Nice Info About Interest Income In Cash Flow Statement Balance Sheet Example

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

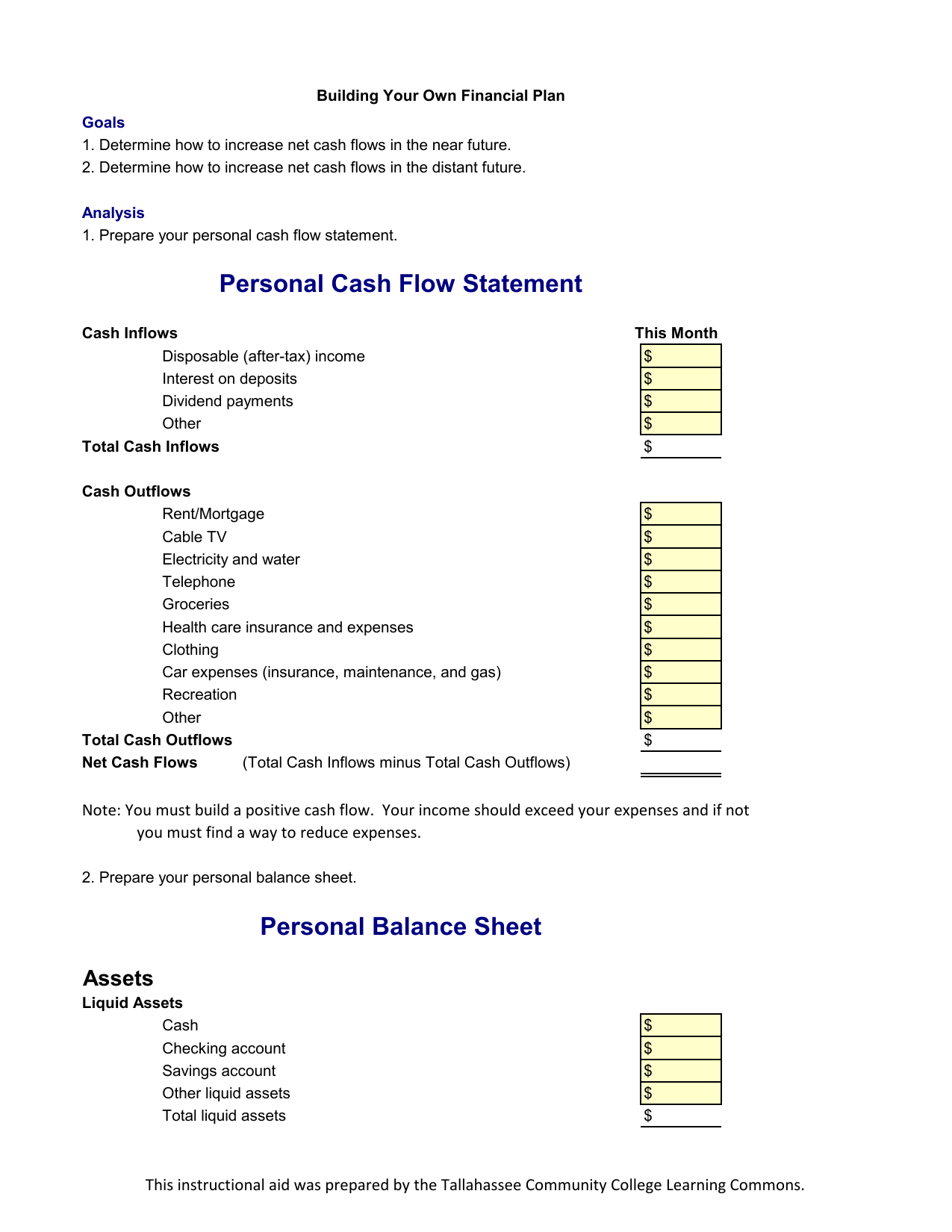

