Awe-Inspiring Examples Of Info About Profit And Loss Statement For 1099 Employee

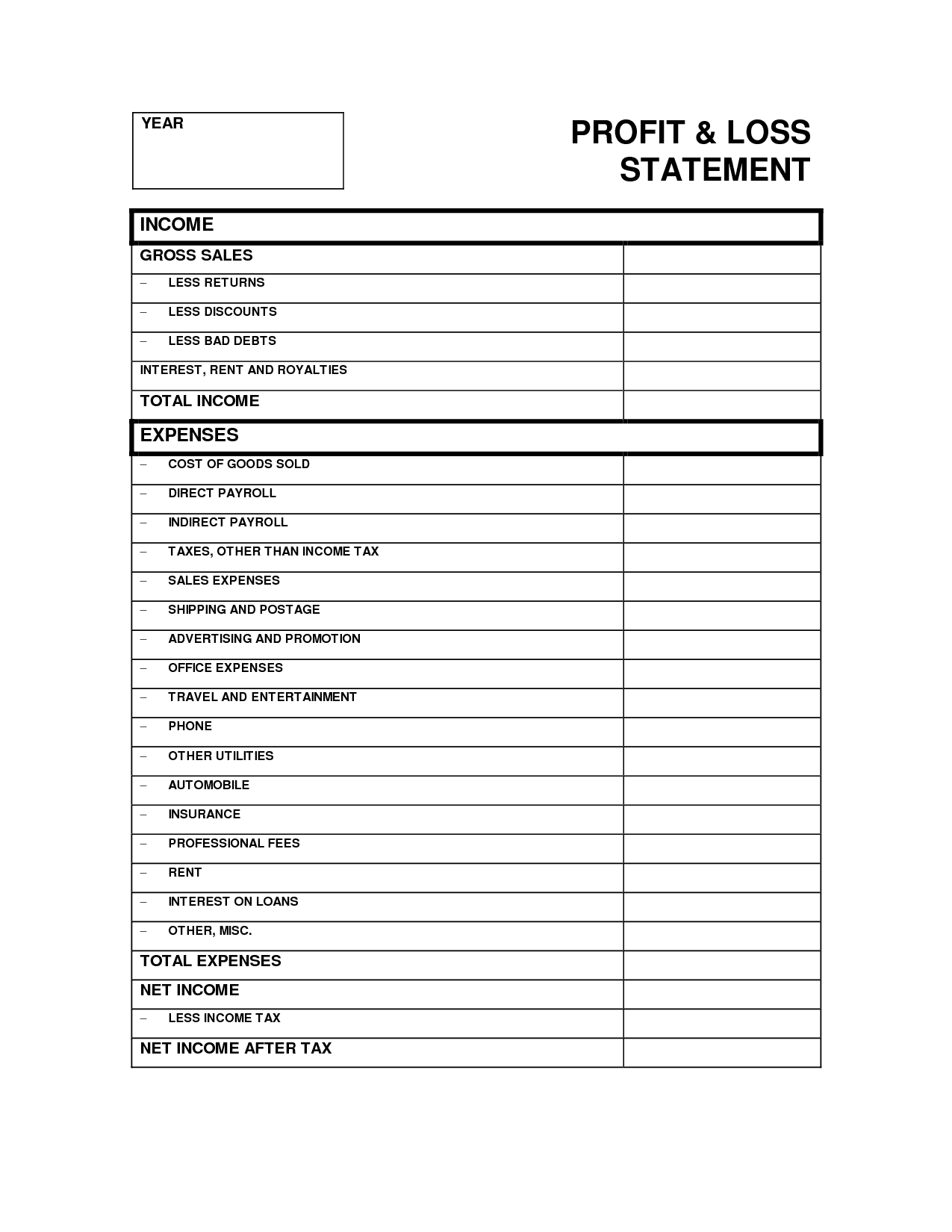

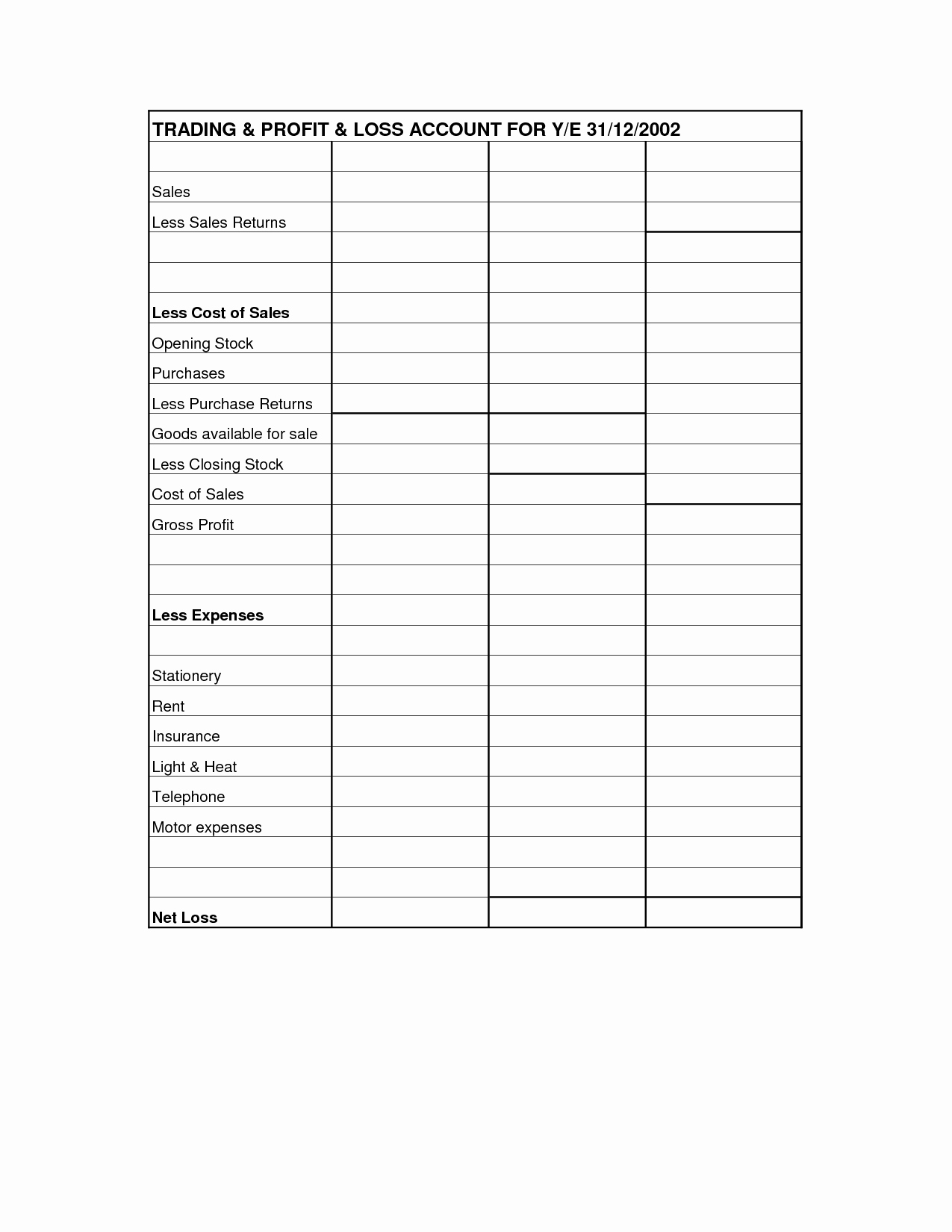

