Perfect Tips About Calculate Operating Cash Flow From Income Statement

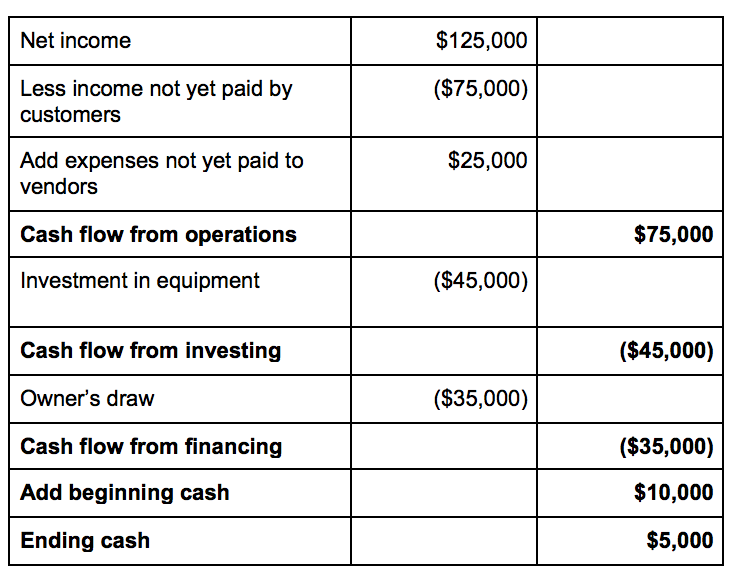

Due to the formula elements, the balance sheet and income statement will be needed to calculate your operating cash flow properly.

