Lessons I Learned From Info About 26as In Tds

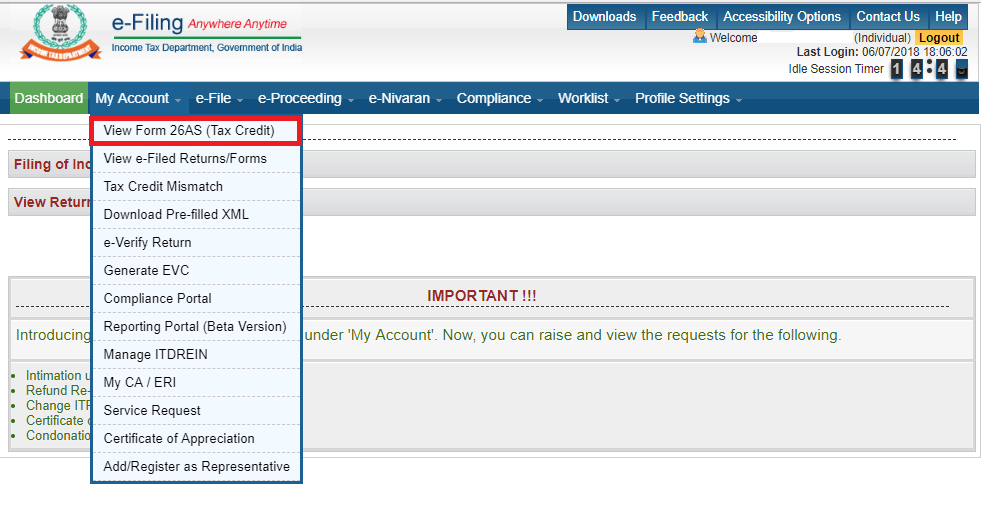

Select the ‘assessment year’ and ‘view type’ (html, text or.

