What Everybody Ought To Know About Partnership Income Statement Example

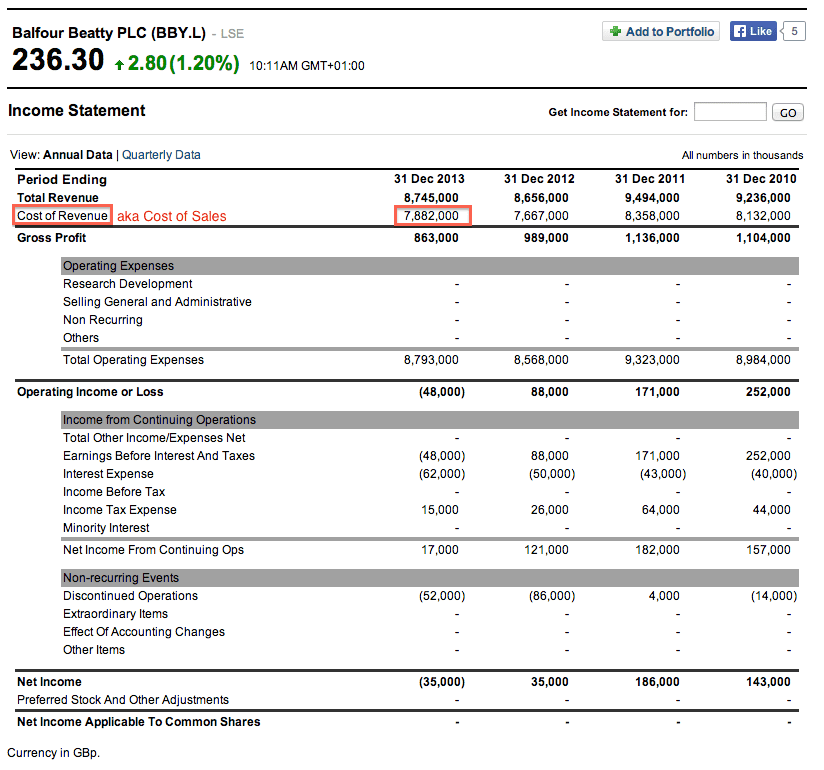

This $4,000 is debited from.

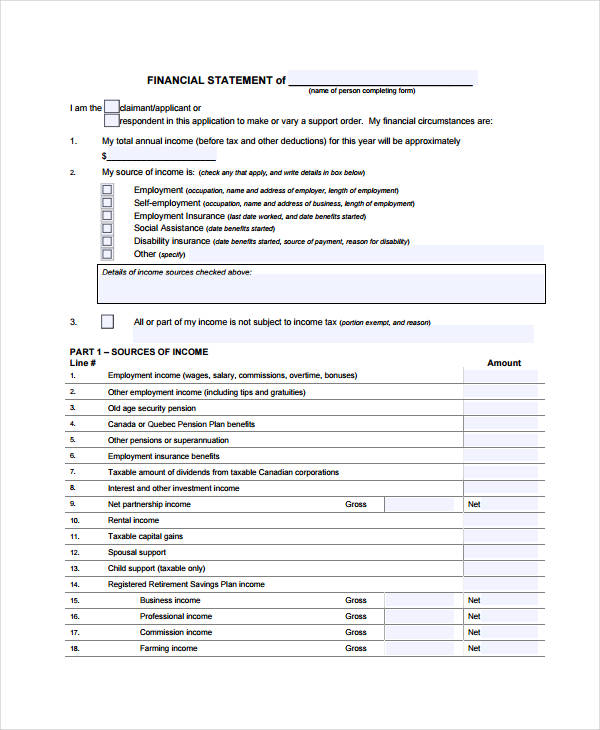

Partnership income statement example. Below is an example income statement for a fictional company. As a result, peter will receive 40 percent of the income or losses, mark 60 percent. Your living / marital relationship is not the issue it is about sharing household responsibilities) b a person named in ‘a’ has a.

