Peerless Info About Accounting For Warranty Expense

A business’ warranty expense is the cost of repairing or replacing items it has sold or is expecting to incur in the future.

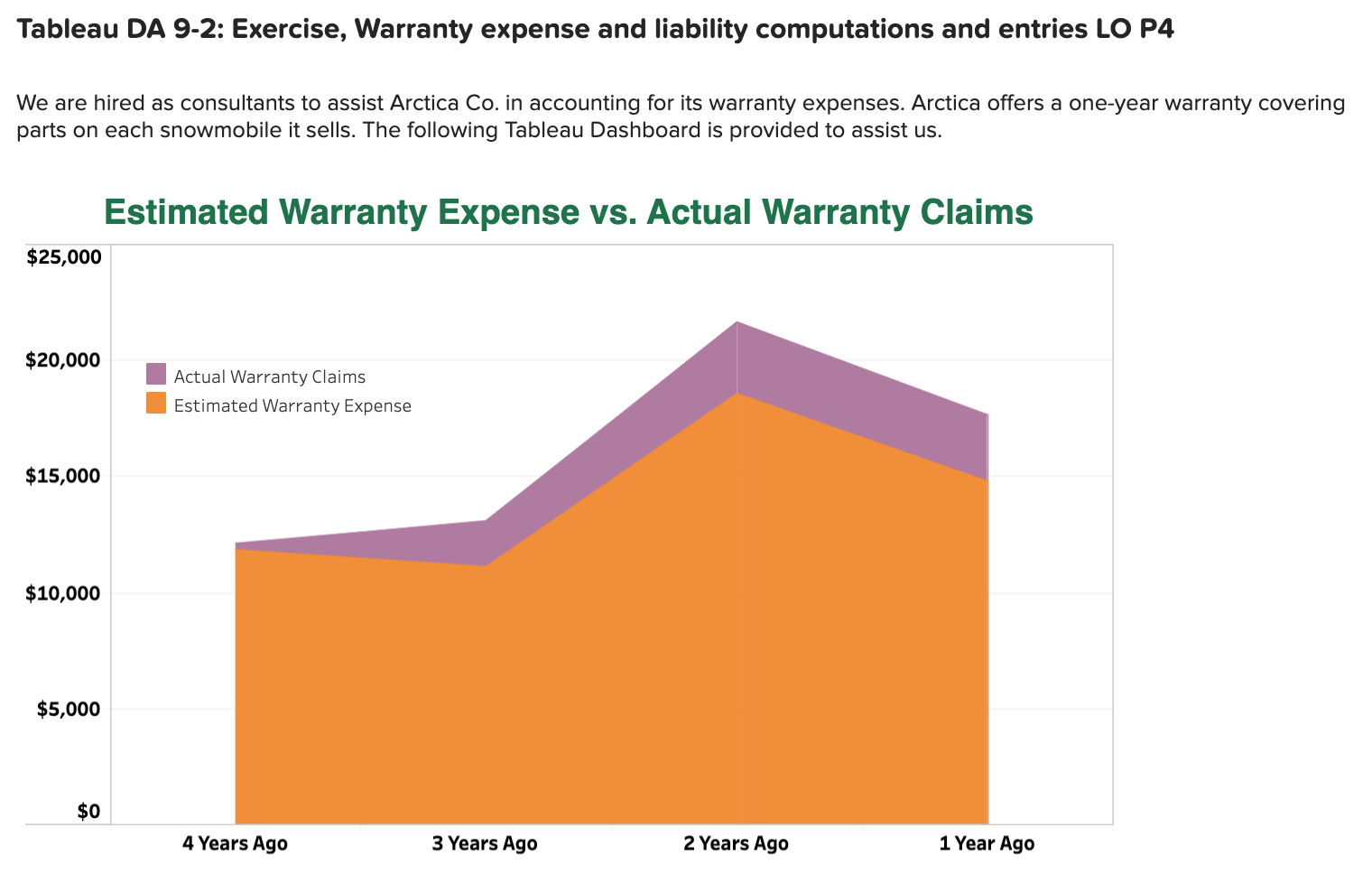

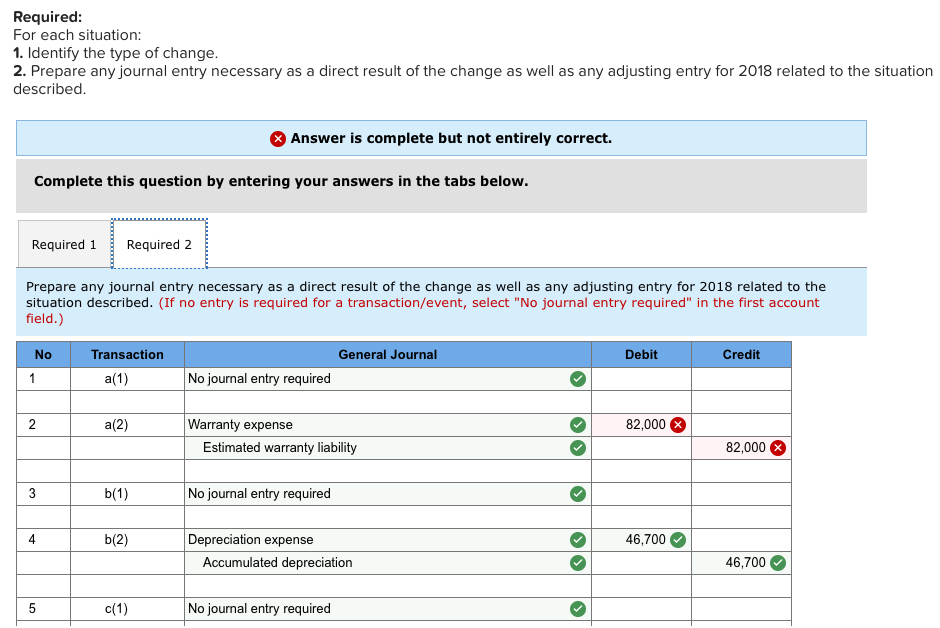

Accounting for warranty expense. Accounting for warranty expense. Account for the liability and expense incurred by a company that provides its customers with an embedded warranty on a purchased product. Accounting