Spectacular Tips About Net Income In The Balance Sheet

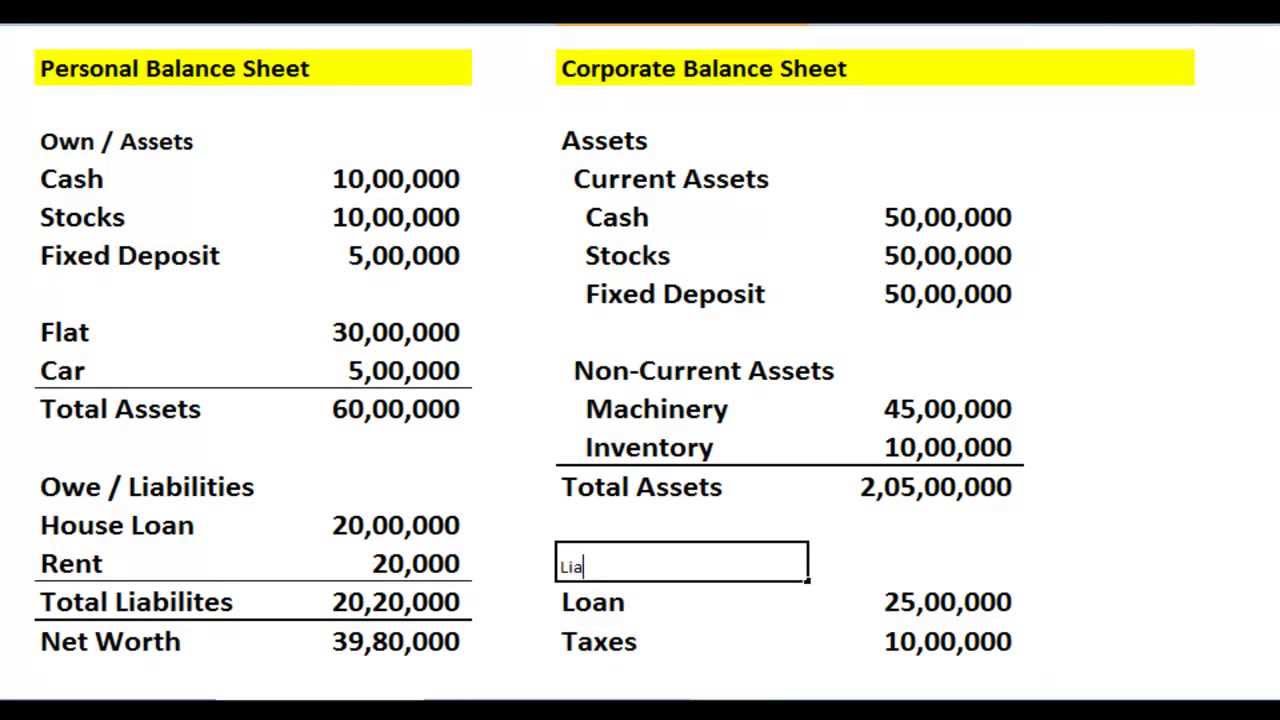

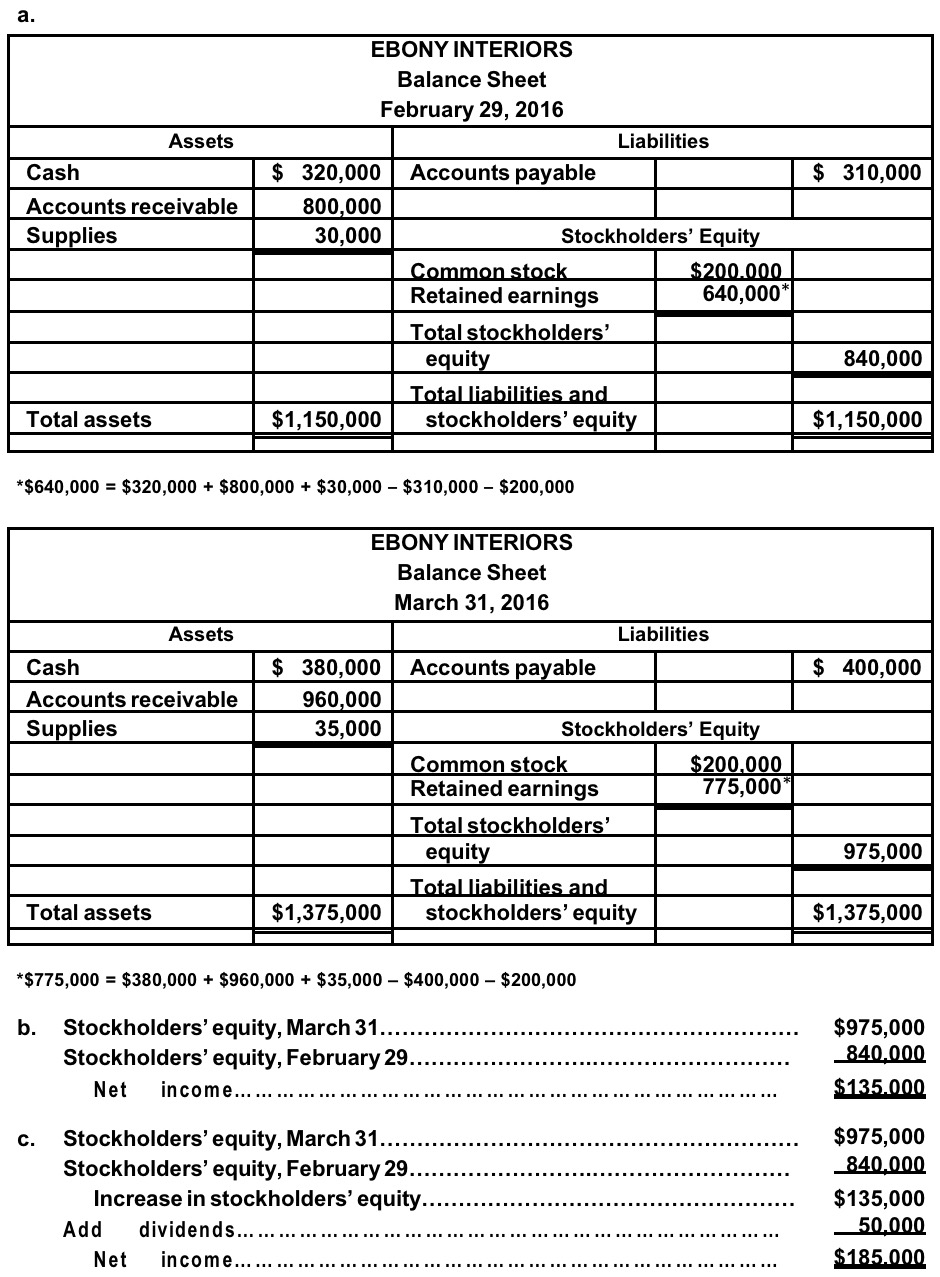

