Have A Tips About Goodwill Meaning Balance Sheet

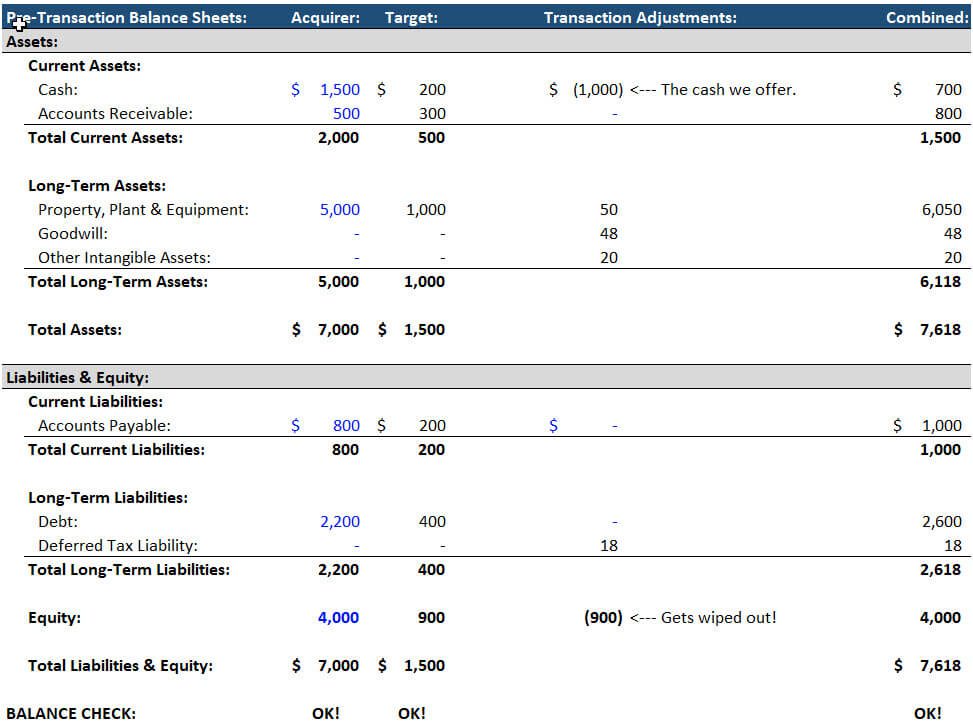

Under the second method of measuring the nci, we take into account the 10% of b that a.