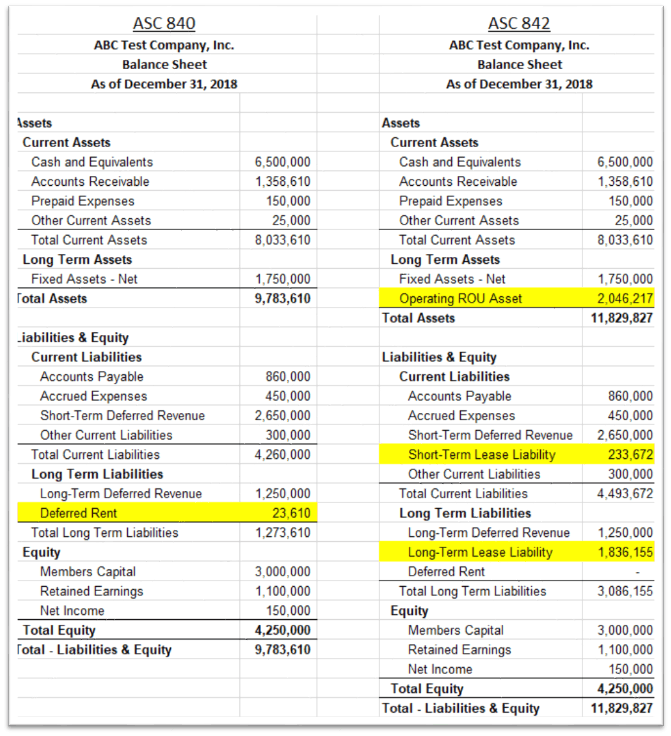

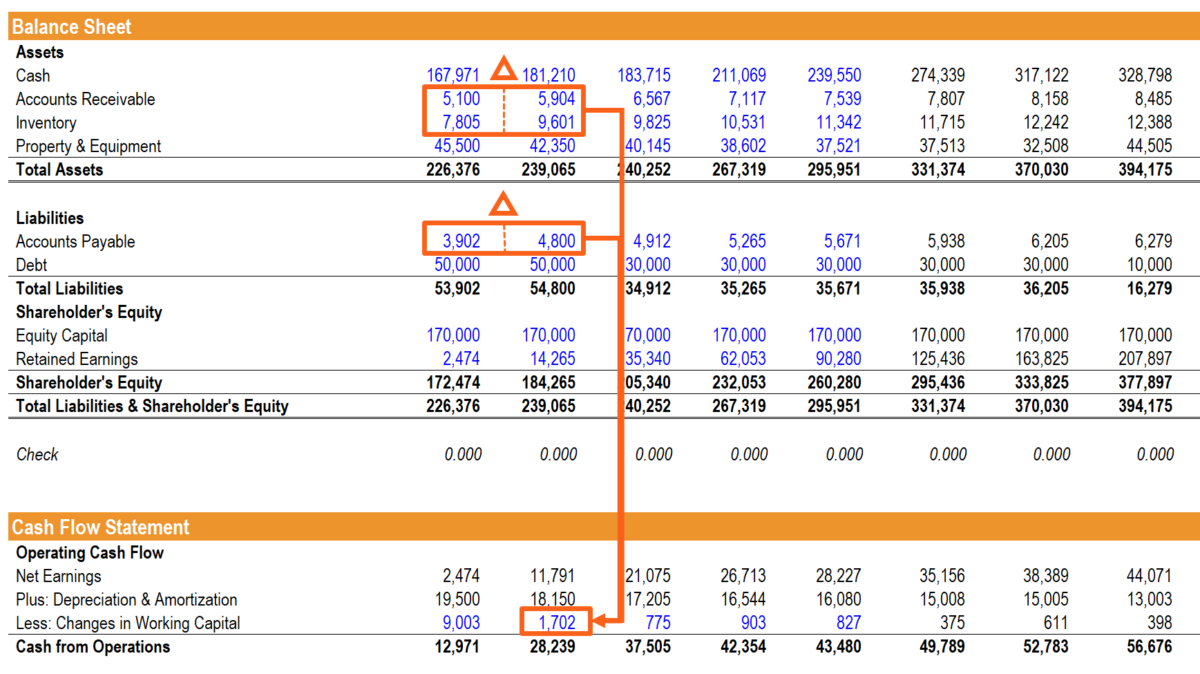

Net working capital (nwc) line items on the balance sheet are each tracked on the cfs.

