Lessons I Learned From Tips About Adverse Audit Opinion

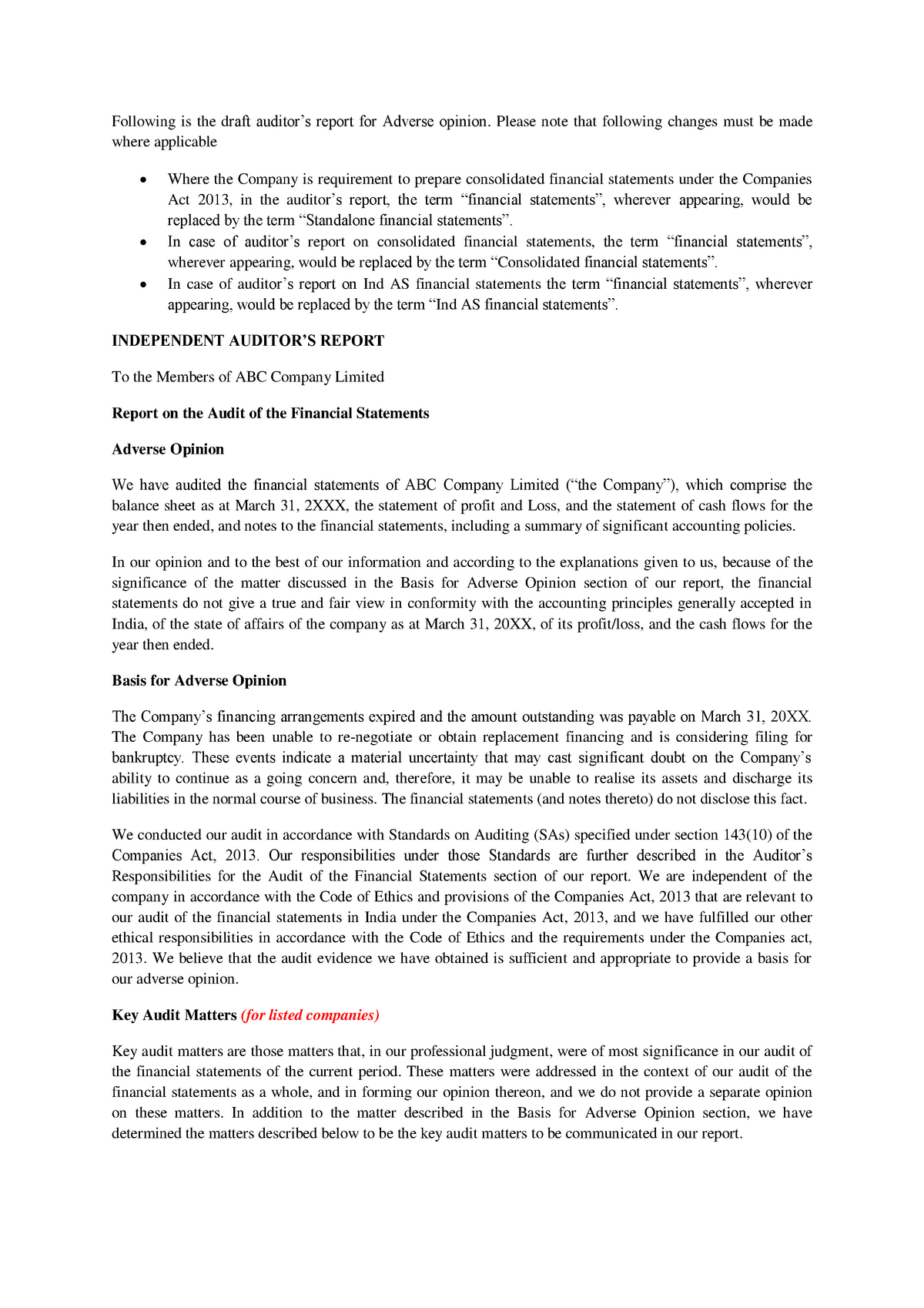

Auditor's reports are letters from auditors that contain their opinions about whether a company's financial statements comply with generally accepted accounting.

