Best Of The Best Tips About Accounting For Uncollectible Accounts

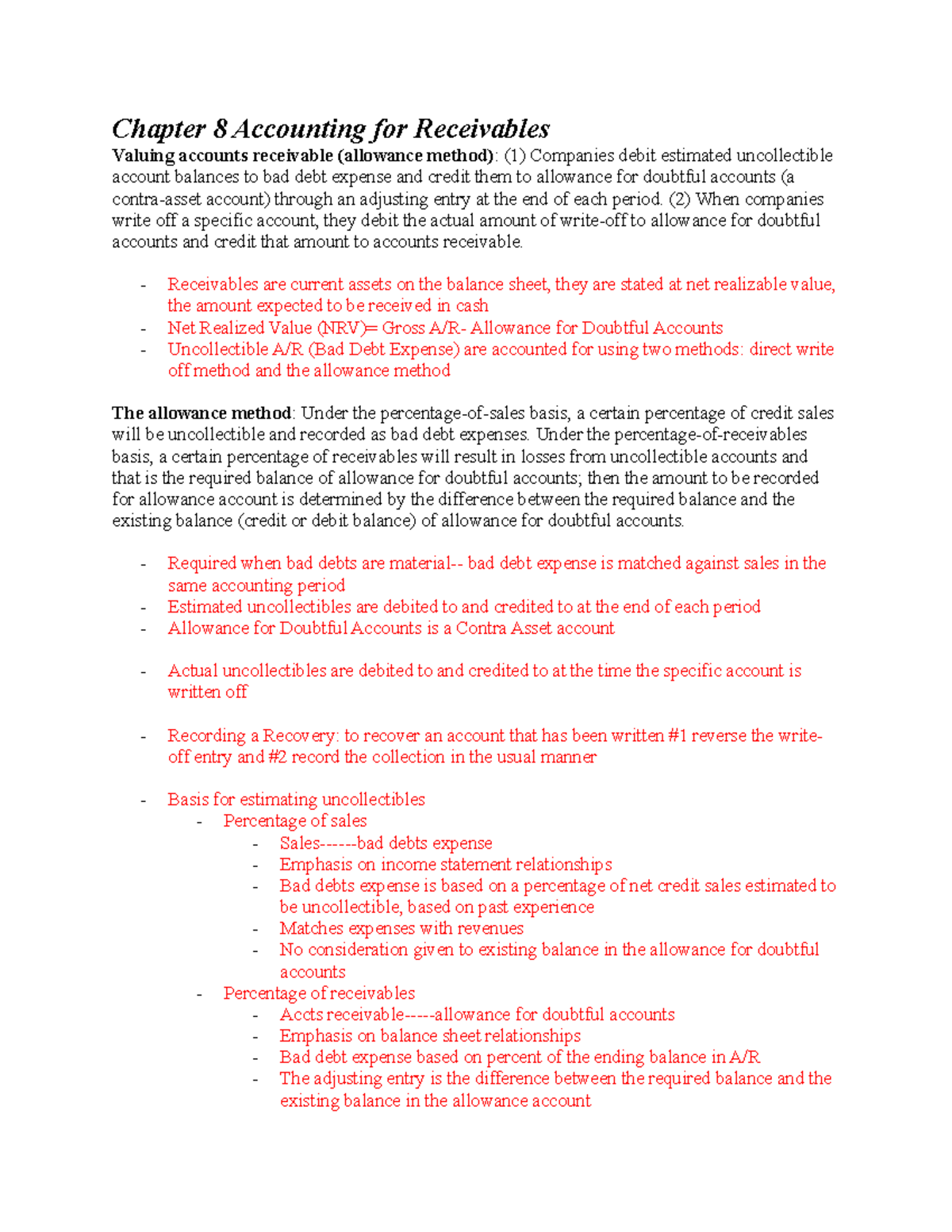

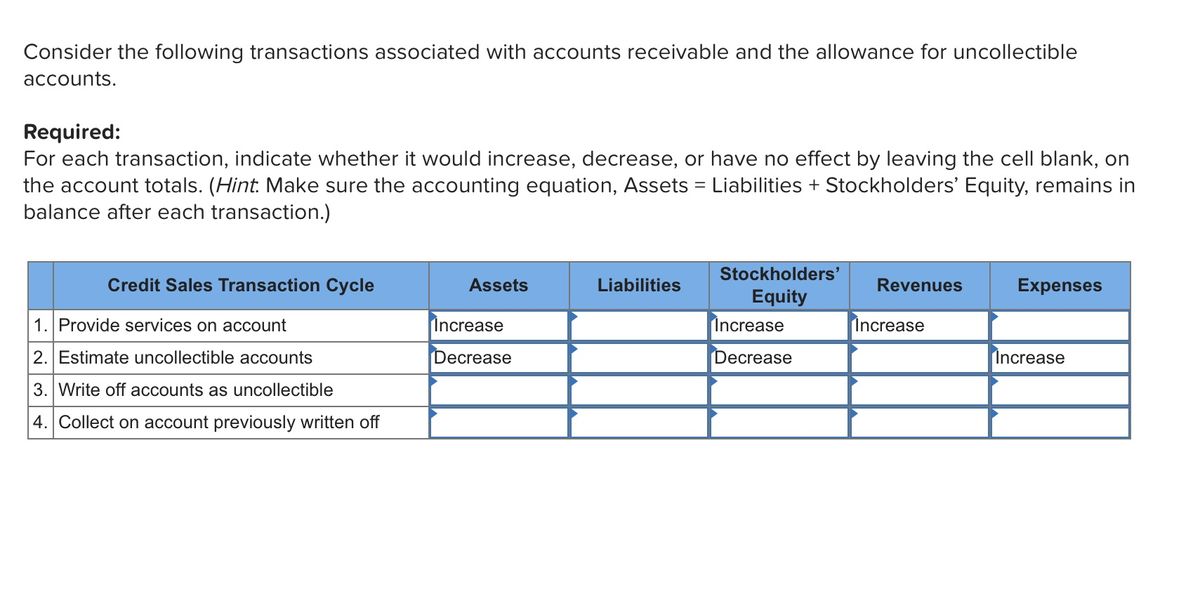

When the expense is recognised depends on the method of accounting for uncollectible accounts.

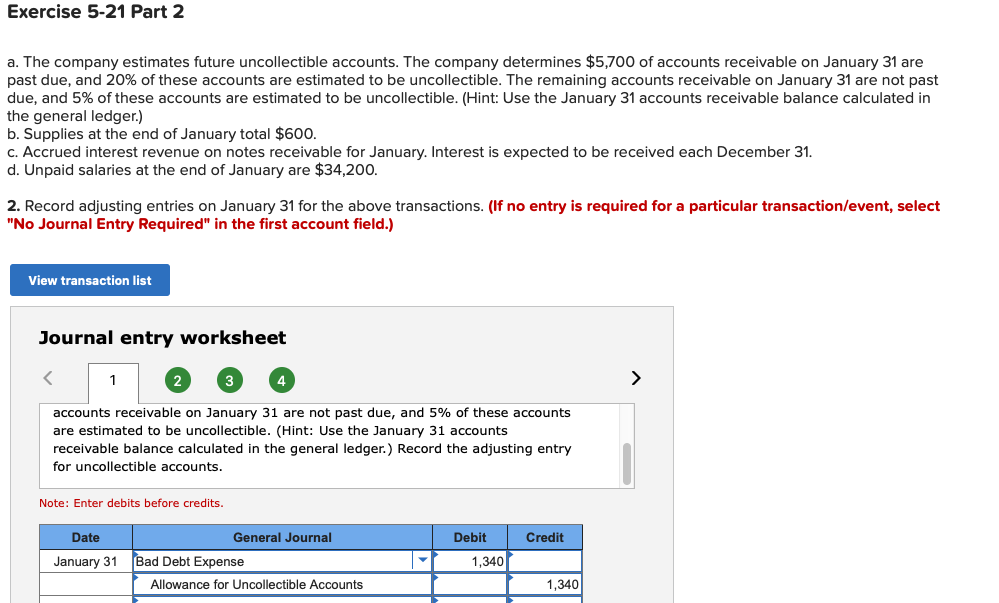

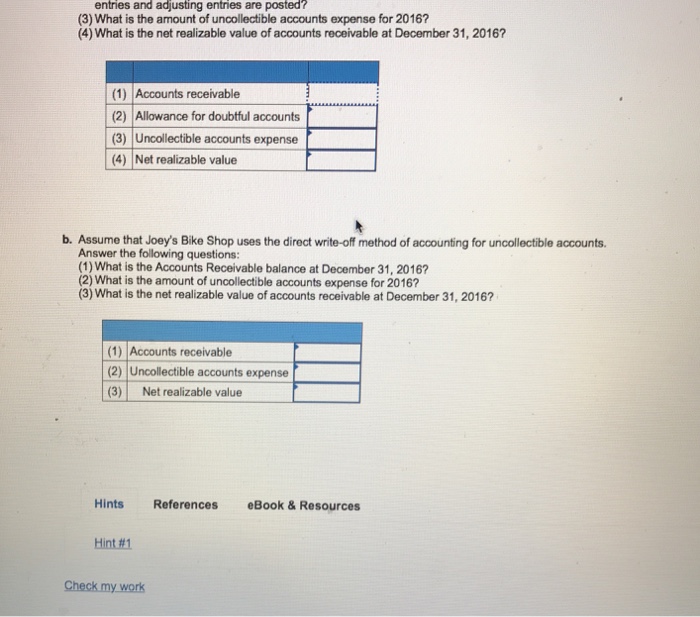

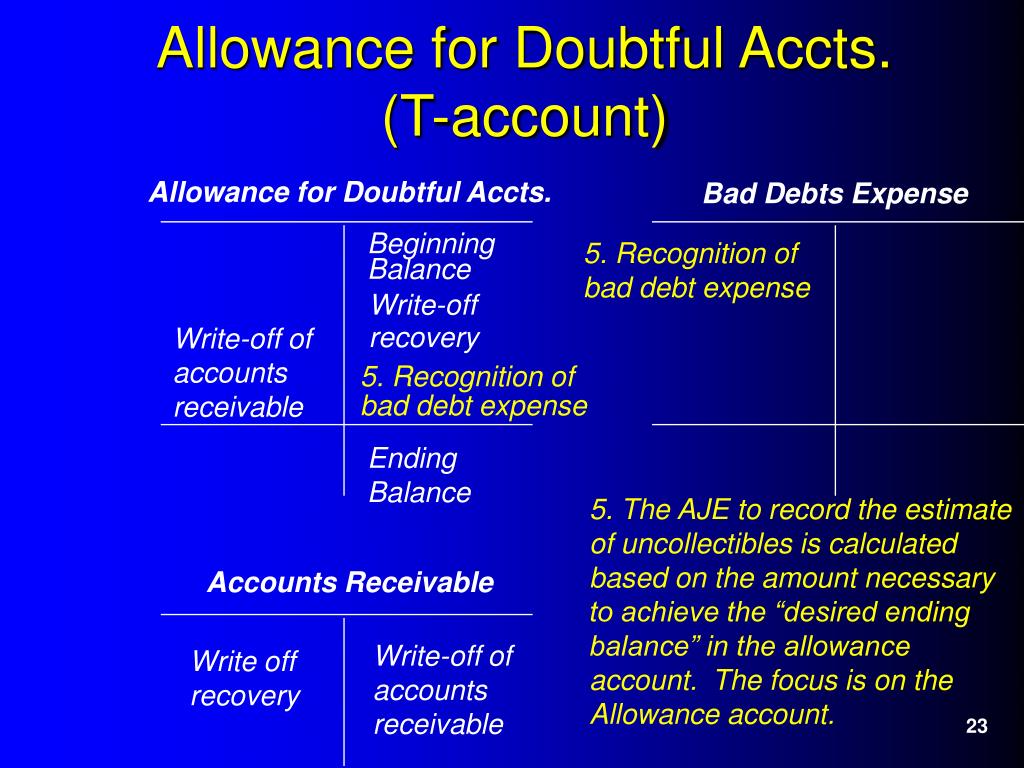

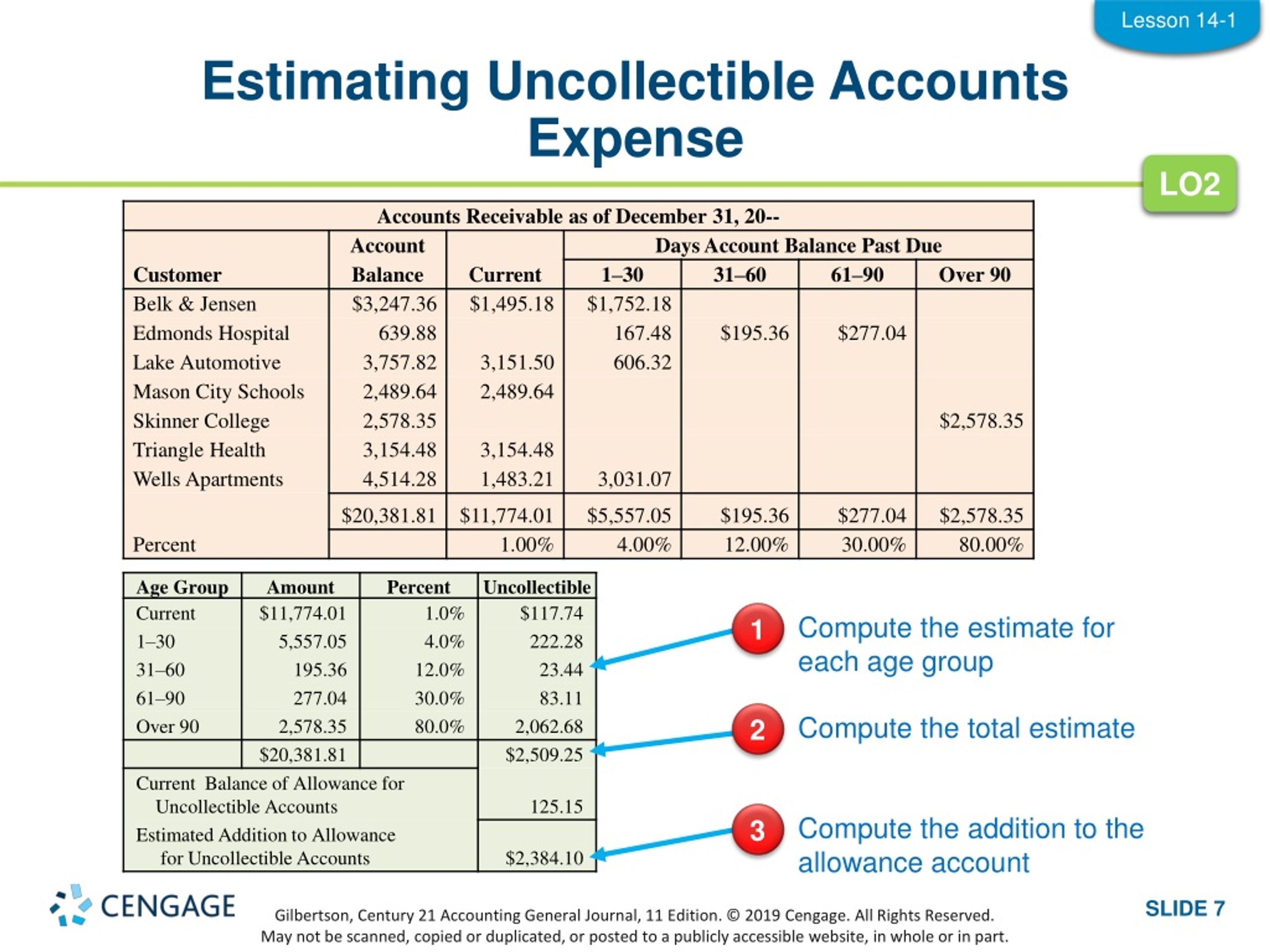

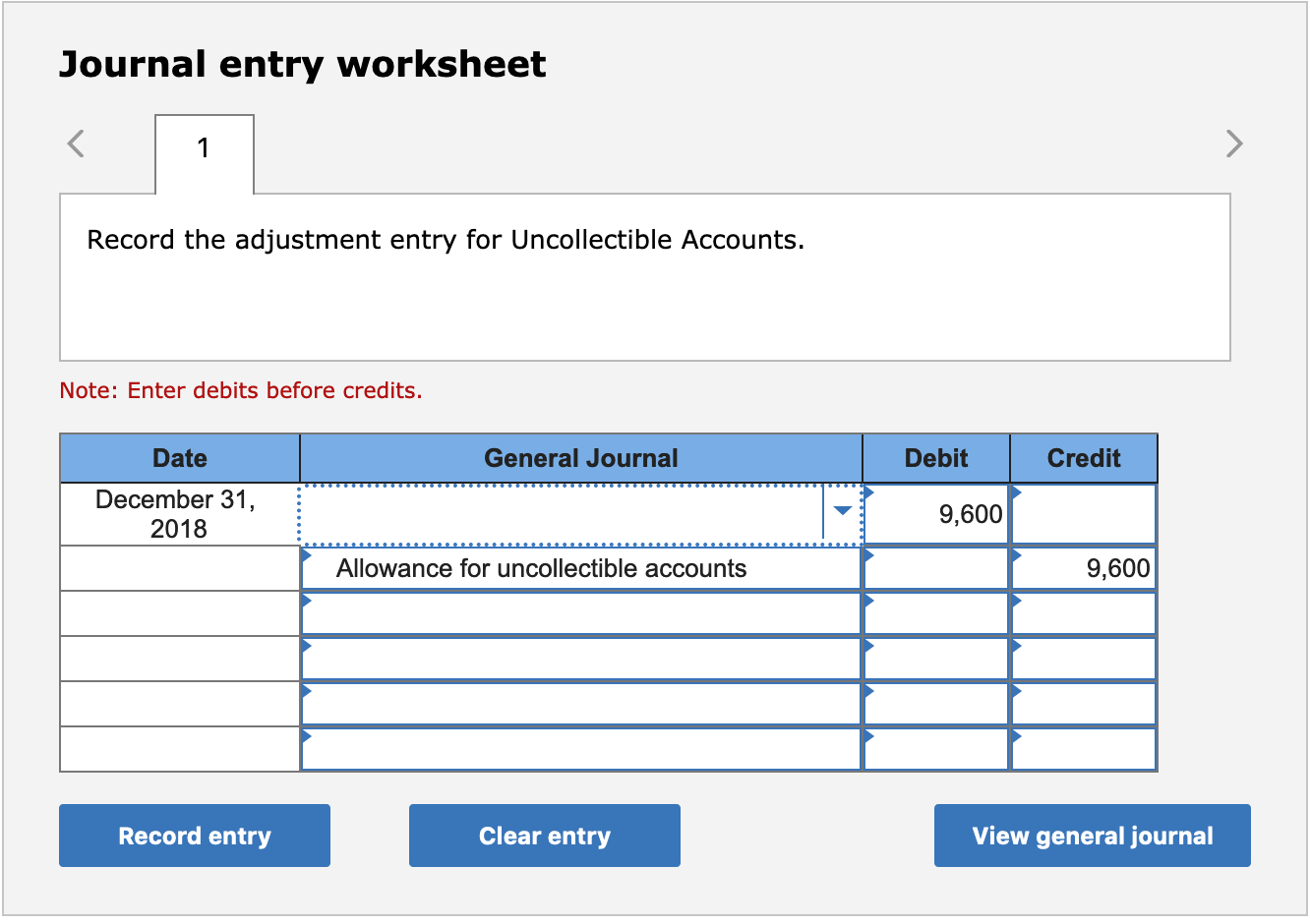

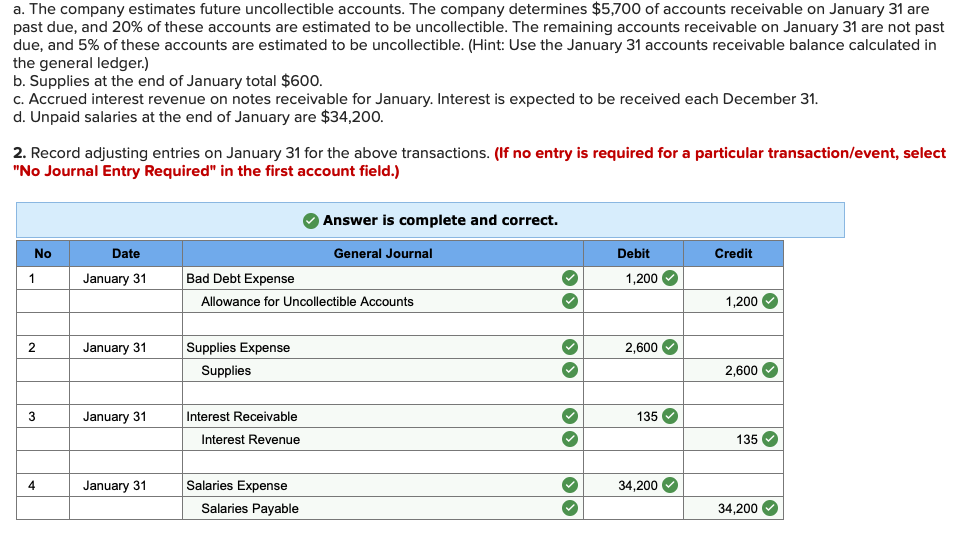

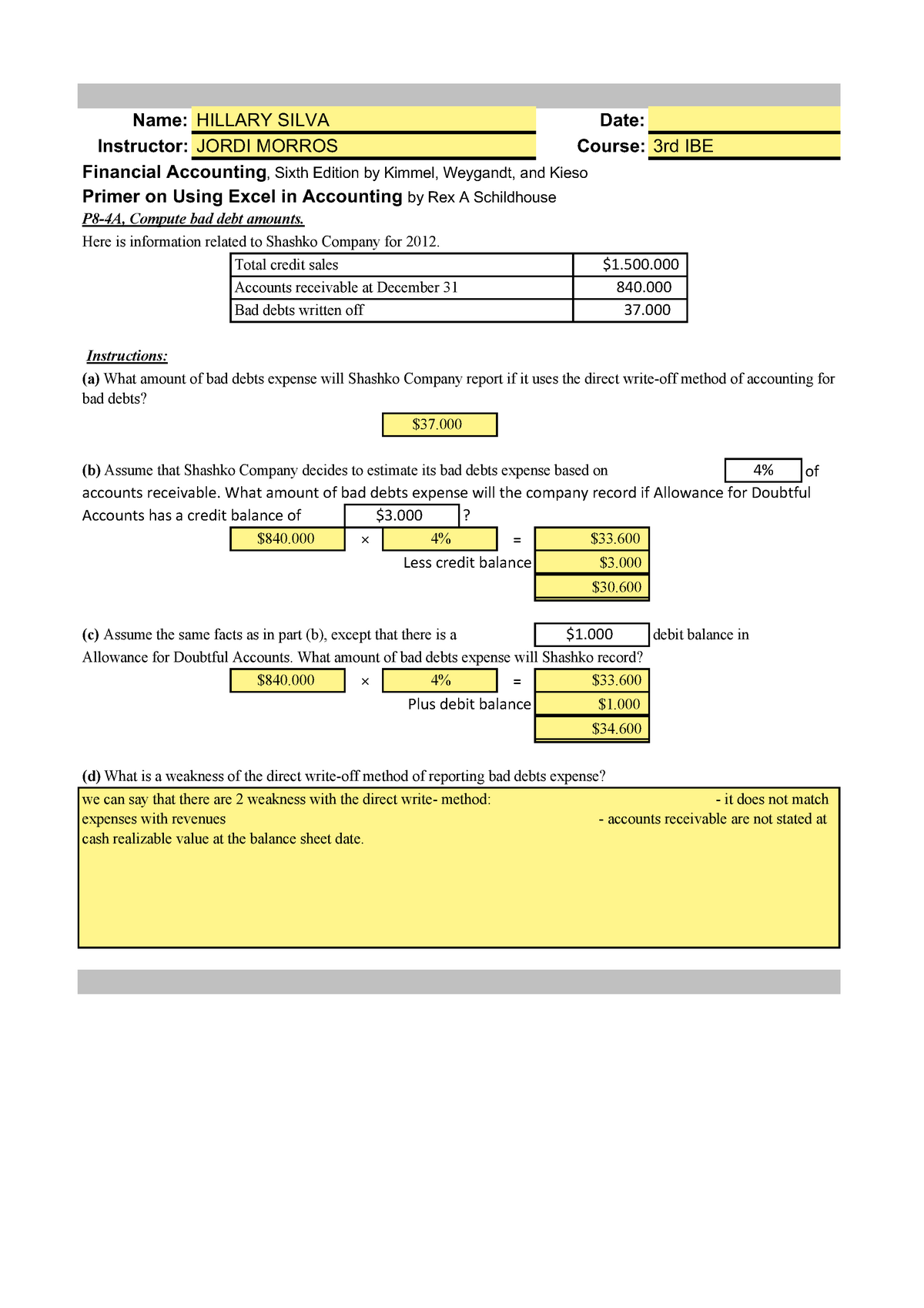

Accounting for uncollectible accounts. The uncollectible percentages and the accounts receivable breakdown are shown here. As a result, it becomes necessary to establish an accounting process for measuring and reporting these uncollectible items. A second account (often called the allowance for doubtful accounts or the.

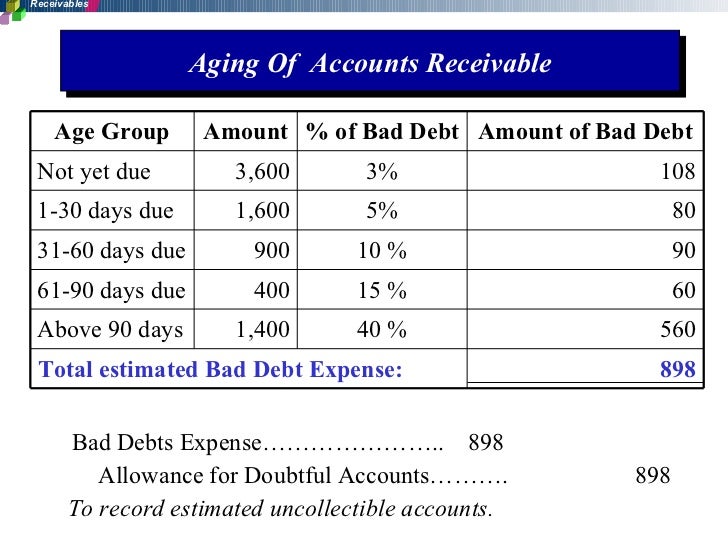

Once this account is identified as uncollectible, the company will record a reduction to the customer’s accounts receivable and an increase to bad debt expense for the exact amount uncollectible. For each of the individual categories, the accountant multiplies the uncollectible. Allowance method for uncollectible accounts the allowance method is a technique for estimating and recording of uncollectible amounts when a customer fails.

Accounting in the finance world 7: For each of the individual categories, the accountant multiplies the uncollectible. For each of the individual categories, the accountant multiplies the.

Accounting for uncollectible accounts using the allowance method to record uncollectible accounts expense journal entries to record original estimate. Each year, an estimation of uncollectible accounts must be made as a preliminary step in the preparation of financial statements. There are two methods a business may use to recognise bad debt:

There are two fundamental methods for handling these uncollectible accounts: Uncollectible accounts are frequently called “bad. The case provides background information on sears’ business and past problems, an introduction to accounting for contingencies, and financial information from public.

In a set of financial statements, what information is conveyed about receivables? The uncollectible percentages and the accounts receivable breakdown are shown here.