Best Info About Indirect And Direct Method Cash Flow

What is the cash flow statement indirect method?

Indirect and direct method cash flow. The direct method presents actual cash flows, while the indirect method calculates cash flows based on adjustments to cash flow from operating activities. In this article we will guide you through the process and help you understand the details and differences between the direct and indirect cash flow method. $405,200.00 adjustments to reconcile net income to net cash flows from (used for) operating activities:

The indirect method considers accruals, so all receivable. The main difference between the direct method and the indirect method of presenting the statement of cash flows (scf) involves the cash flows from operating activities. Items that typically do so include:

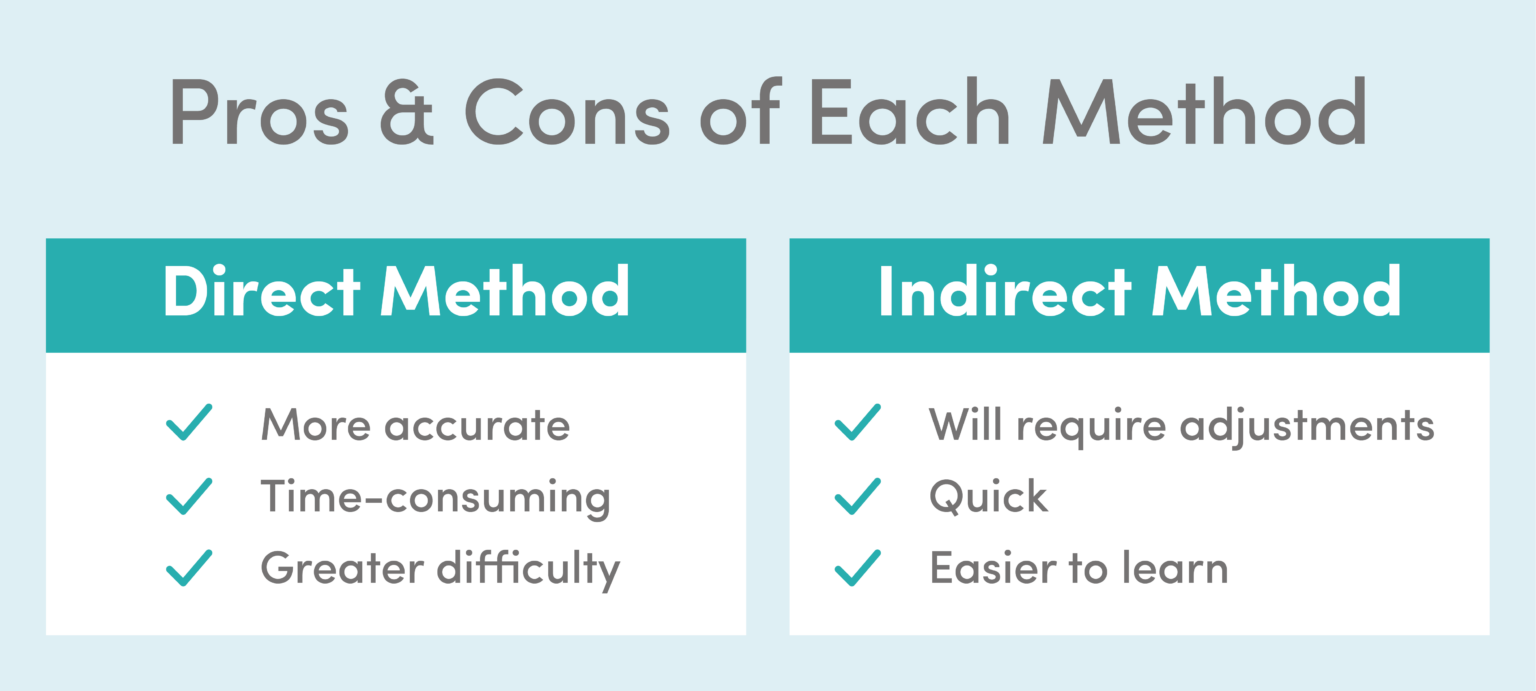

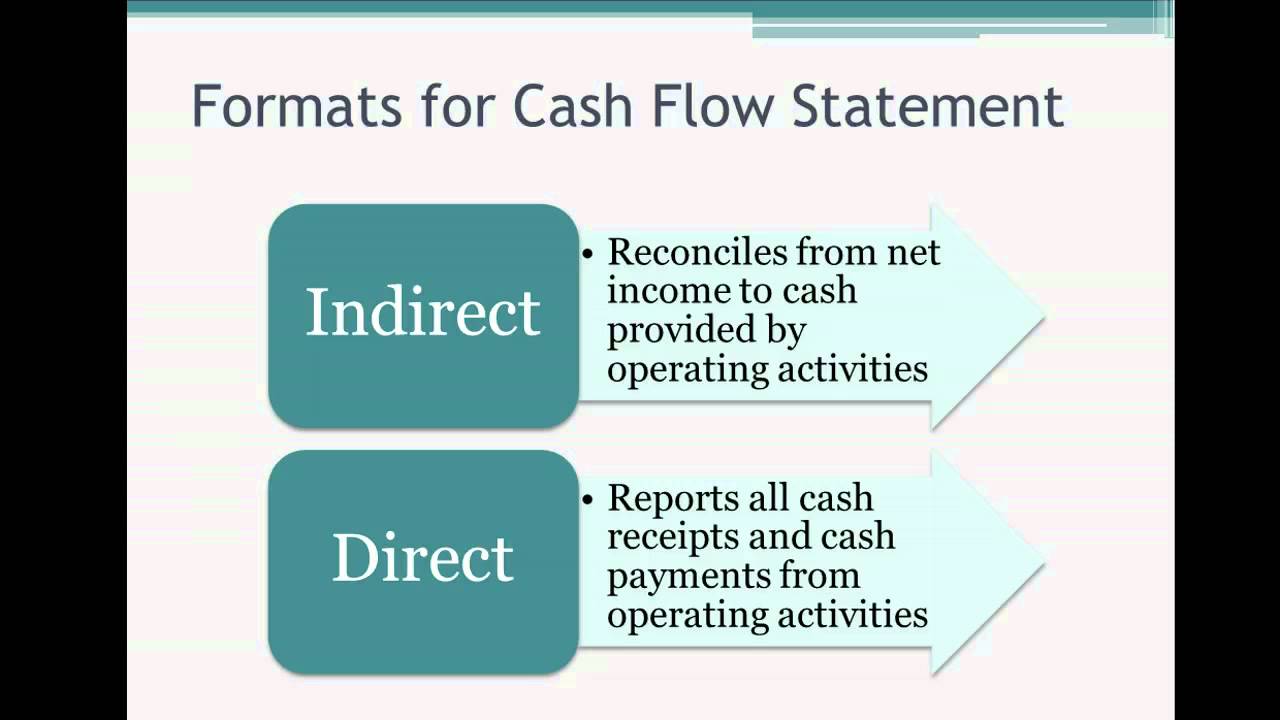

(there are no differences in the cash flows from investing activities and/or the cash flows from financing activities.) The cash flow statement can be generated using the direct method or the indirect method. The direct method and the indirect method.

In the direct method of cash flow statement preparation, actual receipts from customers and actual payments to suppliers, service providers, employees, taxes, etc. We can work out the cash flow from operations using two methods: The american institute of certified public accountants reports that approximately 98% of all companies choose the indirect method of cash flows.

The direct method of cash flow tracking records every single cash movement in and out of a business, such as payments from customers and expenses for supplies and salaries. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows. $81,750.00 loss on disposal of equipment:

How to identify direct and indirect method of cash flow statement? Instead, the direct method is more clear in how it’s calculated and can give you a better idea of your current cash standing. Direct cash flow indirect cash flow;