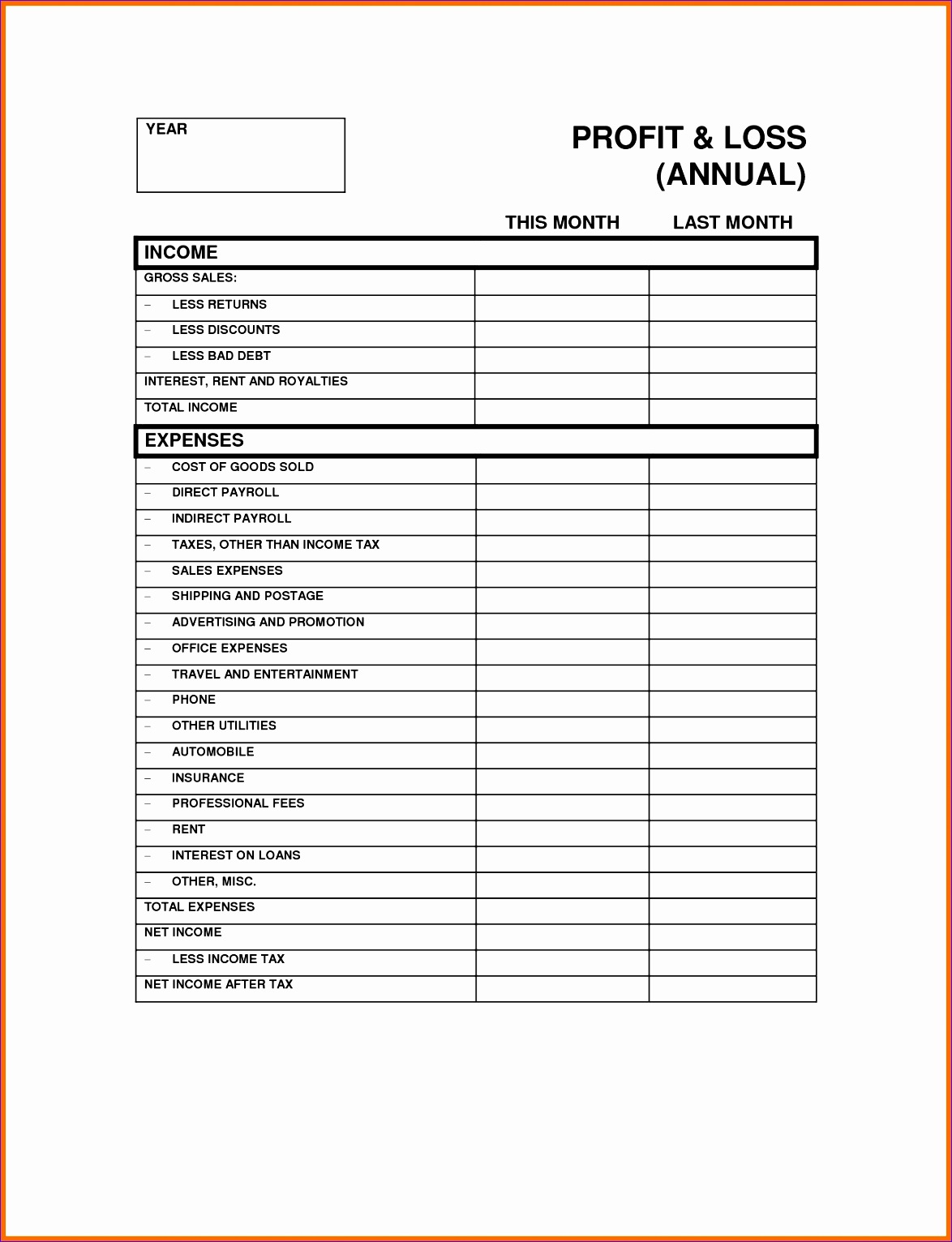

A profit and loss statement contains three basic elements:

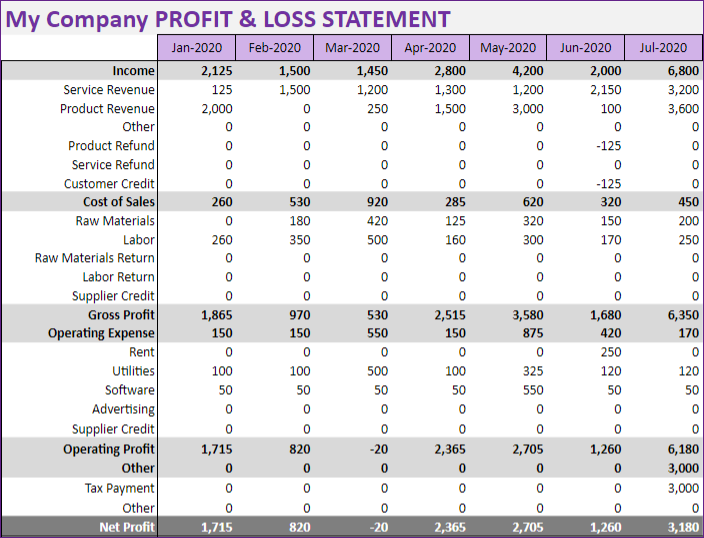

Profit and loss statement for 1099 employee. A p&l statement compares company revenue against expenses to. Revenue, expenses, and net income. In the p & l, you'll list information about.

