Smart Info About Income Statement Business Plan

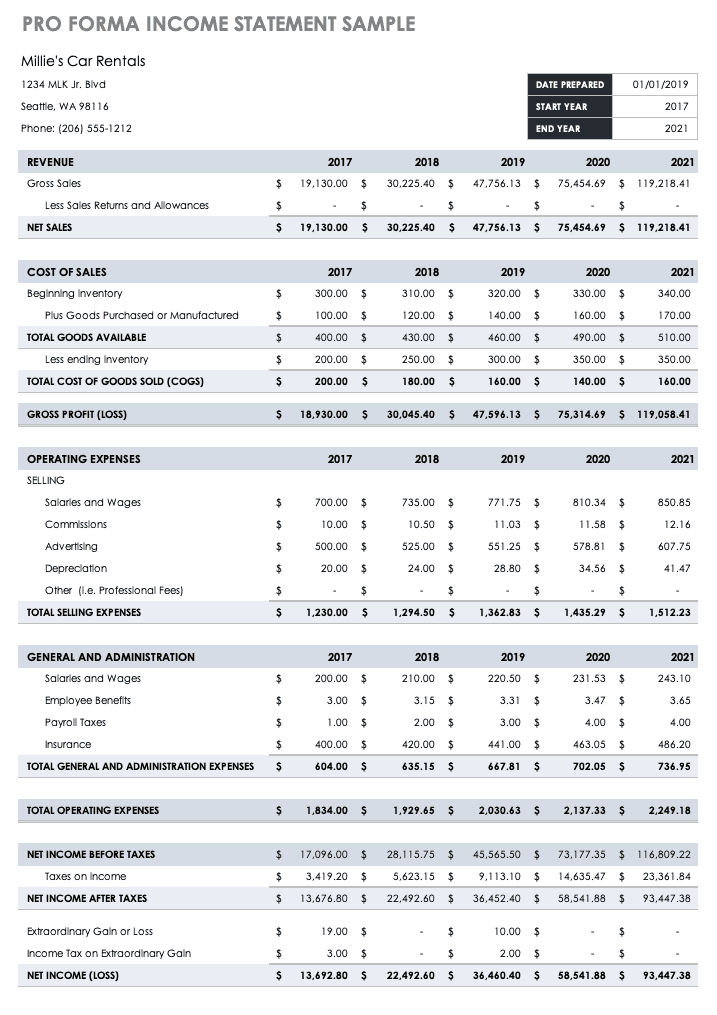

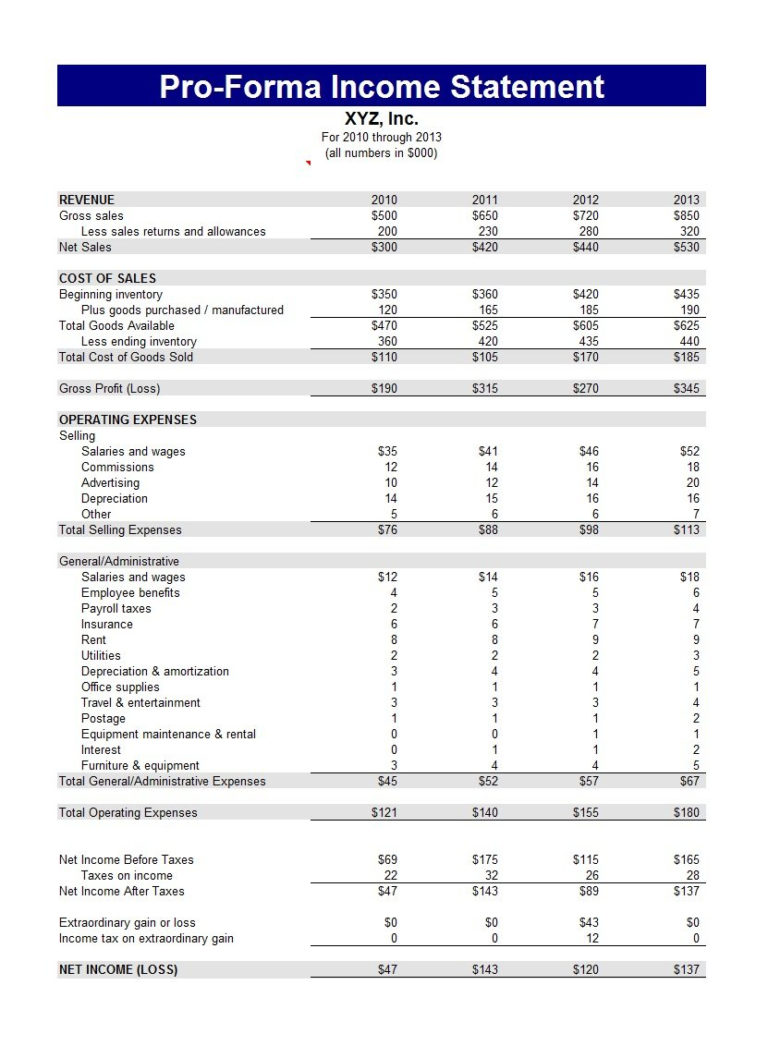

You should also include a pro forma income statement, balance.

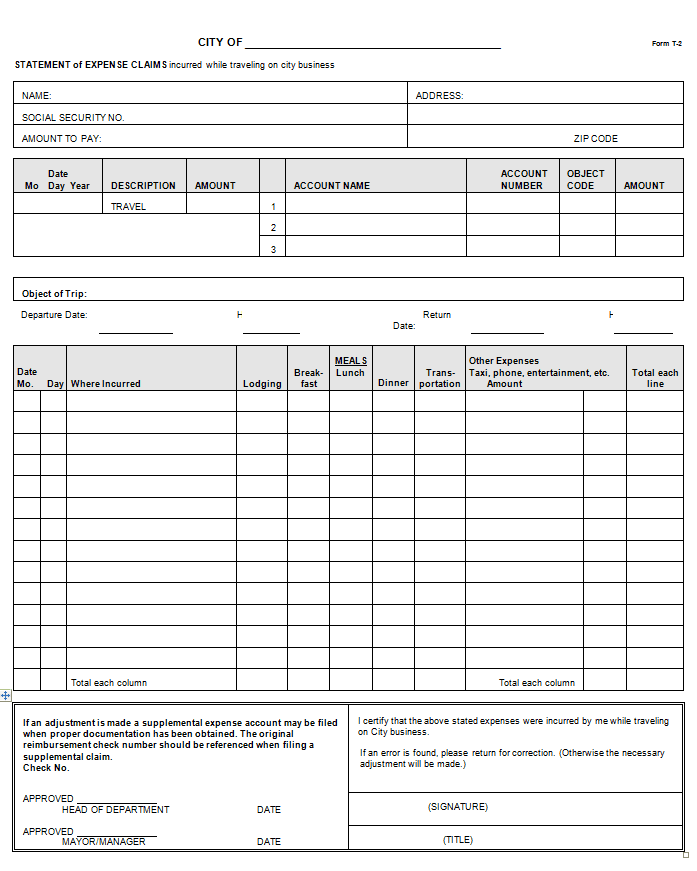

Income statement business plan. To be eligible, the applicant: As you create your financial projections for your business plan, one of the most important components of your plan will be your income statement. Cash flow statement templates for business plan.

