First Class Info About Is Net Income On Balance Sheet

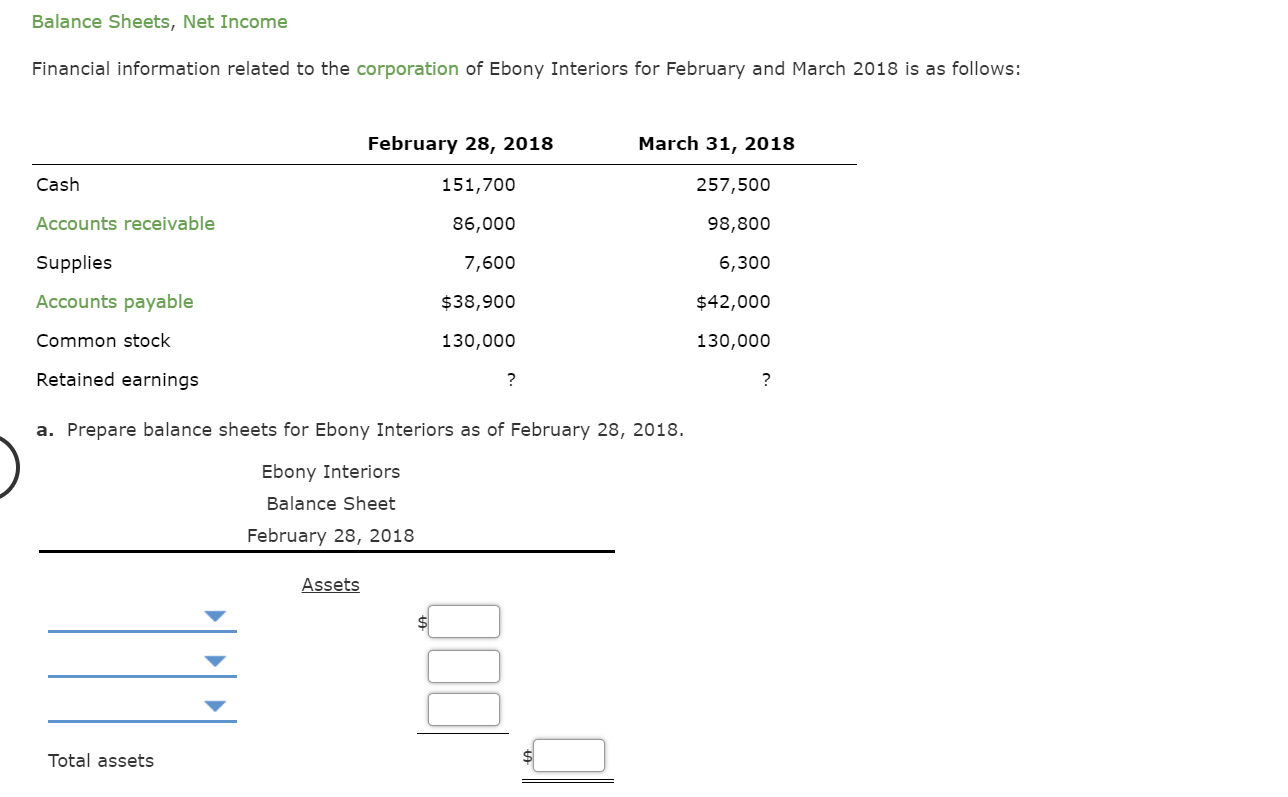

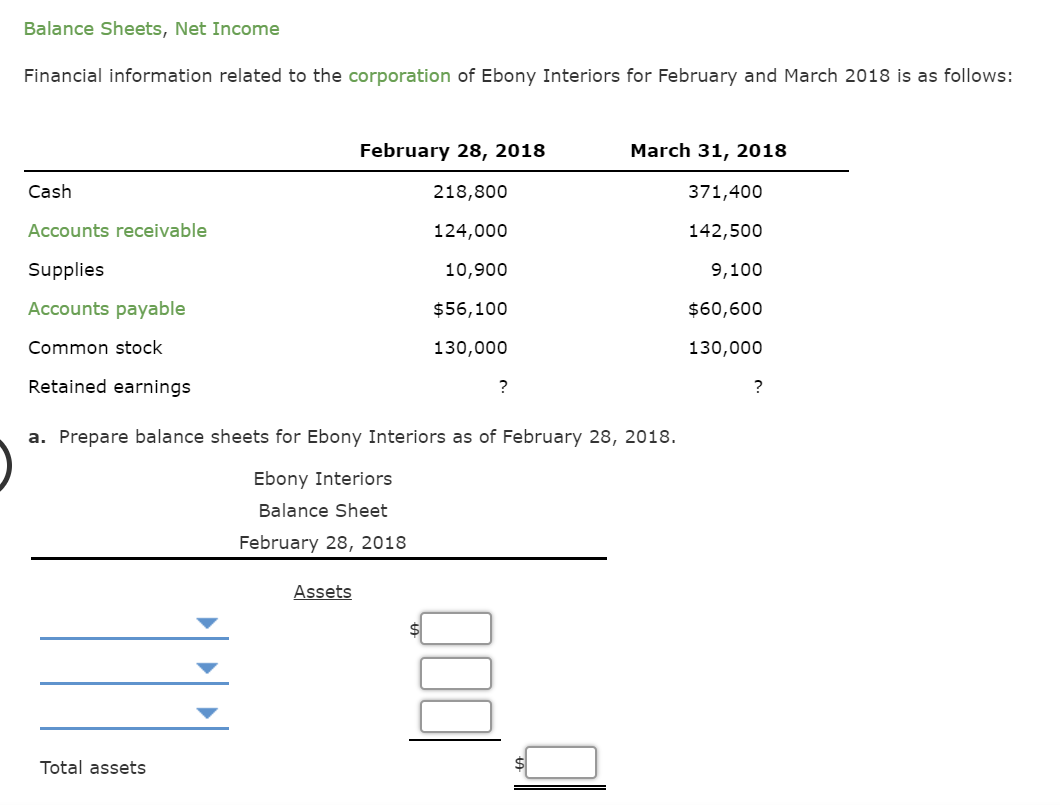

