Best Of The Best Info About Four Financial Statements Are Usually Prepared For A Business

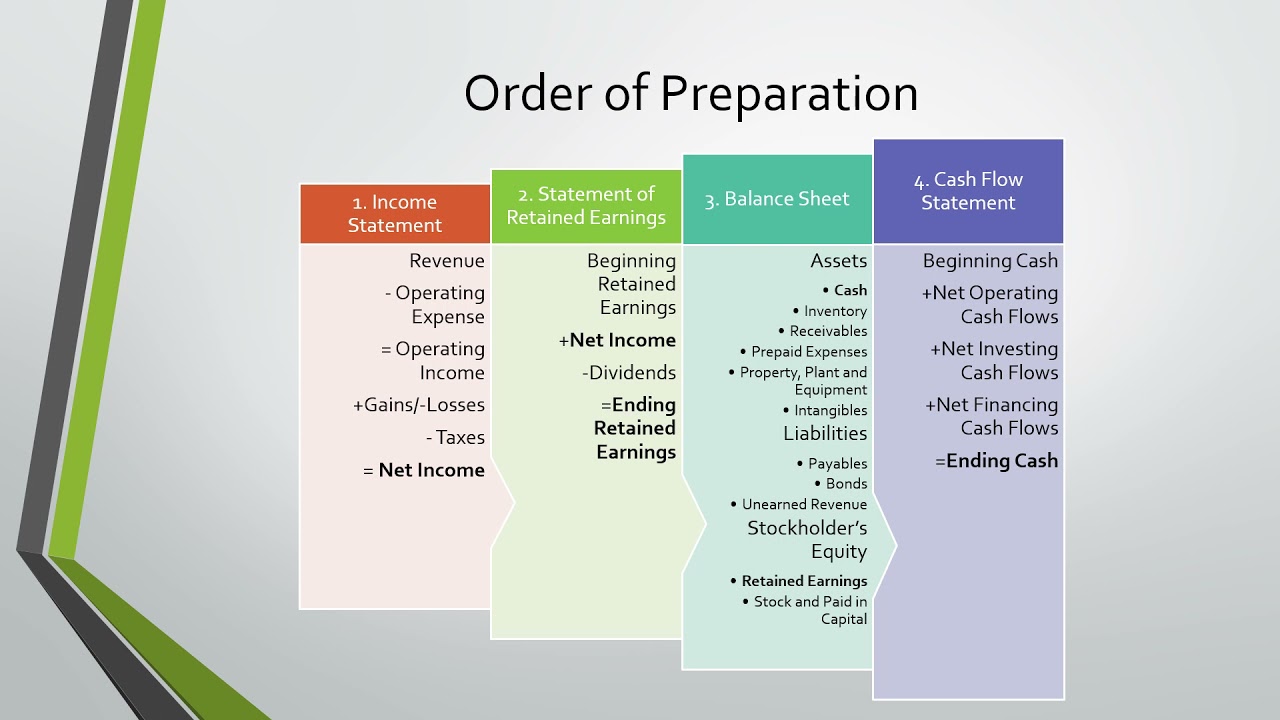

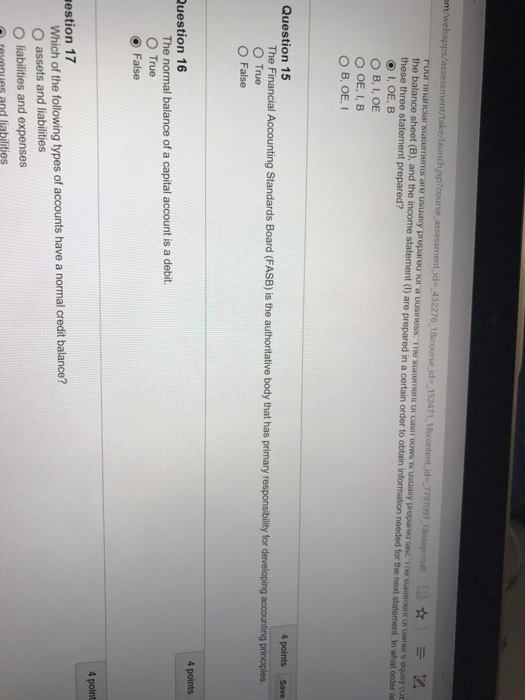

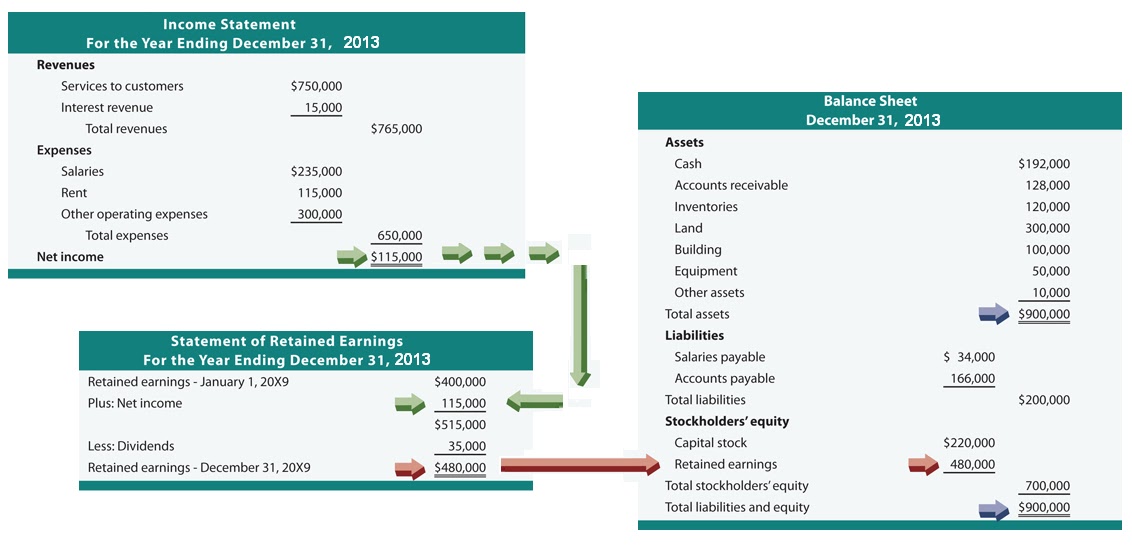

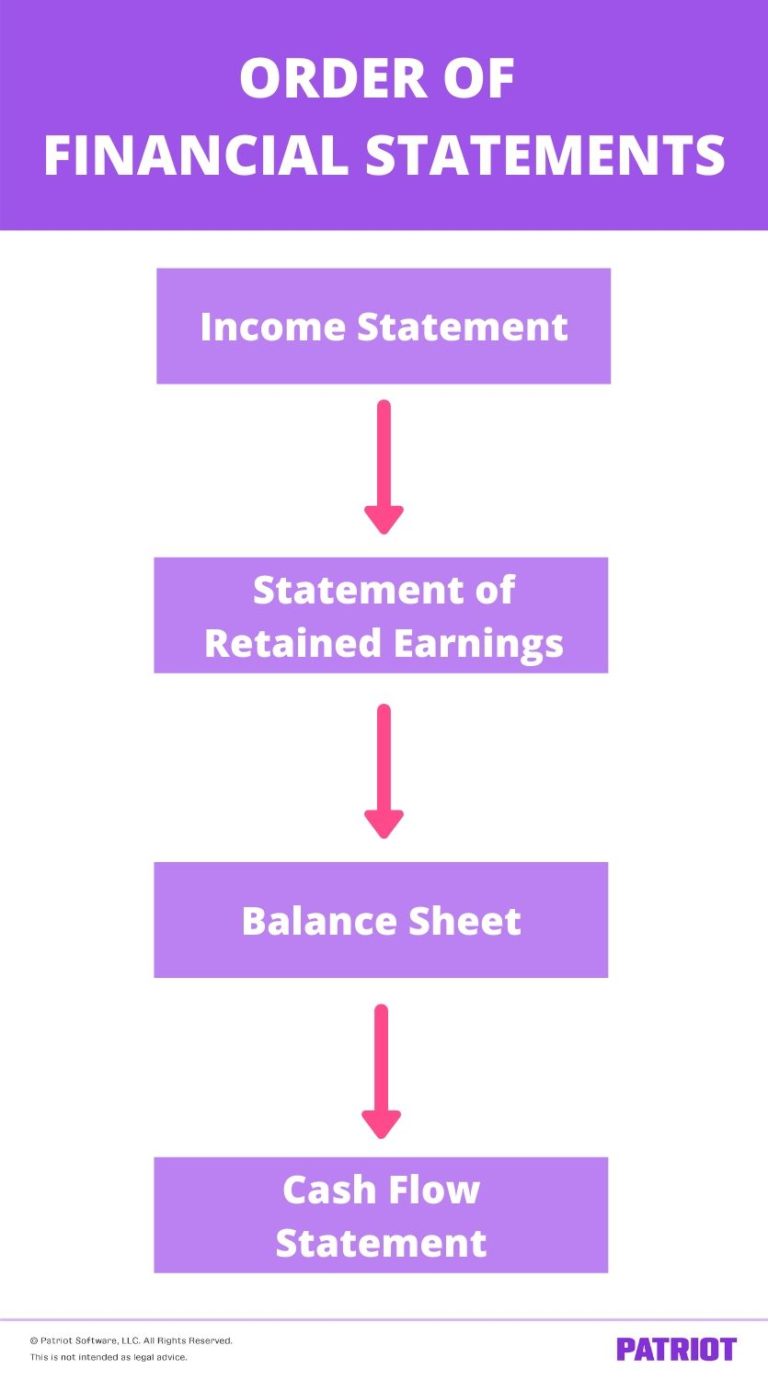

The statement of owner's equity (oe), the balance sheet (b), and the income statement (i) are prepared in a certain order to obtain information needed for the next statement.

Four financial statements are usually prepared for a business. Four financial statements are usually prepared for a business. The income statement answers a business’s most important question: The statement of stockholders' equity (sse), the balance sheet (b), and the income statement (1) are prepared in a certain order to obtain information needed for the next statement.