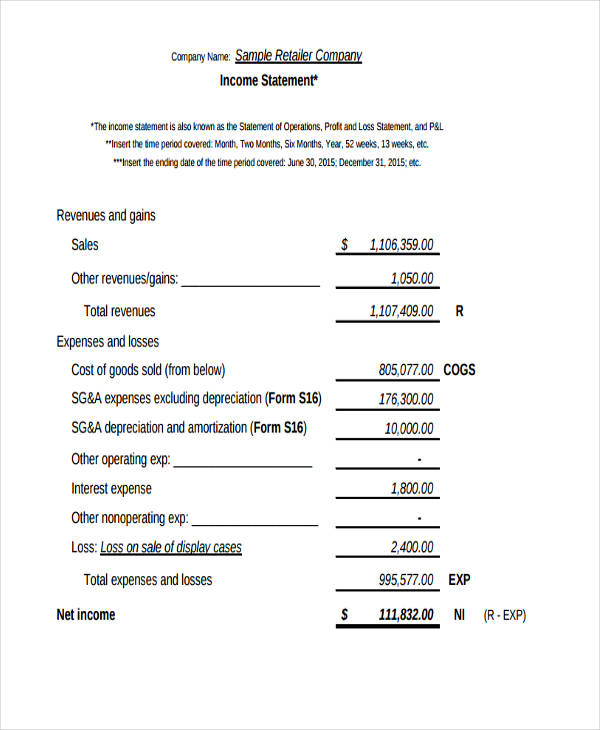

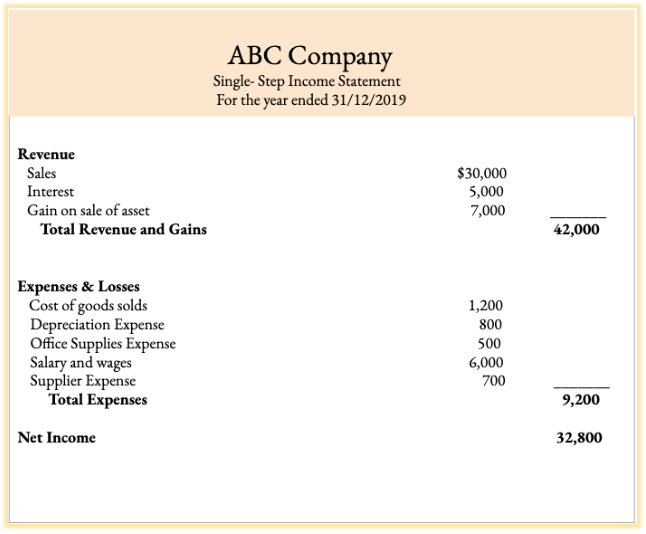

An income statement summarizes your revenue and costs and shows your net profit in your business plan. Filed a new brunswick tax return. Your budget may be based on the financial information of your pro forma statements—after all, it makes sense to make plans based on your predictions.

