Formidable Info About Depreciation In Profit And Loss Account

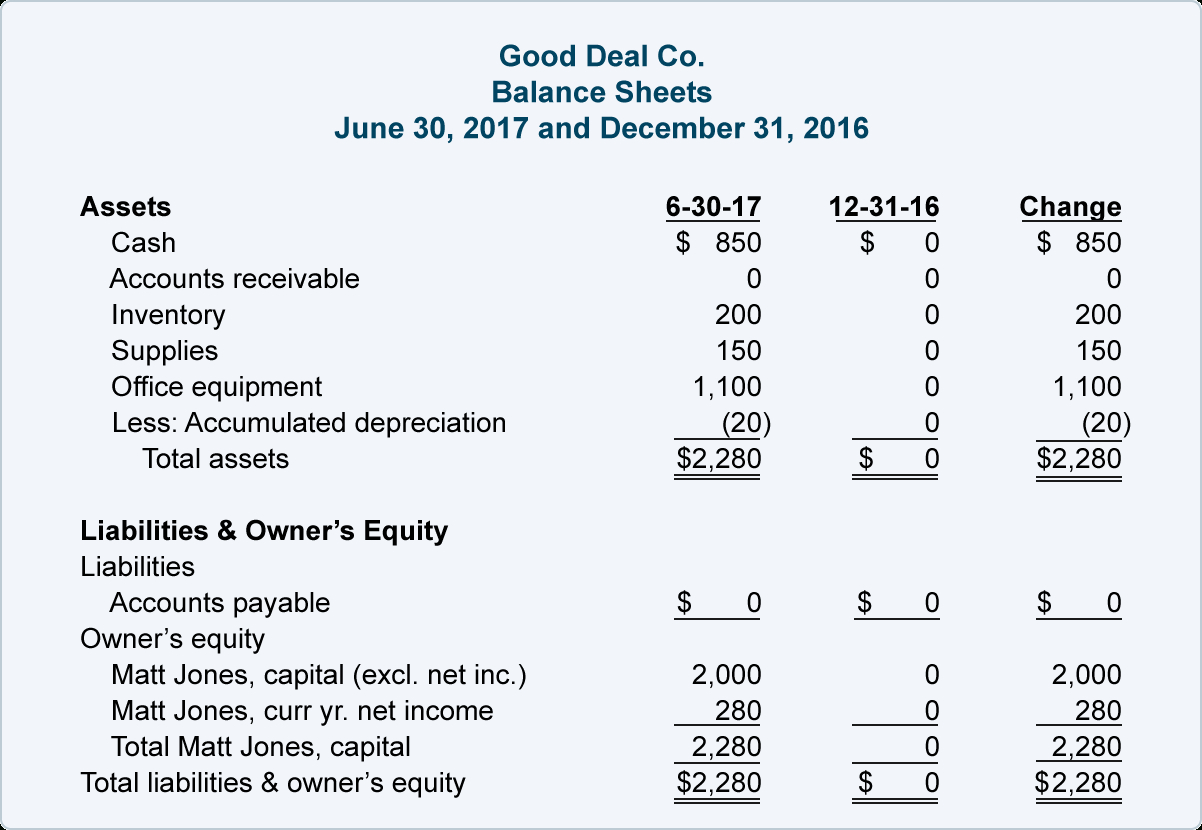

Depreciation is an accounting entry that represents the reduction of an asset's cost over its useful life.