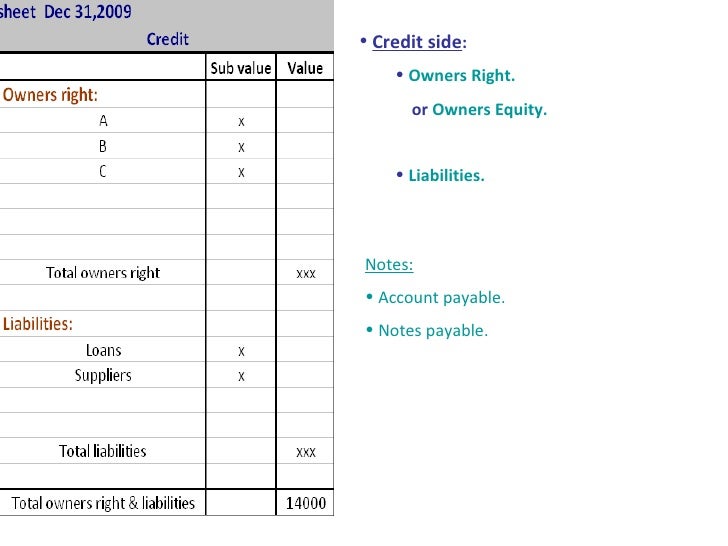

A balance sheet is one of the key financial statements that provides a snapshot of a company’s finances at any given point in time.