for warranties is an excellent example of how accounting supports business decisions and operations.

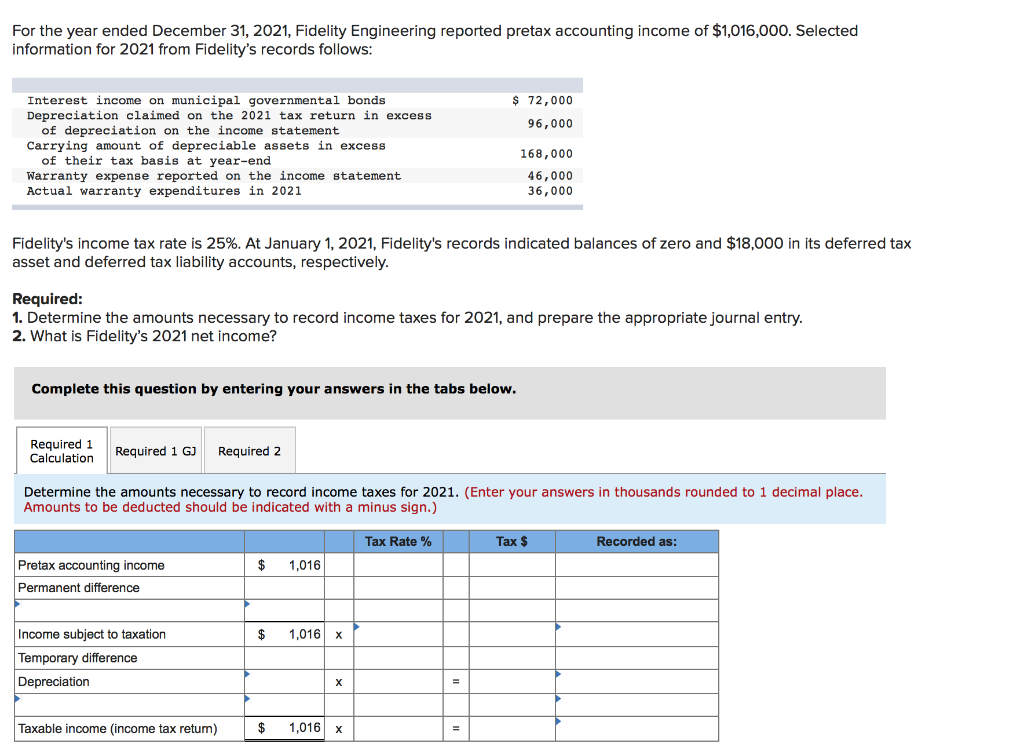

According to the us gaap, since a warranty is an assurance or promise of the seller to his buyer, it will be the expense of the seller if claimed by the buyer, which will be. Warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of goods. This results in an estimated warranty expense for that income year of $120 (2% x $6,000).

