Best Info About Importance Of Preparing Trial Balance

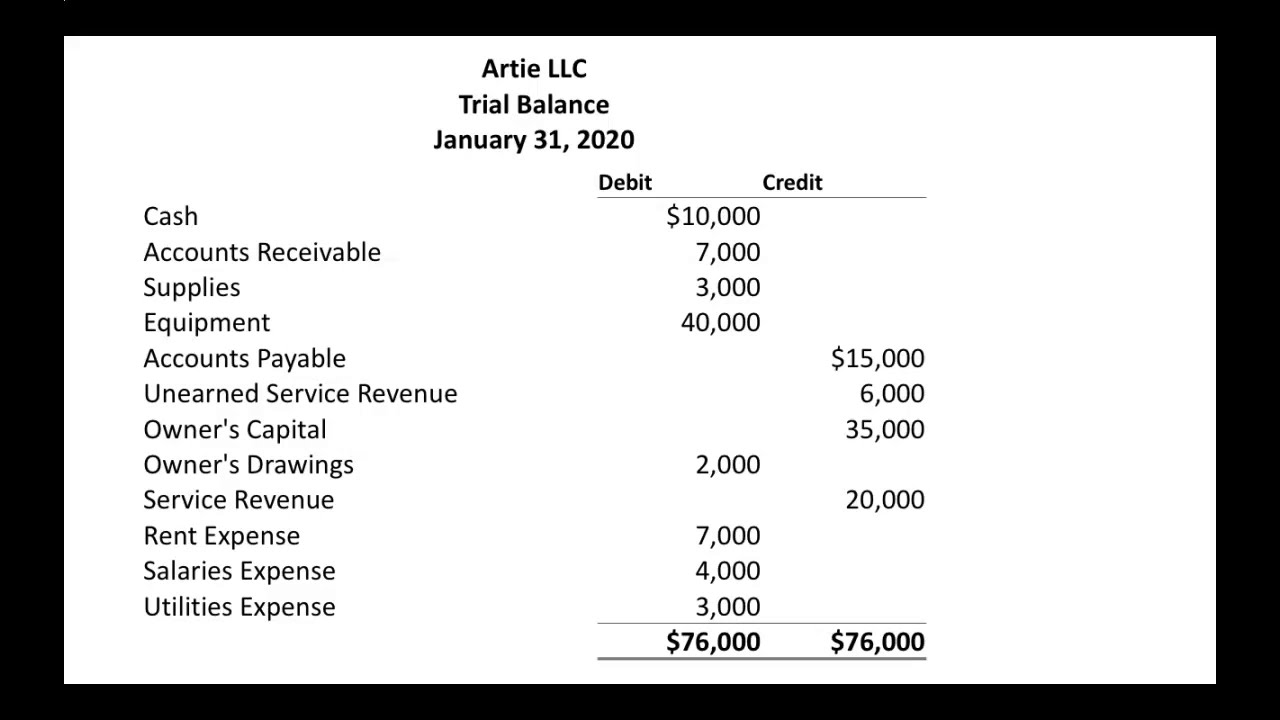

If all debit balances listed in the trial balance equal the total of all credit balances,.