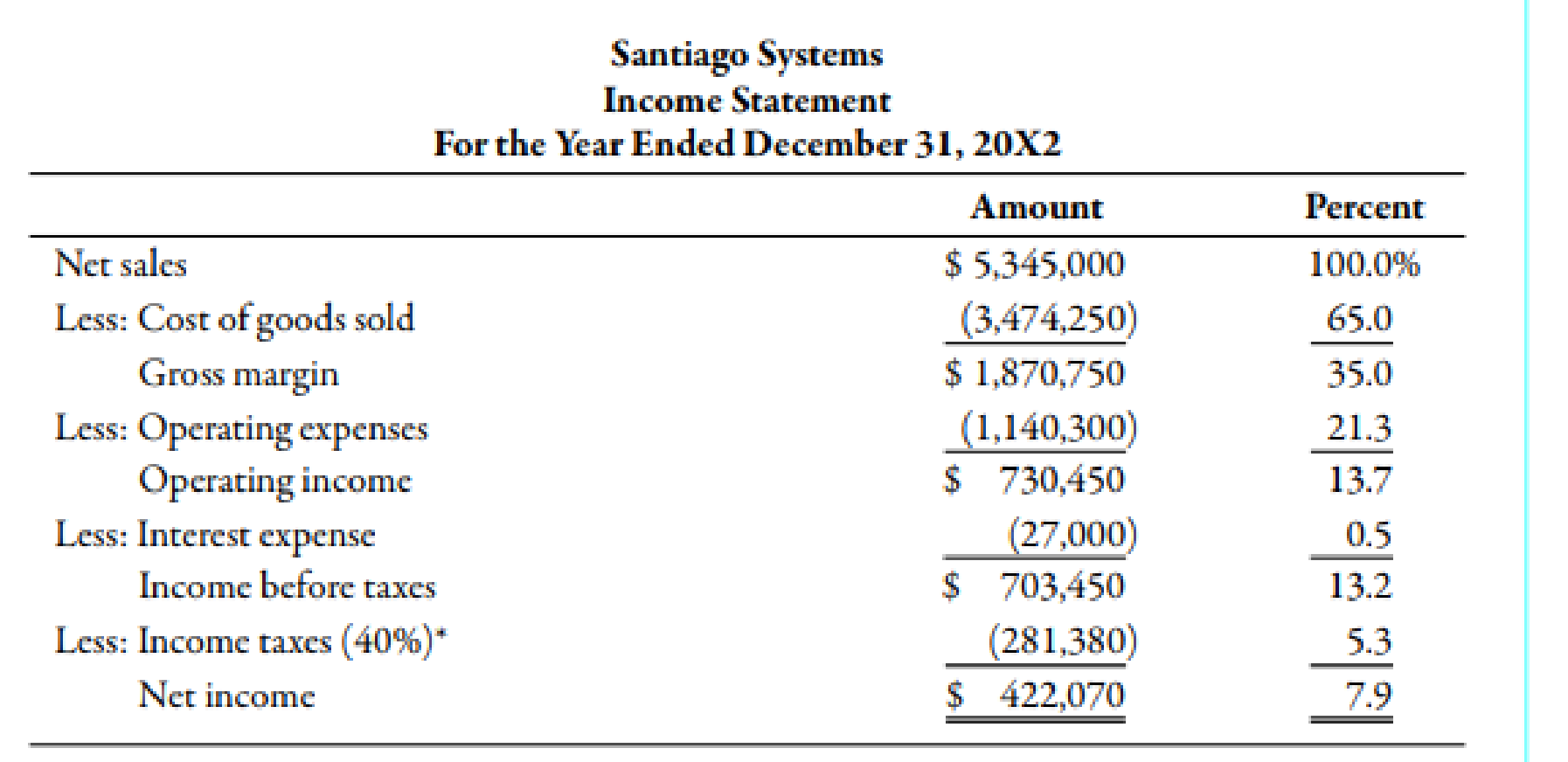

Net income in the balance sheet. A company’s net profits in a given period can be divided by the amount of revenue generated to calculate the net profit margin, a frequently used profitability metric. If your total expenses are more than your revenues, you have a negative net income, also. Net income is the profit that a business earns after all expenses have been deducted from its revenue.

The net income of a sole proprietorship, partnership, and subchapter s corporation will not include income tax expense since the owners (not the entity) are responsible for the. If a farm business has an annual net income of $425,000, the which of the following is the likely change in the balance sheet? Its p&c business leads with $1.9b.

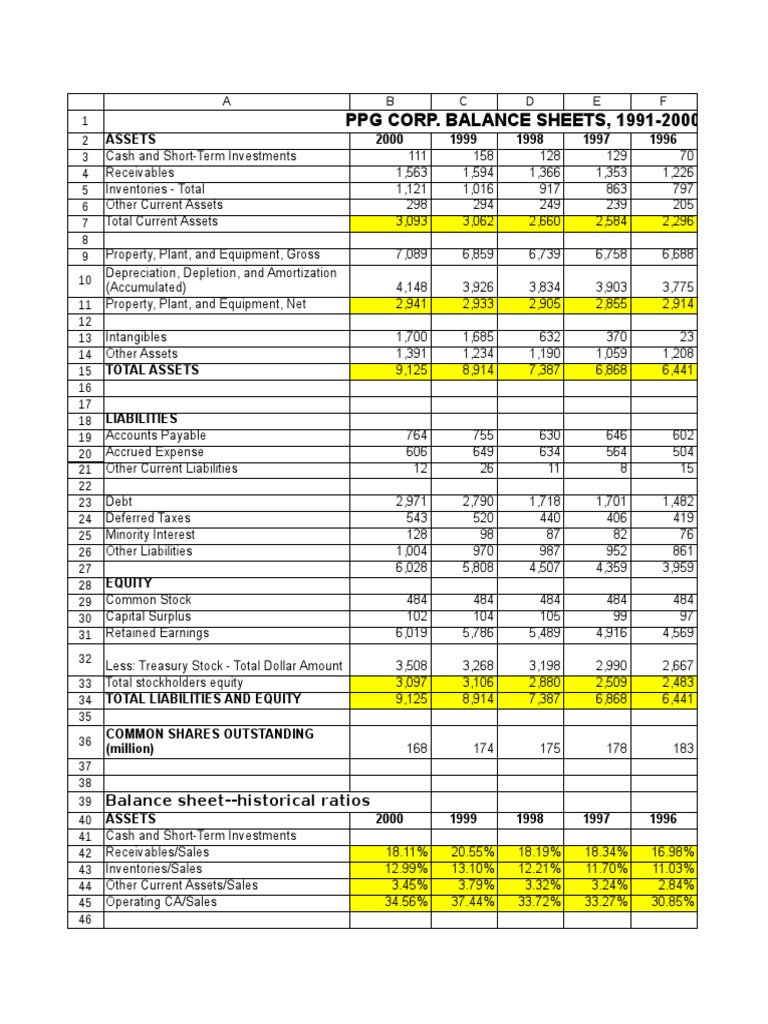

Updated april 30, 2022 reviewed by gordon scott fact checked by pete rathburn the balance sheet and the profit and loss (p&l) statement are two of the three financial. You will need certain minimum items from the balance sheet to calculate the. In short, net income is the positive result of a company’s.