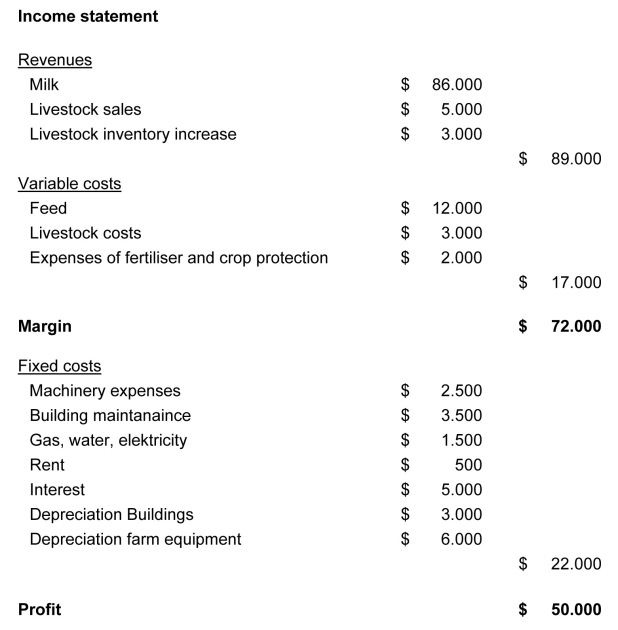

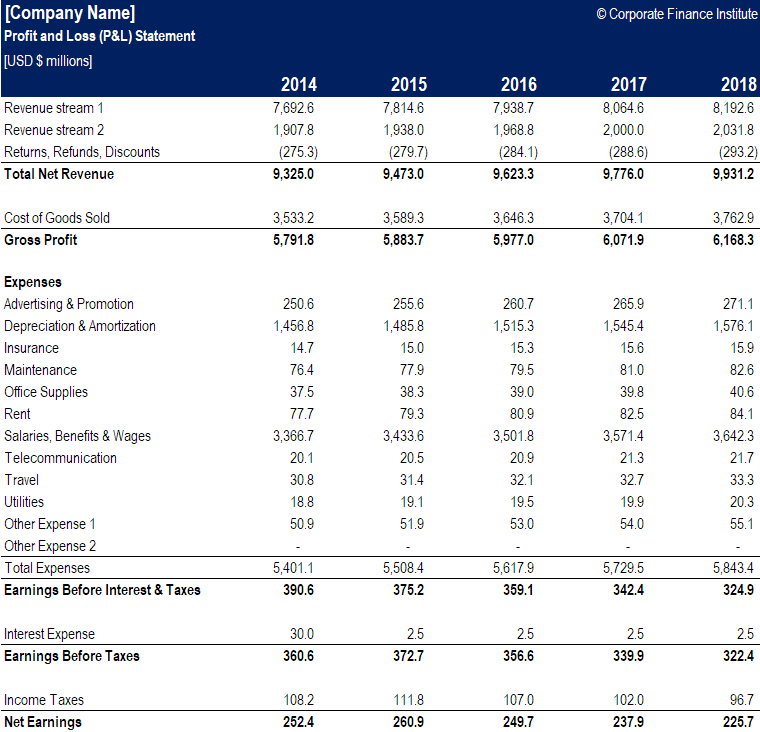

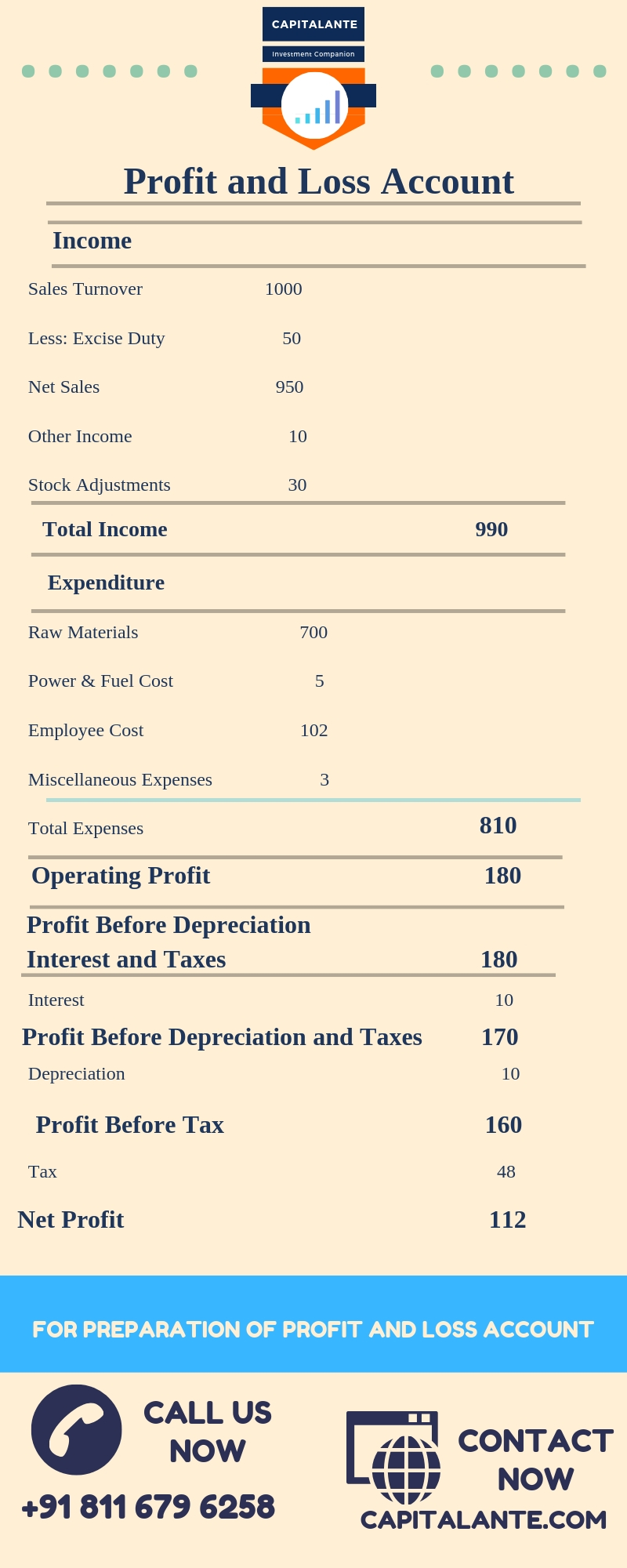

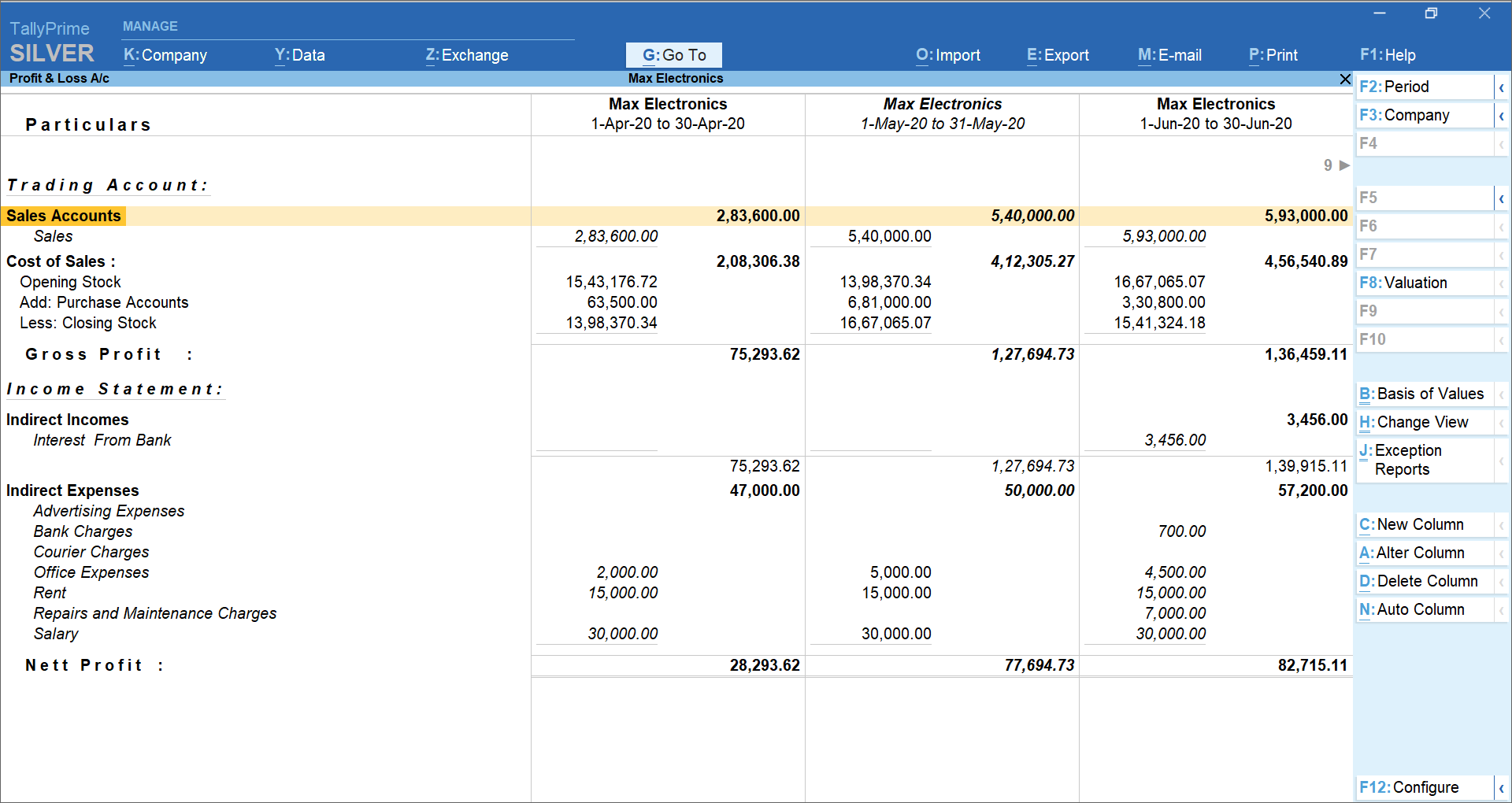

Depreciation in profit and loss account. It is prepared to determine the net profit or net loss of a trader. November 12, 2023 what is the accounting entry for depreciation? Your p&l statement shows your revenue, minus expenses and losses.

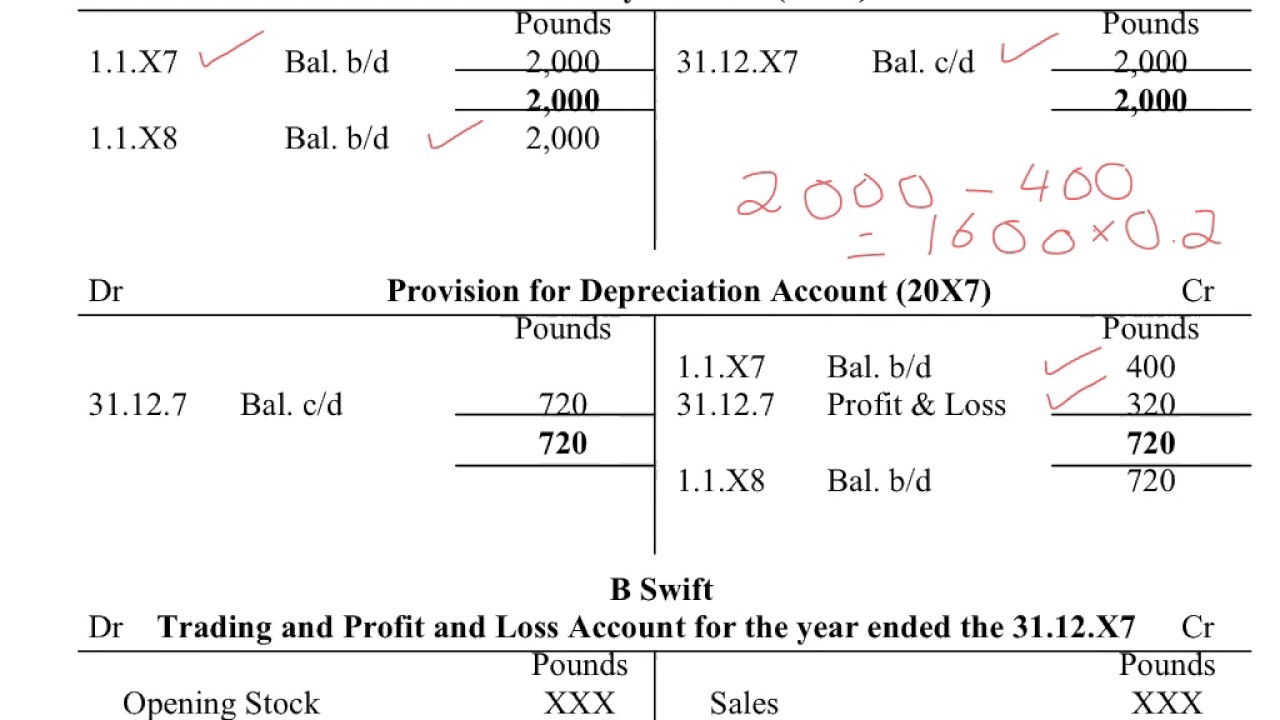

Depreciation, and irrecoverable debts and allowances for receivables. Note that the provision on depreciation account is not a nominal account, it is a part of the asset account. Depreciation is one of those costs because assets that wear down eventually need to be replaced.

