Stunning Info About Understanding Company Balance Sheet

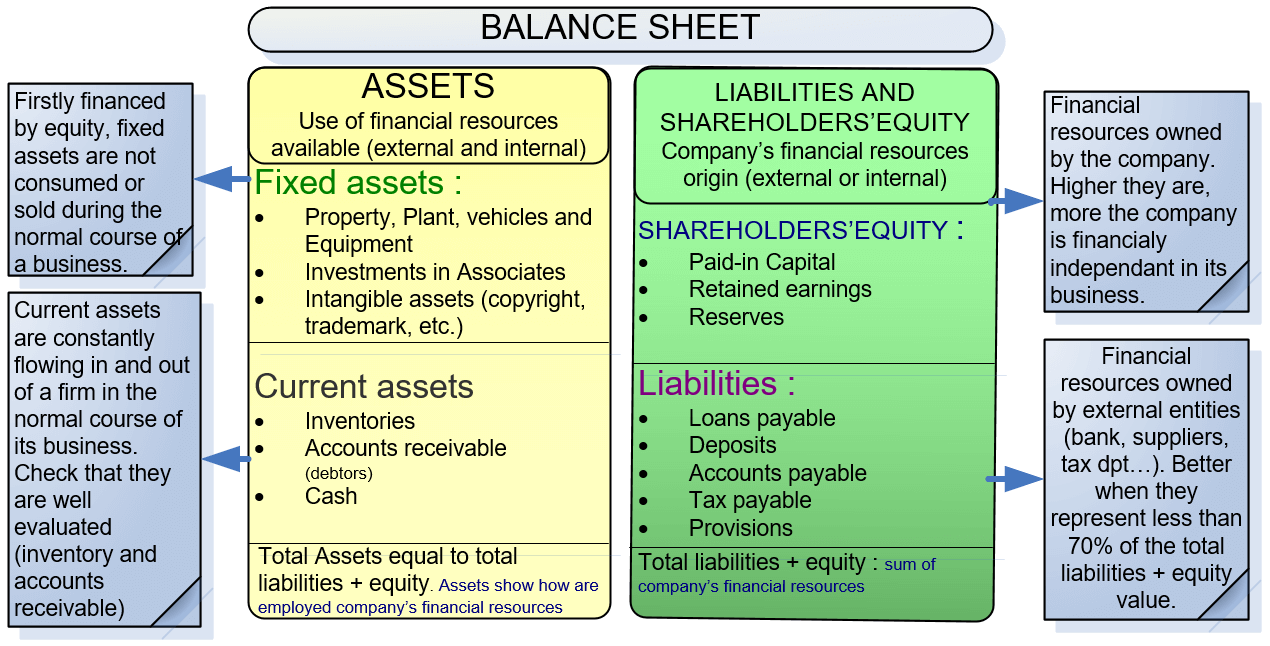

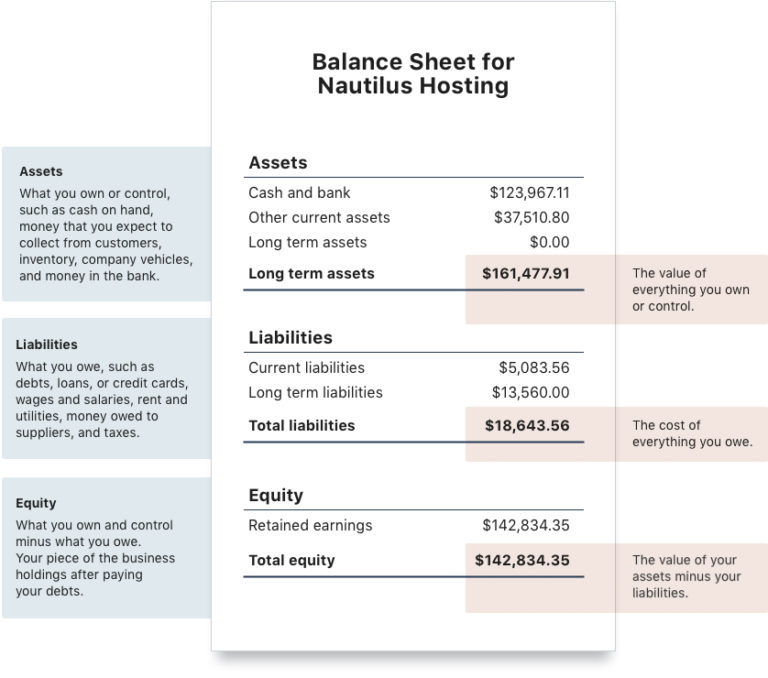

Each section provides valuable information about a company’s financial position.