Determine the beginning and ending balances of each account the first step in calculating net income from a balance sheet is to determine the beginning. Unique characteristics are included in the balance sheet and income statement of a bank's financial statements that help investors decipher how banks make. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

This aggressively drove a return on equity. Net income margin = net income/total revenue. Understanding the balance sheet.

Key components of net income. In other words, it’s the money that remains once all bills and costs are paid. Gross profit is the number you get when you take your.

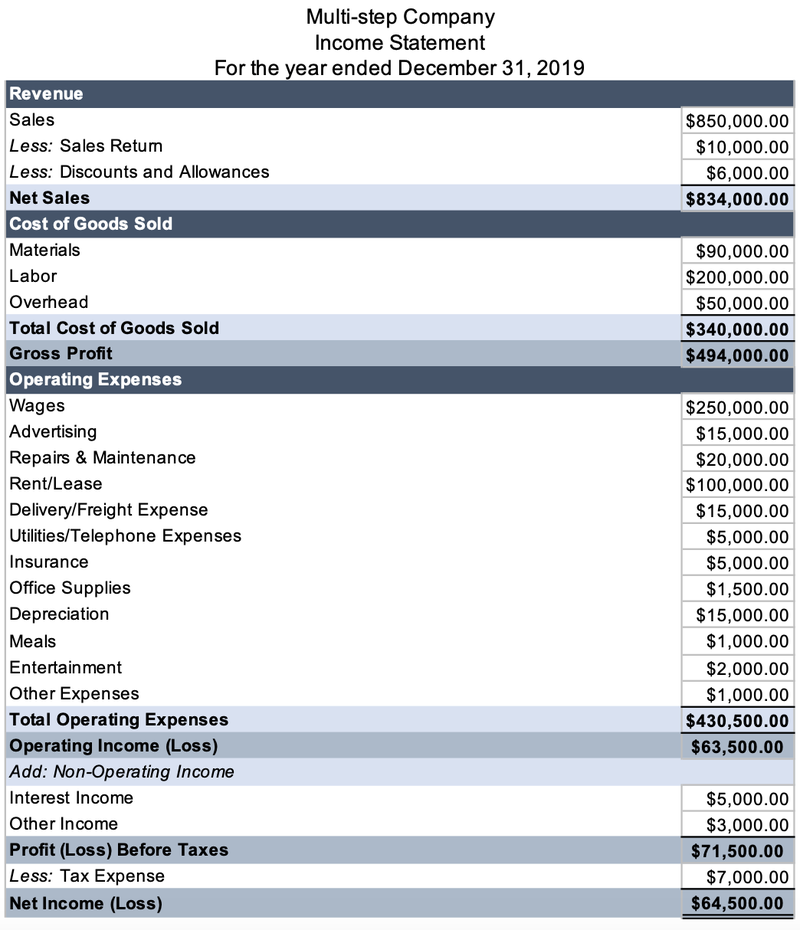

According to the credit rating agency, these ratings reflect the company’s balance sheet strength, which am best has assessed as very weak due to a significant. On the income statement, net income is revenue minus costs and expenses (including income taxes) which equals profit (or loss if negative). This is the process of.

In the simplest terms, net income is your total revenue minus all your costs, taxes, and operating expenses. Here is the calculation: Net income is a component in.

This mainly reflects the phasing. The income statement was first since net income (or loss) is a required figure in preparing the balance sheet. Net income margin is a comparison of total revenue received during a time period to the.

Did you get it ⬇️樂 question: Net income can be positive or negative. During the period close process, all temporary accounts are closed.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)