Beautiful Work Info About Financial Accounting Cash Flow Statement

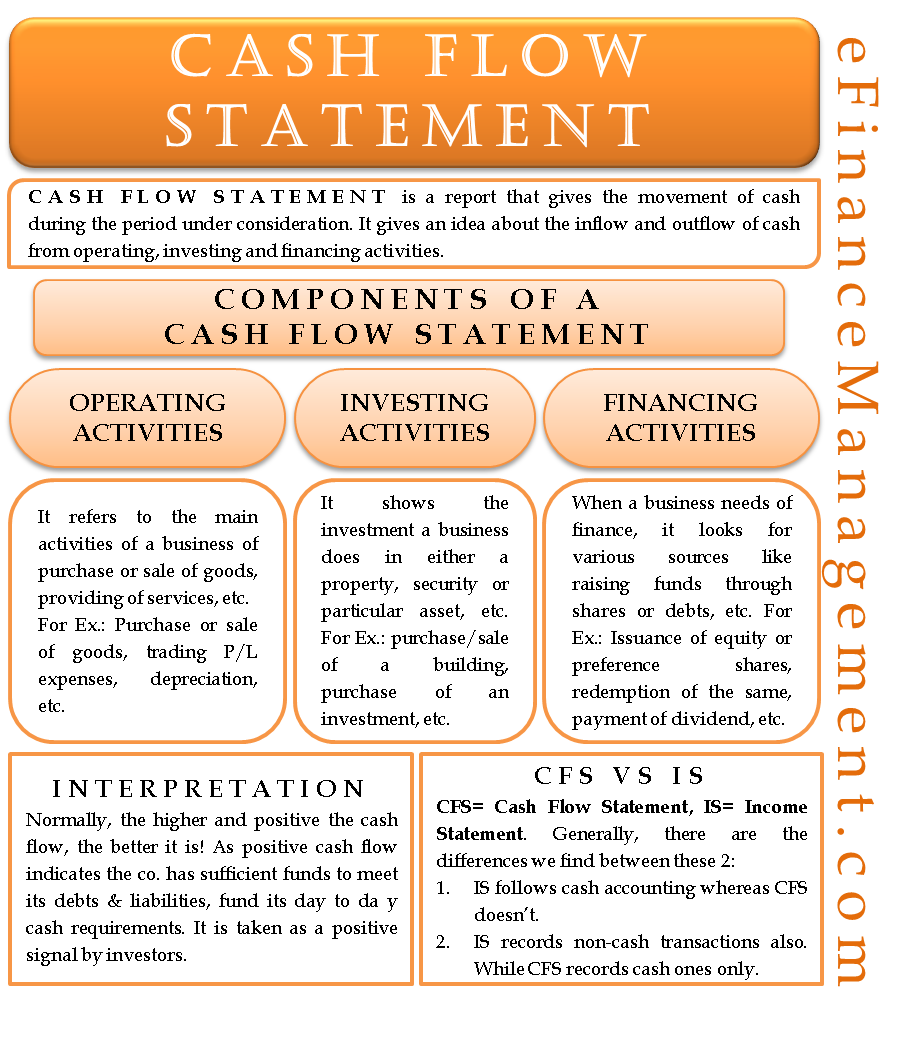

A cash flow statement (cfs) is a financial statement primarily intended to provide information about the cash receipts and cash payments of a business during the period of time covered by the income statement.

Financial accounting cash flow statement. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. Simply put, it reports the cash inflows and cash outflows within your business during a time period, whether that’s over a week, a quarter, or a financial year. There is often more than one way that financial statements.

The cash flow statement is an important financial statement issued by a company, along with the balance sheet and income statement. Cash flow statements this article considers the statement of cash flows of which it assumes no prior knowledge. How to create a cash flow statement.

Accounting is an instrumental part of running a small business. List and describe the elements of the statement of cash flow. It gives valuable insight into an organization’s financial position and working capital.

These offer an inside look at a company. In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

The three financial statements are: Notes to the financial statements; A cash flow statement is a crucial financial document that details all your sources of cash over a given period of time.

It is standard practice for businesses to present. Implementing systems and best practices for keeping track of expenditures and revenues is key to managing cash flow. Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows.

The statement of cash flows classifies cash receipts and disbursements as operating, investing, and financing cash flows. It’s important to remember that not all. A typical cash flow statement comprises three sections:

Also known as the statement of cash flows, this statement illustrates how your business operations are performing. Overall, the cash flow statement seems to be correctly prepared, considering the provided assumptions and scenario details. The income statement illustrates the profitability of a company under accrual accounting rules.

They show you changes in assets, liabilities, and equity. The main components of the cash flow statement are: It also reconciles beginning and ending cash and cash equivalents account balances.

Step 1/5 1. Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities. The md&a section of apple's annual report provides a detailed explanation of the company's financial performance, its cash flows from operating, investing, and financing activities, and the factors that have.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)