Ideal Tips About Deferred Revenue Cash Flow Statement

Cash flow statements are one of the three fundamental financial statements financial leaders use.

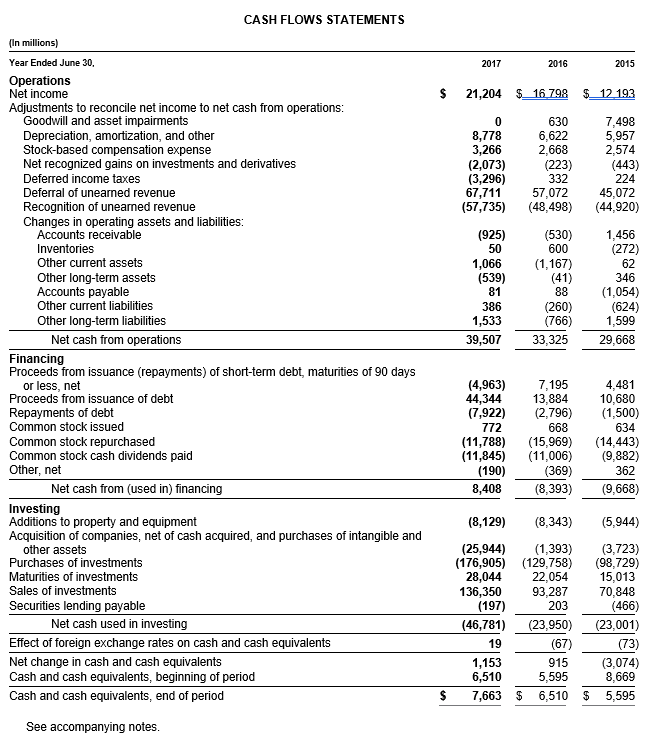

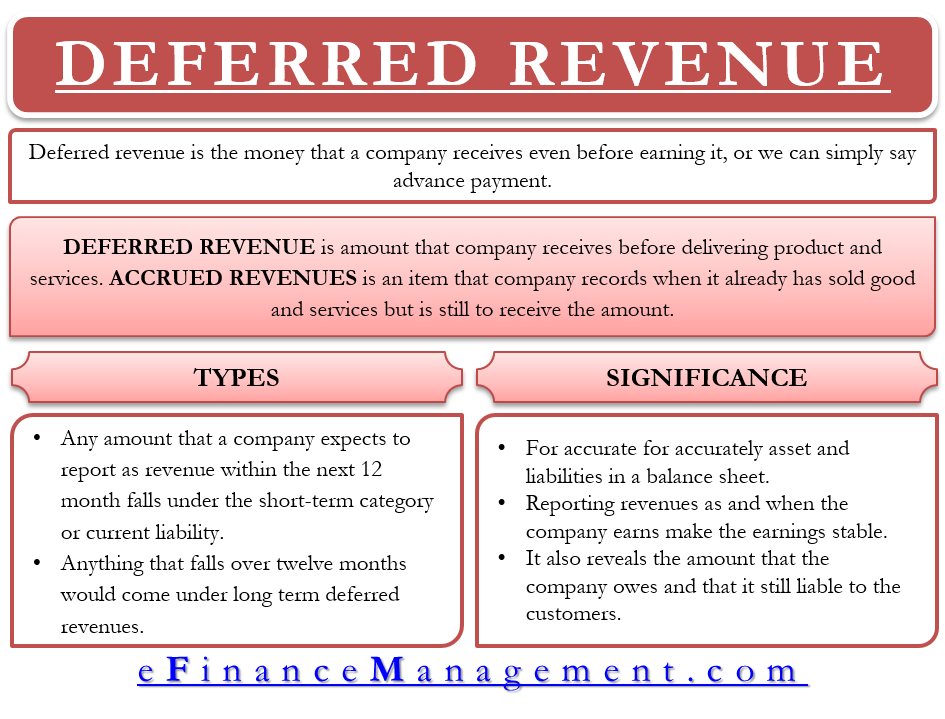

Deferred revenue cash flow statement. The cash flow is recorded immediately, while revenues are. Deferred revenue can be recorded on the cash flow statement, noted as deferred revenue. Cash flow statement although you haven't earned deferred revenue yet, it's still cash that you can spend.