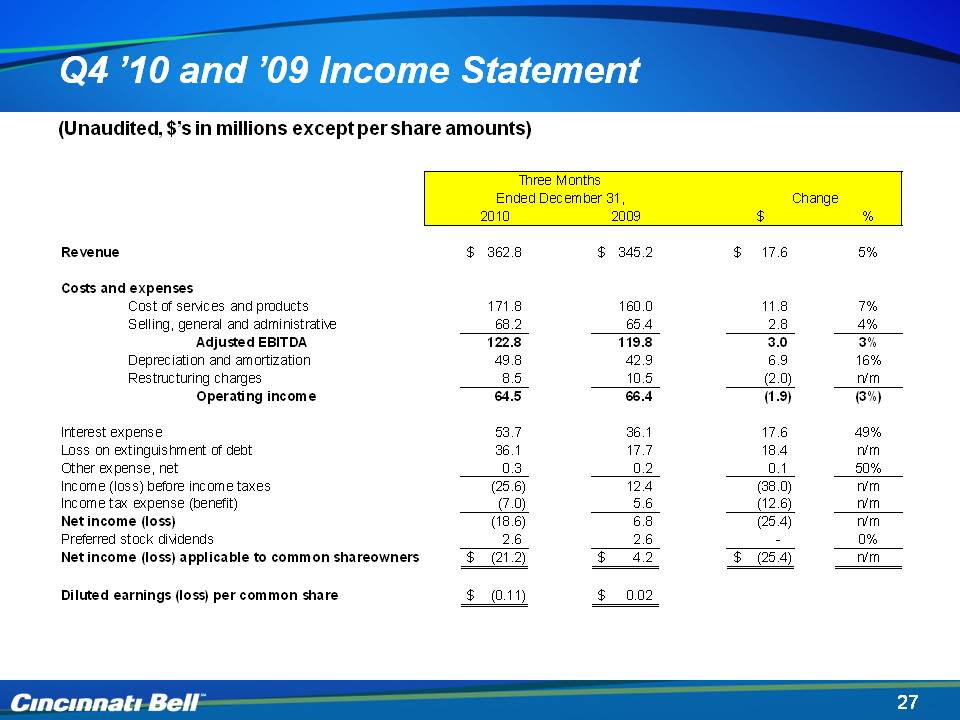

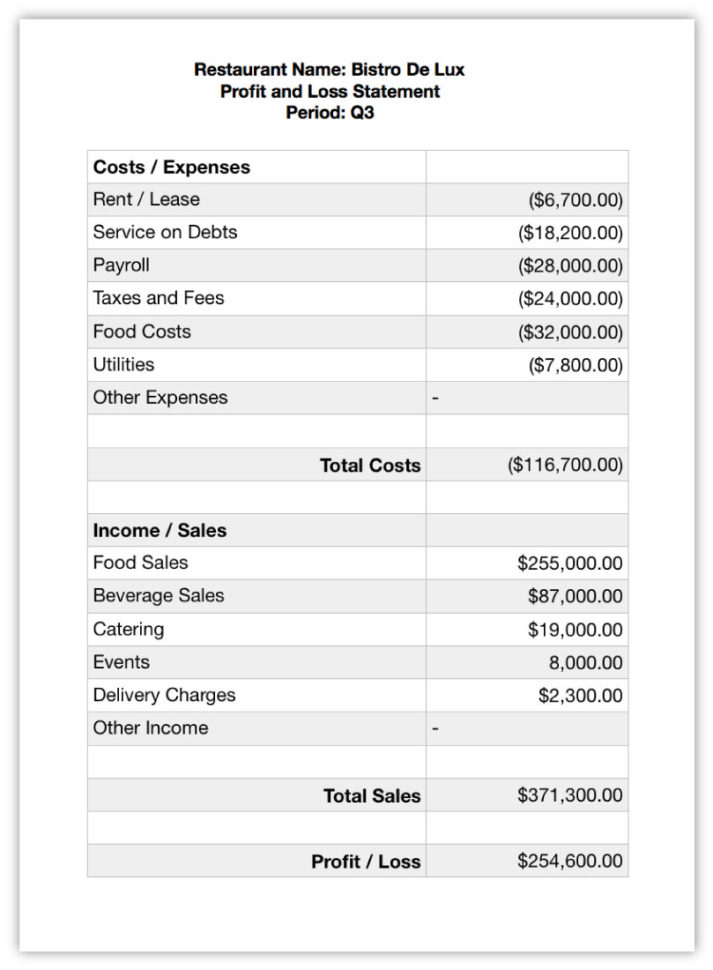

Everything you need to know understanding an income statement. Financial statements needed for a successful business plan, including balance sheet, income statement, and sources and uses of funds. Shows the company’s revenue, expenses, and profit or loss.