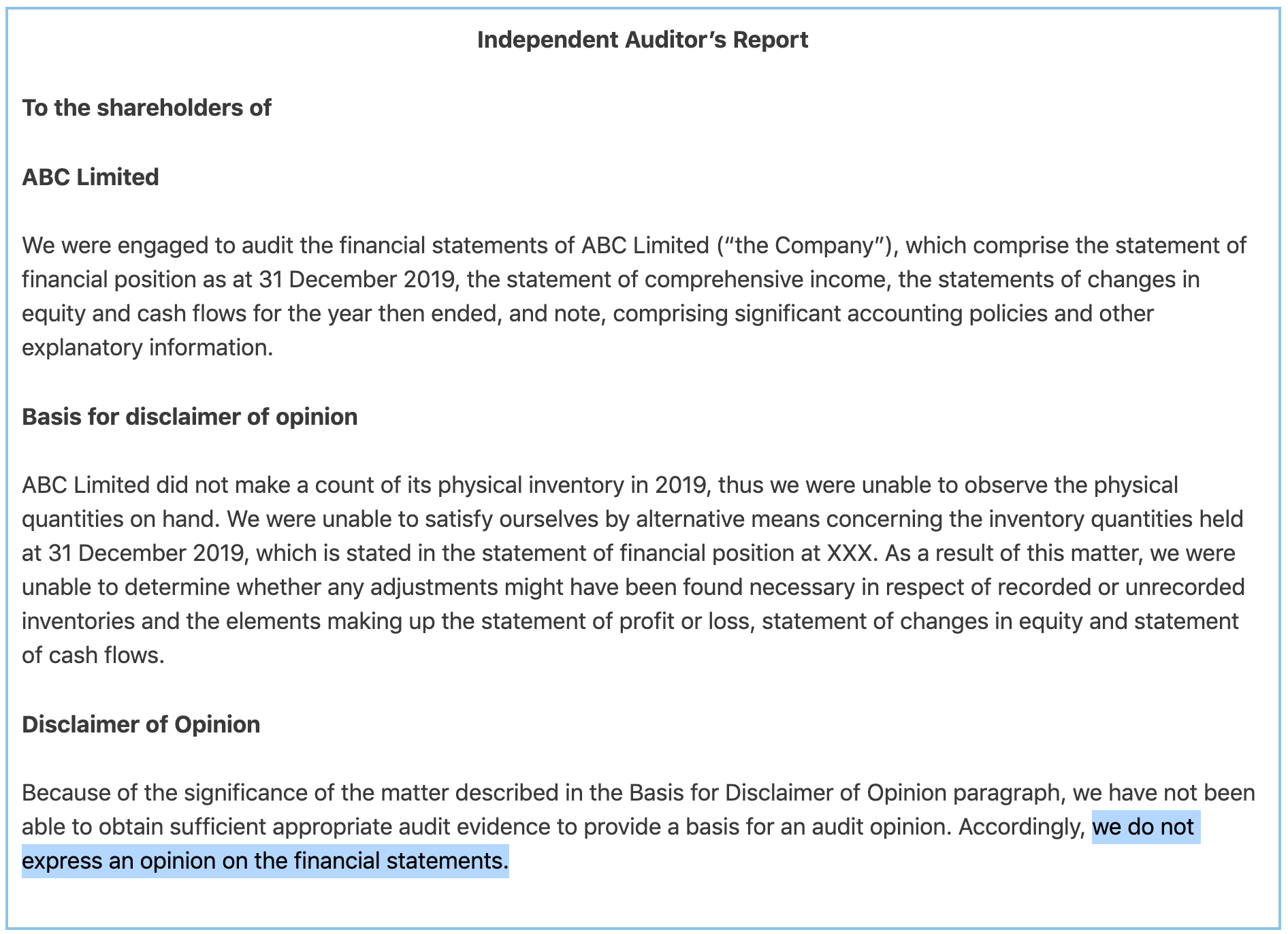

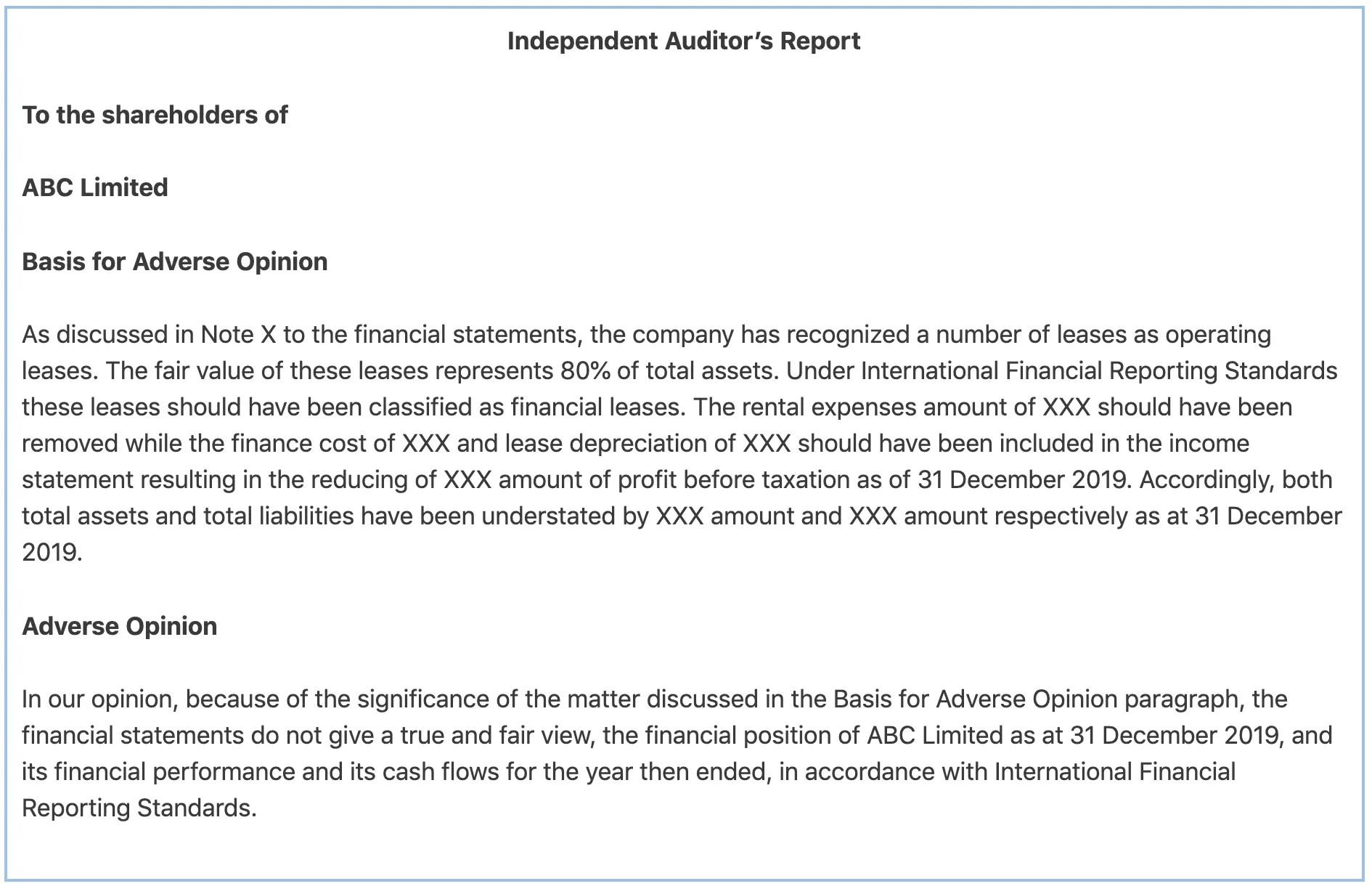

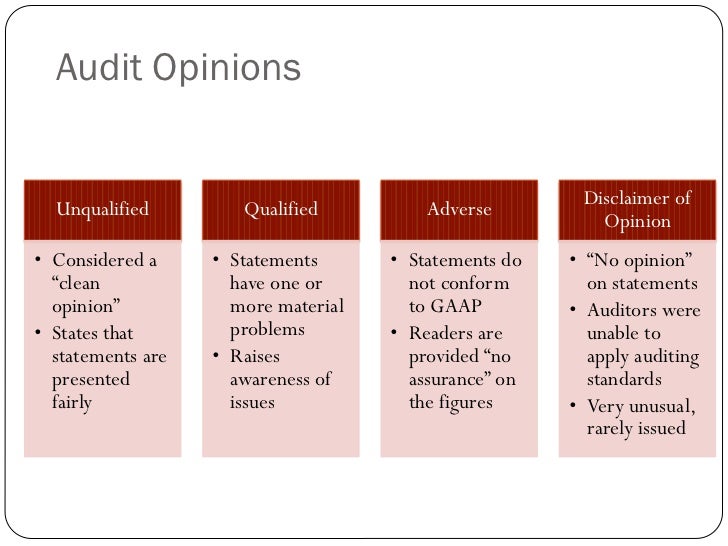

