Inspirating Info About Treatment Of Current Account In Balance Sheet

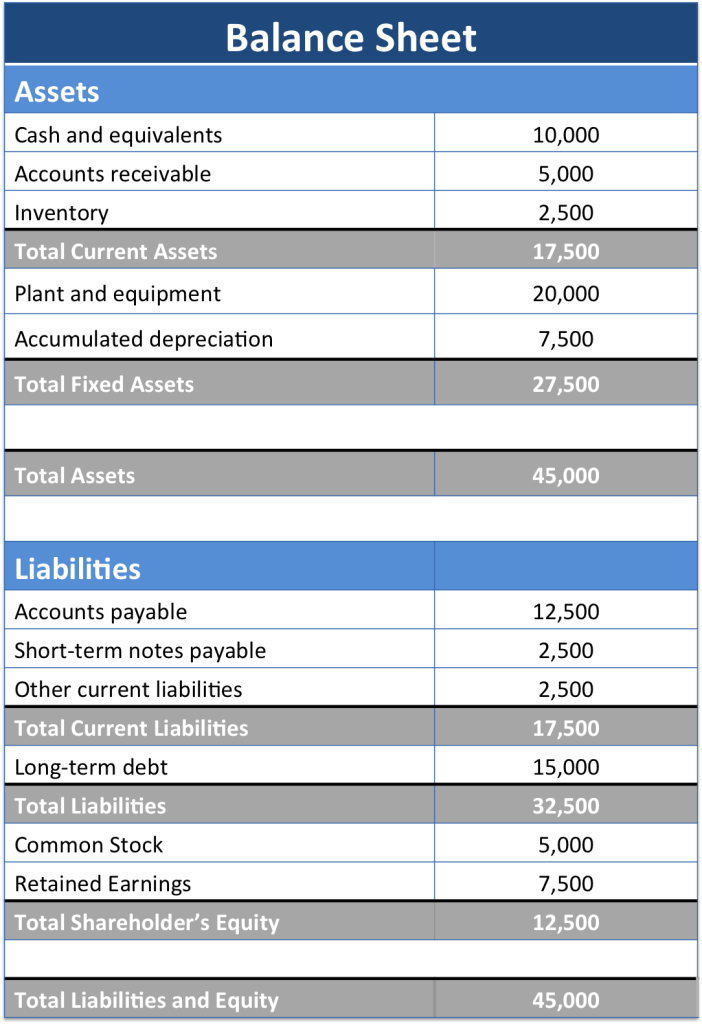

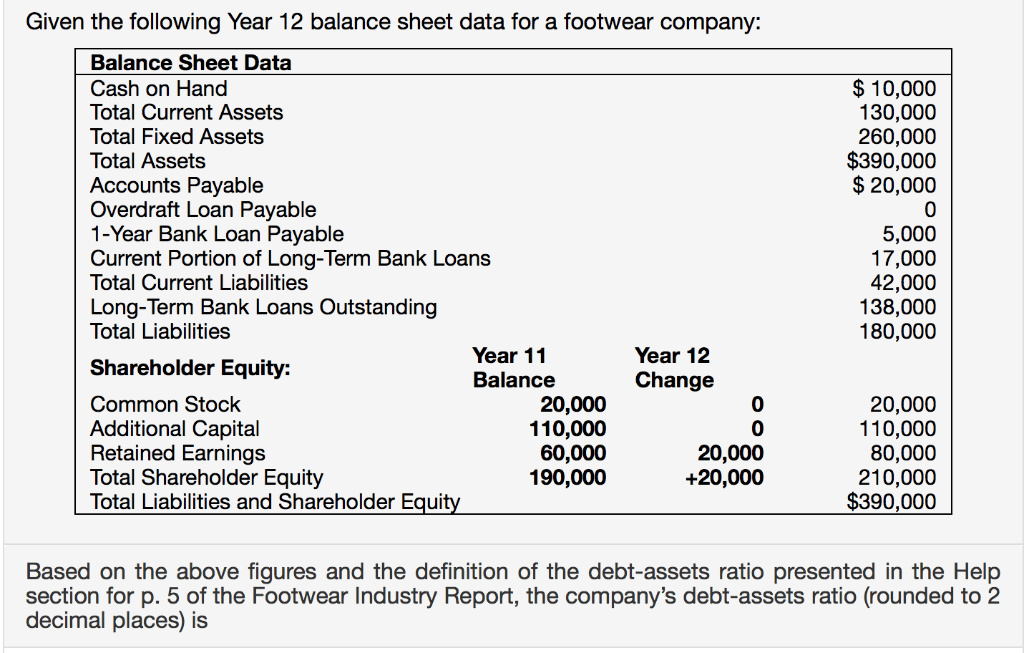

The term, other current liabilities is a line item on the balance sheet.

Treatment of current account in balance sheet. When the firm is dissolved it becomes necessary to settle its liabilities and dispose off its assets. This account is called a “director’s current (or loan) account”. The word other means that these current liabilities are not significant.