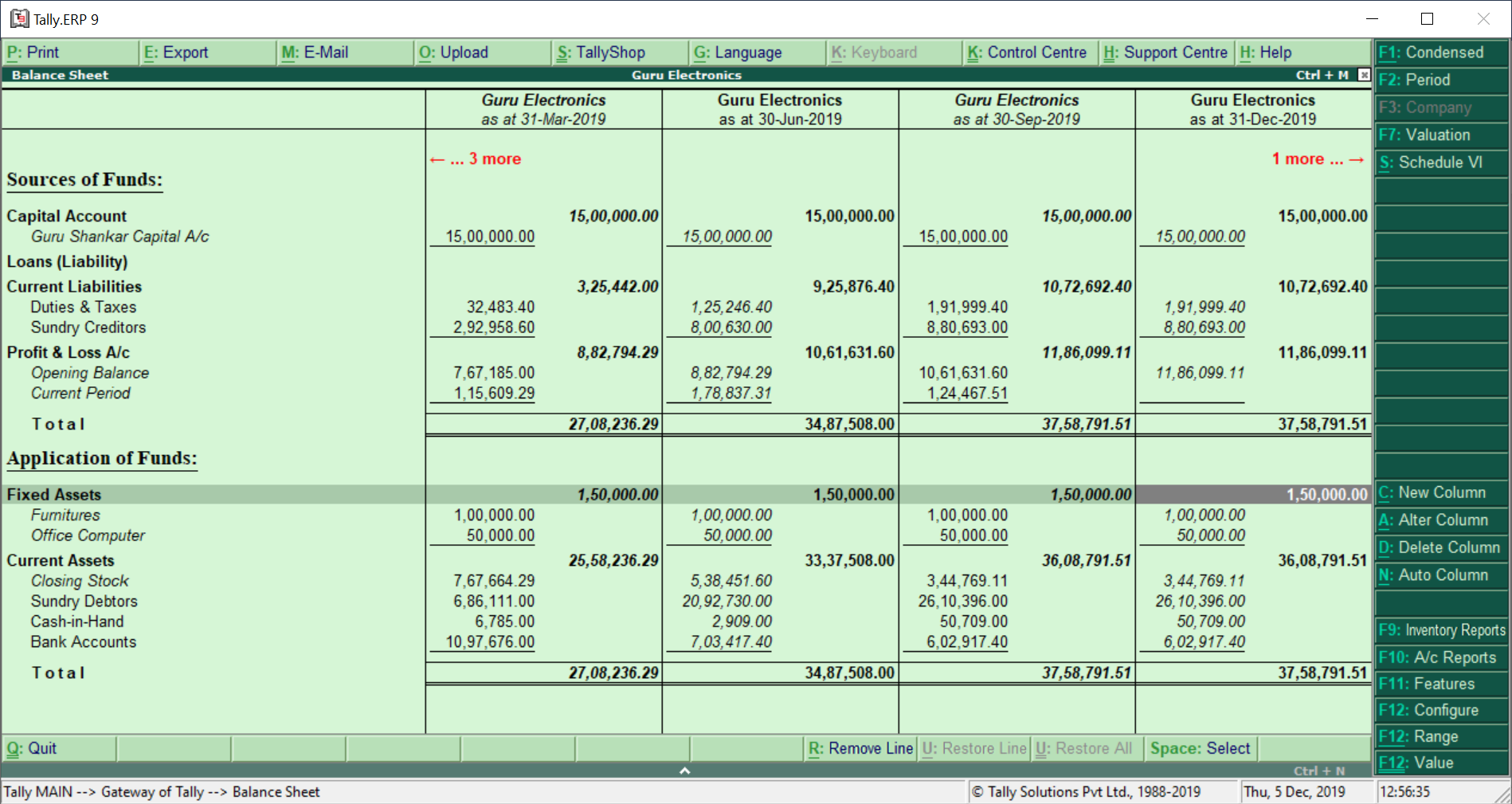

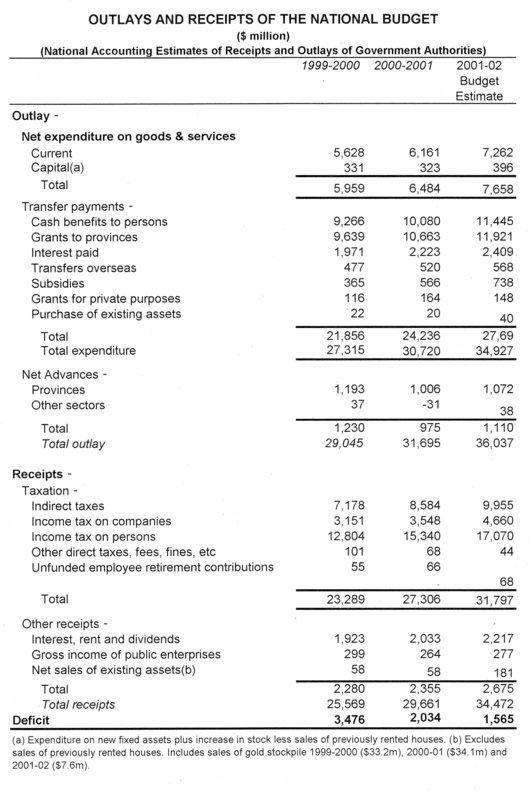

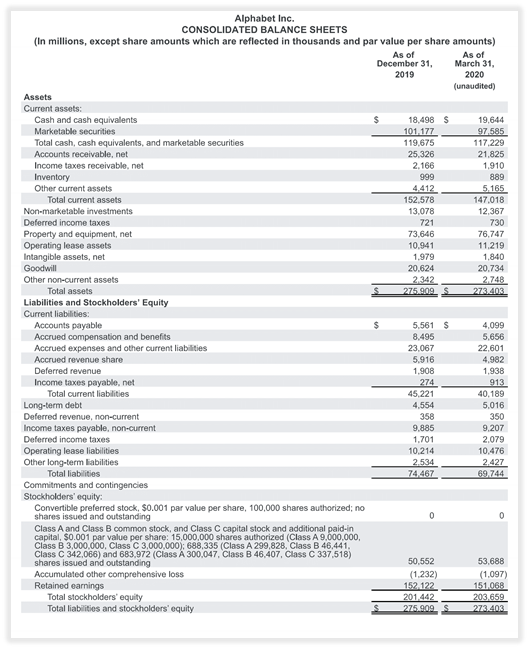

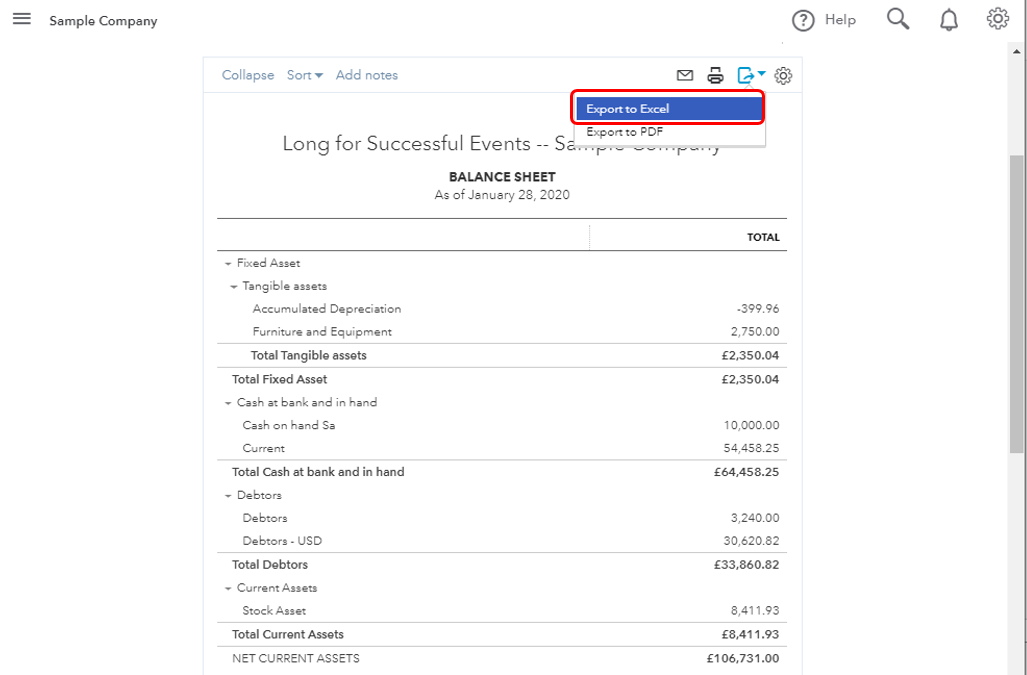

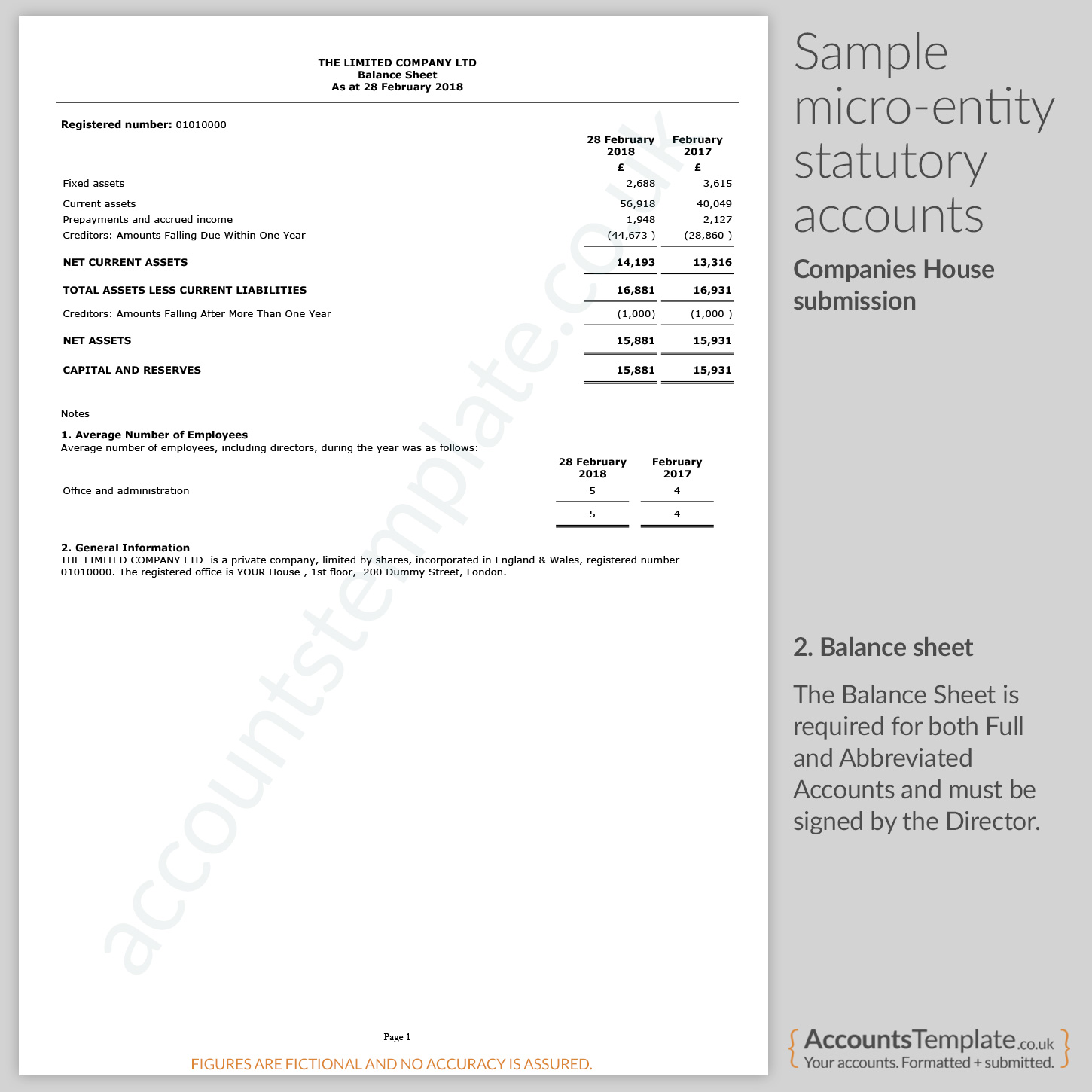