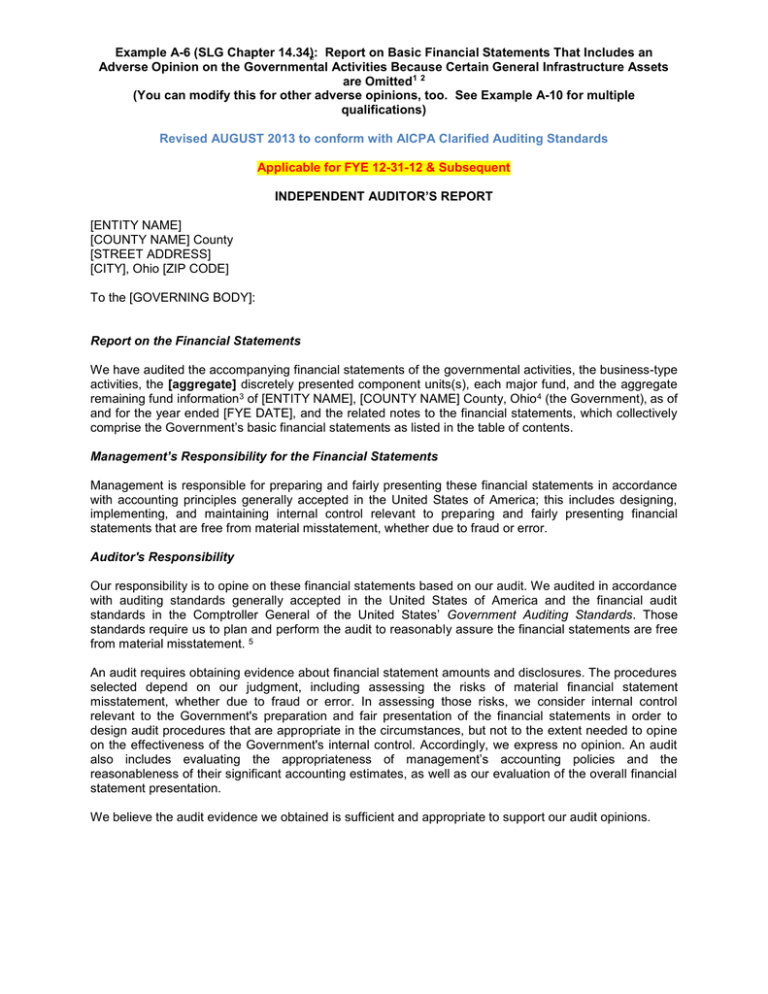

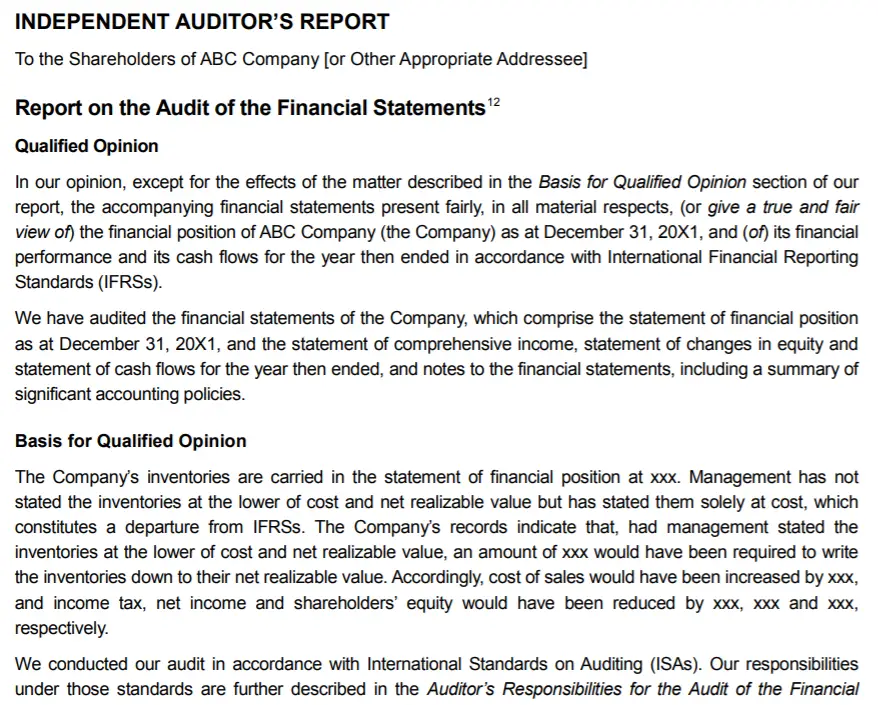

Adverse audit opinion. Learn how to issue an adverse opinion on the financial statements due to a material and pervasive misstatement in the financial statements when the auditor has obtained all. Even though there is an adverse opinion, it is important that the titles of the primary. And (b) to express clearly the.