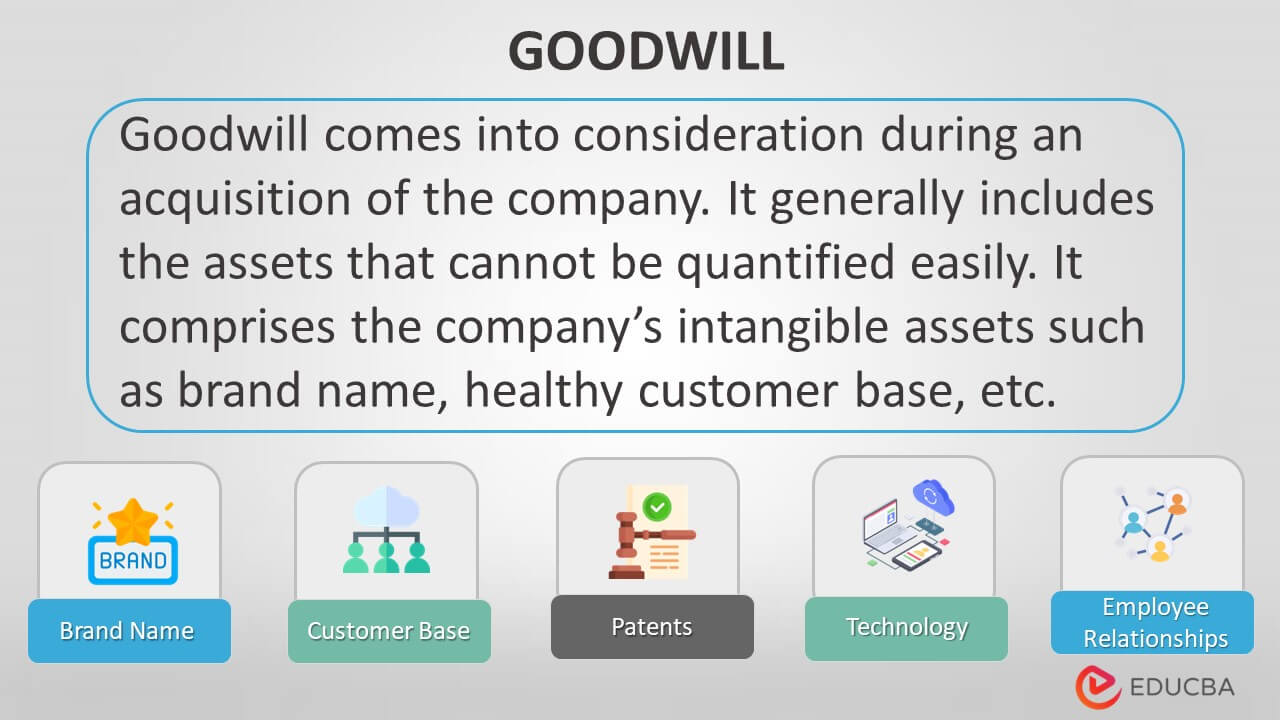

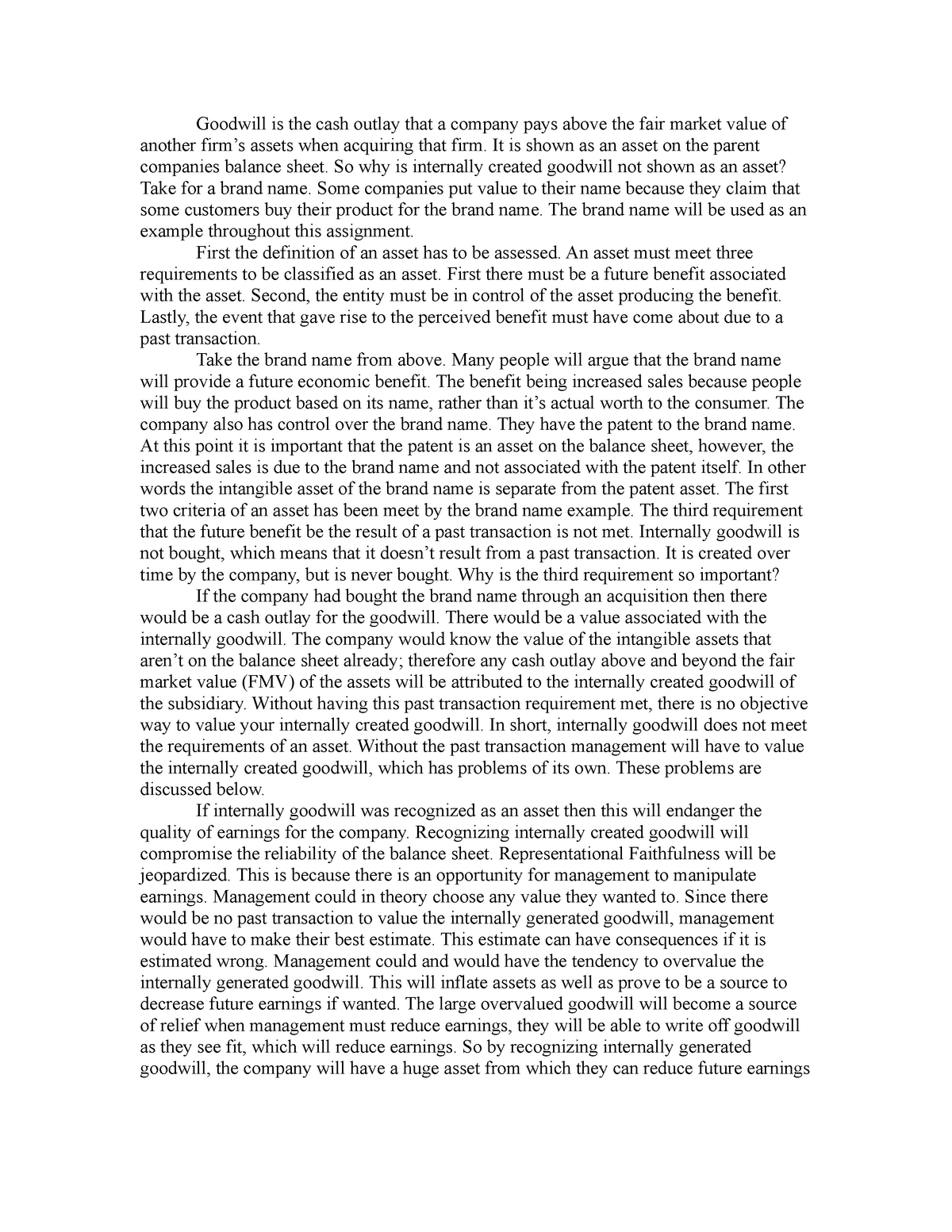

Goodwill meaning balance sheet. Key takeaways goodwill is equal to the amount between a business’s purchase price and its fair market value, and is usually considered during a business acquisition. Goodwill typically only comes into play when one company purchases another. Business goodwill is usually associated with business acquisitions.

When goodwill goes bad let's consider an. Goodwill is typically recorded on the balance sheet when a company buys another business and pays a premium for it. It reflects the premium that the buyer pays in addition to the net value of its other assets.

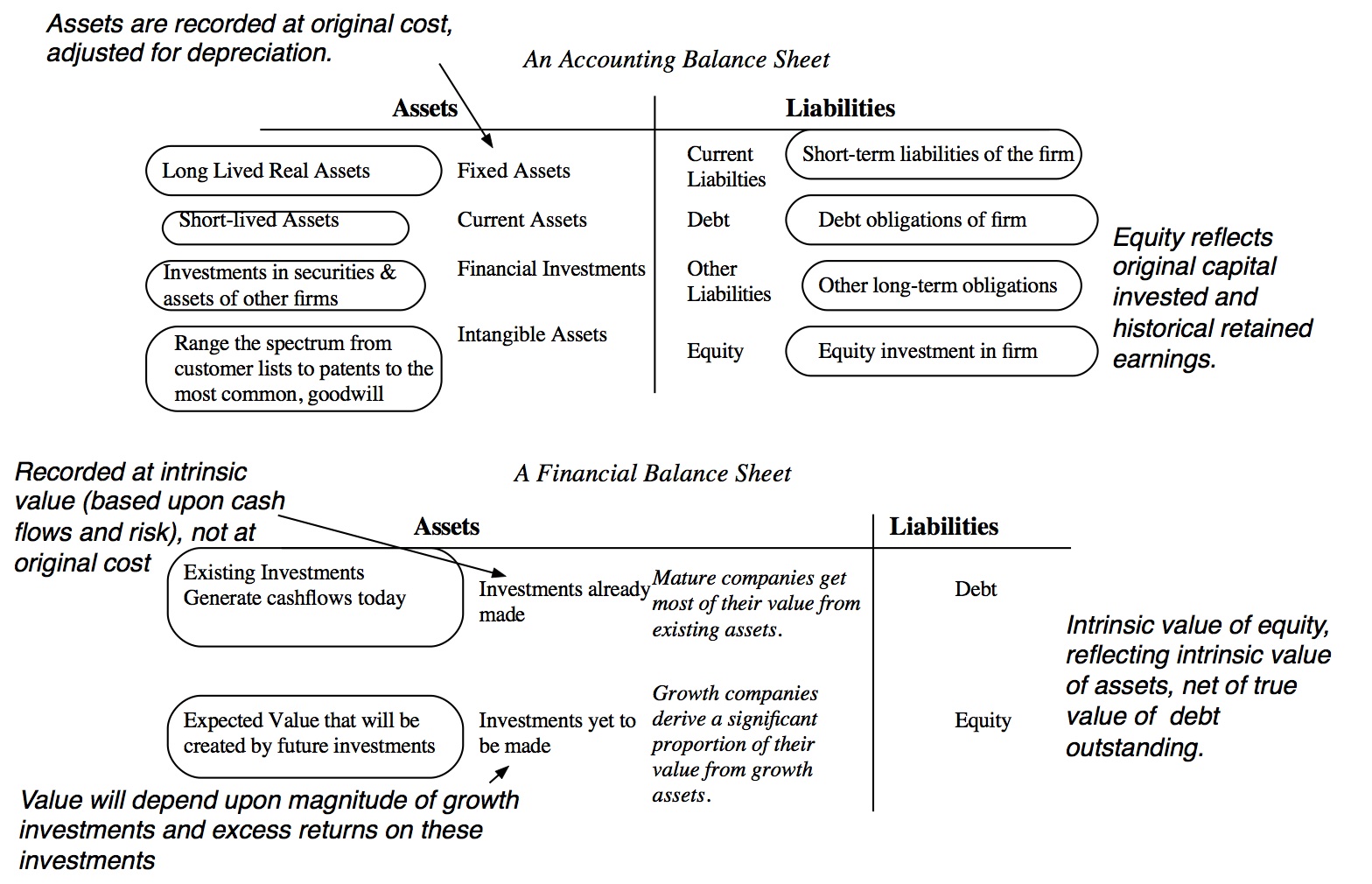

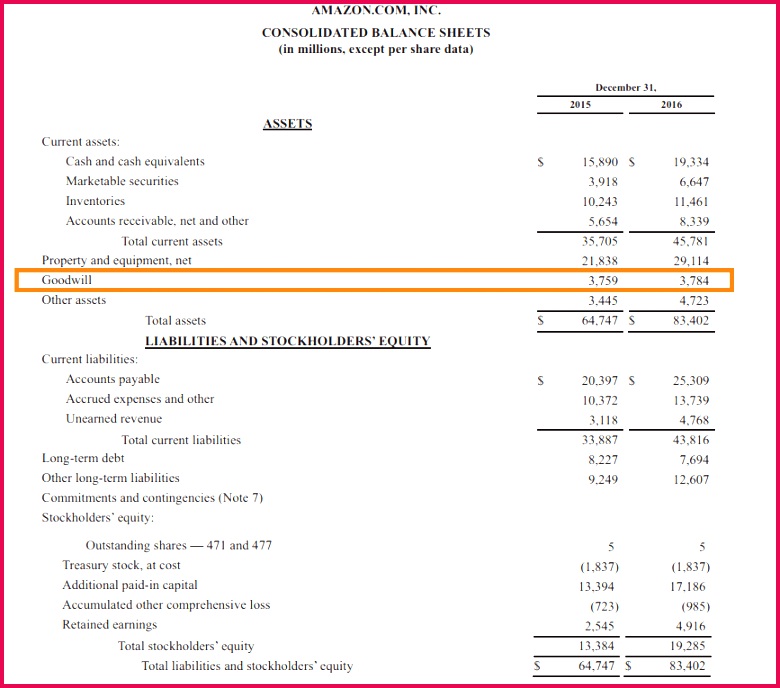

For example, company abc may purchase company xyz for more than the fair value of its assets and debts. On a balance sheet goodwill and intangible assets are each separate line items. Key concepts selected accounts accounting standards financial statements bookkeeping auditing people and organizations development misconduct v t e in accounting, goodwill is an intangible asset recognized when a firm is purchased as a going concern.

Goodwill is an intangible asset that features prominently on a company’s balance sheet. Goodwill is an intangible asset used to explain the positive difference between the purchase price of a company and the company’s perceived fair value. This premium reflects the buyer’s belief that the acquired company possesses certain valuable intangible assets which will provide future economic benefits.

Accounting march 31, 2023 in accounting, goodwill is the value of the business that exceeds its assets minus the liabilities. When testing goodwill for impairment, banks are required to assess the carrying value of a significant balance sheet asset by applying the discipline of fair value measurement. Goodwill occurs when one company acquires another for a price higher than the fair market value of its assets.

In other words, goodwill represents an acquisition amount over and above what the purchased firm's net assets are deemed to be valued on the balance sheet. It arises over a period of time due to the good reputation of the business. Goodwill goodwill is a miscellaneous category for intangible assets that are harder to parse.