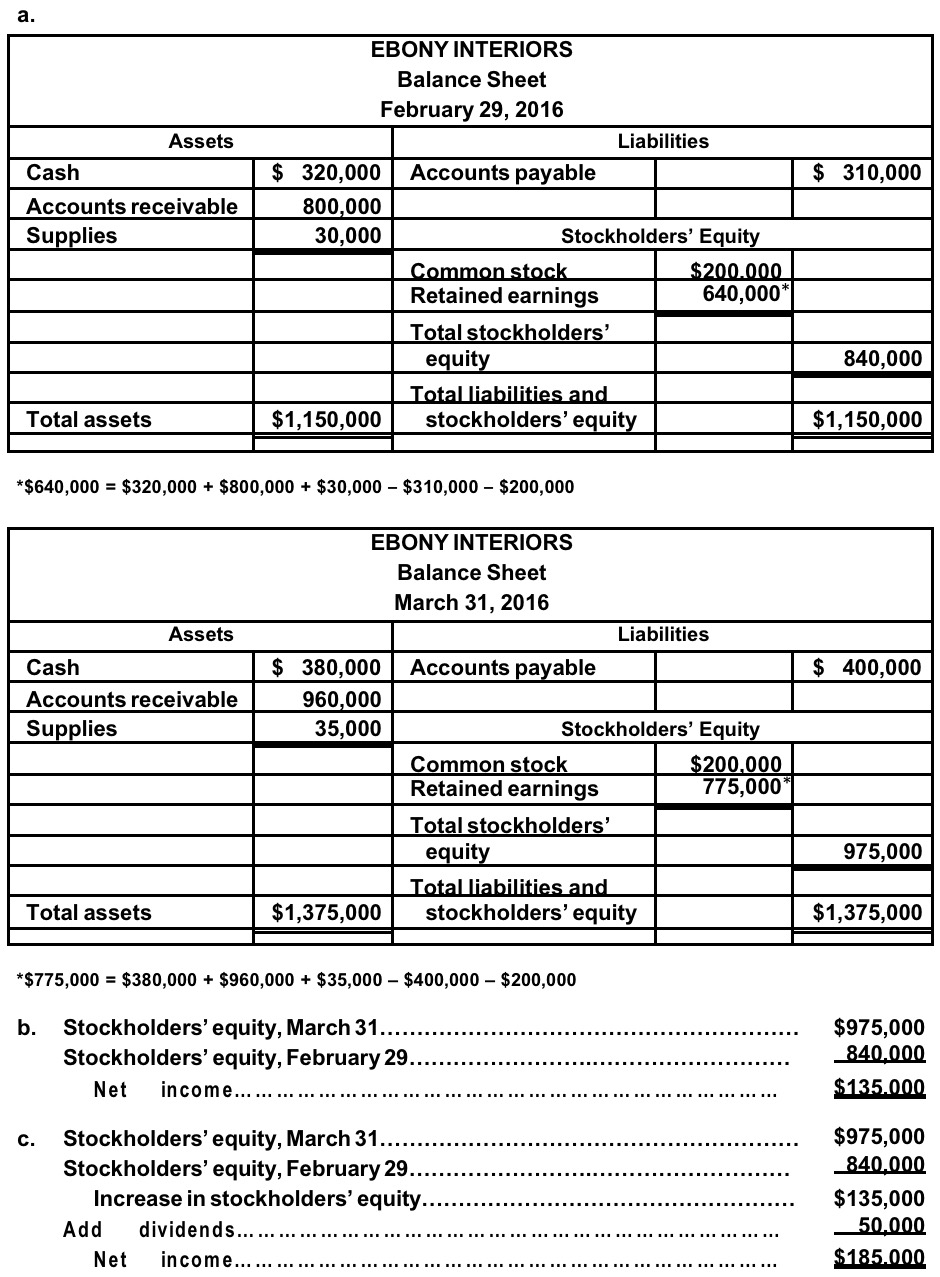

Determine the beginning and ending balances of each account.