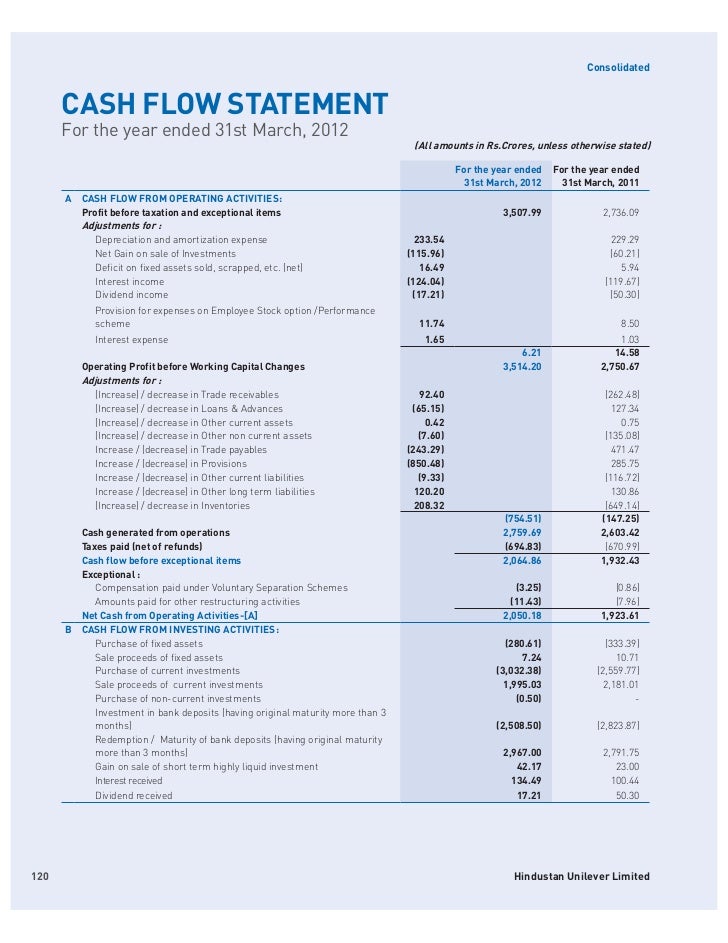

Interest income in cash flow statement income balance sheet example. Assets cash and cash equivalents are liquid assets, which may include treasury bills and certificates of deposit. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. Make adjustments for movement in working capital step 6:

Overview of the three financial statements Build financial models with correct interconnectivity between the three primary accounting statements: Average cash and cash equivalents → (beginning + ending cash balance) ÷ 2 cash rate → interest rate earned on cash interest income vs.