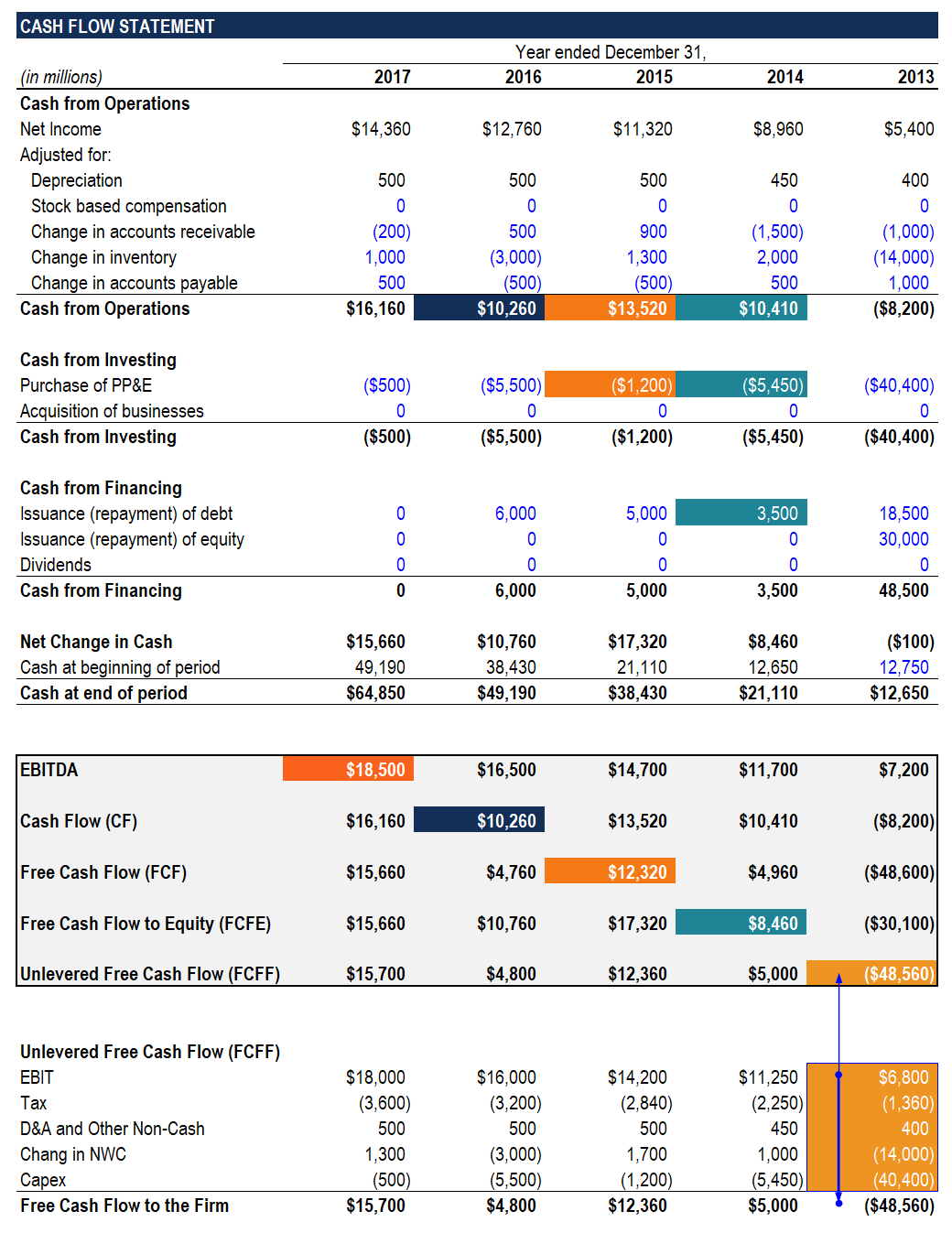

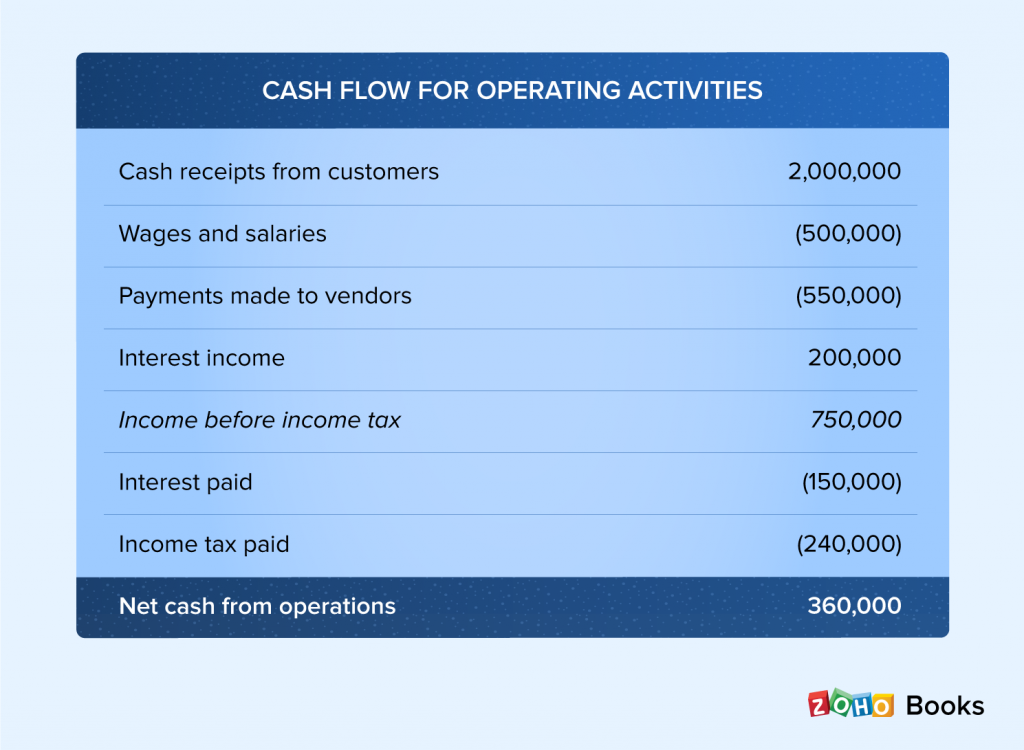

Calculate operating cash flow from income statement. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. If you would like to p. Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital.

The cash flow statement or statement of cash flows. Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues. Trump claimed under oath last year that he was sitting on more than $400 million in cash, but between justice engoron’s $355 million punishment, the interest mr.

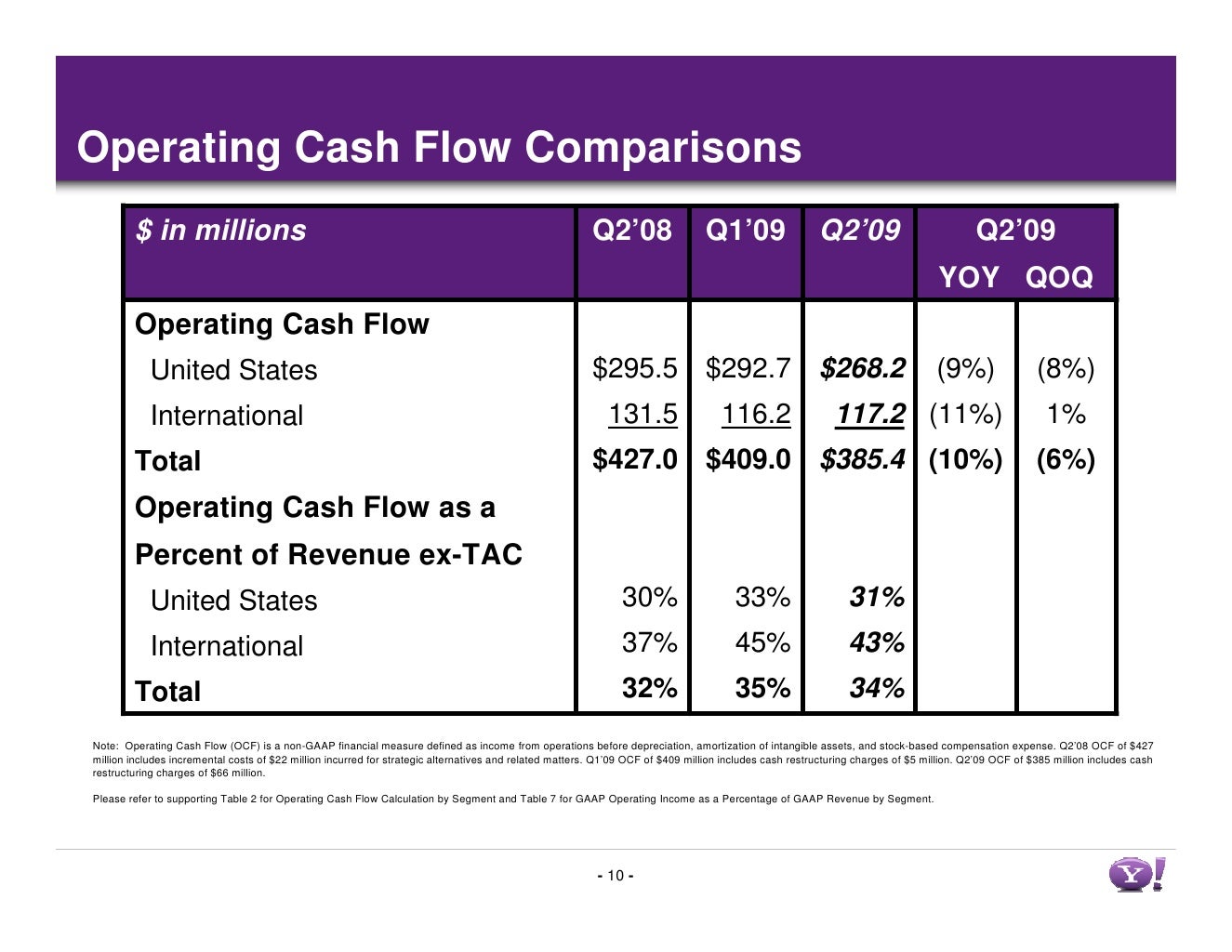

It’s calculated as revenue minus operating expenses. The direct method can be used if a company records all transactions on a cash basis. But as it does not provide much detailed information to the investor, companies use the indirect method of ocf.

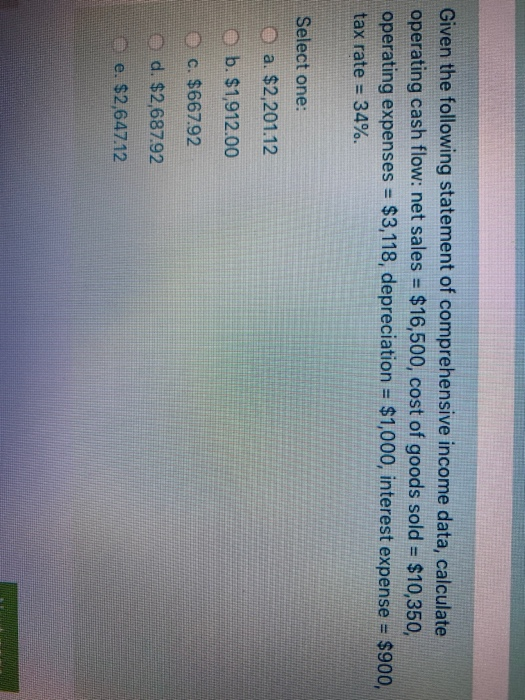

Like ebitda, depreciation and amortization are added back to cash from operations. Net income is calculated by subtracting the cost of sales, operational expenses, depreciation, interest, amortization, and taxes from total revenue. Total revenue is the full amount of money an organization earns from sales during the accounting period

In this case, depreciation and amortization is the only item. Trump owes and the $83.3. This is the type of math you will be doing when building financial models.

Determine the current period for analysis, whether it's monthly, quarterly, or annually. Determine the starting point identify the starting point for calculating the free cash flow. The direct method of calculating operating cash flow is:

Income the company has from outside of its operations is not included in the operating cash flow. Calculate the cash flows from investing activities Operating cash flow can be found in the cash flow statement, which reports the changes in cash compared to its static counterparts—the income statement, balance sheet.

Find the cash and cash equivalent at the beginning and end of the reporting period step 3: Start calculating operating cash flow by taking net income from the income statement. What is operating cash flow?

Find the net profit from the income statement step 2: Adjust for changes in working capital. Make adjustments for movement in working capital step 6:

This task sets the foundation for the rest of the process. The cash flow statement. Cash flow from operating activities = net income + depreciation, depletion, & amortization + adjustments to net income + changes in accounts receivables + changes in liabilities + changes in.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)