This excess income cannot be assigned to any specific tangible or intangible asset and is hence included in the goodwill of the company. Definition goodwill in accounting is a term that represents the excess amount between the purchase price and fair market value of a business. A balance sheet is a financial statement that reports a company's assets, liabilities and shareholder equity at a specific point in time.

Warren buffet doesn’t place a lot of emphasis on the goodwill you find on the balance sheet (called accounting goodwill) instead, he places a lot of emphasis on what he calls the economic goodwill. What is goodwill on a balance sheet? In accounting, goodwill is an intangible asset that occurs when a buyer buys an existing business.

Since goodwill is an intangible asset, it is recorded on the balance sheet as a noncurrent asset. When a company earns a rate of return that is greater than the fair value of the tangible and intangible assets combined, the excess income is considered goodwill for the company. Economic goodwill is what can be earned more than the market return from intangible assets.

The amount remaining would be listed on company abc's balance sheet as goodwill. What’s “goodwill” on a balance sheet? It arises when one company acquires another and pays more for it than the fair market value of the acquired company’s identifiable tangible and intangible assets minus its liabilities.

:max_bytes(150000):strip_icc()/GettyImages-181132157-4e4b7e178b7946a3b50c2cd4cd40c571.jpg)

:max_bytes(150000):strip_icc()/Goodwill-Definition-6b68b9485c394cb185b3097a8558a25e.jpg)