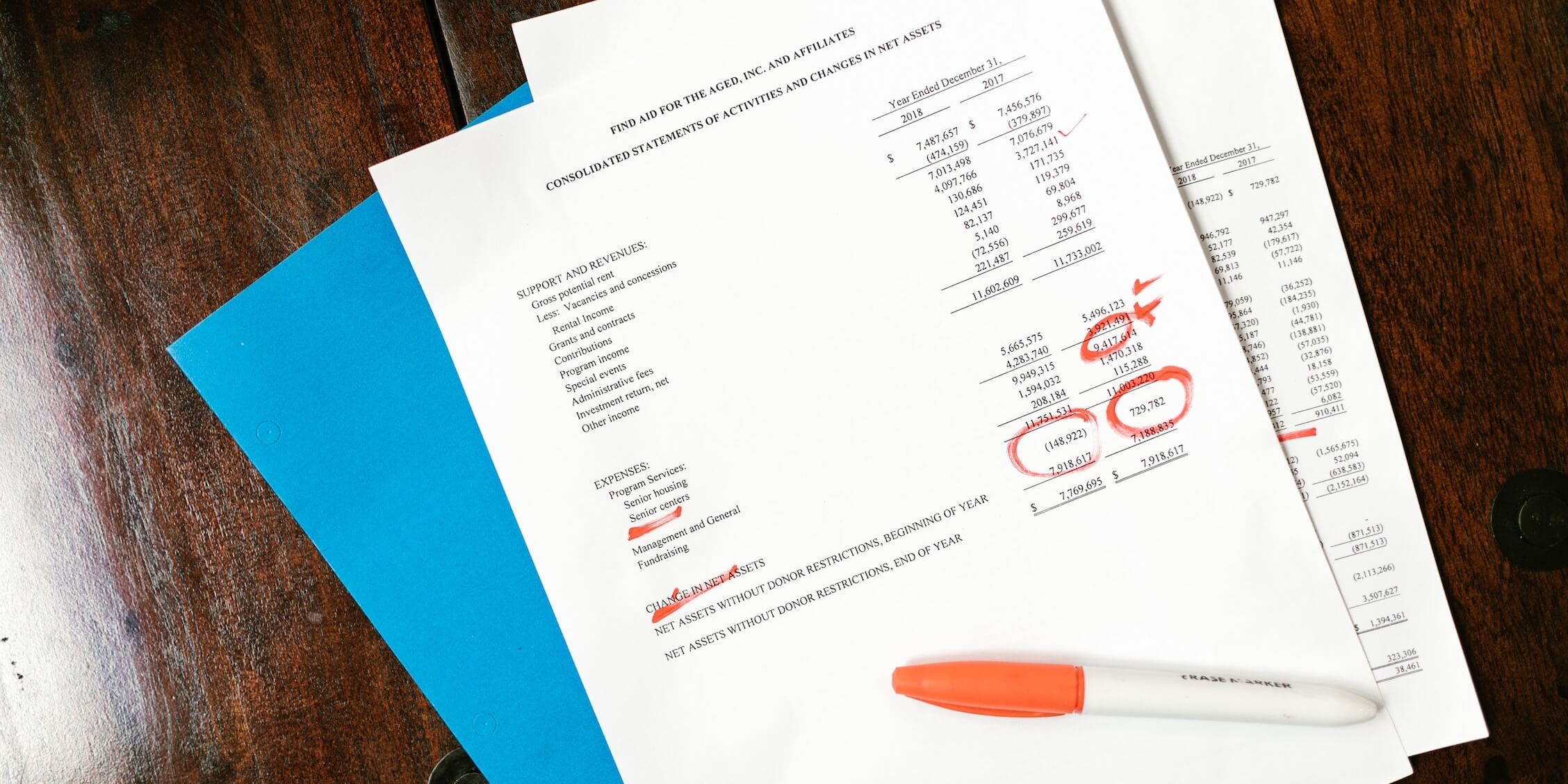

Nonprofit entities use a similar but different. Assets will include items like property, inventory, cash and all transactions through a company's accounts receivable. The income statement presents the revenues, expenses, and profits/losses generated during the.