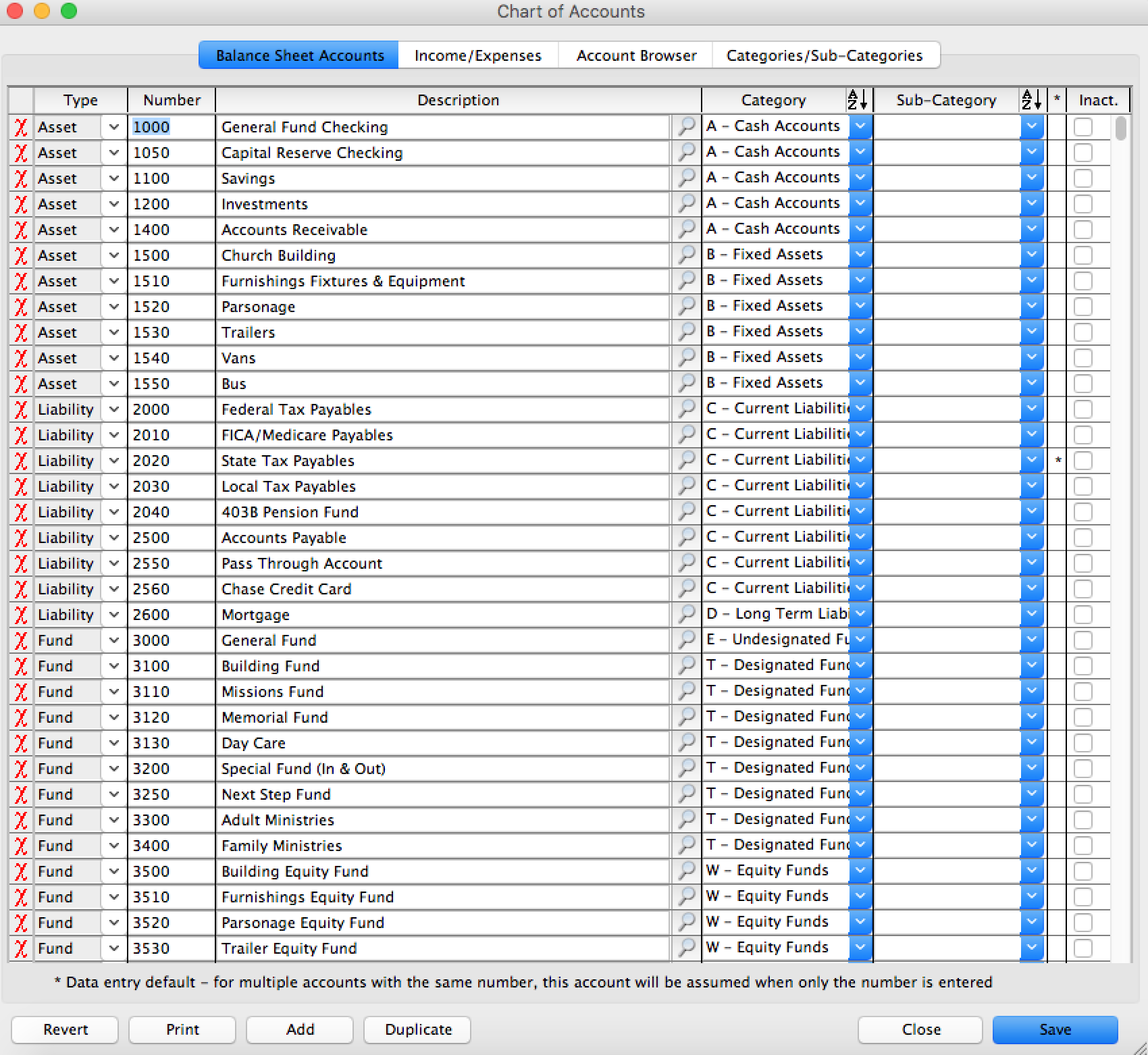

Any withdrawals made by the director from bona fide credit balances on their current accounts cannot be constituted as an advance because these are simply. In case of admission of a new partner, we need to transfer the reserves or accumulated profits and losses in the. Accounts payable is considered a current liability, not an asset, on the balance sheet.

First the draw or withdrawal by the owner reduces the capital account. The balance sheet contains many items, including assets owned by the business, liabilities to be paid by the business, and equity in the financing structures. It is not a company bank account, but can be compared to an “account” used for each customer.

The residual, if any, is taken by the partners to their. Accounting treatment of reserves in case of admission of a partner:

The drawing account will have a debit balance for two reasons. This mass balance has been negative for both the antarctic ice sheet (ais) and greenland ice sheet (gris) for several decades, with individual rates estimated at. Current tax liabilities are measured at the amount expected to be paid to taxation authorities, using the rates/laws that have been enacted or substantively enacted by the.

