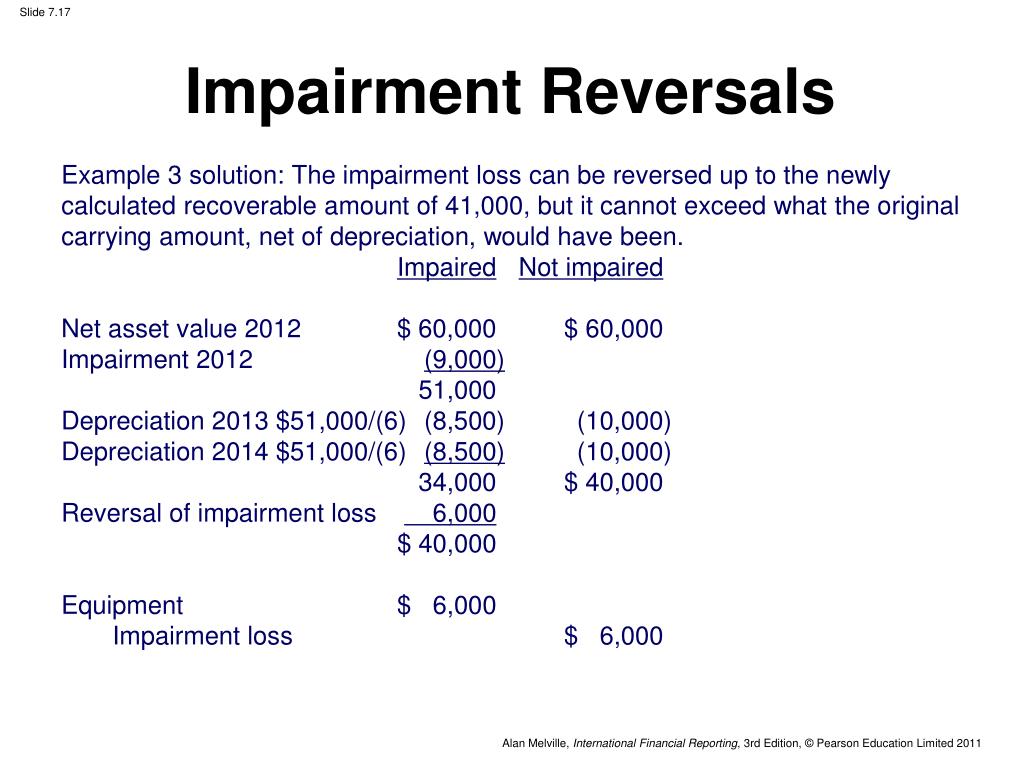

Fixed asset impairment journal entry. Then other assets are reduced pro rata. Download the full reversing impairment losses article for an example of reversing a previously recognised impairment loss for an individual asset and an example that illustrates the practical application of the requirements.

If the carrying amount is less than the recoverable amount, no impairment loss needs to be recognized. Ias 36 impairment of assets in april 2001 the international accounting standards board (board) adopted ias 36 impairment of assets, which had originally been issued by the international accounting standards committee in june 1998. On january 1, 20x5 zarlascht inc.

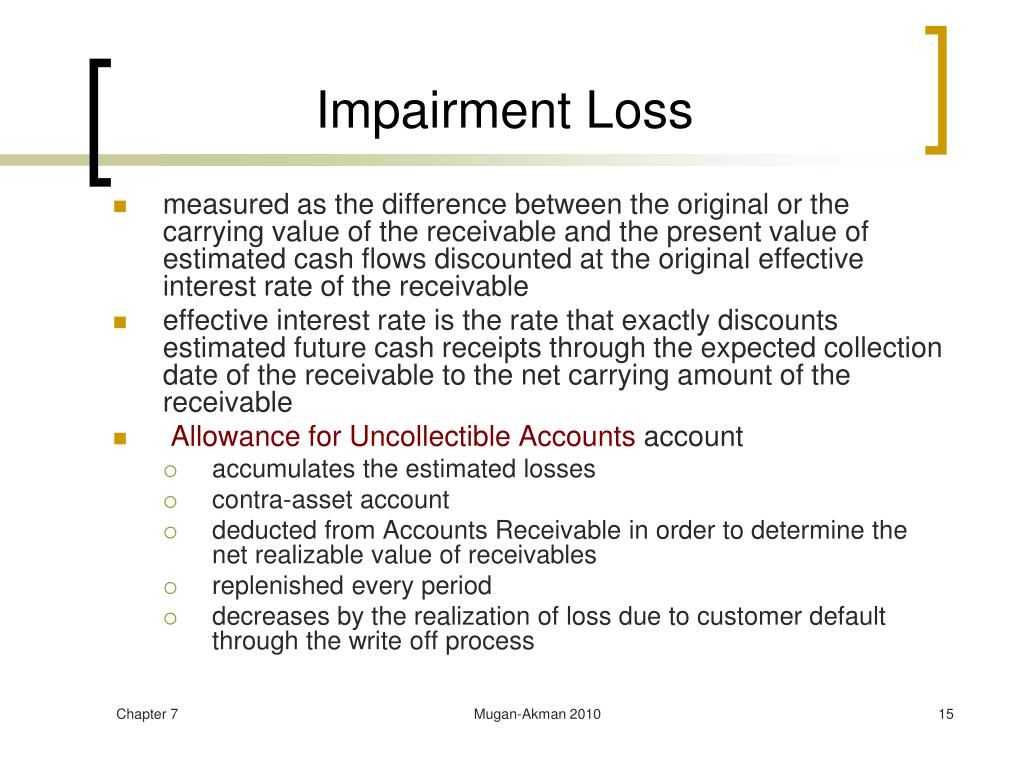

The journal entry to record an impairment is a debit to a loss, or expense, account and a credit to the related asset. Impairment refers to a sharp decrease in the fair market value of an asset due to several internal and external factors. The investment property is carried at cost.

Consider the following example. An impairment loss is recognized through a journal entry that debits loss on impairment, debits the asset's accumulated depreciation and credits the asset to reflect its new lower value. A contra asset impairment account, which holds a balance opposite to.