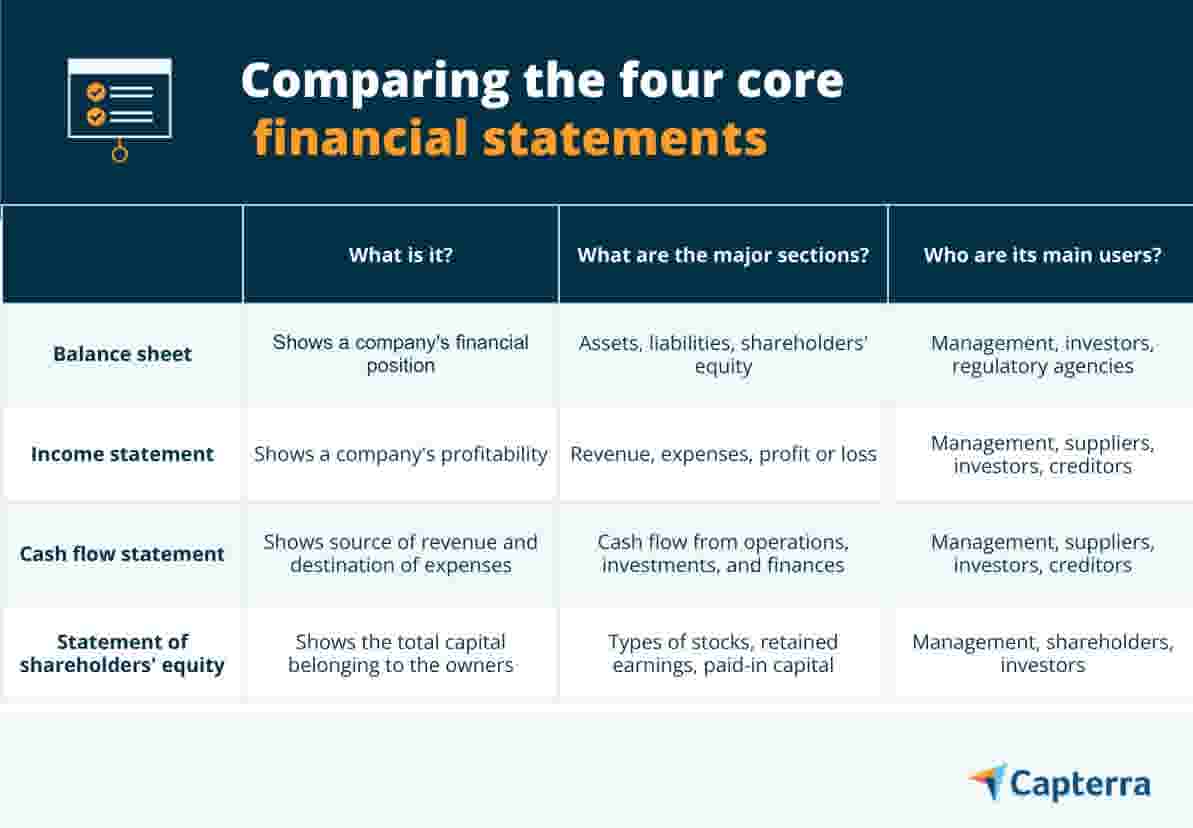

A complete set of financial statements is used to give readers an overview of the financial results and condition of a business. Your income statement tells you how much profit you realized during the accounting period. Read on to explore each one and the information it conveys.

