Here’s A Quick Way To Solve A Tips About On Balance Sheet Liquidity

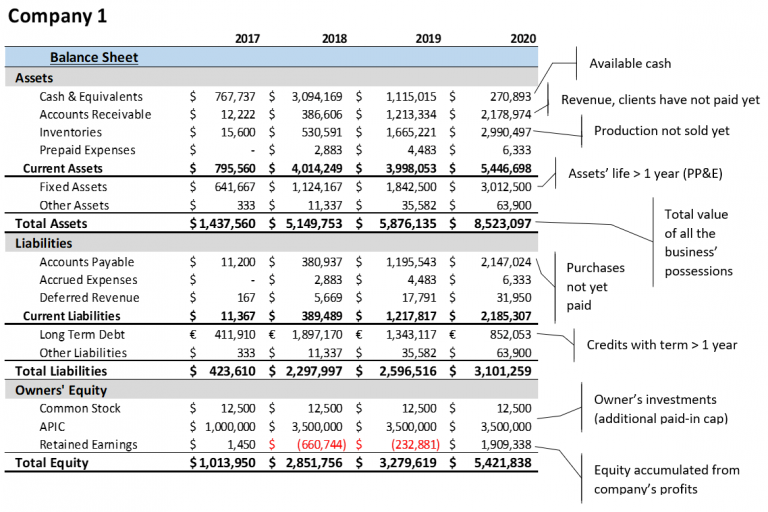

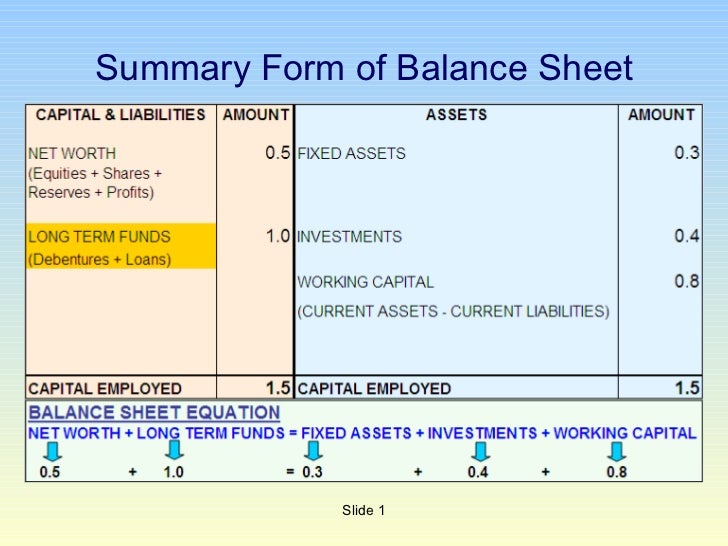

The balance sheetbalance sheeta balance sheet is one of the financial statements of a company that presents the shareholders' equity,.

On balance sheet liquidity. Credit risk actually breaks down into two types: The interagency supervisory guidance highlights that management should ensure that. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

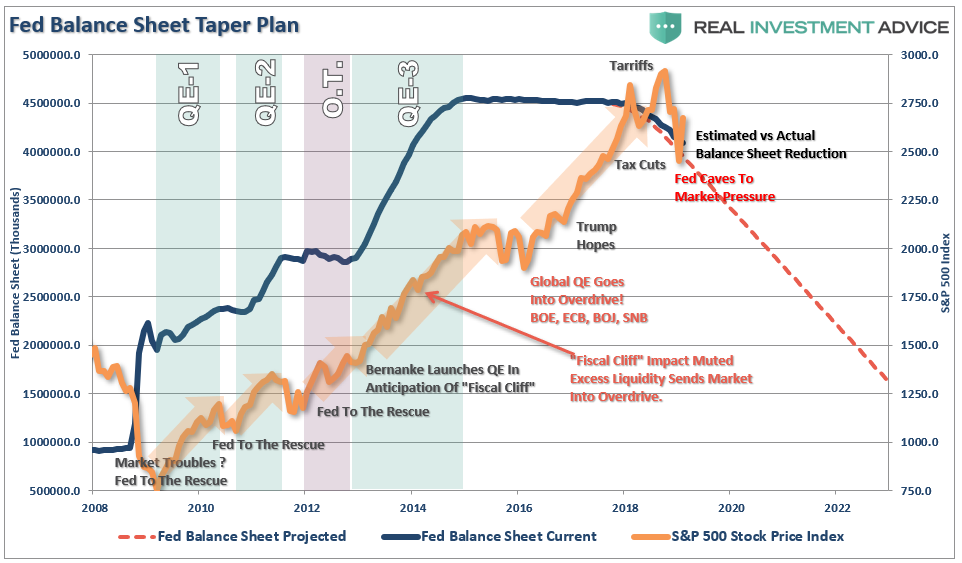

You must consider both sides of the balance sheet. The liquidity ratio is assets divided by liabilities. Bostic said he doesn't see a shortage of liquidity that would cause the fed to shift gears on the balance sheet cuts, in comments to a gathering held by money.