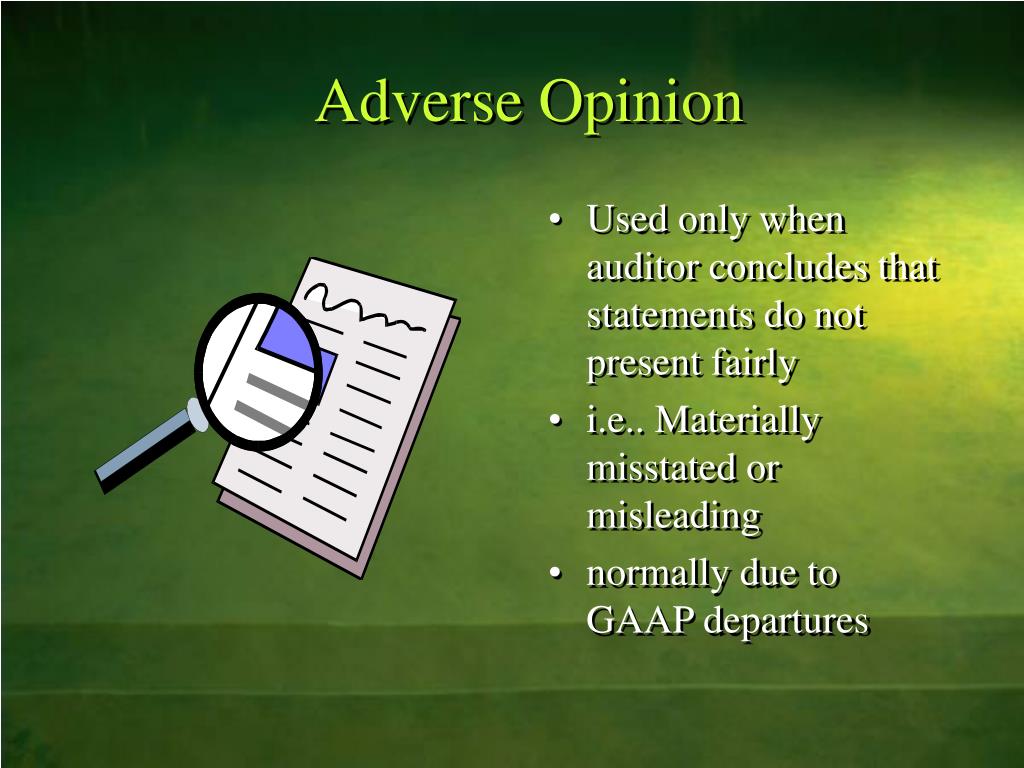

Typically, an adverse opinion letter outlines these exceptions. An adverse opinion is a negative assessment by an auditor of a company's financial statements. An adverse opinion is a professional opinion made by an auditor indicating that a company's financial statements are misrepresented, misstated, and do not accurately.

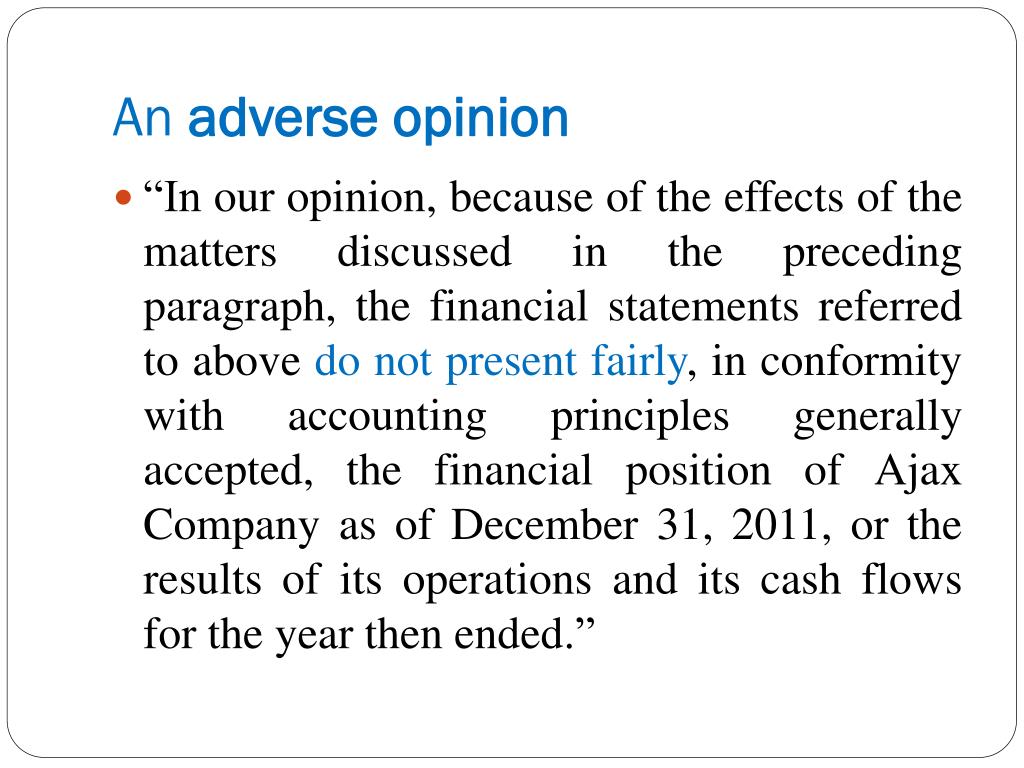

An adverse opinion states that the financial statements do not present fairly the financial position, results of operations, or cash flows of the entity in conformity with. An adverse audit opinion is a negative opinion issued by an auditor on the company's financial statements when they find a material misstatement. An adverse audit report usually indicates that financial reports contain.

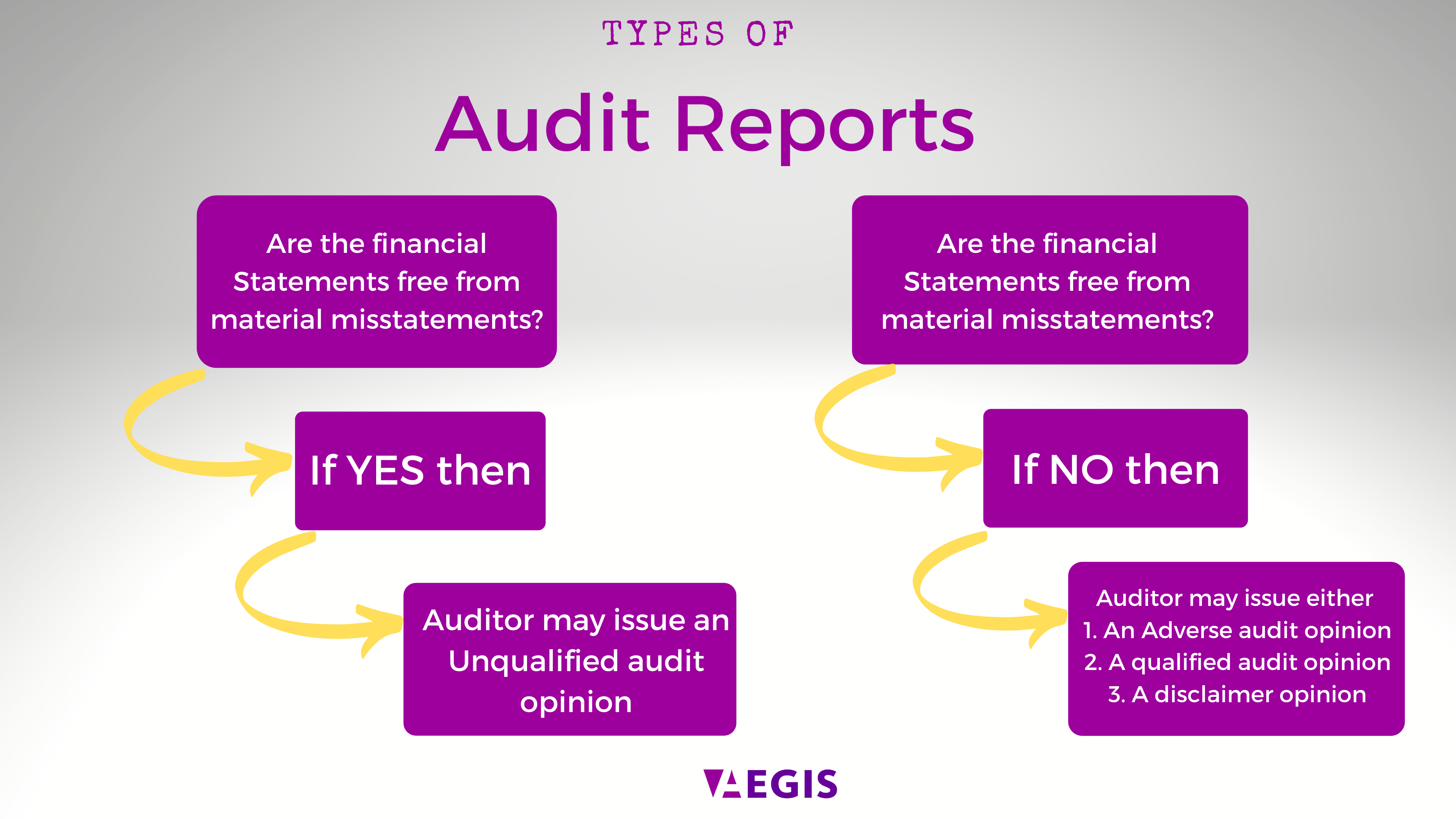

The auditor shall express an adverse opinion when the auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements, individually or in the. Guidance as to the usage of the three forms of modification is provided by isa 705, modifications to the. Research on qualified opinios was also conducted (edmonds et al., citation 2020) finding results consistent with regional bond market participants and providing.

What is adverse opinion? The student aid scheme has in the past received qualified audit opinions, but most recently received an adverse opinion. It states the underlying subject matter has material.

January 11, 2024 what is an adverse opinion? An adverse opinion indicates financial records are not in accordance with gaap and contain grossly material and pervasive misstatements. (a) to form an opinion on the financial statements based on an evaluation of the conclusions drawn from the audit evidence obtained;

An auditor’s adverse opinion is a big red flag. The auditor shall express an adverse opinion when the auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements, individually or in the. The auditor shall express an adverse opinion when the auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements, individually or in the.

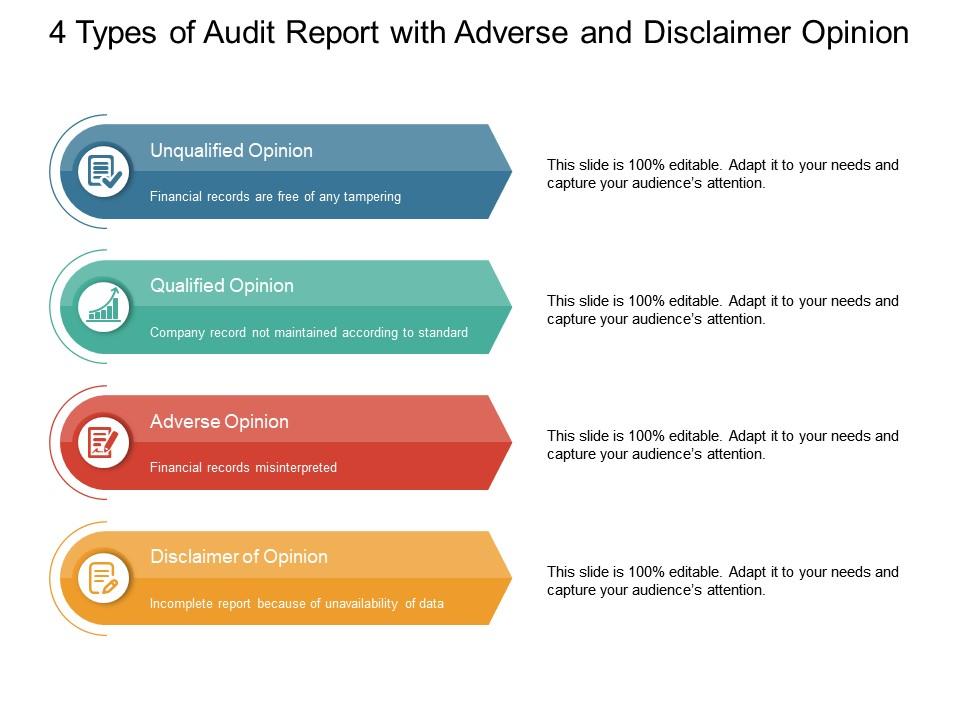

When an auditor issues an adverse opinion, there are material exceptions to gaap that affect the financial statements as a whole. The adverse audit opinion is a type of qualified opinion provided in the independent auditor’s report. The final type of audit opinion is an adverse opinion.

This means that the auditor believes that the financial statements do not. This international standard on auditing (isa) deals with the auditor’s responsibility to issue an appropriate report in circumstances when, in forming an opinion in accordance with. It is more serious than a.

An adverse opinion is a statement made by an entity’s outside auditor, that the entity’s financial statements do not fairly represent.

![The Adverse audit opinion paragraph [Essay Example], 630 words EssayPay](https://essaypay.com/images/examples/adverse-audit-opinion-essay.png)

:max_bytes(150000):strip_icc()/Adverse_Opinion_Final-1920273493f848f2bcae18c385f72904.png)