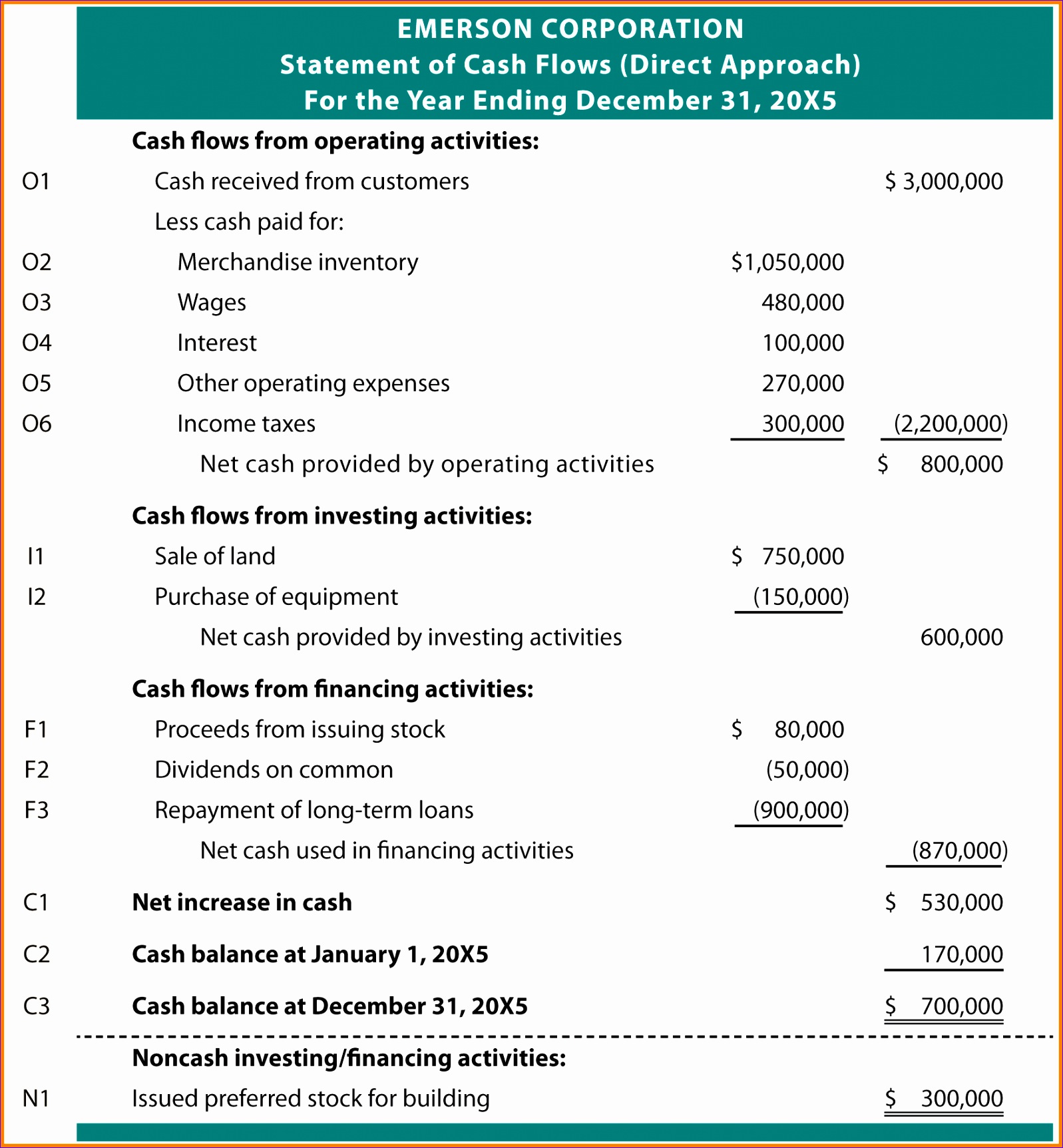

When using the direct method to calculate cash flow from operating, investing and financing activities, your statement may look something like this: (a) the direct method and (b) the indirect method. The cash flow from the operations section of the cash flow statement can be prepared using either the direct method or the indirect method.

Definition of a cash flow statement direct cash flow method calculations indirect cash flow method calculations Creating a cash flow statement involves using either the direct or indirect cash flow method and setting up the right processes. For instance, assume that sales are stated at $100,000 on an accrual basis.

A cash flow statement is a summary of your company’s incoming and outgoing cash from operations, investments, and financing. The indirect method uses increases and decreases in balance sheet line items to modify the. There are two ways to prepare your cash flow statement:

This is not only difficult to create; The indirect method is one of two accounting treatments used to generate a cash flow statement. Factoring in the direct and.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)