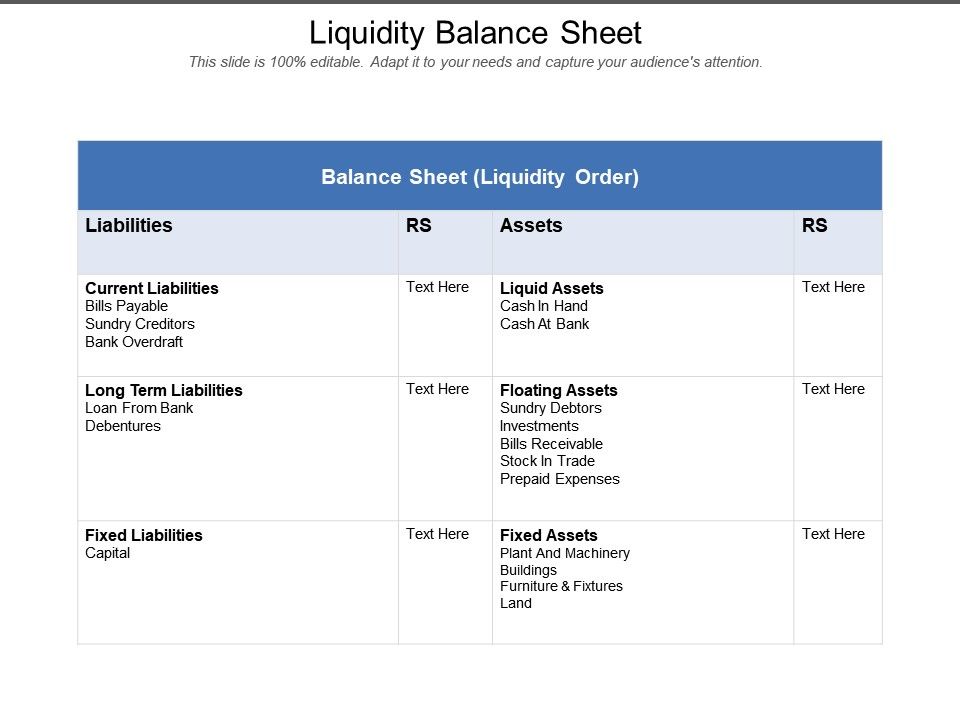

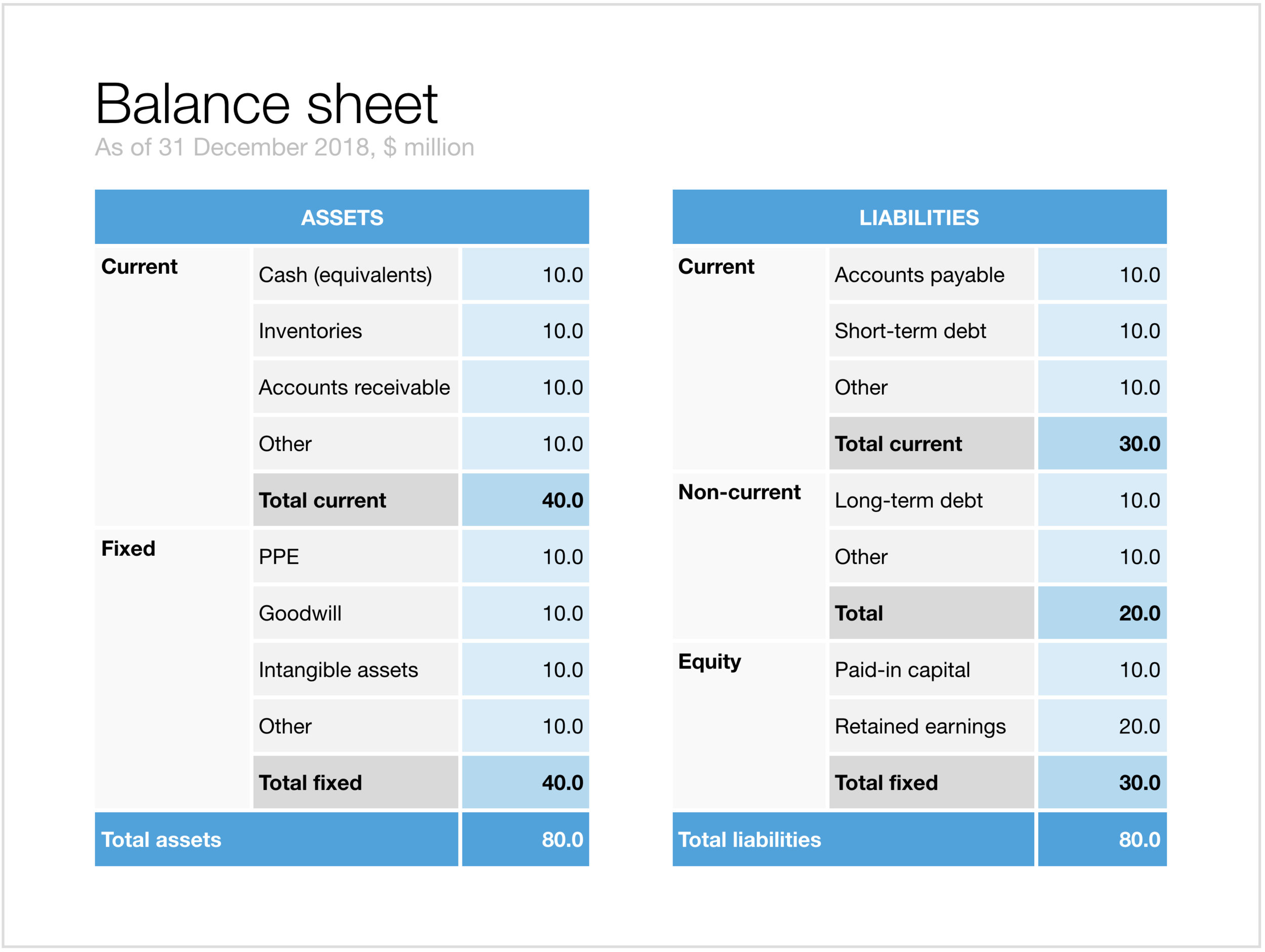

A balance sheet is a financial statement that reports a company's assets, liabilities and shareholder equity at a specific point in time. So, at the top of the balance sheet is cash, the most liquid asset. The order of liquidity is the order in which assets are listed on a balance sheet, starting with the most liquid assets and ending with the least liquid assets.

Order of liquidity is the presentation of assets in the balance sheet in the order of the amount of time it would usually take to convert them into cash. What is the definition of. Liquidity risk measures the marketability of an asset and the ease at which is can be converted into cash, without incurring a monetary loss.

As fixed assets age, they begin to lose their value. Companies use liquidity ratios in order to calculate their own accounting liquidity utilizing data from a balance sheet. Also listed on the balance sheet are your liabilities, or what your company owes.