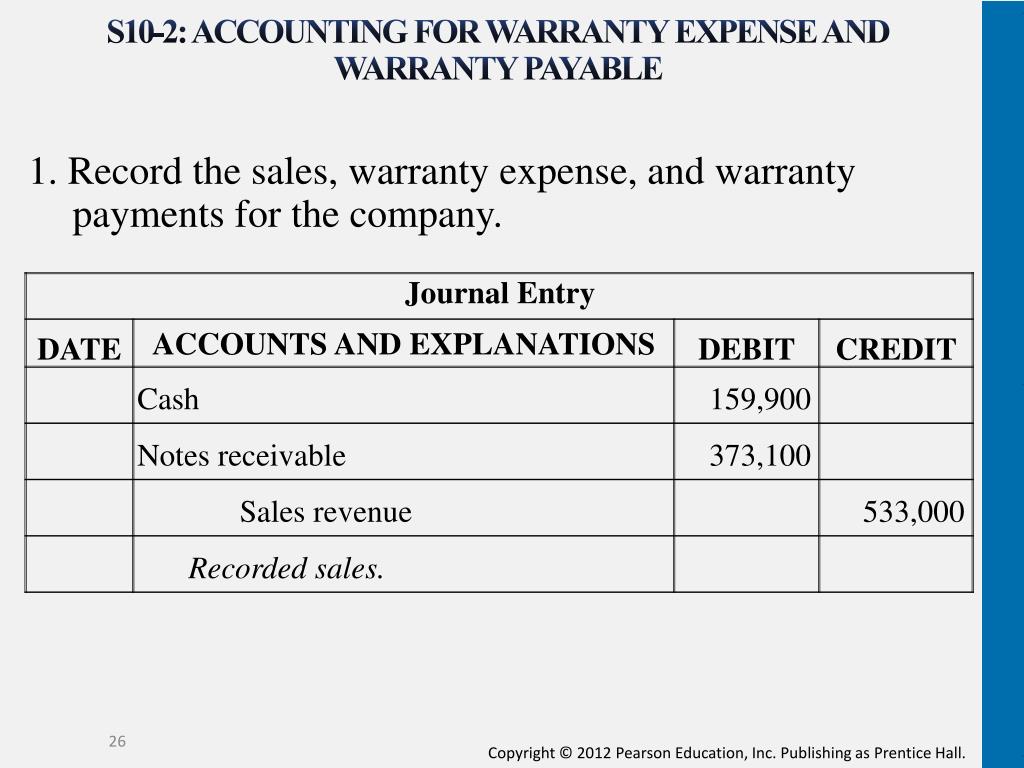

Solution in order to account for the obligation that occurs as a result of the warranty given, the company abc can calculate the estimated provision for warranty as below: This warranty is in effect. So, the warranty’s accounting nature is an expense for the entity that will be debited to the company’s accounts at the time of sale against the warranty provision account.

