Underrated Ideas Of Info About Purpose Of The Income Statement

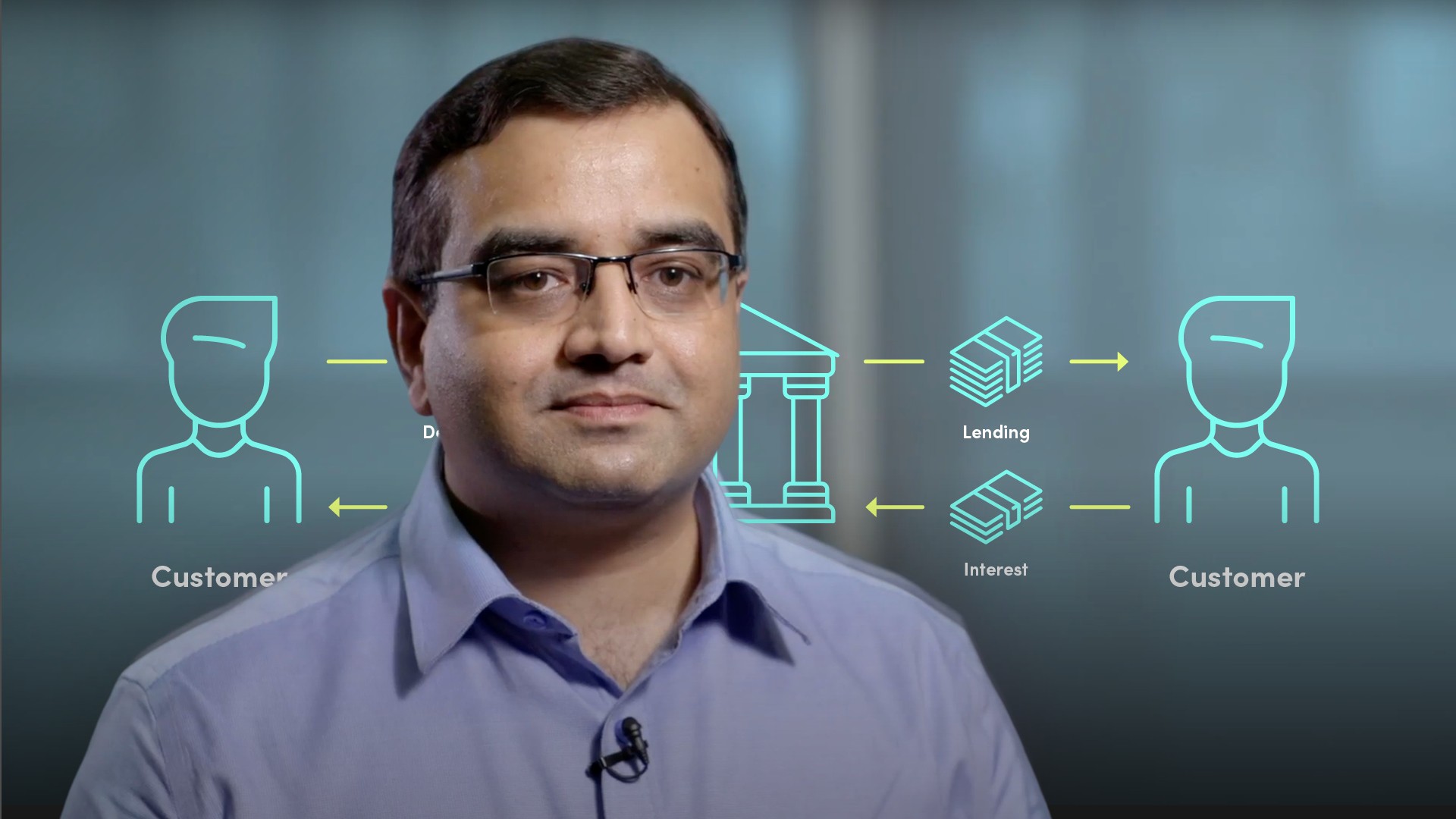

The three financial statements are:

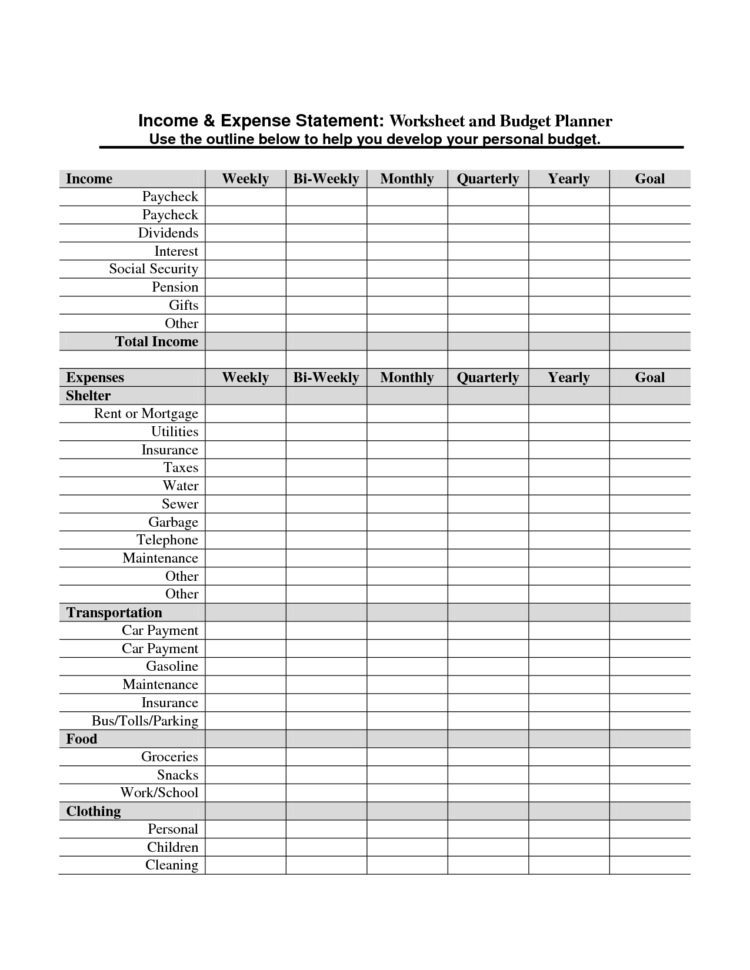

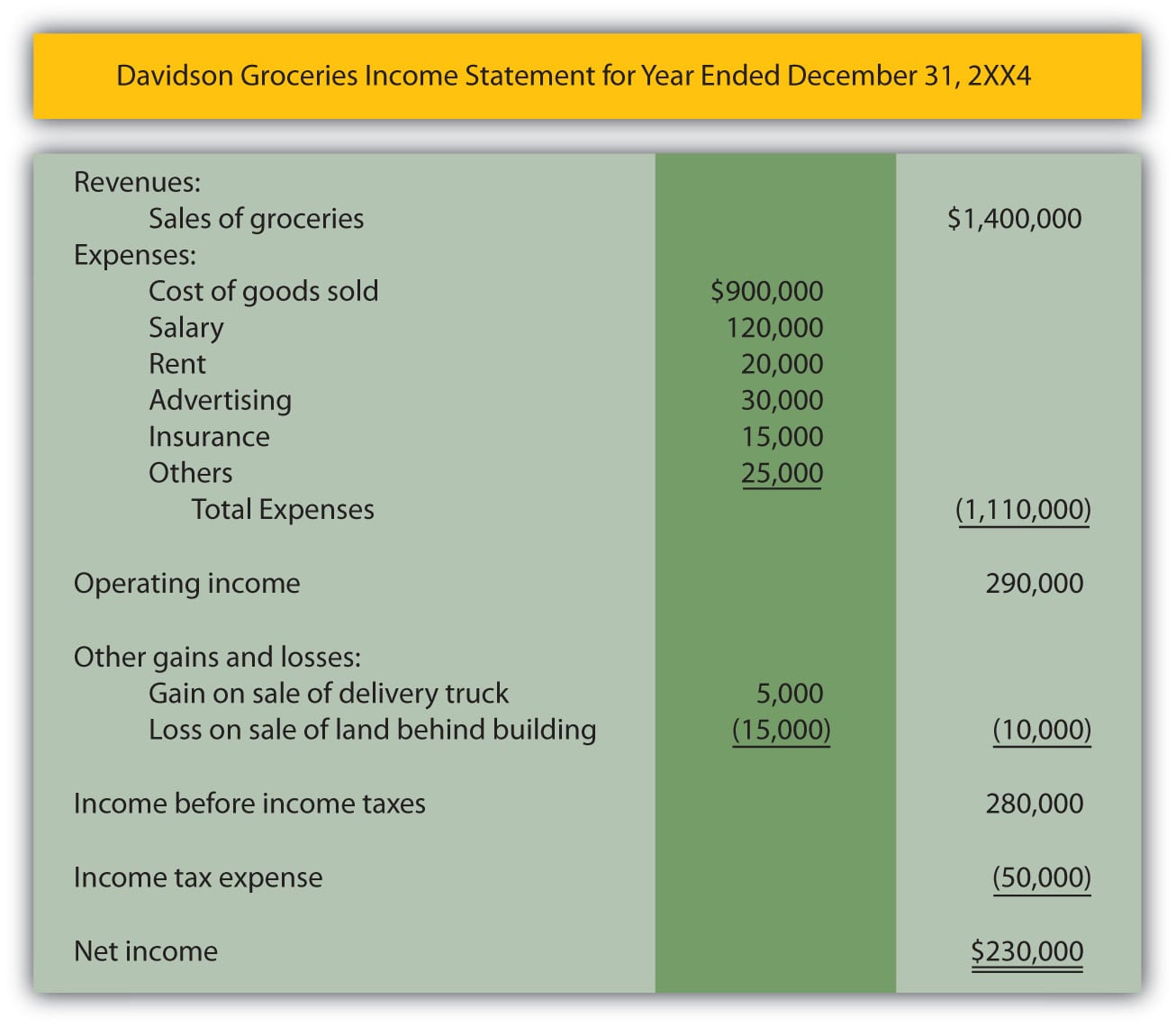

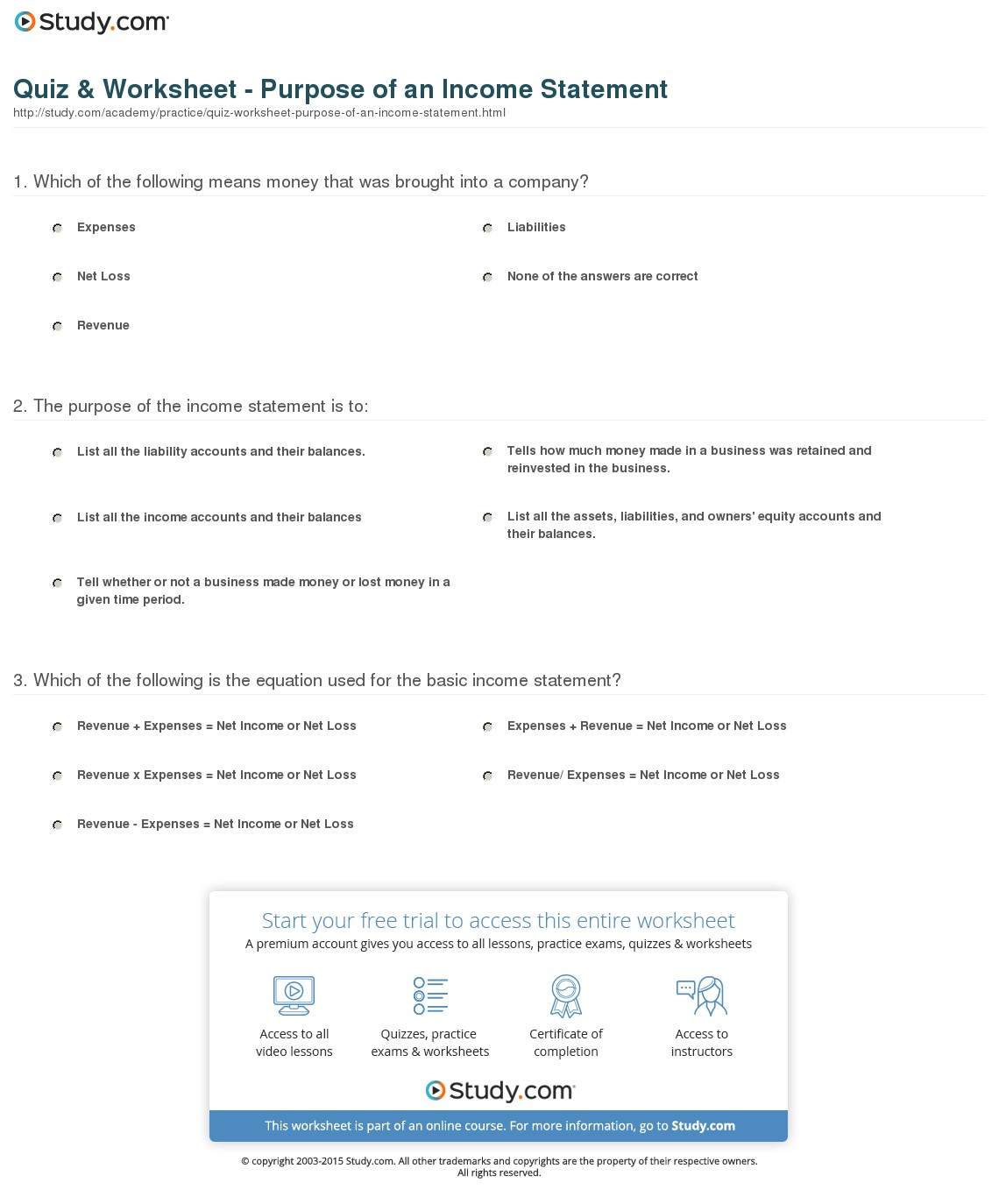

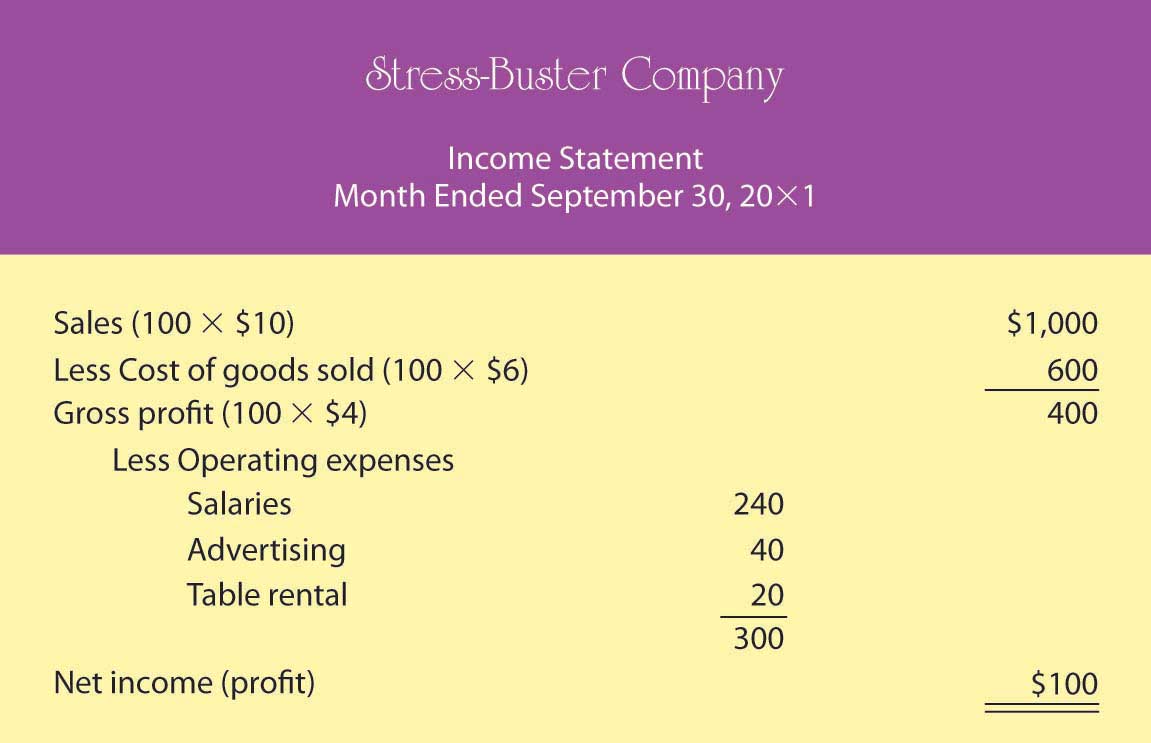

Purpose of the income statement. The purpose of an income statement is to provide financial information to investors, creditors, and readers, whether the company is profitable during the financial year. The income statement can be prepared in one of two methods. An income statement, also known as a profit and loss statement (p&l statement), summarizes a business’s revenues and expenses over a period of time.

You can create an income statement on a monthly, quarterly, or annual basis. It’s one of the most important financial statements for small business owners, so it’s key to understand what an income statement is, what its purpose is, and how to read one. An income statement is a financial document that details the revenue and expenses of a company.

Income statements can follow one of two reporting formats: It shows whether a company has made a profit or loss during that period. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions in penalties and new restrictions on.

Income statement purpose #1 mainly, income statements are prepared for assessing a company’s financial performance over a specific period of time. This document gauges the financial performance of a business in terms of profits or losses for the accounting period. The income statement is a company’s financial report that shows its profit and loss over a specific period, usually a year.

It is a reporting tool for management, investor, lender, and creditors. The single step income statement totals revenues and subtracts expenses to find the bottom line. Within an income statement, you’ll find all revenue and expense accounts for a set period.

This means it does not factor. Key takeaways an income statement is one of the three major financial statements, along with the balance sheet and the cash flow. Qbi is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, s corporations, sole proprietorships, and certain trusts.

The income statement shows how much of a profit your business made — or that you assume you will make if it’s a projection — during a specific period of time. The income statement shows a firm’s performance over a specific period of time. The income statement illustrates the profitability of a company under accrual accounting rules.

An income statement provides valuable insights into a. The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period, as well as any resulting net profit or net loss. Together with the balance sheet and the cash flow statement , it provides a detailed insight into the financial health of your business, including whether you’re making a profit or a loss.

Then when deducted from the gross profit. A cash flow statement shows the exact amount of a company's cash inflows and outflows over a period of time. An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period.

Each of the financial statements provides important financial information for both internal and external stakeholders of a company. The income statement is the most common financial statement and shows a company's. The difference between the revenue and expenses is the profit for shareholders.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)