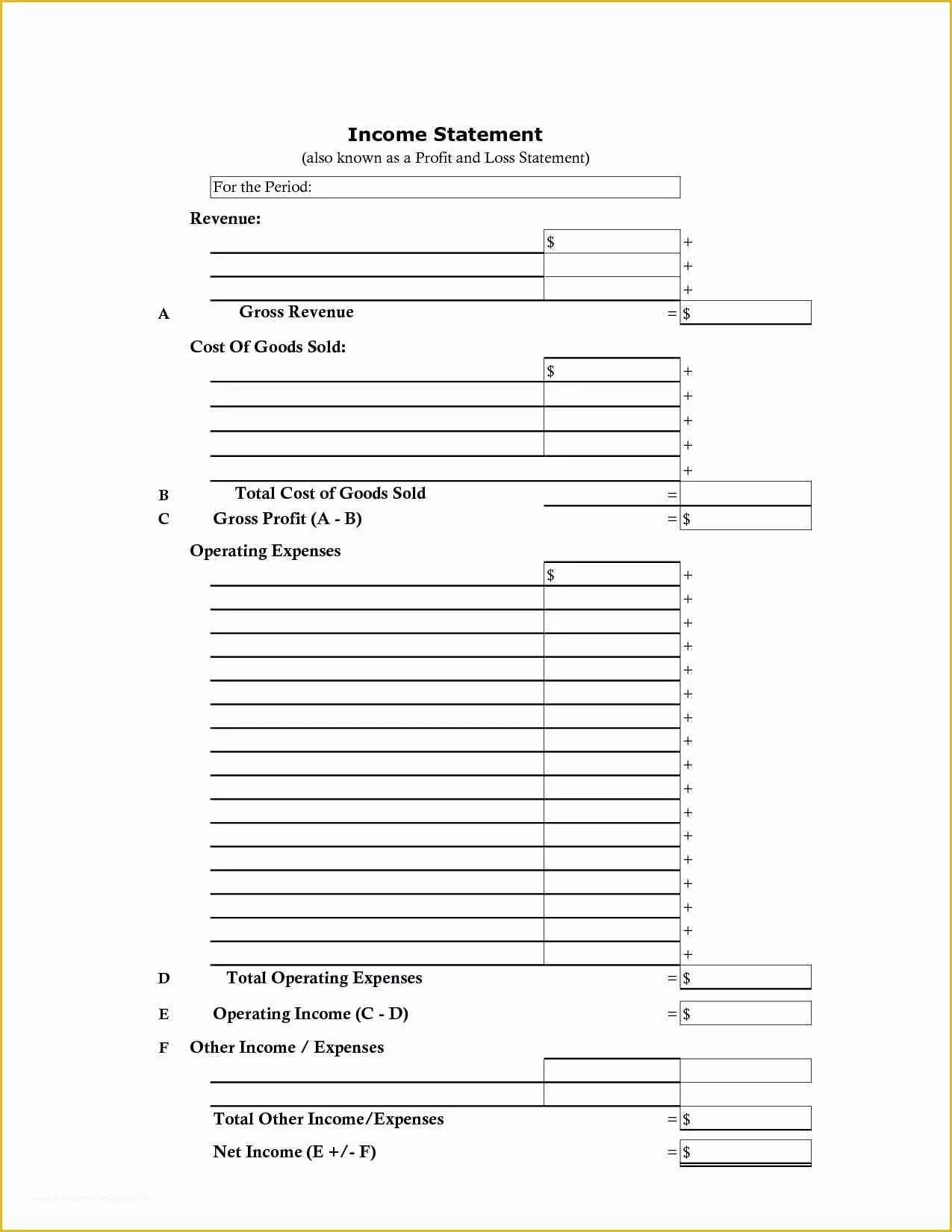

This profit and loss statement form can help you quickly and easily begin the process of creating one for your business. A profit and loss statement is essential for tracking your business finances, but manually one every month, quarter or year takes time and effort. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

This plan, called the one participant 401 (k) by the irs, allows solo business owners to enjoy the benefits of a corporate 401 (k). Profit and loss statement or income statement — a financial document that details revenues, sales, expenses, and costs in one form or another, depending on the. Instructions for completing sample profit and loss statement for self‐employed homeowners the numbered sections correspond to the definitions below.

More advanced profit and loss statements also include. Independent contractors generally report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Profit and loss statements.

All 1099 contractors should work on making sure they have a profit and a loss statement for every single month of the year. Net expenses from the expense statement is calculated by multiplying gross 1099 earnings by the expense. The single step profit and loss statement formula is:

Product business = 35% expense factor floor.