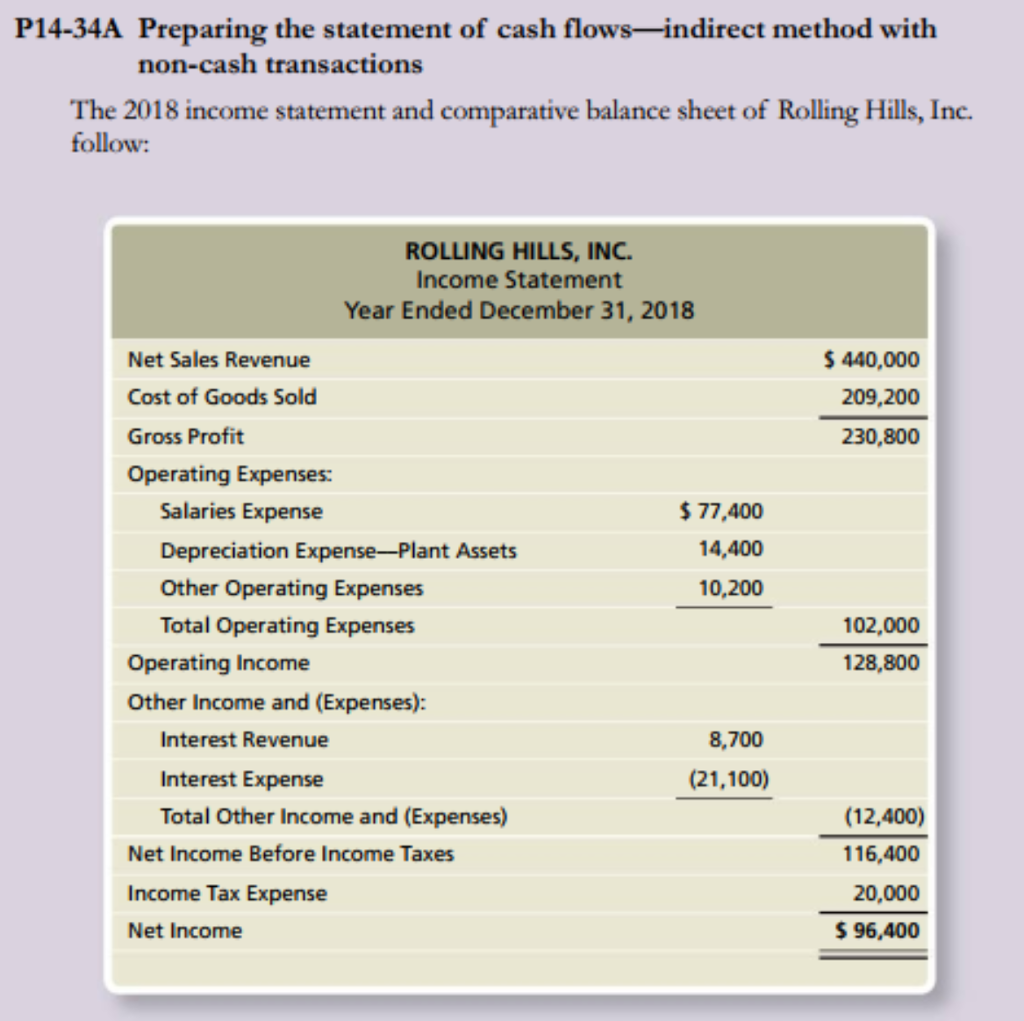

Receipts from sales revenue, salaries paid during the year etc), but. Make adjustments for non cash transactions step 4: Please briefly describe an income statement, statement of cash flows, and balance sheet.

The income statement shows a company or individual’s money. Did you get it ⬇️🤔 question: The cfs measures how well a.

Determine net cash flows from operating activities. The amounts on the scf provide the reasons for the change in a company's cash and cash equivalents during the period covered. Please describe the five types of financial ratio analyses, give two examples of each from each type, and.

Below are examples of items listed on the balance sheet: The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how.

Income statement and balance sheet. For example, operating activities of a hotel will include cash inflows and outflows from the hotel business (e.g. Example of a cash flow statement.

For simplicity, we will assume that the company does not have cash equivalents. The cash flow statement uses information from your company’s income statement and balance sheet to show whether or not your business succeeded in generating cash during the period defined in the. The balance sheet, income statement, and cash flow statement:

The cash flow statement is one of three key financial statement for a company. Did you get it ⬇️樂 question: An income statement compares revenue to expenses to determine profit or loss.

Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in. Calculate the cash flows from. Income statement, balance sheet, and p&l.