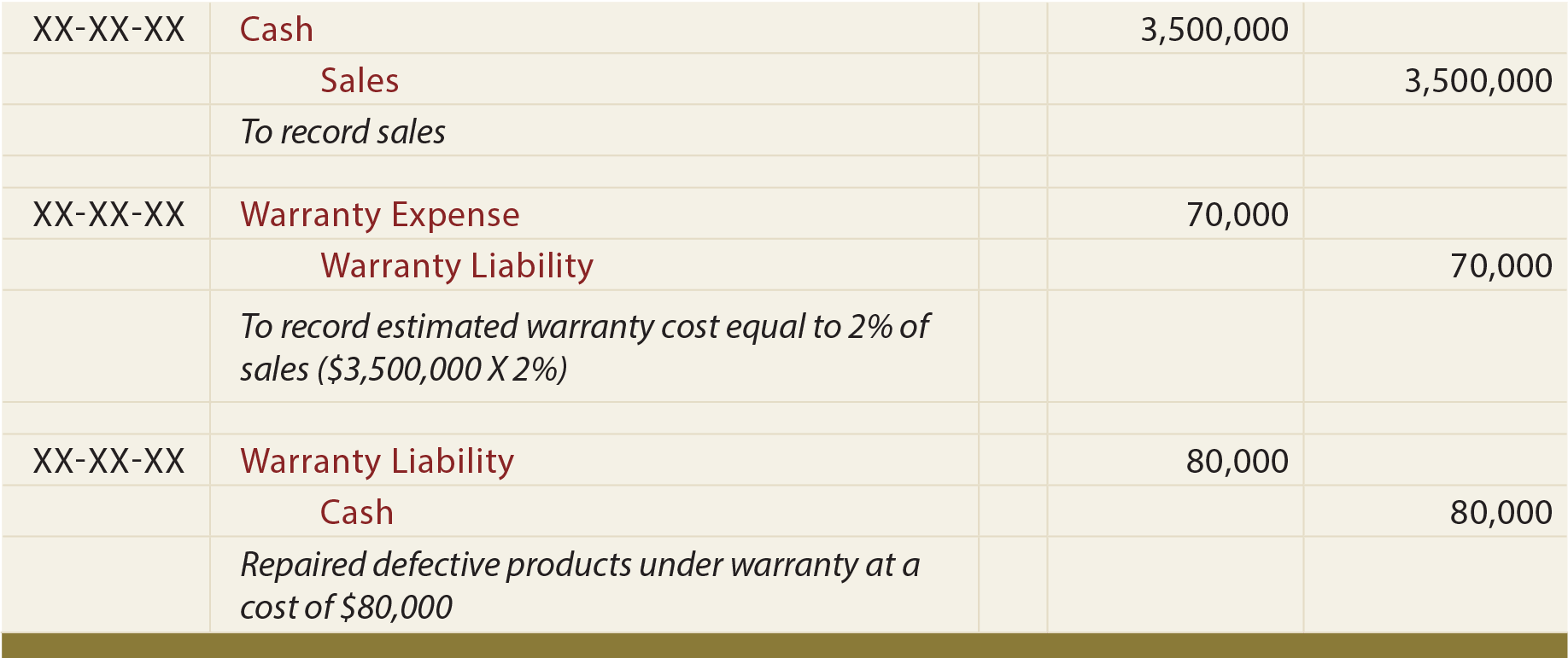

Warranty expense = 30 products x $20 per product = $600 in this case, we can make the journal entry for warranty expense by debiting the $600 into the warranty expense. Units sold, the percentage that will be replaced within the warranty period, and the cost of. How to account for warranty expenses.

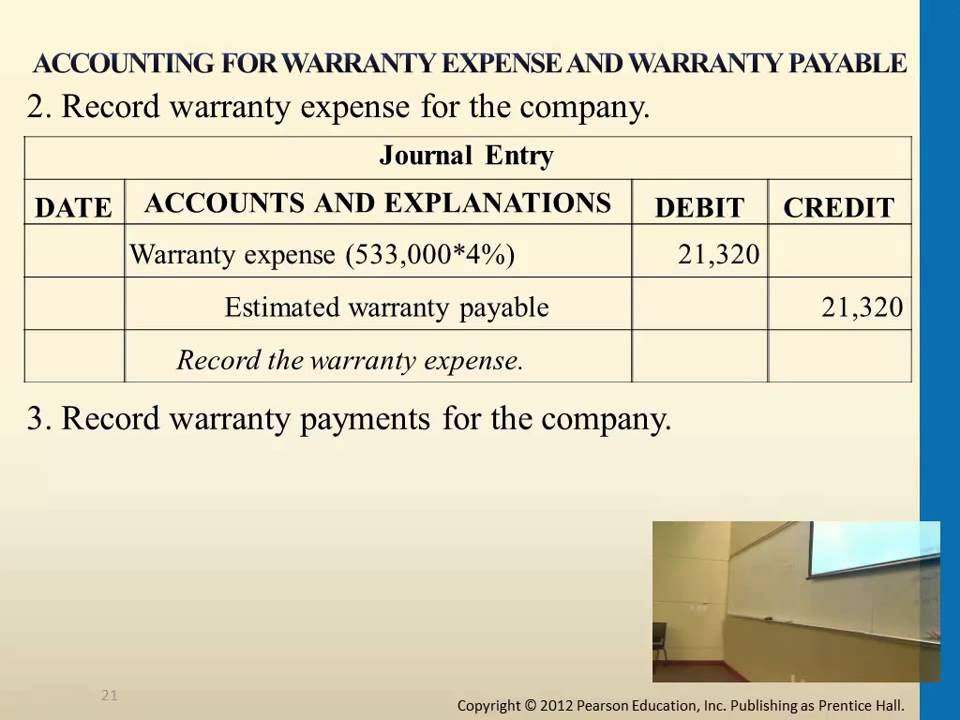

This video explains how to accrue warranty expense using the accrual method. Average cost of repairing or replacing. Accounting for extended warranty extended warranty is the warranty that company provides in addition to the normal warranty.

Provision for warranty is the liability account on the balance sheet and it will be reversed when the actual warranty incurs. Warranty accounting refers to a type of accounting that companies use to allocate expenses for replacing or repairing damaged products for customers. Warranties that provide a service journal entry the.

The lowry controller elects to apply a high 3% warranty claim rate as the basis for an accrual, based on the results of initial product testing. Number of units sold during a particular accounting period 2. Figure 13.12 year one—recognize expected cost of warranty claims.

A business’s warranty period determines how much. The watch manufacturer recognises the $120 liability on its balance sheet and an. To estimate the warranty expense for a company, we need to know three main things:

Percentage of the sold products that will probably need a repair or a replacement based on previous experiences 3. Cash payments to customers might be accounted for as warranties in limited situations, such as a direct reimbursement to a customer for costs paid by the customer to a third. In terms of accounting, if it is likely that an expense will be incurred, and the company can estimate the expense's.

This video illustrates how to account for warranties using the expense approach (standard warranty) and the revenue approach (extended warranty) under. It also illustrates how to apply the accrual. To record the warranty expense, we need to know three things: