Heartwarming Tips About Cash Flow Statement Is Prepared

Use the cash flow statement to evaluate the company’s financial health.

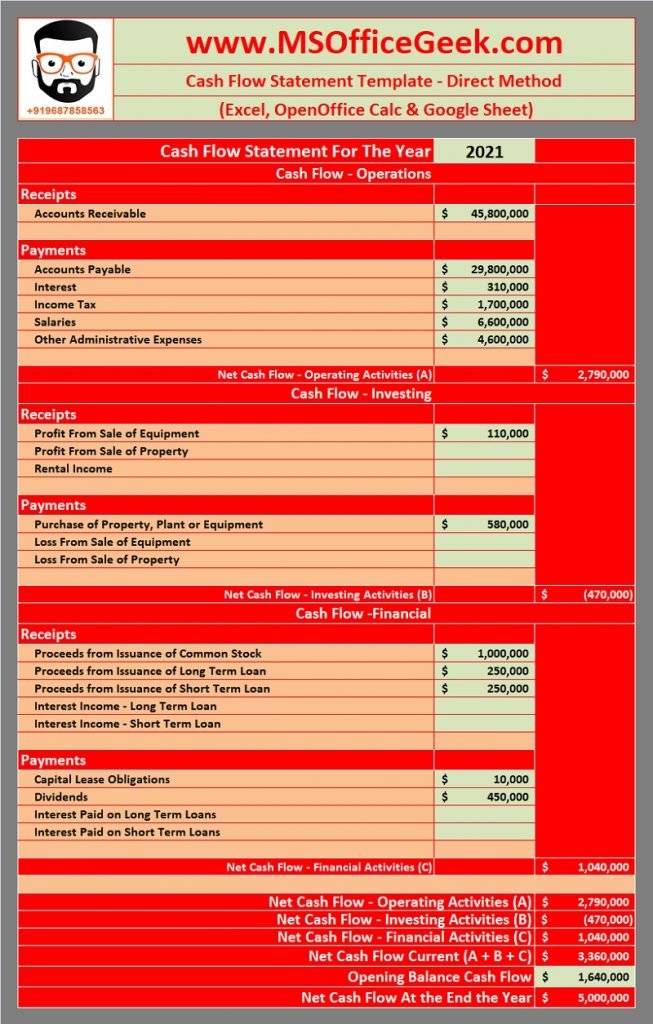

Cash flow statement is prepared. Net cash flow = operating cash flow + financing cash flow While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of.

The statement of cash flows was created due to a lack of cash flow information on the income statement, balance sheet, and statement of owners’ equity. Need to know how to prepare a cash flow statement? The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet.

Therefore, it provides a more accurate statement of how cash is flowing in and out of the company. Written by jeff schmidt what is the statement of cash flows? Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance.

Whether you're just starting out in the business sector or you're a seasoned executive in a successful corporation, you should recognize the. The statement of cash flows is prepared by following these steps: The cash flow statement is required for a complete set of financial statements.

What is a statement of cash flows? Add back noncash expenses, such as depreciation, amortization, and depletion. A cash flow statement is one key report that businesses prepare to handle their accounting.

Now that you know what a cash flow statement is, let’s go into the details of how this financial statement. Two examples include year ended december 31, 2022 and three. How cash flow statements are prepared.

Begin with net income from the income statement. What is a cash flow statement? It is an essential document for evaluating the sources and uses of cash for an organization.

Now that you understand what comprises a cash flow statement and why it’s important for financial analysis, here’s a look at two common methods used to calculate and prepare the operating activities section of cash flow statements. A cash flow statement differs from a p&l because it focuses solely on the actual money coming in and out of the business, regardless of when revenues are earned and expenses are incurred. A cash flow statement, also known as the statement of cash flows, is a financial statement that shows the flow of cash into and out of your business during a specific period of time.

The income statement shows revenues and expenses using the accrual basis of accounting, but it does not indicate how much cash was received for revenues or paid. To support cash planning and to provide external financial statement users such as lenders and investors information about the firm’s cash flow, the statement of cash flows is prepared. The cash flow statement removes accounting methods such as accruals, depreciation and amortization.

Learn what goes into the preparation of a cash flow statement, how to understand it, and a few different methods you can use. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Discover how to put together a cash flow report that provides insights to help your business make better decisions.