Four financial statements are usually prepared for a business. The financial statements are comprised of four basic reports, which are noted below. There are four main financial statements.

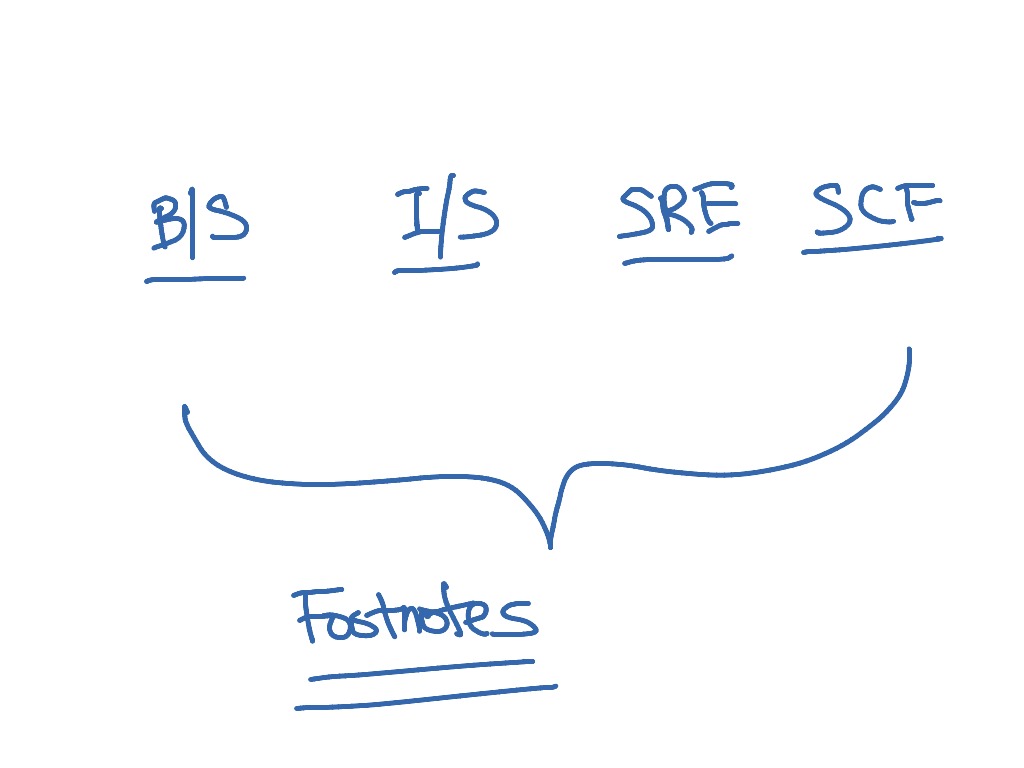

And (4) statements of shareholders’ equity. The statement of cash flows is usually prepared last. Four financial statements are usually prepared for a business.

The basic financial statements of an enterprise include the 1) balance sheet (or statement of financial position), 2) income statement, 3) cash flow statement, and 4) statement of changes in. The financial statements prepared for most small businesses comprise a balance sheet and an income statement usually these are prepared by an accountant. 1.4.1 income statement the net income from a business’s operations for a period of time is so important to business people and investors that one financial statement—the income statement—is dedicated to showing what that amount is and how it was determined.

Four financial statements are usually prepared for a business. Balance sheet the balance sheet is an important document that details a company's assets, liabilities and shareholder equity. They show you the money.

Let us consider each of them in more detail. Four financial statements are usually prepared for a business. The balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings.

Each one presents a different view of a business’s finances, but they all share information and should be taken alongside one another to create a complete picture of its current. Financial statements may be prepared for different timeframes. The statement of owner's equity (oe), the balance sheet (b), and the income statement (i) are prepared in a certain order to obtain information needed for the next statement.

The financial statement of a company is based on four types of accounting statements: The statement of cash flows is usually prepared last. The four main financial statements for a small business include the income statement, the balance sheet, the statement of cash flow and the statement of owner's equity.