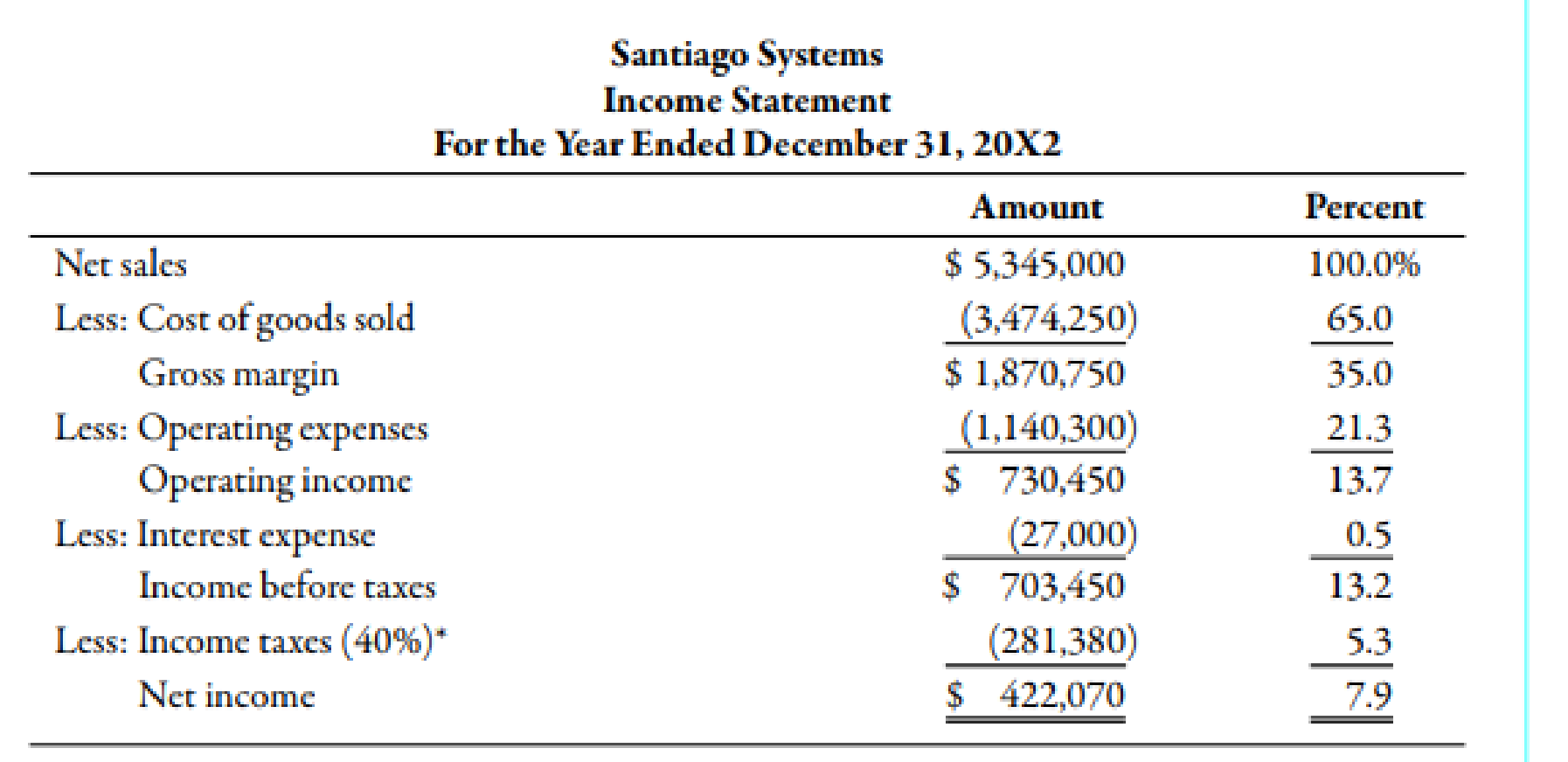

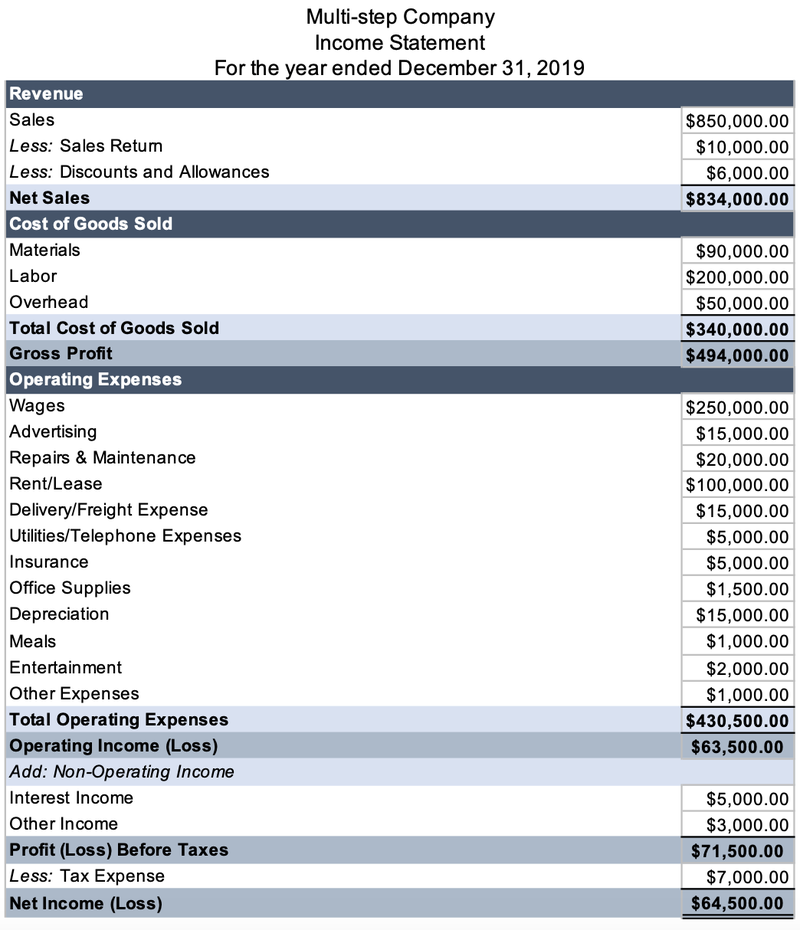

Is net income on balance sheet. Net income (profit after taxes or net profit) is the residual amount on an income statement after subtracting costs and expenses from net revenues for the accounting period. Net income and retained earnings as mentioned earlier, the financial statements are linked by certain elements and thus must be prepared in a. We would need to determine the.

While it is arrived at through the income statement, the net profit is also used in both the balance sheet and the cash flow statement. When your company has more revenues than expenses, you have a positive net income. Identify connected elements between the balance sheet and the income statement.

To calculate net income on a balance sheet, take your total revenue and subtract all expenses, including cost of goods sold, operational costs, interest and taxes. Net income does not match between pnl and bs reports. Net income helps gauge the financial performance of a company over a specific period of time, while balance sheets provide detailed information about a.