The current ratio is the simplest liquidity ratio to calculate and interpret. Types of liquidity ratios 1. Examples of balance sheet liquidity in a sentence balance sheet, liquidity, net leverage and cash flow 1) “available liquidity” is cash plus borrowing available on our.

Items on a company’s balance sheet are typically listed from the most to the least liquid. Fact checked by timothy li solvency ratios vs. Tips for using liquidity ratios in balance sheet analysis:

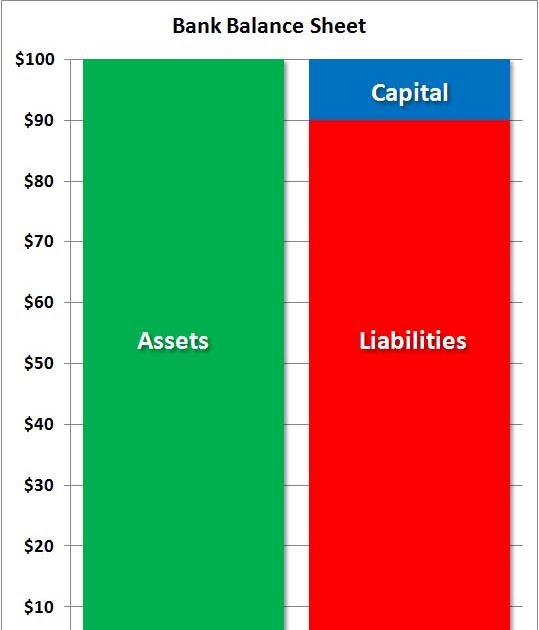

Therefore, cash is always listed at the top of the asset section, while other types of. Current ratio = current assets / current liabilities. A cushion of liquid assets is a key component in a bank’s overall liquidity position.

Analyzing liquidity ratios over multiple periods can help identify trends and. At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data. D/e = total liabilities / total shareholders' equity = $152,969 /.

An overview solvency and liquidity are both terms that refer to an enterprise's state of. The order of liquidity is a way of presenting asset accounts on the balance sheet.

/Balance-Sheet-56a0a31d5f9b58eba4b25300.gif)