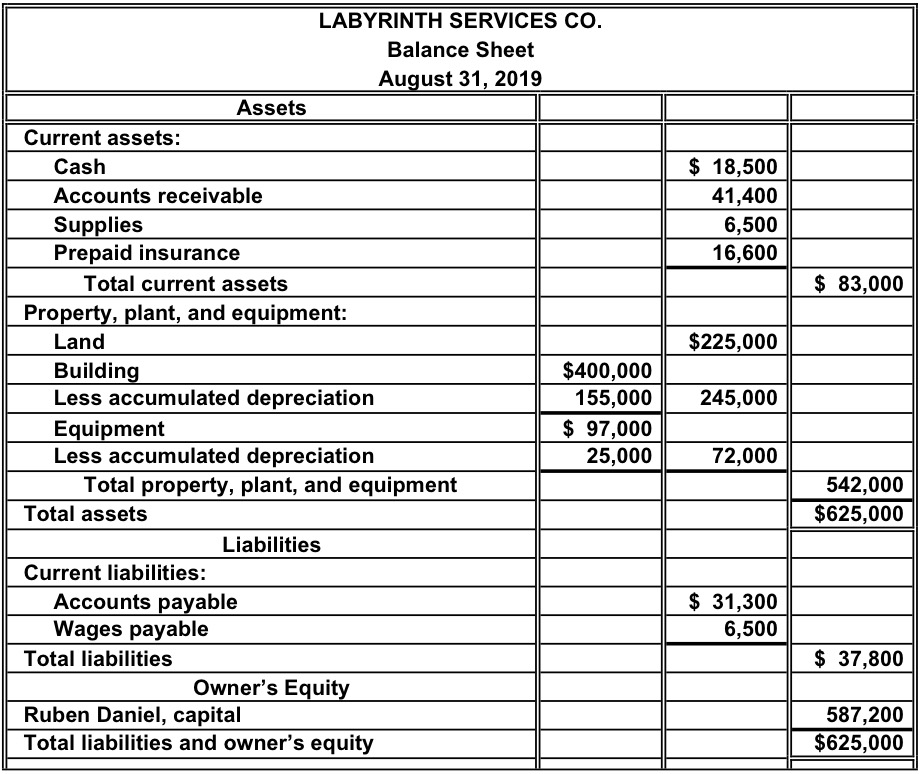

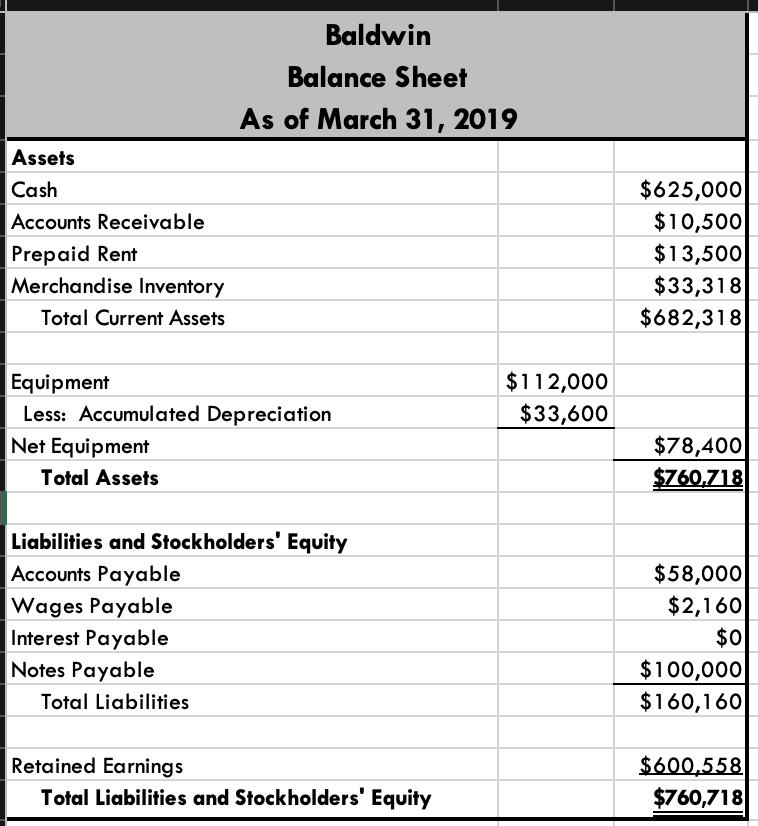

The cost of sales consists of opening inventory plus purchases, minus closing inventory. Classify the outstanding borrowings as noncurrent only if it is reasonable to expect that the specified criteria will be met over the 12 months following the balance sheet date. My name is elena cardone and i am a wife of grant cardone, mother and an ardent supporter of american values and an.

This is a very common adjustment. Current liabilities examples are accounts payable, taxes payable, salaries, loans, and other existing debts. It is part of the balance of payments, the statement of all transactions made between one country and another.

The closing inventory is therefore a reduction. Liability for loan is recognized. To demonstrate the treatment of the allowance for doubtful accounts on the balance sheet, assume that a company has reported an accounts receivable balance of.

Individual transactions should be kept in the accounts payable. The balance sheet, one of the core three.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)