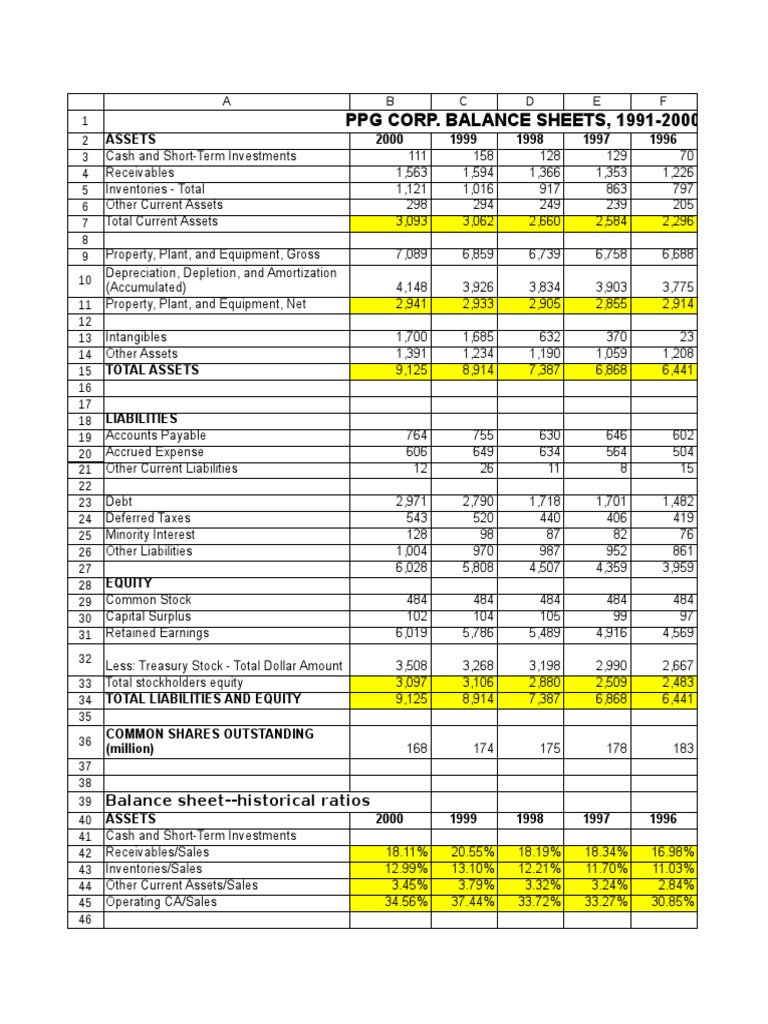

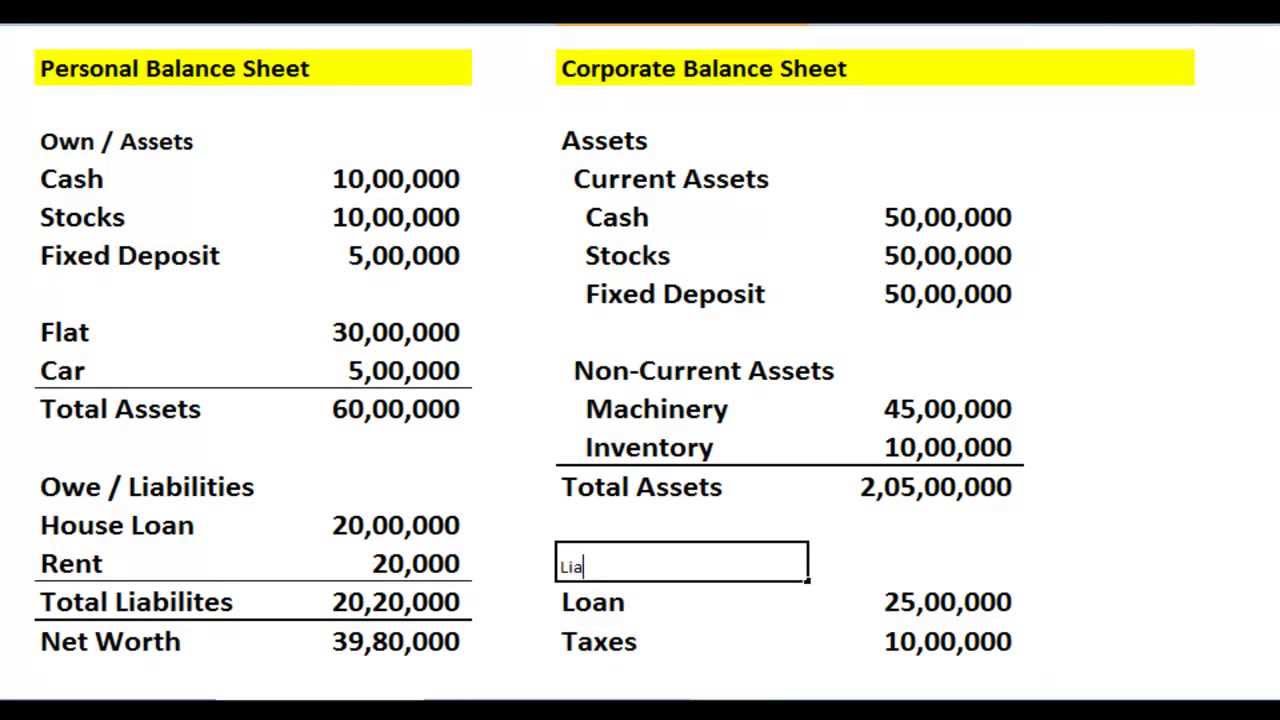

As of 2001, companies are not. The resulting number represents the net income, a key indicator of a company’s financial health and profitability. The balance sheet is based on the fundamental equation:

The p&l statement shows net income, meaning whether or not a company is in the red or black. It shows the amount of money left after deducting expenses. Not all types of businesses have cogs.

Your bank balance is the sum of all the deposits and withdrawals you have made. Which tended to be a drag on net income. Net income & retained earnings.

Net income flows into the balance sheet through retained earnings, an equity account. Intel's net debt is 2.5 times its ebitda. No, net income is not found on the balance sheet, it is rather found on the income statement.

To find your net income, you’ll need to subtract the following business expenses from your sales revenue: You will need certain minimum items from the balance sheet to calculate the net income of your business. Gross profit is the number you get when you take your revenue and subtract your cost of goods sold (cogs).

In the simplest terms, net income is your total revenue minus all your costs, taxes, and operating expenses. Last updated january 3, 2024 learn online now fundamentals of income statement what is net income? The first step in calculating net income from a balance sheet is to determine the beginning and ending balances of each account.

It can also be referred to as a statement of net worth or a statement of financial position. Cost of goods sold (cogs) operating expenses. Net income also refers to an individual's income after taking taxes and deductions into account.

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)