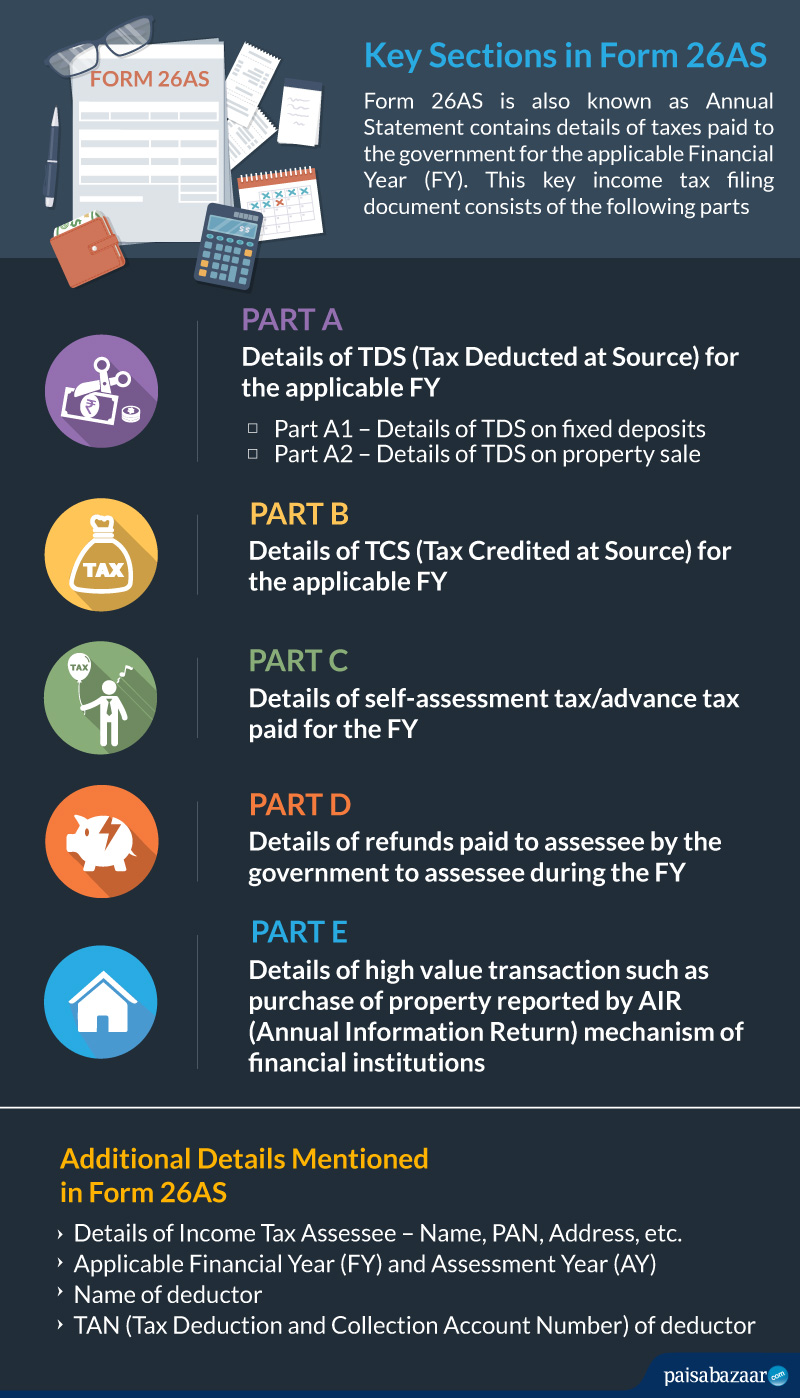

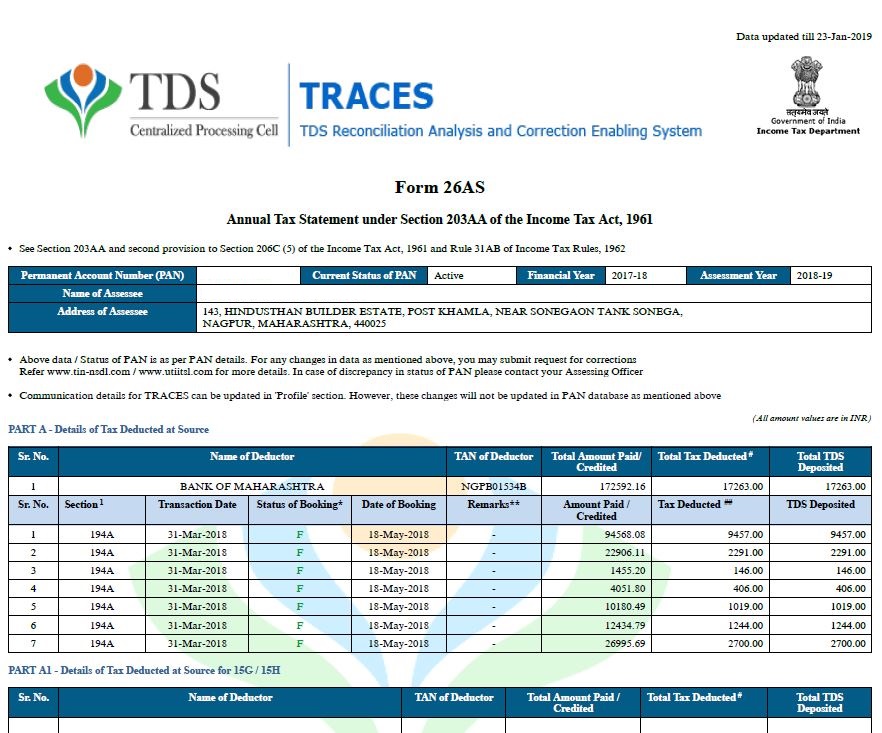

26as in tds. Things to verify in your tds certificate with form 26as. Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along. If you are not registered with traces, please refer to our e.

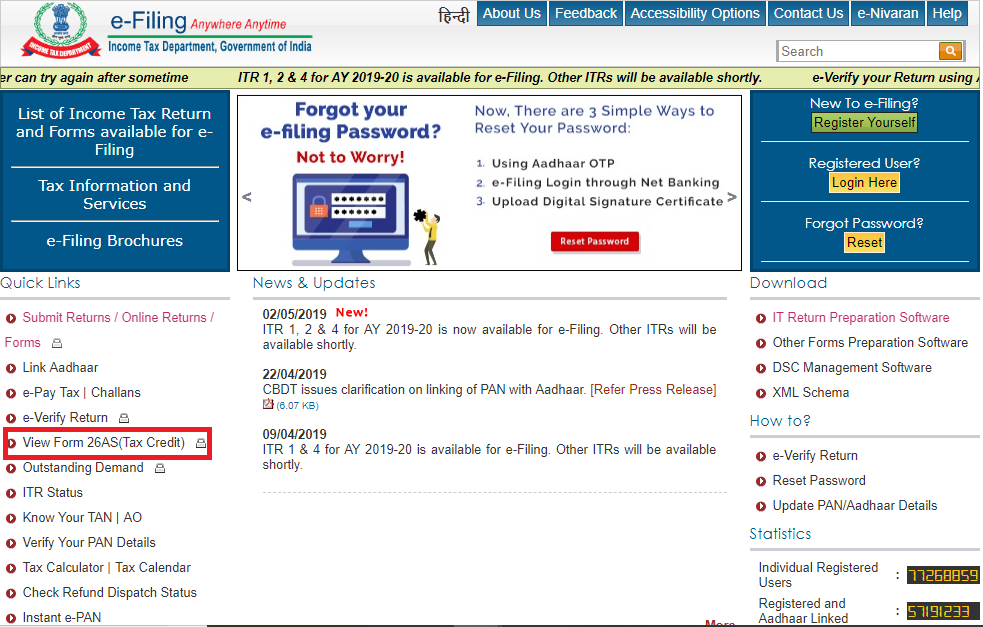

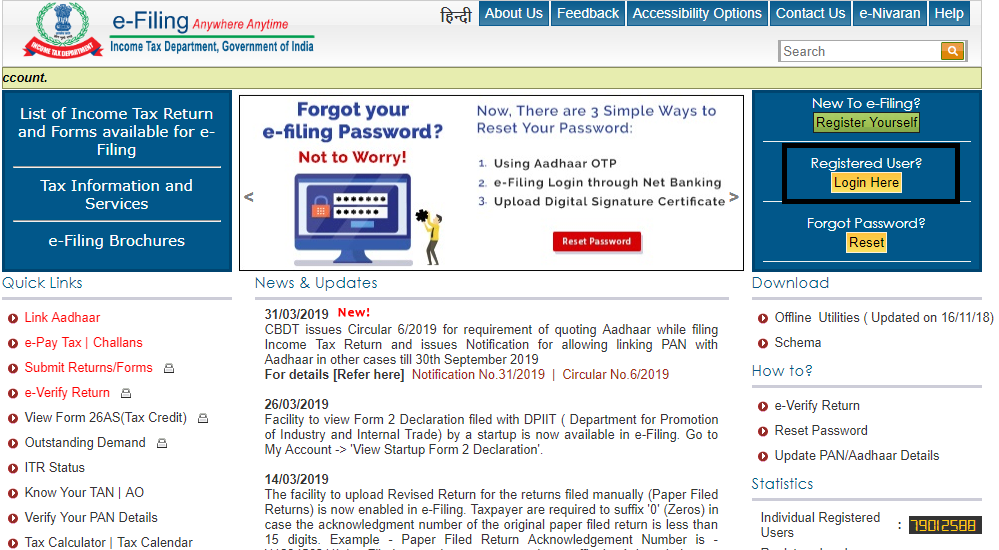

The website will appear as shown. It shows the amount of tds, tcs and other forms of tax payment such as. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

Cycle causes further discrepancies and complications. Form 26as provides the taxpayer with the relevant tax related information such as details of tds and tcs, details of taxes paid in the form of advance tax and self. Read the disclaimer, click 'confirm' and the user.

Form 26as is a consolidated tax statement issued to. The significant difference between the two documents is that all details present in form 16a are available in form 26as whereas only the tds details of form. Form 26as is the tax credit statement maintained by income tax department.

The website provides access to the pan holders to view the details of tax credits in form 26as. On the other hand, form 26as contains records of all transactions related to tax deducted at source (tds), tax collected at source (tcs) or tax refund claimed. In case the tds shown in the tds certificate is not reflected in form 26as,.

Form 26as enables a taxpayer to check the amount of tax levied against him. It is also required to check that tds, which is mentioned in form 16/16a, is reflected in form 26as. Spillover to next tax.