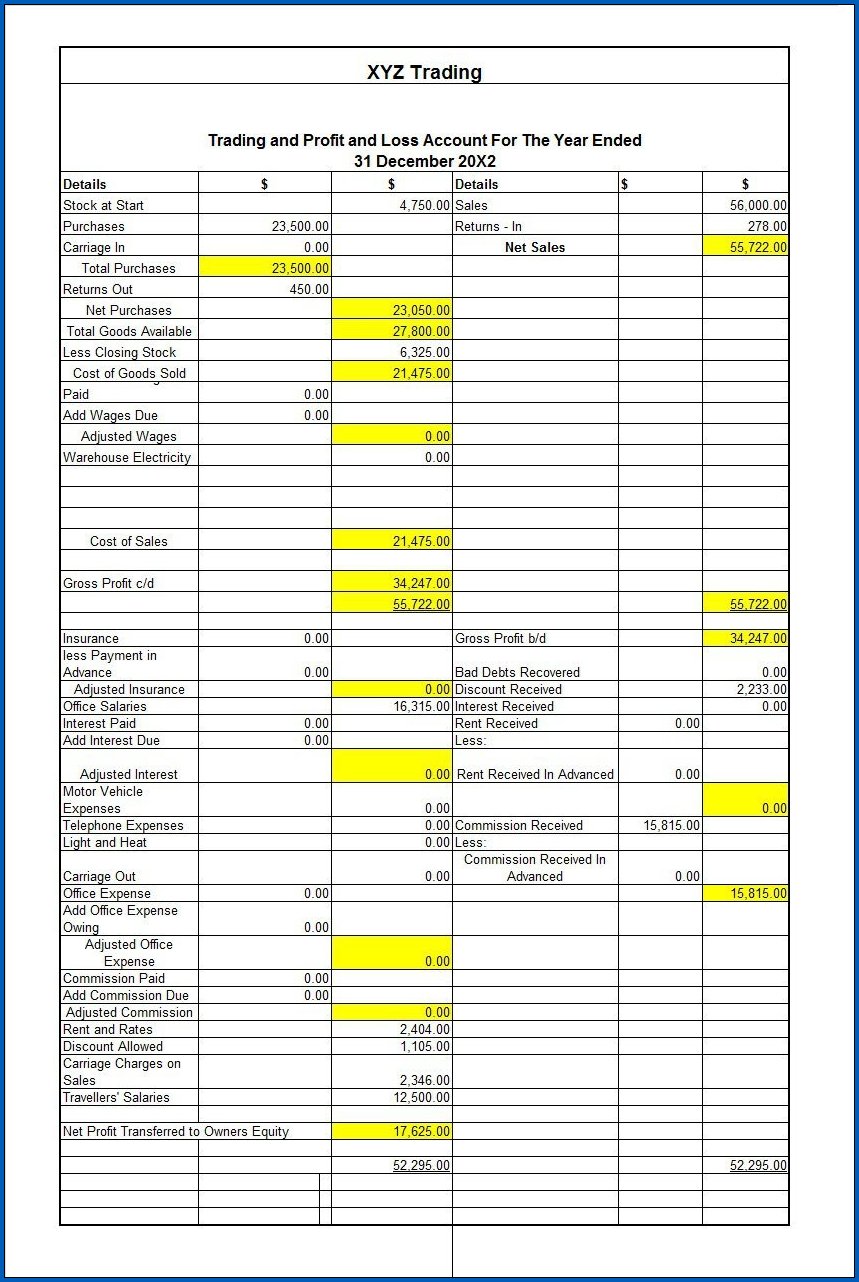

In the company’s profit and loss account, depreciation would be calculated at one third of £2k, being £667 and this figure would be included with the company expenses, thereby reducing the bottom line net profit for the year. Trading account is a part of profit & loss account. Final accounts are prepared on the basis of trial balance.

In the company’s corporation tax computation, the corporation tax would be computed on the basis of the company. Profit loss account is prepared to find out gross profit or gross loss. Depreciation accounting helps you figure out how much value your assets lost during the year.

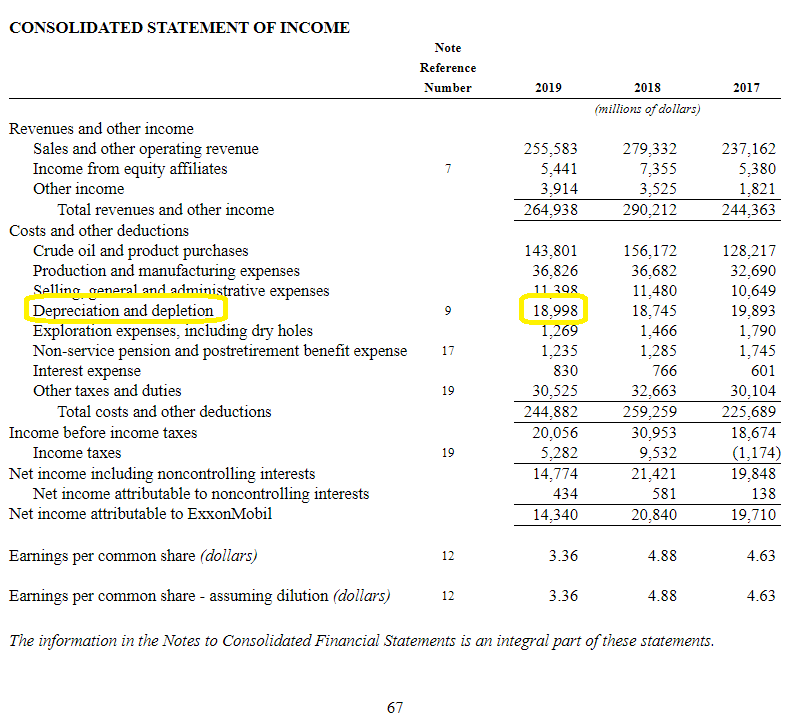

In other words, depreciation spreads out the cost of an asset over the years,. Depreciation expense is the amount that a company's assets are depreciated for a single period (e.g, quarter or the year), while accumulated depreciation is the total amount of wear to date. Gross profit or gross loss is.

Q4 loss after depreciation sek 2.6 million versus loss sek 1.6 million year ago. These entries are designed to reflect the ongoing usage of fixed assets over time. The value of depreciation is posted to the profit and loss account as expenses.

Depreciation as an expense (cost of doing business) to understand how profitable your business is, you need to know all your costs. Entry 4 the balance of the provision for depreciation account is carried forward to the next year. Q4 revenue sek 6.4 million versus sek 5.8 million year ago.

Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. The depreciation expense account, being a nominal account, is closed at the end of each financial year by transferring its balance to the profit and loss account. The balance in depreciation expense account is transferred to the profit and loss account at the end of the year.

Polyplank loss after depreciation widens to sek 2.6 mln. A profit and loss (p&l) account shows the annual net profit or net loss of a business. The outcome is either your final profit or loss.

Depreciation is an accounting concept that applies to a business’ fixed assets, such as buildings, furniture and equipment. What is an asset and which types of assets depreciate? In depreciation, assets are depreciated to show the true or original value of assets.