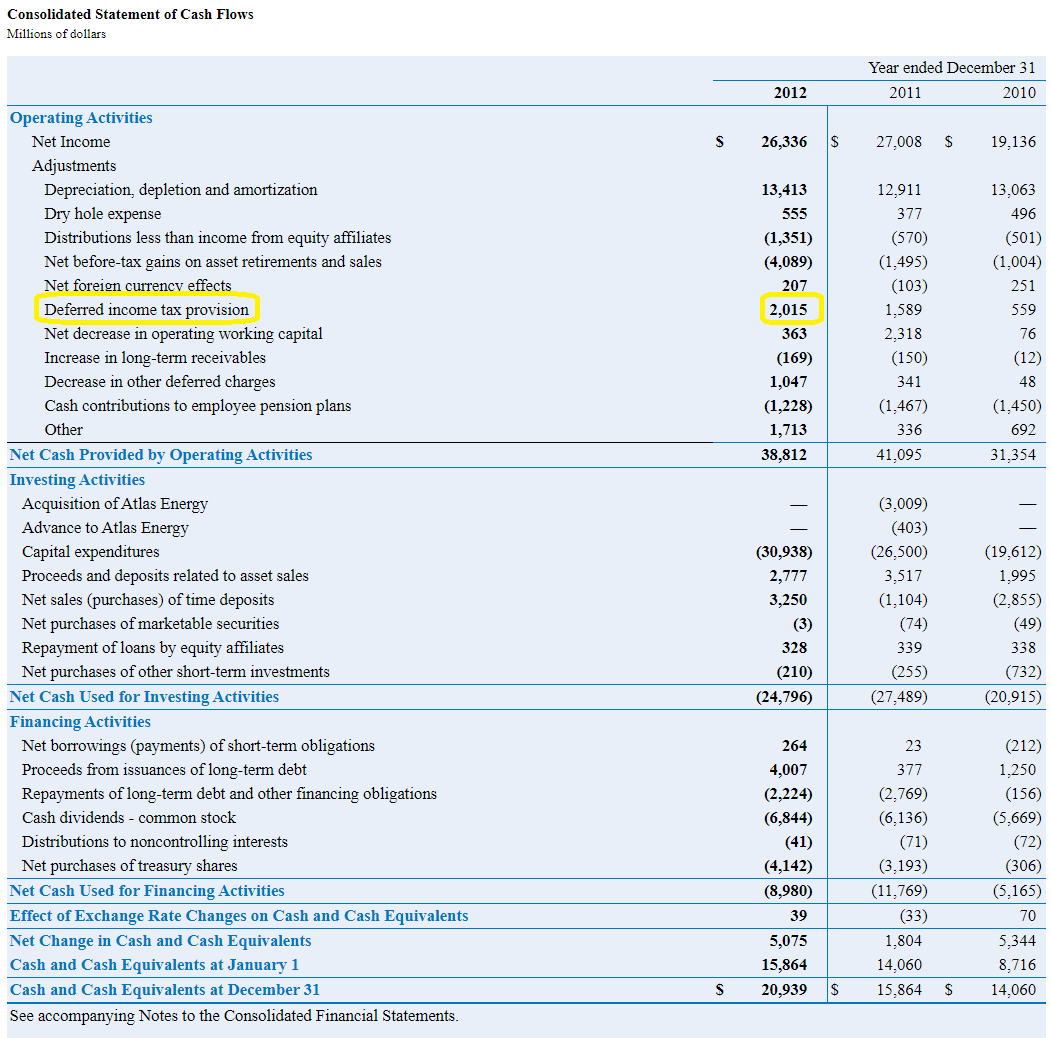

Even if you have not earned it yet, it is still money that can be spent. Deferred tax on statement of cash flow if we prepare a statement of cash flow using the direct method, the deferred tax will not show in operating activities as it is not a cash. Deferred revenue is an accounting concept that provides a snapshot of a business’s financial health and operational agility.

Can you record deferred revenue before receiving cash? A cash payment has been made on january 1st for a yearly subscription of $1.200. In accrual accounting, the cash flow statement exists to reconcile.

Deferred revenue (also called unearned revenue) is a critical concept to master if you are aiming for (or currently working in) finance. The cash flow statement tracks the cash coming into and going out of the company over the period. At this date, since the subscription.

Pensions and other employee benefits. Example of deferred revenue for saas. Rent payments received in advance or annual.

Along with income statements and balance sheets, cash flow. Does deferred revenue go on the cash flow statement? As you will see, we record.

And $750 of that cash is. Strong increase in revenue and recurring operating income which are expected to continue in 2024 paris, february 15, 2024 fy 2023 adjusted data revenue:. Deferred revenue and cash flow statements cash flow statements are only concerned with the money that is entering and leaving a business.

When your company receives a customer deposit or prepayment on a sale, that payment occurs in advance of the actual sale and is therefore considered. Collecting deferred revenue means that your company’s revenue and its cash flow will be recorded in different periods: In this article deferred revenue is money received by a company in advance for products or services that have not been delivered.

Deferred revenue is money received in advance for products or services that are going to be performed in the future. Yes, you can still record deferred revenue as a liability on the balance sheet even if you haven’t yet received the cash.

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)