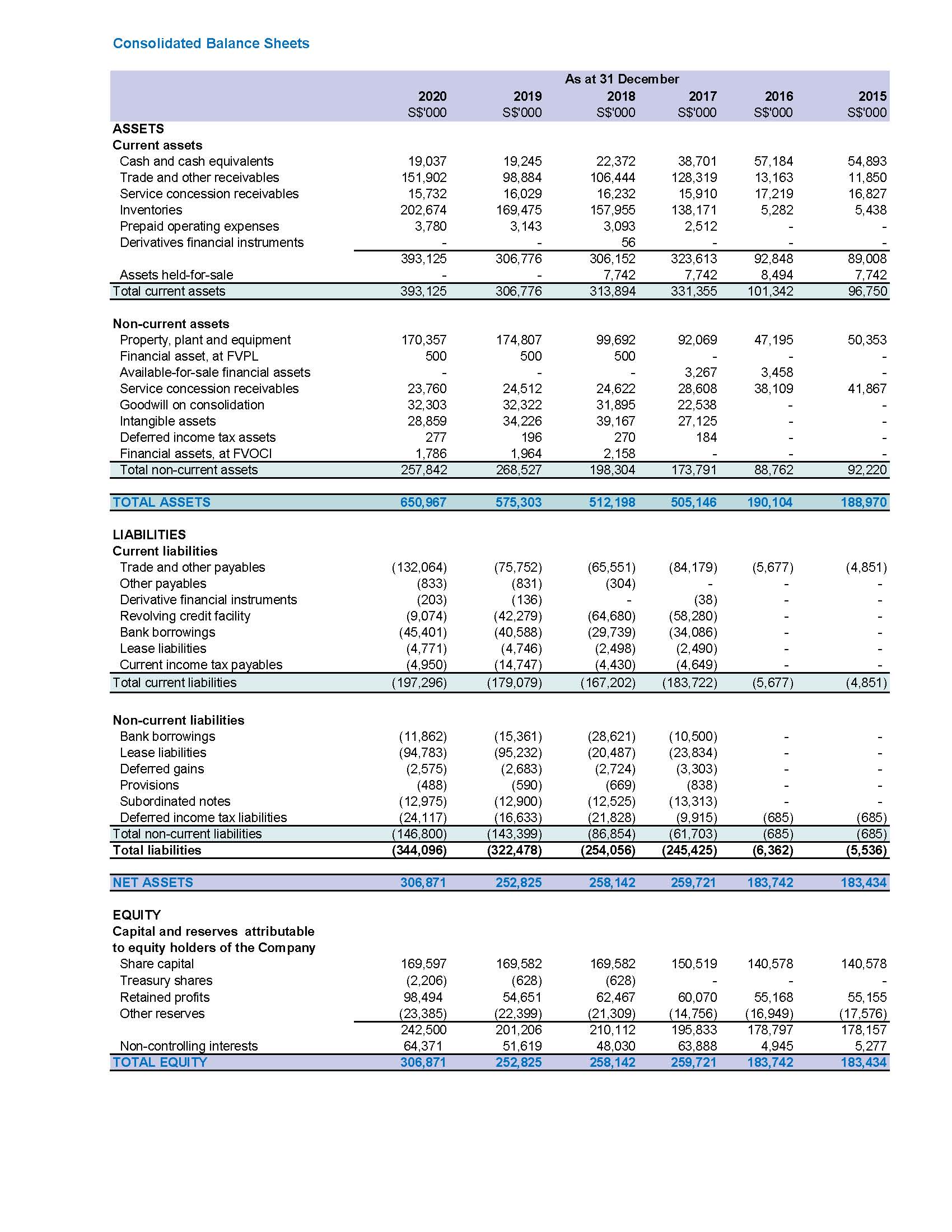

Understanding company balance sheet. This blog post will break down what this means and why it matters for your business or accounting practice. A balance sheet is used to present a company’s financial position on a specific day. At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data.

The balance sheet shows a company’s assets,. A balance sheet covers a company’s assets as. First quantum signs $500m copper deal with shareholder, says asset and stake sales progressing.

It allows you to see what resources it has available and how they were financed as of a specific date. If a balance sheet is dated december 31; Special dividend of € 1.00 per share.

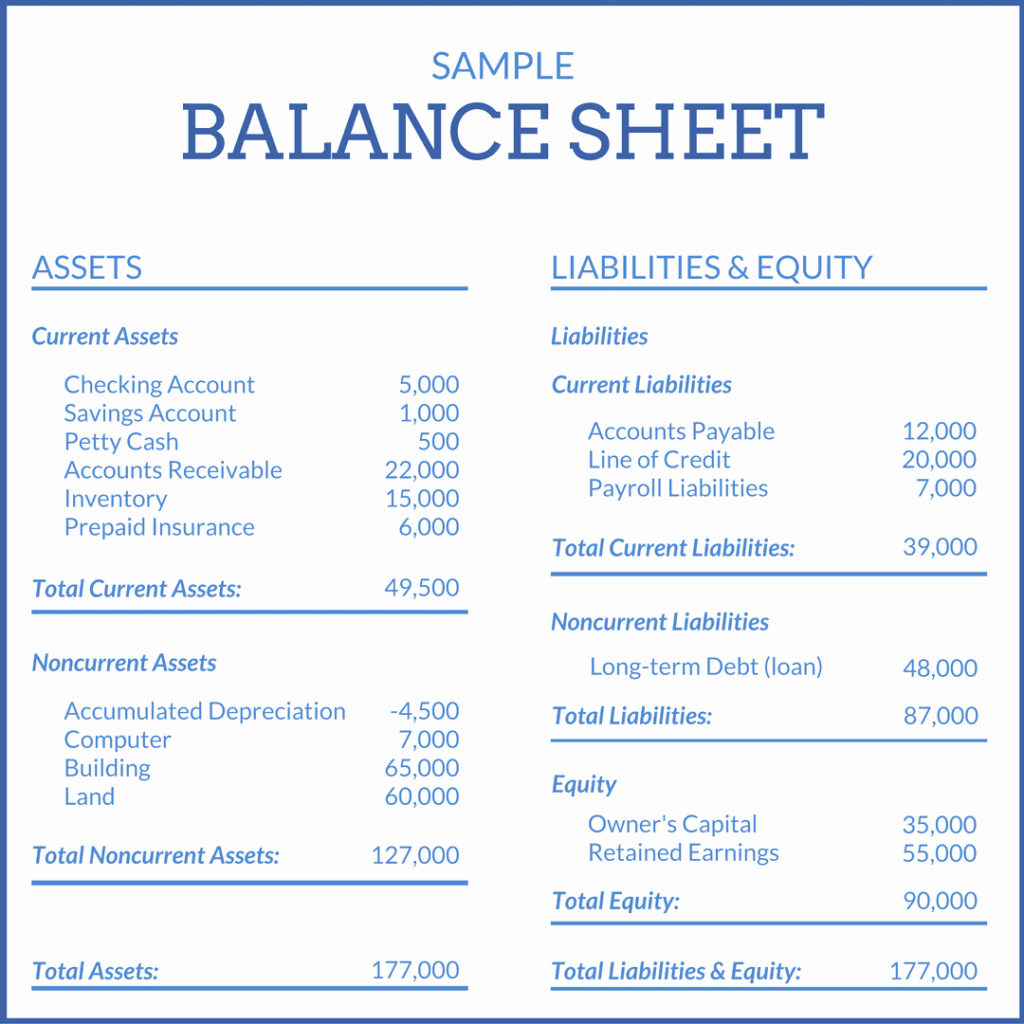

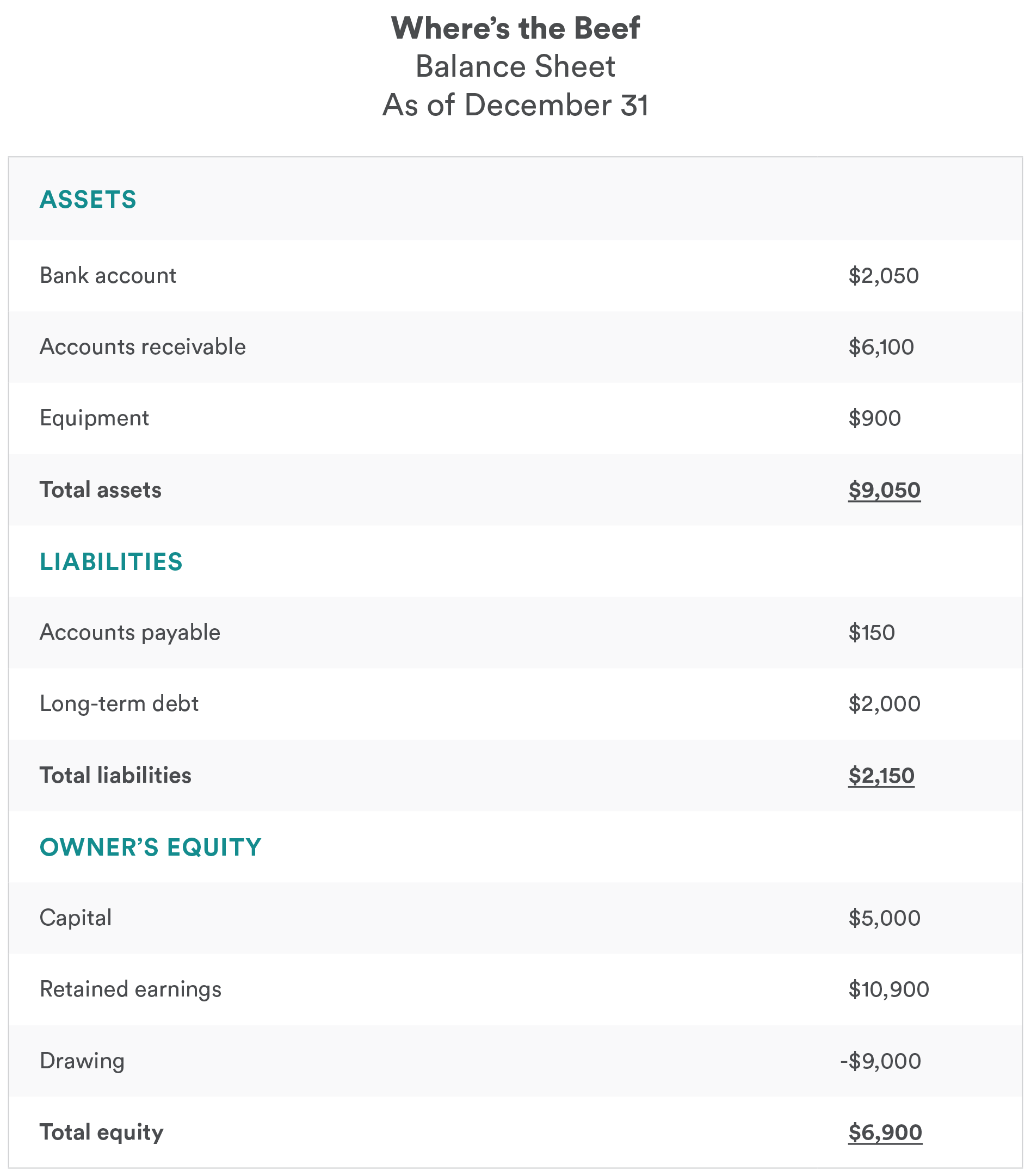

A balance sheet is a financial document that provides a thorough overview of a company’s financial position. Add each asset as a line item within the relevant category and assign appropriate values. Equity is the owners’ residual interest in the assets of a company, net of its liabilities.

It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. You can also see that the assets and liabilities are further classified into smaller categories of accounts. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health.

Its assets, also known as debits. Accumulated amortization reduces the value of intangible assets on a company’s balance sheet over time. It adheres to the fundamental accounting equation:

Fed minutes suggest officials are seeking smallest balance sheet possible. A balance sheet presents a financial snapshot of what the company owns and owes at a single point in time, typically at the end of each quarter. The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement.

The balance sheet, also known as the statement of financial position, is one of the three key financial statements. As a business owner or investor, understanding the balance sheet is crucial to evaluating the financial health of a company. A balance sheet conveys the “book value” of a company.

A company's financial statements — balance sheet, income, and cash flow statements —are a key source of data for analyzing the investment value of its stock. Breaking down the balance sheet. There are 5 modules in this course.

Assets, liabilities, and shareholders’ equity. You’ll understand how this silent subtractor works in your ledger, revealing its impact on asset. Balance sheets serve two very different purposes depending on the audience reviewing them.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)