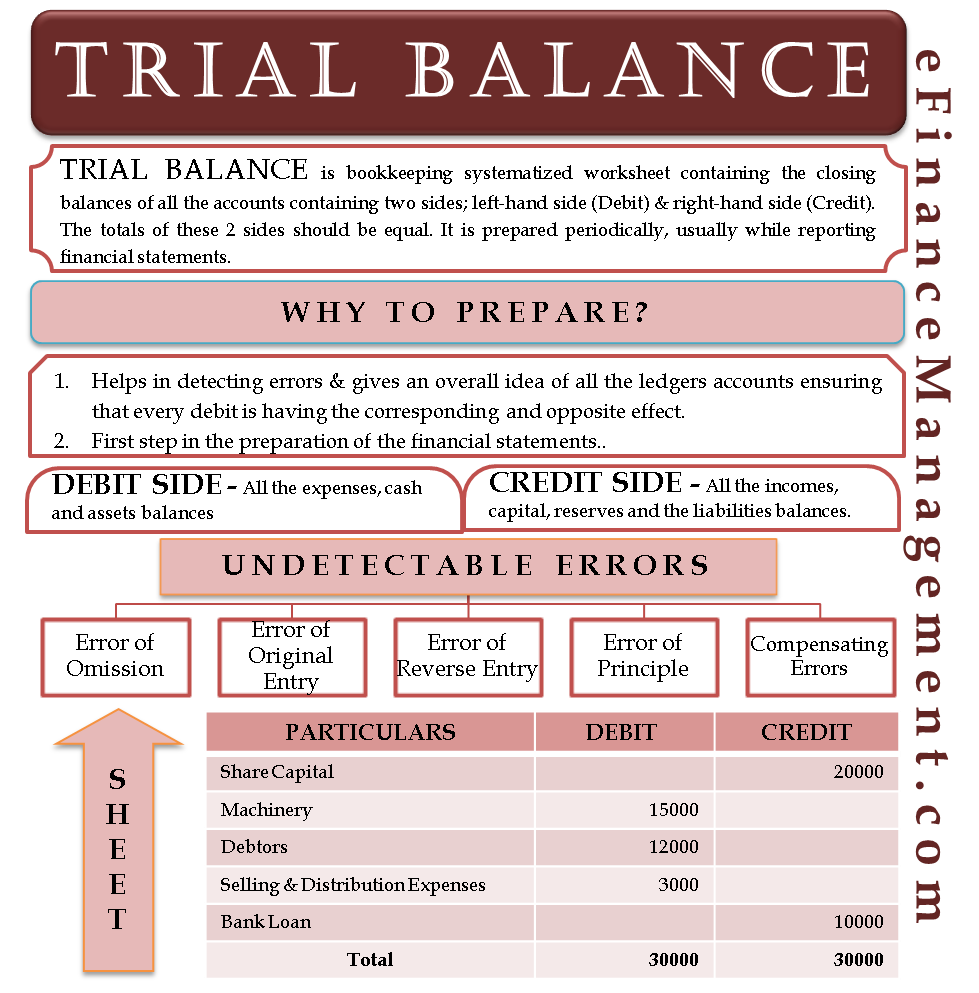

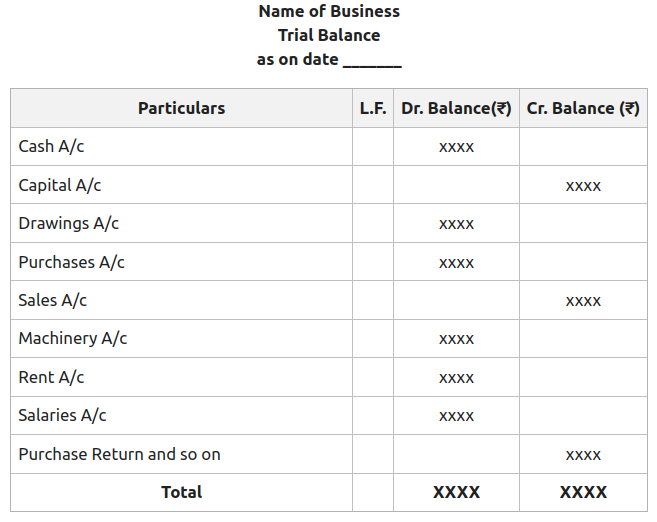

Importance of preparing trial balance. The trial balance is a bookkeeping or accounting worksheet in which all ledger account are listed in debit and credit columns. There is a commonly heard advice that “if you want to invest in shares of a company, you must study its trial balance”. Trial balances will ensure that a corresponding credit entry is recorded in the books for every debit entry that’s recorded, which is critical to ensuring accuracy in.

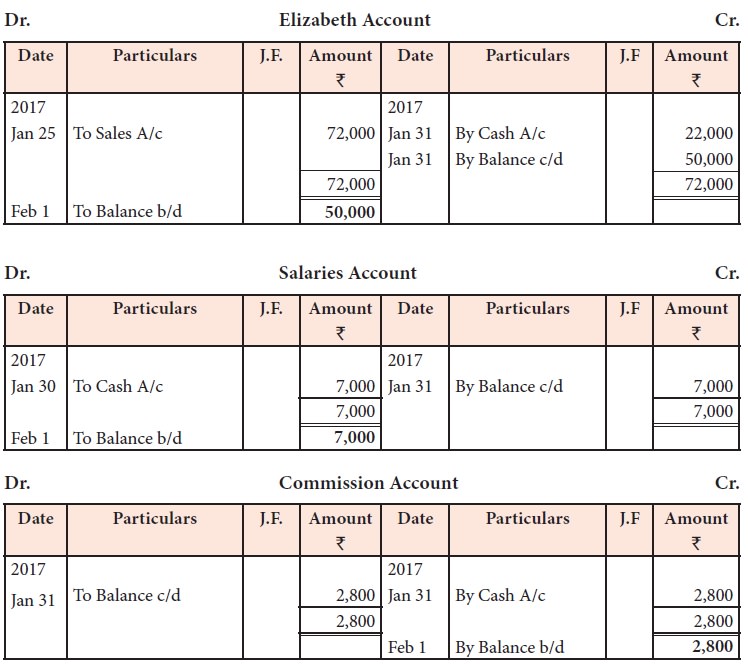

This is the most important part of accounting so generally, it has a variety of advantages but there also some disadvantages of. How do you prepare a trial balance? As discussed in the previous section, a trial balance is a list of all accounts in the general ledger that have balances.

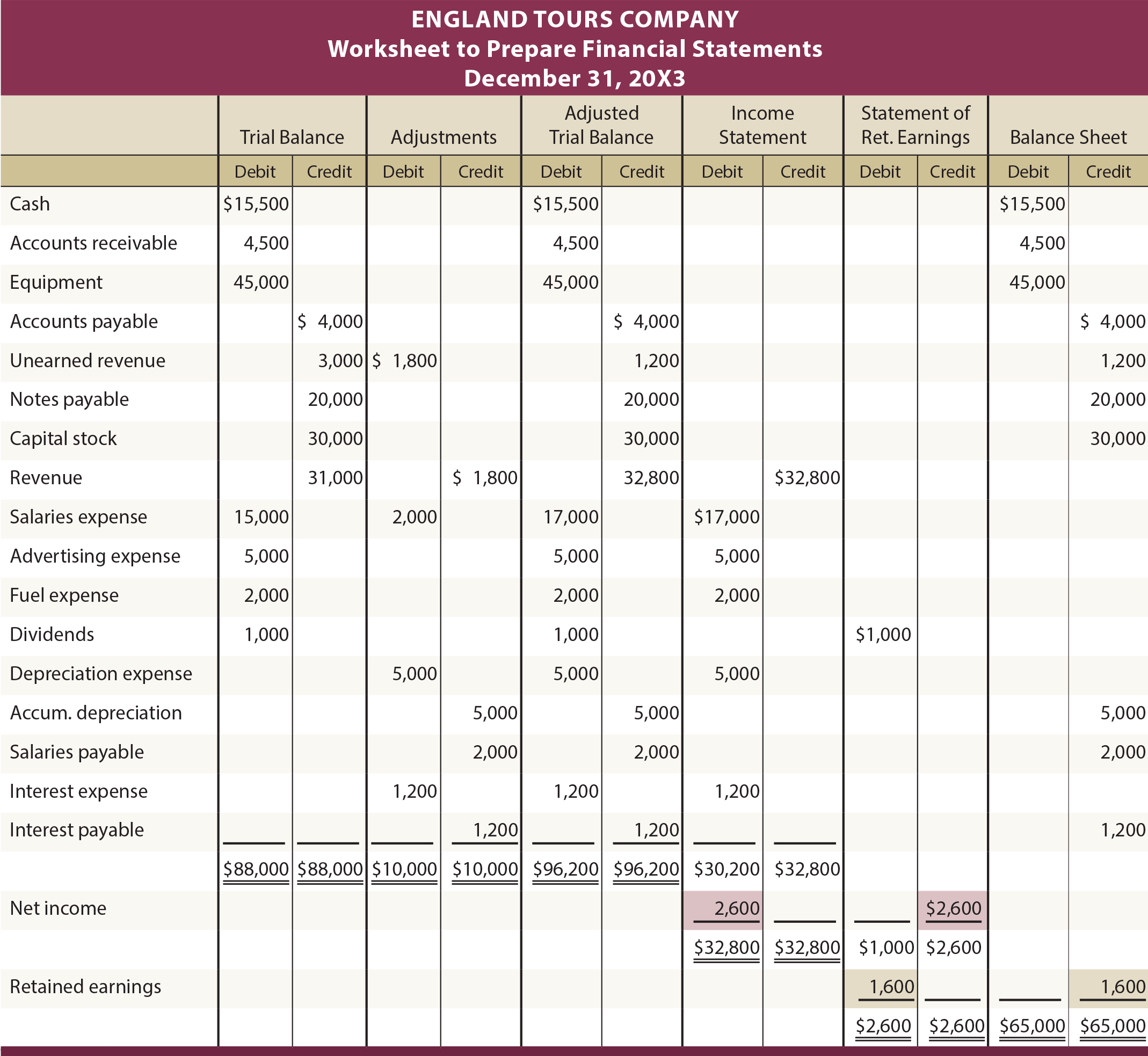

This method shows the difference between the debit side and credit side. A trial balance lists the ending balance in each general ledger account. Income statement s will include all revenue and expense accounts.

How does a trial balance work? It is important to note that the trial balance is unable to detect all recording errors. A trial balance can be an important tool for auditors as they can analyze the.

To prepare the financial statements, a company will look at the adjusted trial balance for account information. The first step is to make sure that all the ledger accounts are balanced. The term 'trial balance' is derived from the perspective that it acts as a test for fundamental entries in the bookkeeping but does not perform a full audit.

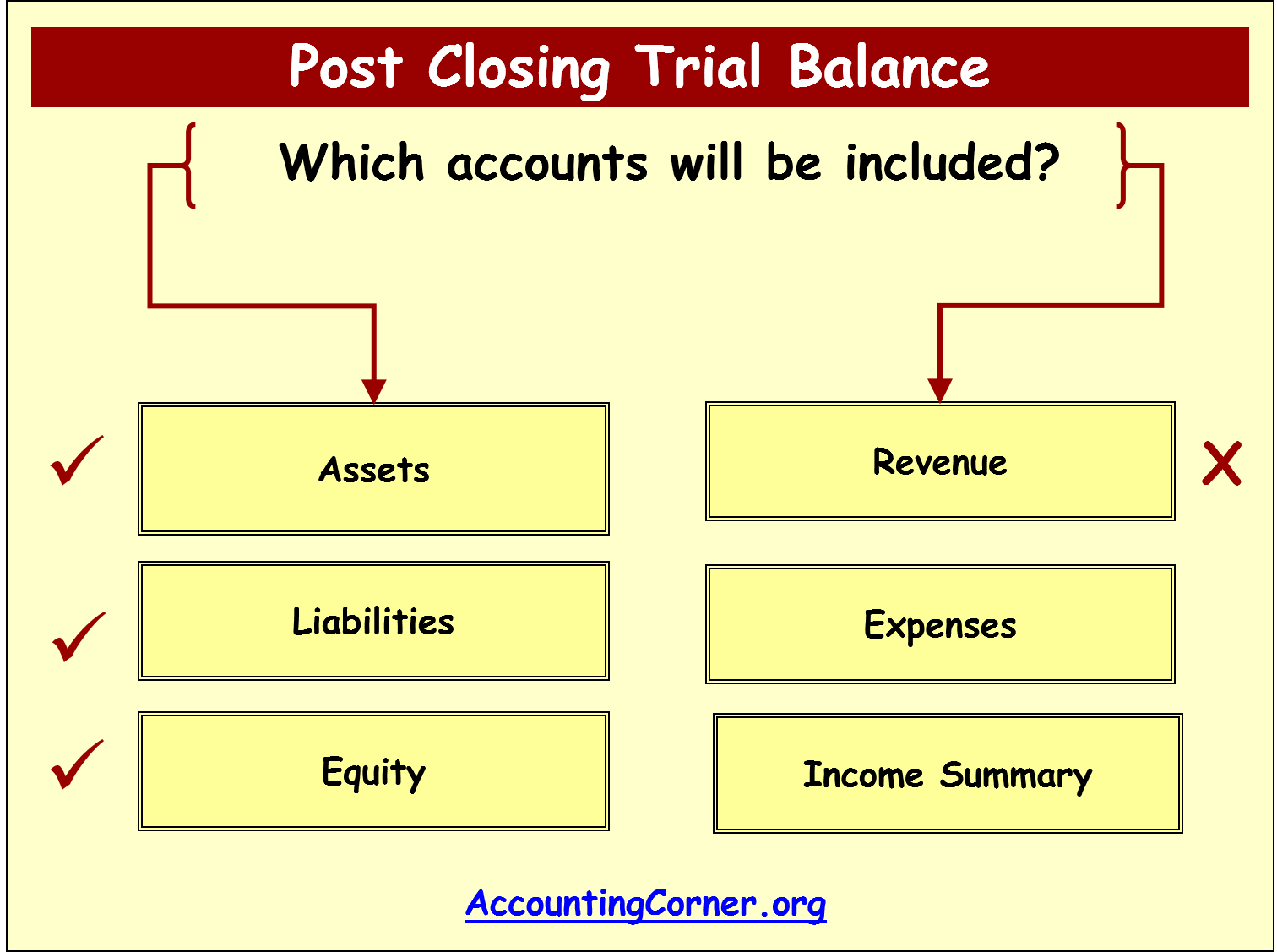

It is a summary of the business activities. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. The main objective of a trial balance is to ensure the mathematical accuracy of the business transactions recorded in a company’s ledgers.

Being a summary sheet, it helps to give a bird’s eye view of the accounting transactions of the company. In short, trial balance is prepared for the purpose of identifying and detecting errors that enter in general ledgers. What are the 3 different methods of preparing a trial balance?

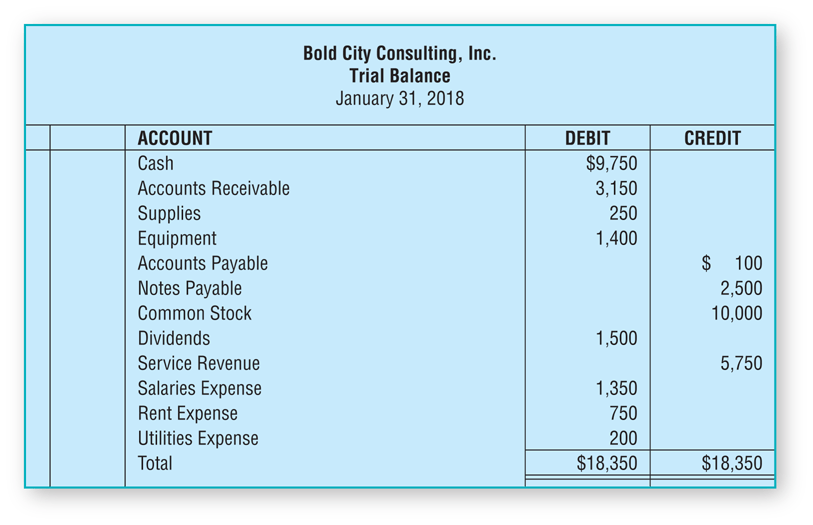

What are the methods of preparing trial balance? You also need to post all financial transactions to the journals and summarizing them on the ledger statements. A trial balance is simply a financial statement which depicts the summary of debit and credit balances for all accounts.

Purpose of preparing a trial balance the basic purpose of preparing a trial balance is to test the arithmetical accuracy of the ledger. It is also an indicator of the financial health of the business. To prepare a trial balance,

Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet. For example, if an expense paid of $500 is incorrectly recorded as $5000. In this method, debit and credit balances of each account are shown in two different columns.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)