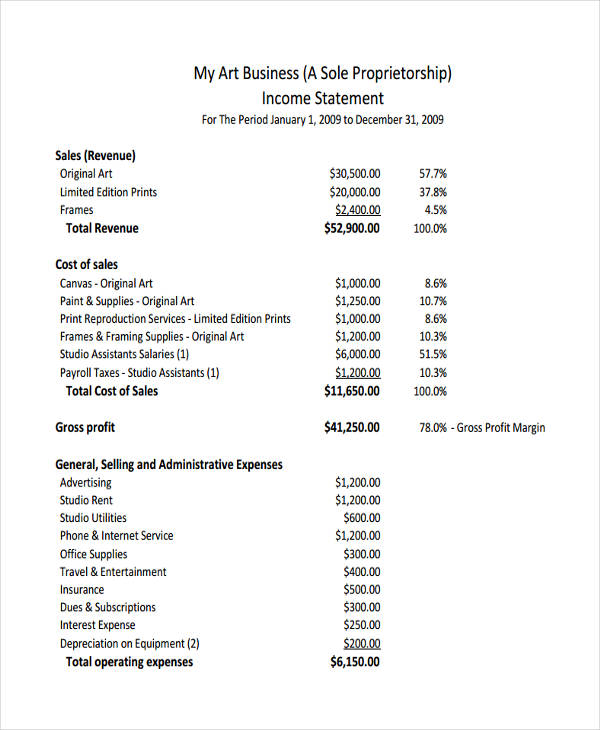

This information is very important to business plan readers. An income statement, also called a profit and loss statement (or p&l), is a fundamental tool for understanding how the revenue and expenses of your business stack up. Had $3,000 or more in family working income for that taxation year.

Currently, the industry generates over $56 billion in revenue annually, with an average growth rate of 3.9% over the past five years. On 16 feb 2024, dpm and finance minister lawrence wong delivered the budget 2024 statement in parliament. Your income this year is $37,000.

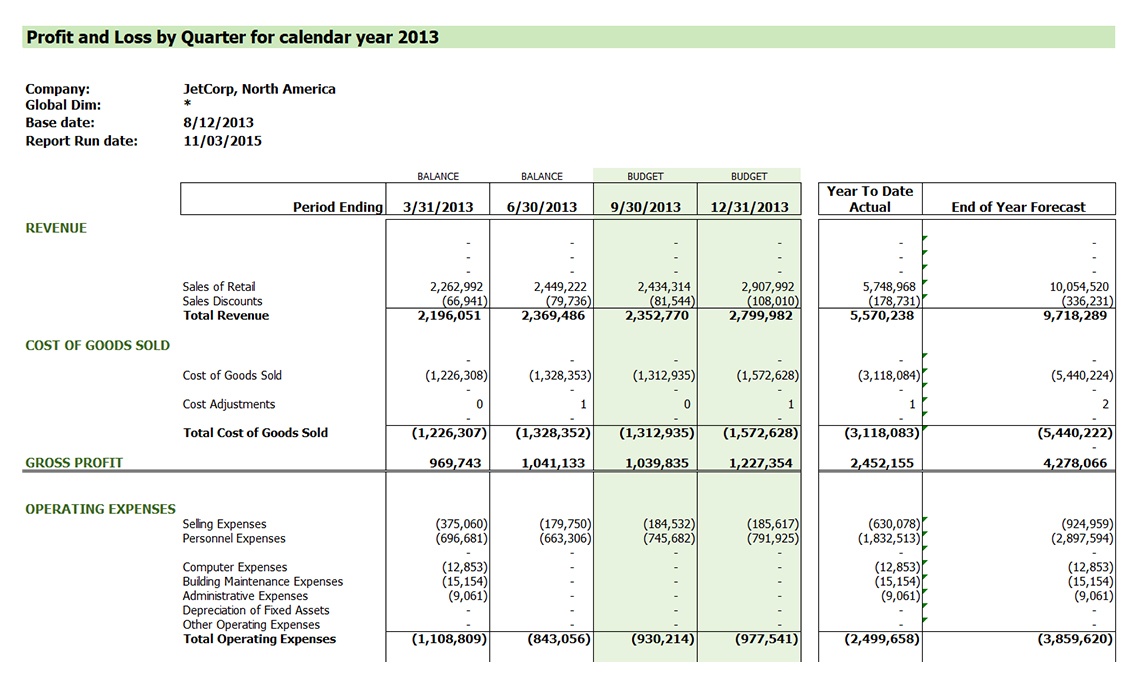

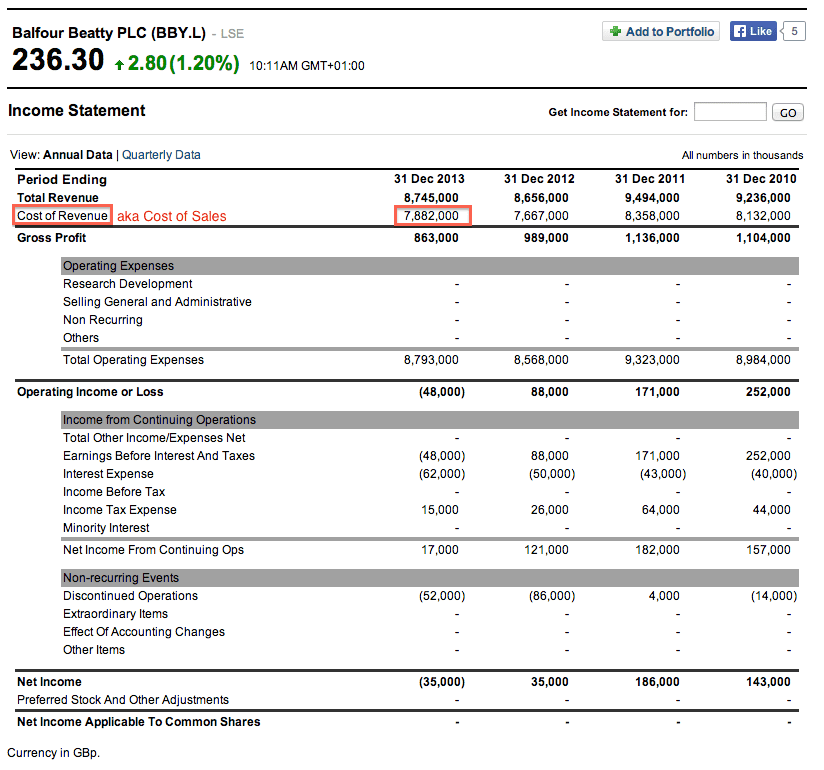

The figure shows the company’s annual revenues, costs, and profits for the most recent year as well as for the. Jetta productions inc/getty images the financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. When writing a pro forma business plan, you will need to include information such as your company’s sales forecasts, expenses, capital expenditure plans, and funding requirements.

Watch budget 2024 statement. It adds up all your revenue from sales and other sources, subtracts all your costs, and comes up with the net income figure, also. This refers to the money your business has at.

Put simply, a balance sheet shows what a company owns (assets), what it owes (liabilities), and how much owners and shareholders have invested (equity). Income statements depict a company’s financial performance over a reporting period. The income statement (also called a profit and loss statement) summarizes a business’ revenues and operating expenses over a time period to calculate the net income for the period.

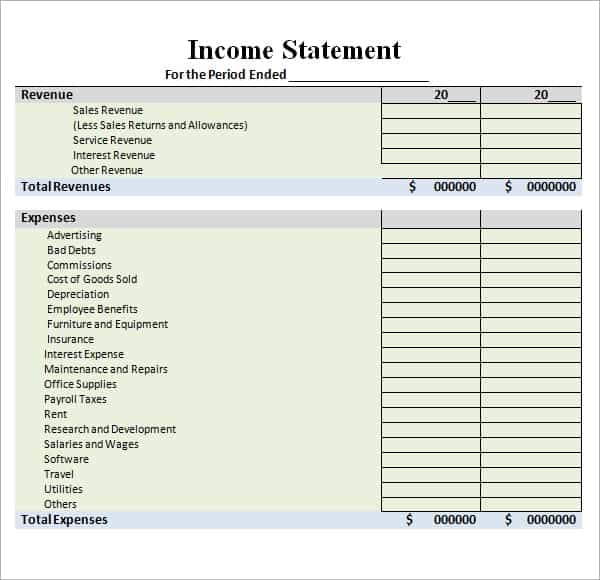

Must be a resident of new brunswick at the time of application. The income statement calculates the company’s net income or net profit by taking into account its earnings, gains, expenses, and losses over a period. A small business income statement template typically includes the following line items for tracking your business's financial status:

The qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Be 19 years of age or older as of december 31, 2023. A balance sheet, on the other hand, only lists the fiscal situation on a specific date.

![Business Plan Financial Projections [Simplified] Statement](https://i.pinimg.com/originals/cb/63/7d/cb637d4cd8db8319625d90ecb5e0efc1.jpg)