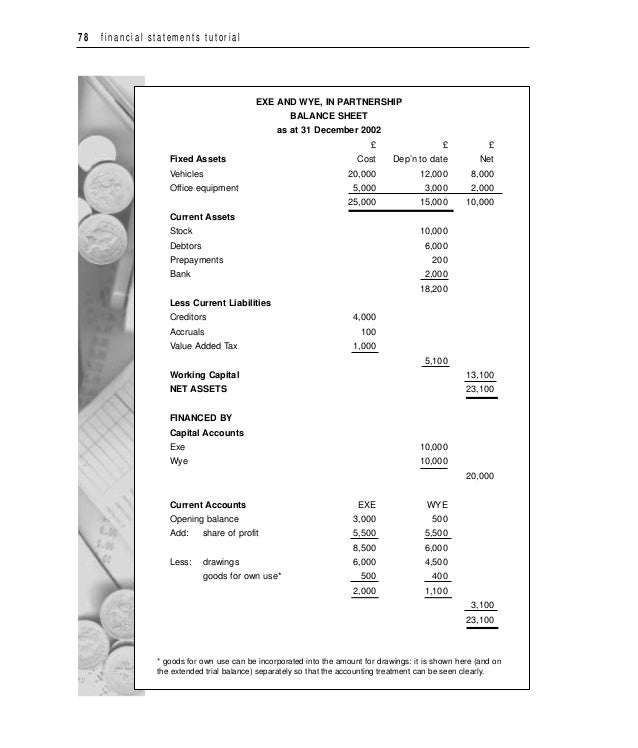

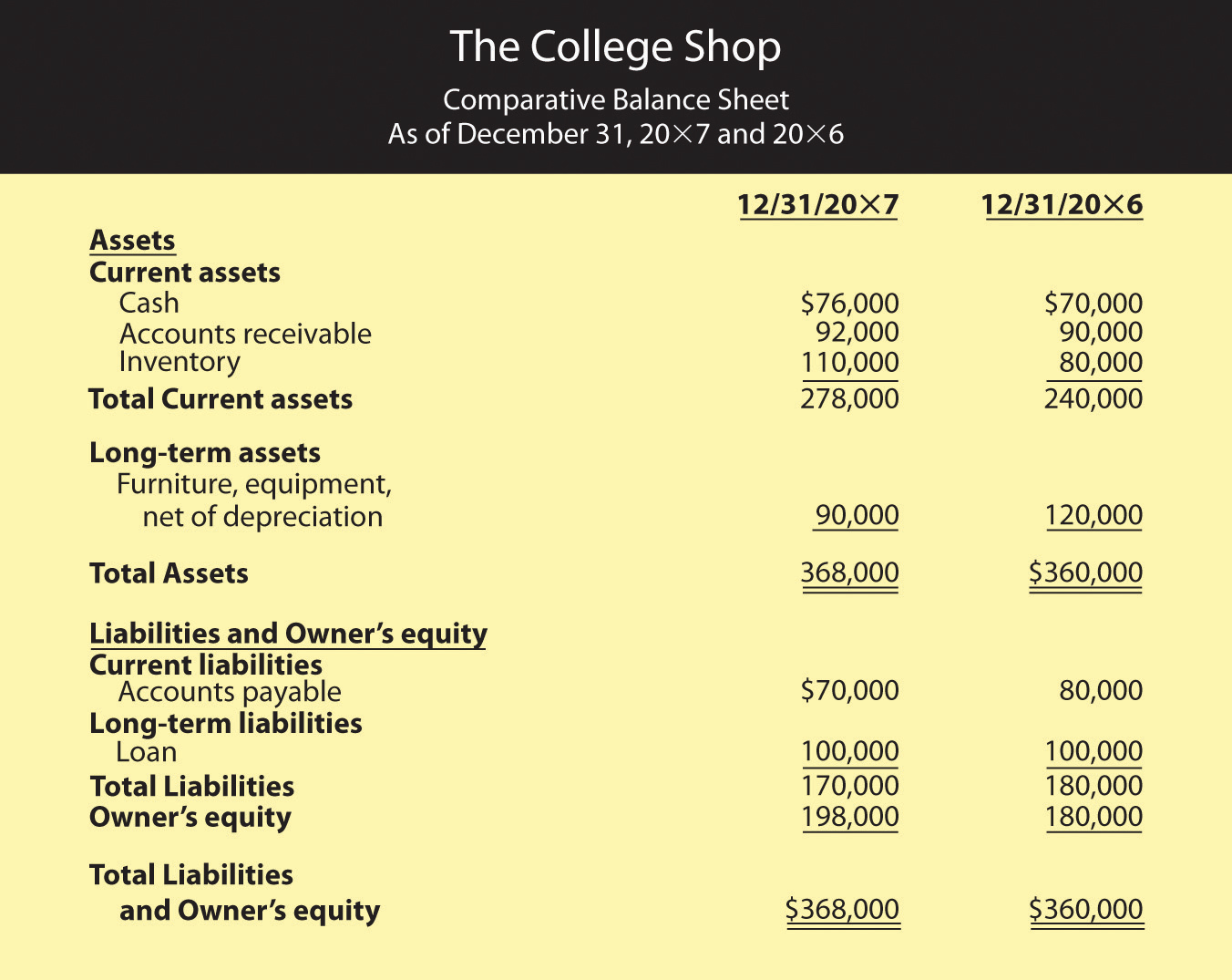

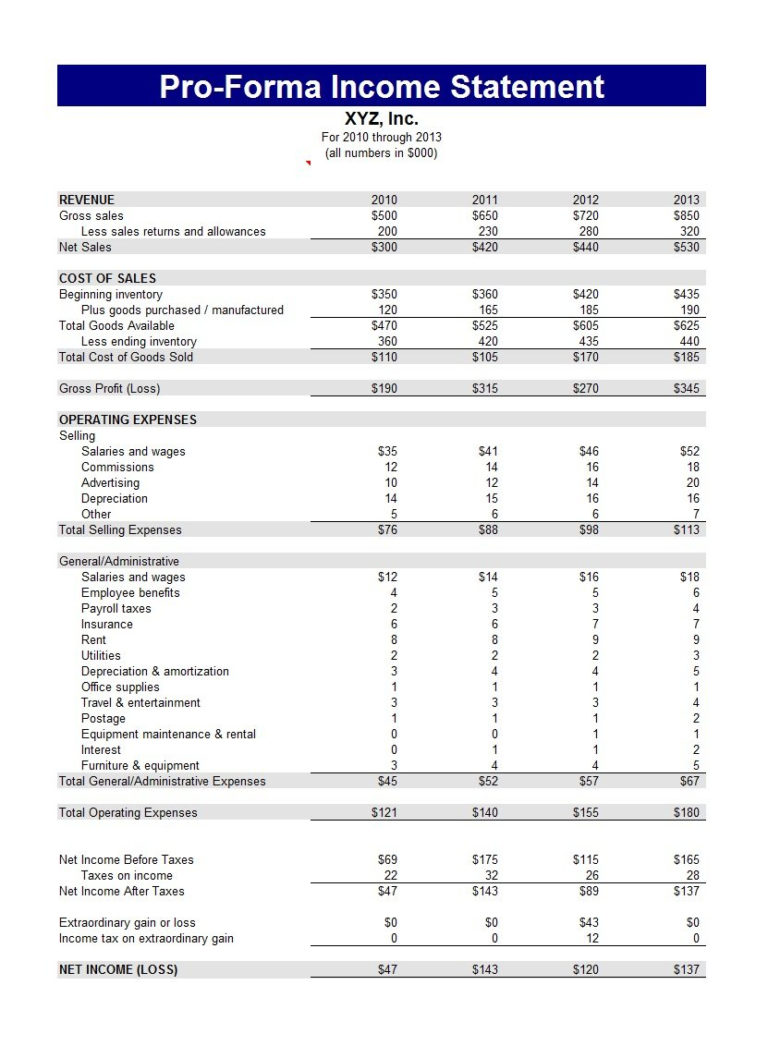

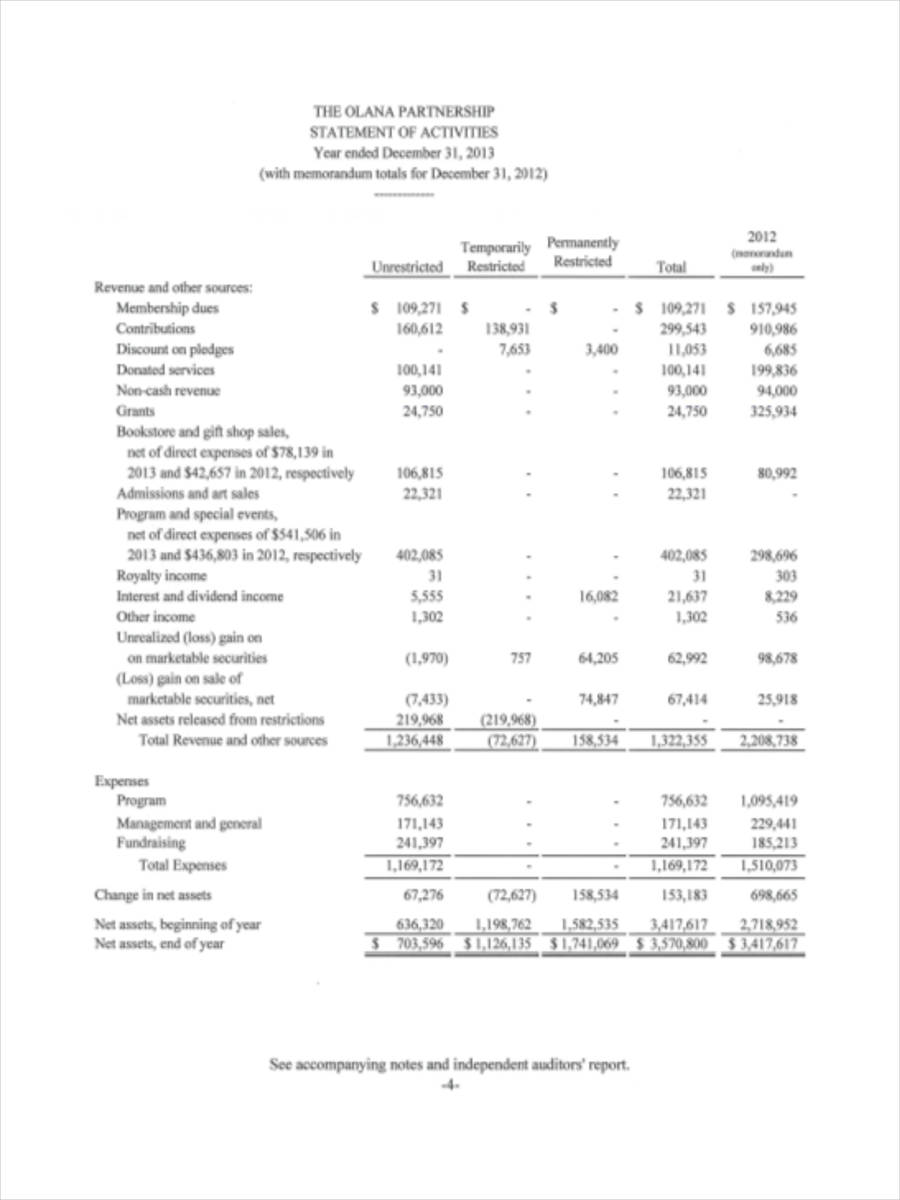

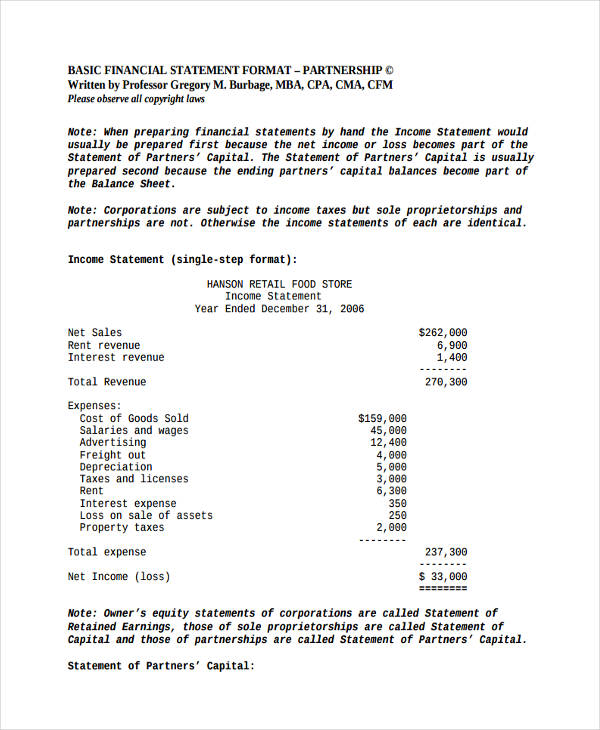

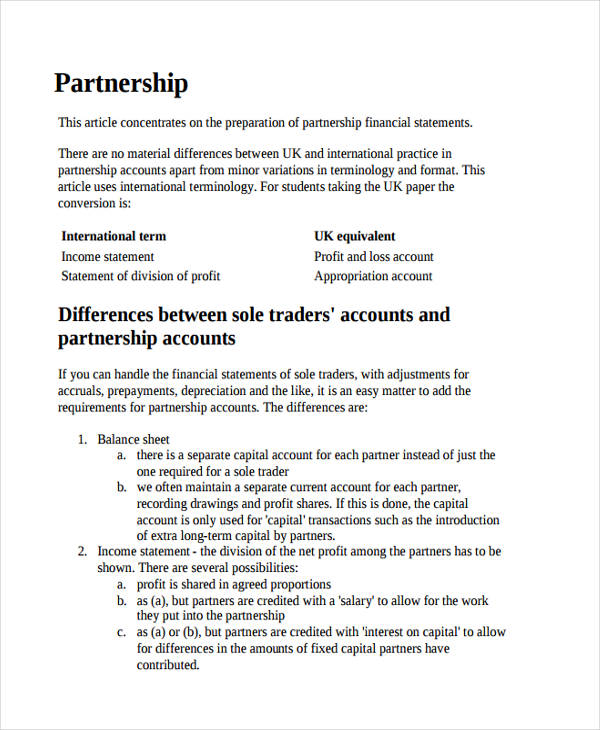

Templates include calculations for revenue, expenses, and overall. Financial statements of a partnership include: Write up the partners' current accounts for the year ended 31 march 20x3

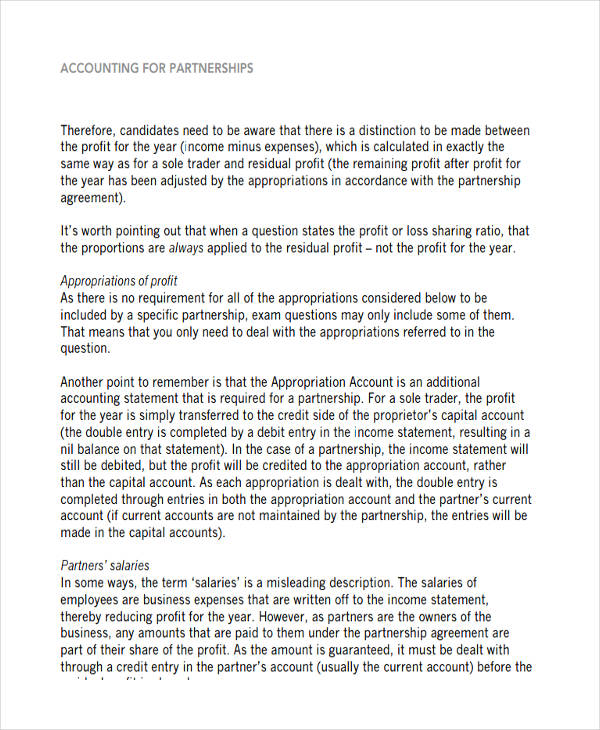

For example, if there is a profit in the income summary account, then the allocation is a debit to the income summary account and a credit to each capital. Income statement for the year ended 30 june 2009. Profit motive as it is a business, the partners seek to generate a profit.

As you can see at the top, the reporting period is for the year that. The partnership will pay the placement agent ongoing compensation on a monthly basis equal to 1/12th of 3.0% (3.0% per year) of the net assets (as defined in. Similar to a proprietorship’s statement of equity, a statement of partners’ capital shows each partner’s contributions to the business, net income (or loss).

Example two partners establish a partnership. Partnership format | pdf | balance sheet | income statement. Using dee's consultants net income of $60,000 and a partnership agreement that says net income is shared 50%, 40%, and 10% by its partners, the portion of net income.

Income statement for the year ended 30 june 2009. For example, assume that partner arnold withdraws $5,000 from a partnership firm of which he is a member.

(a) prepare the partnership's trading and income statement and statement of division of profit for the year ended 31 march 20x3 (9 marks) b. Peter contributes $40,000, mark $60,000. A small business income statement template is a financial statement used to report performance.

For example, a company with three partners whose net income is $12,000 would allocate $4,000 to each partner under net income. The three financial statements for a partnership are the income statement, capital statement (or statement of owner's equity), and balance sheet. By way of example, assuming the partnership profit and loss account showed a net income for the year of 95,000, the following journal entry is posted to.

Unincorporated business entity in fa2, a partnership will always be an unincorporated business entity. An appropriation account for the period ended; Sample income statement, balance sheet and statement of changes in equity of partnership.

I am living with: