Amazing Info About Bakery Cash Flow Statement

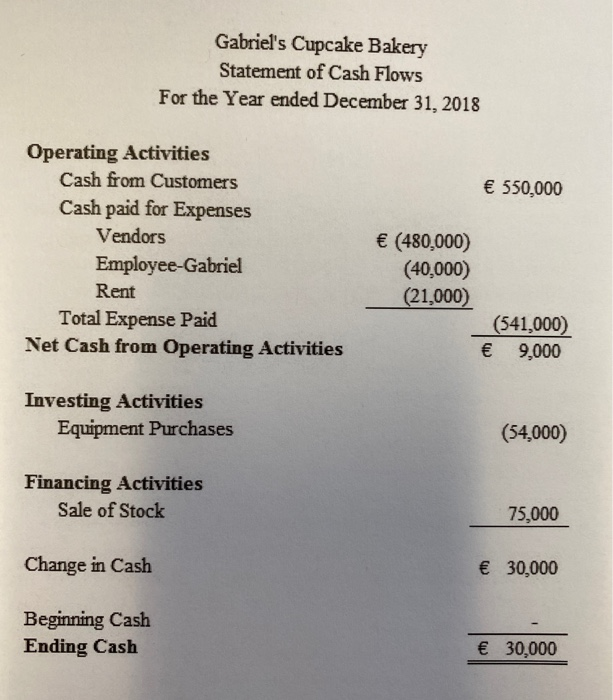

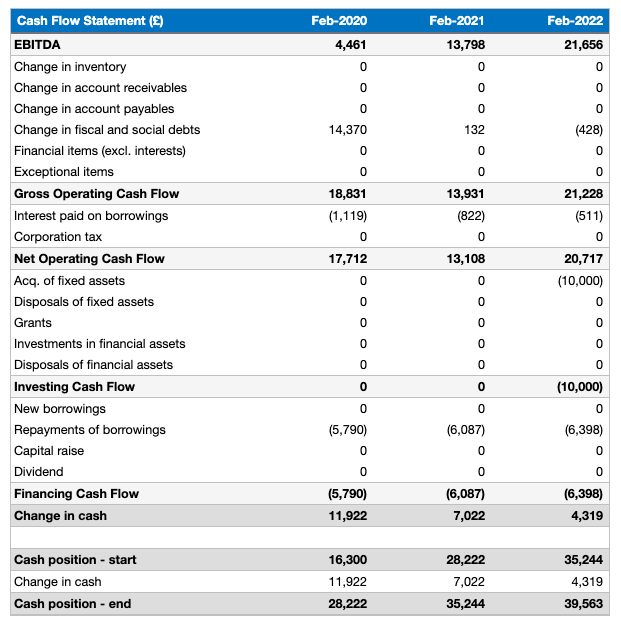

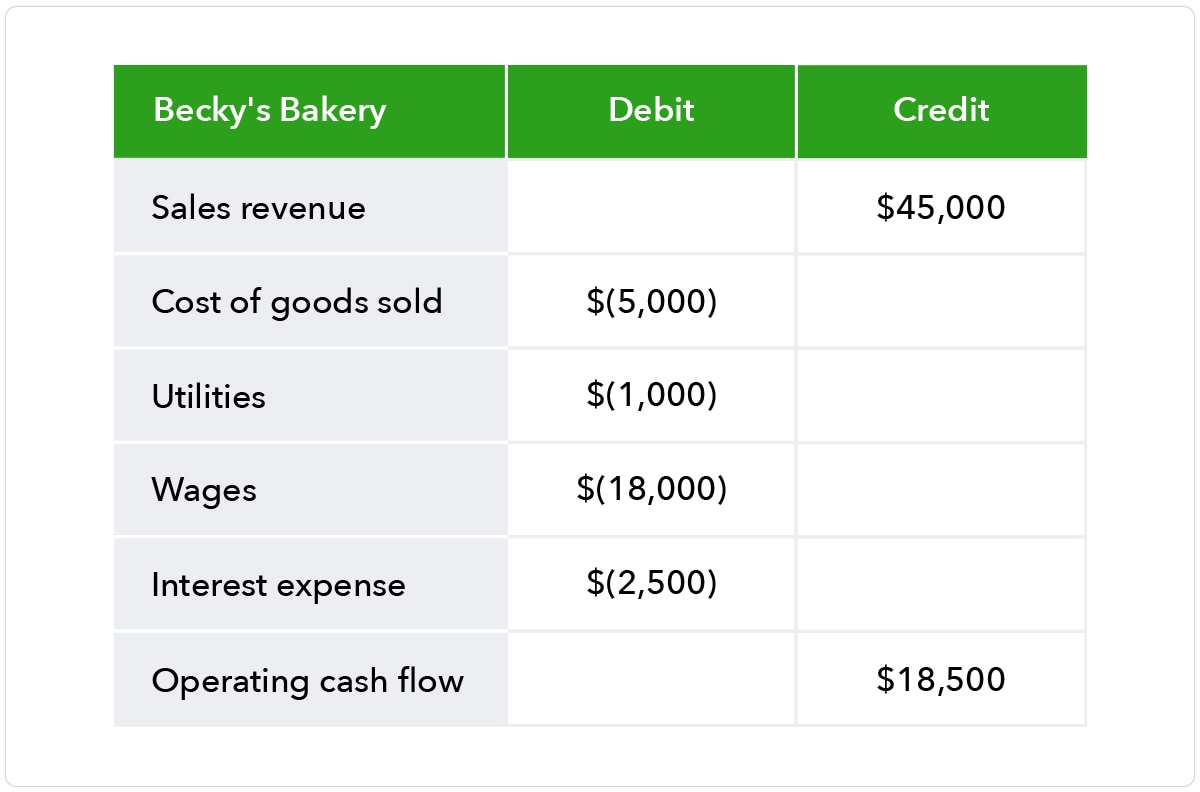

A cash flow statement shows the cash coming in and out of business within a specific timeframe (usually a month, quarter or year).

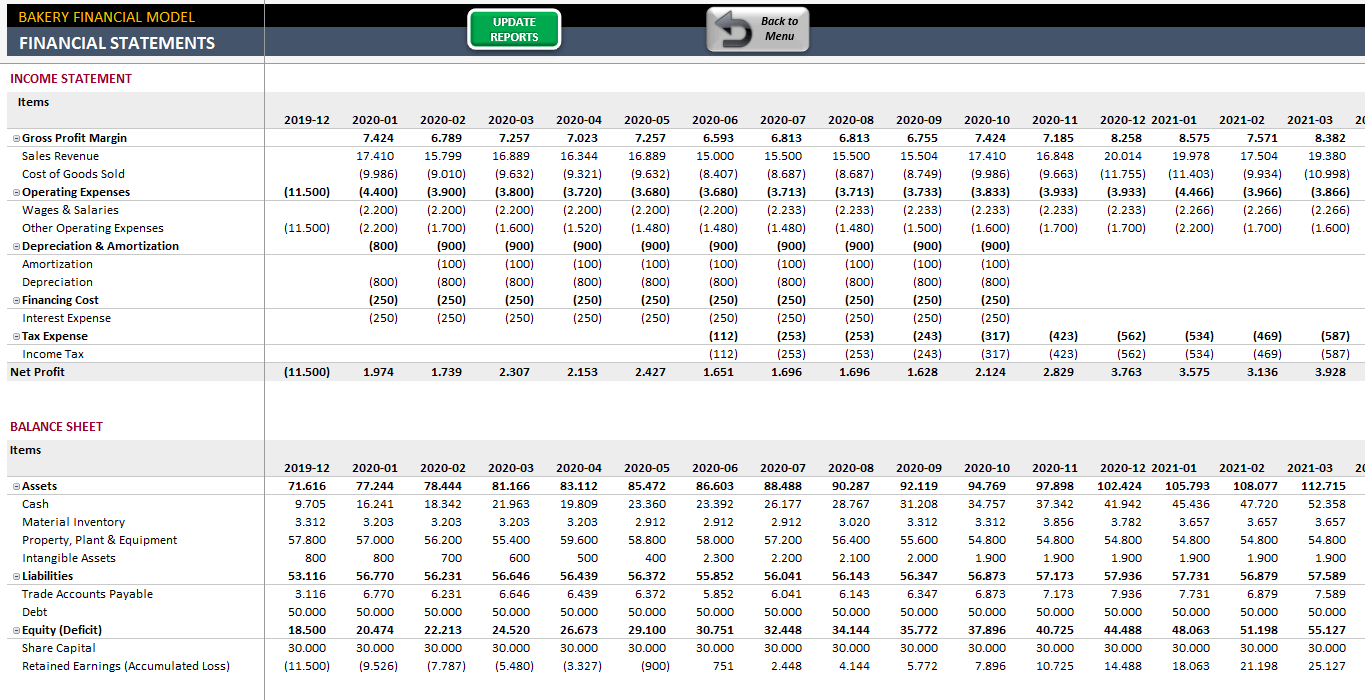

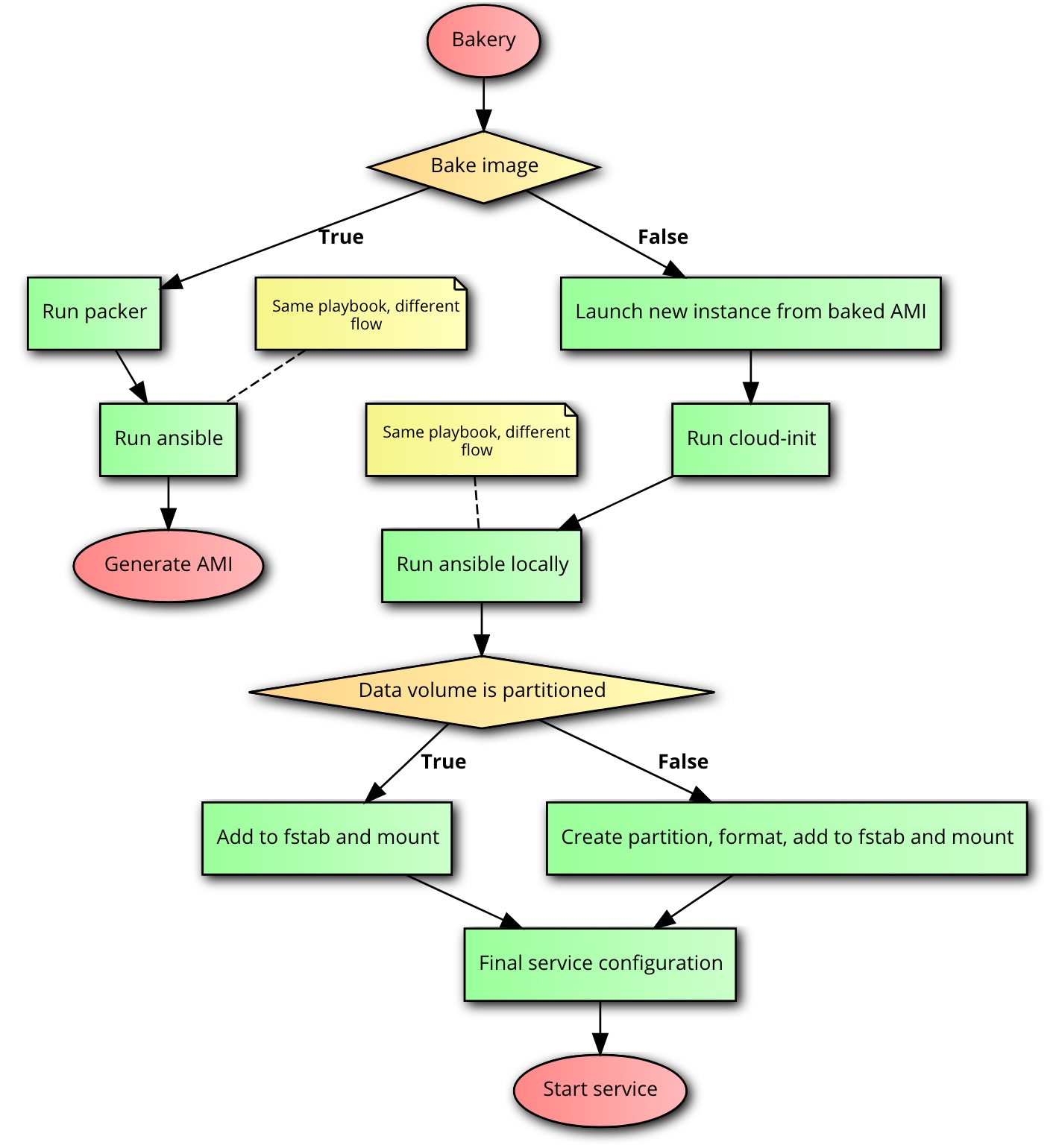

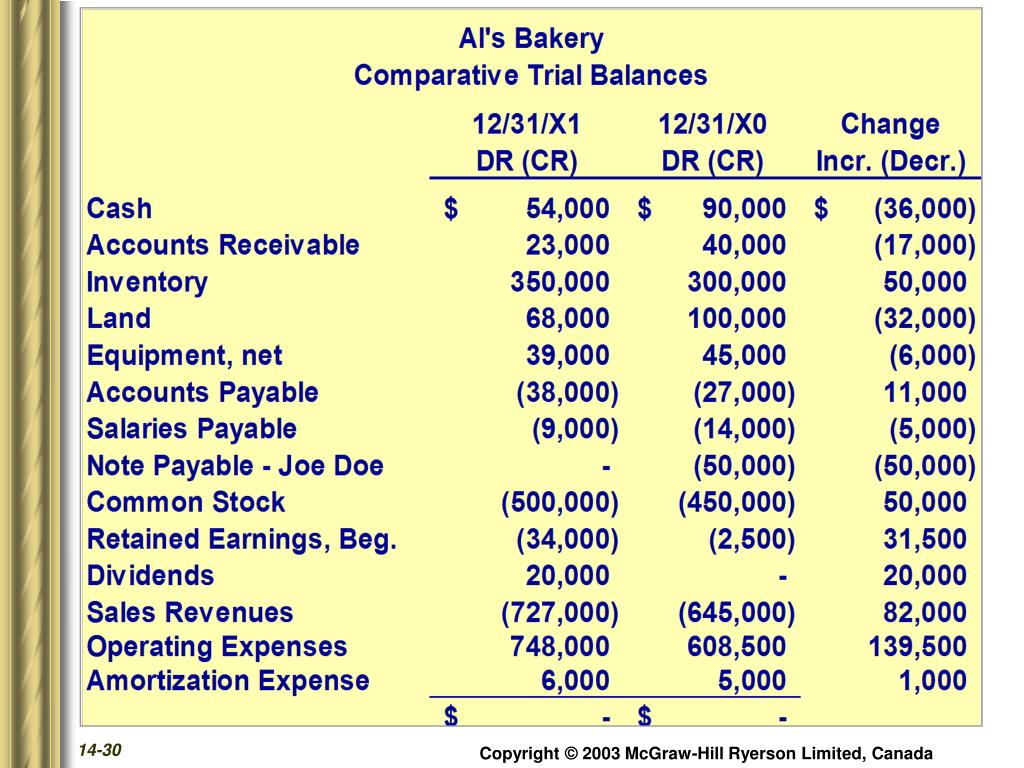

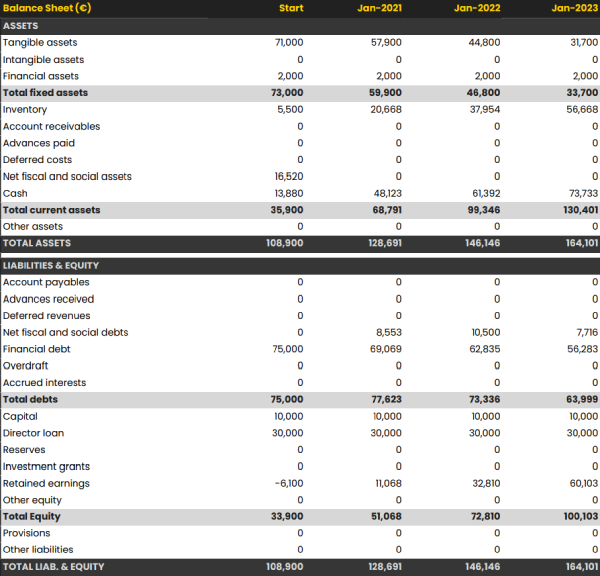

Bakery cash flow statement. For your bakery business plan, provide a snapshot of your financial statement (profit and loss, balance sheet, cash flow statement), as well as your key assumptions (e.g. Sap s/4hana cloud for finance. Net cash flow from operations net profit:

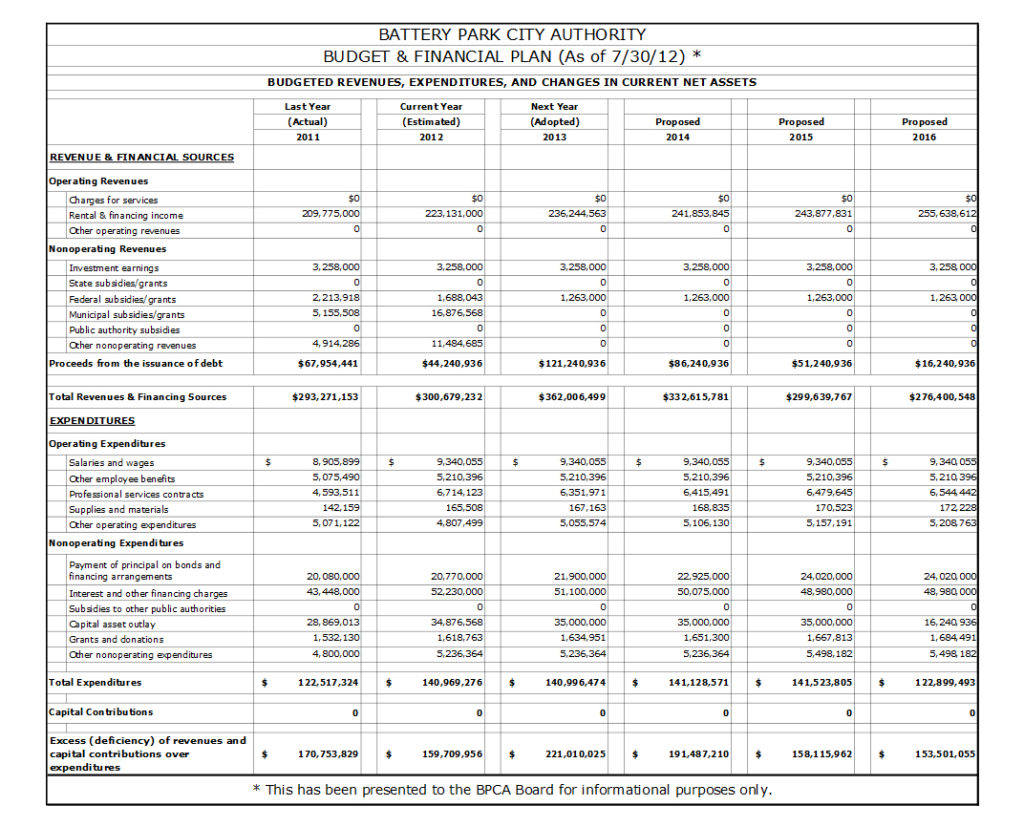

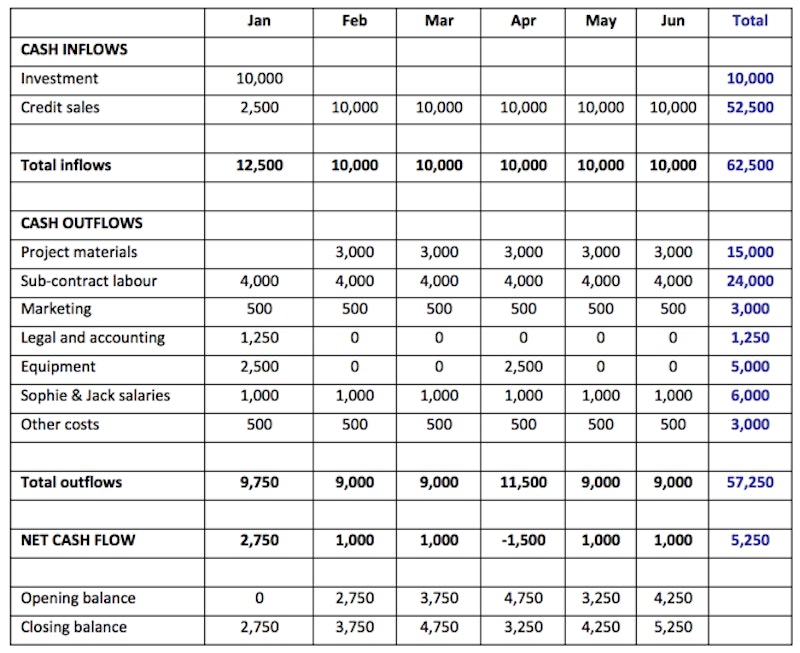

The number of customers over time ; How will the bakery secure funding? Below is a sample of a projected cash flow statement for a startup.

Bakery financial plan: Sap s/4hana cloud for finance. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

Are you writing a bakery business plan? Fully editable 5 year bakery including monthly and annual income statement, cash flow, and balance sheet projections. Writing out a business plan is, therefore, essential for a new bakery.

Income statement and free cash flow. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Detect any potential cash flow problems.

Its purpose is to indicate whether the net cash flow has increased or decreased. Statement of cash flows example. The total fee for registering the business in florida:

It aims to meet the demand for healthier lunch options in the area. Simply take your revenues and subtract all expenses. Our startup budget & expenditure.

The cafe is jointly owned by three partners and will be managed by an experienced executive chef. Change in sales tax payable:. Financial statements balance sheet [insert financial statement] income statement [insert financial statement] cash flow statement [insert financial statement]

This means you must forecast: Make sure to cover here _ profit and loss _ cash flow statement _ balance sheet _ use of funds Cash is king, but small bakeshop owners need to consider the best time to send out invoices, repay their loans, collect money, and plan for expansion to keep cash flow healthy.

Innovation rate increased to 20%; Let’s first discuss a few important concepts to better understand how this financial statement works and why it’s important. Number of customers and prices, expenses, etc.).