Smart Info About Prepaid Insurance Trial Balance

What is prepaid insurance?

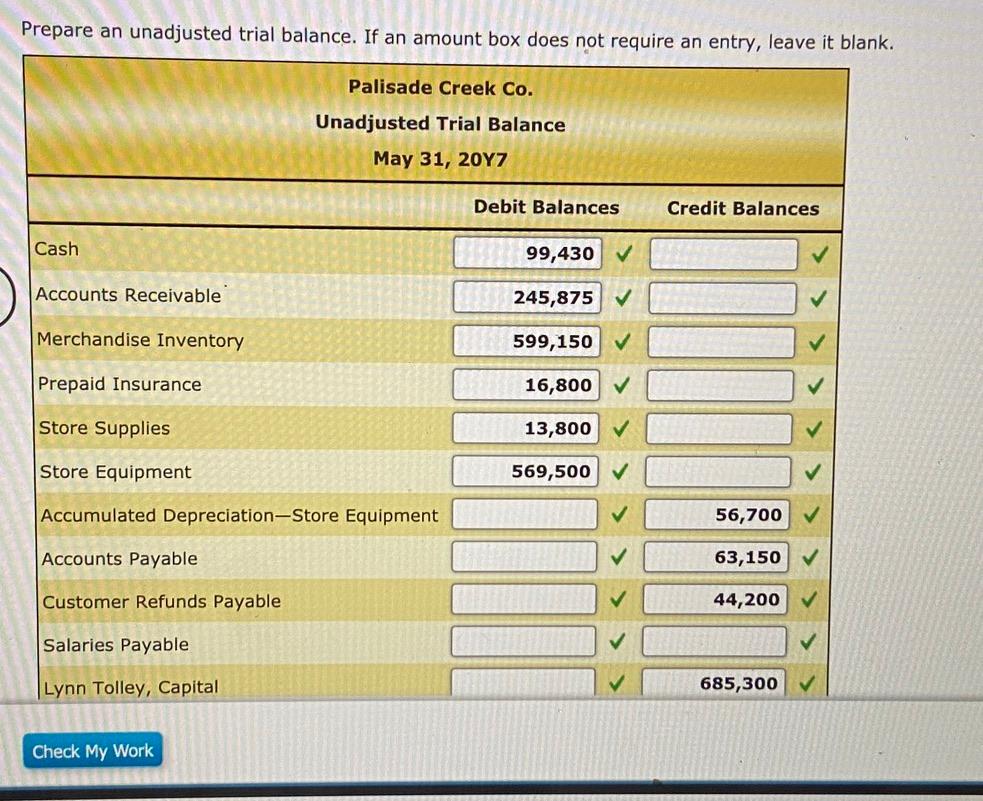

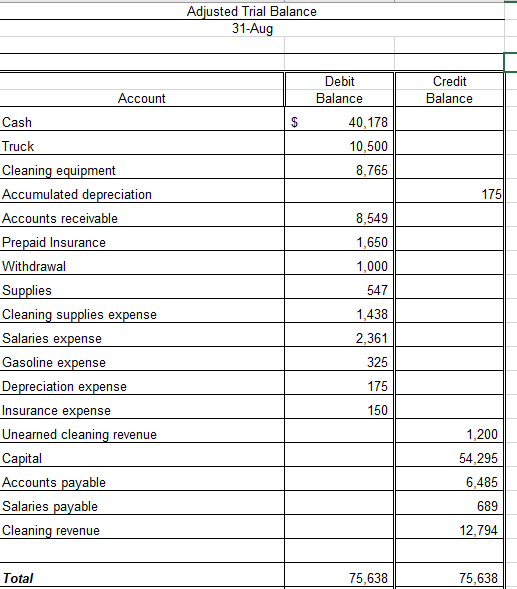

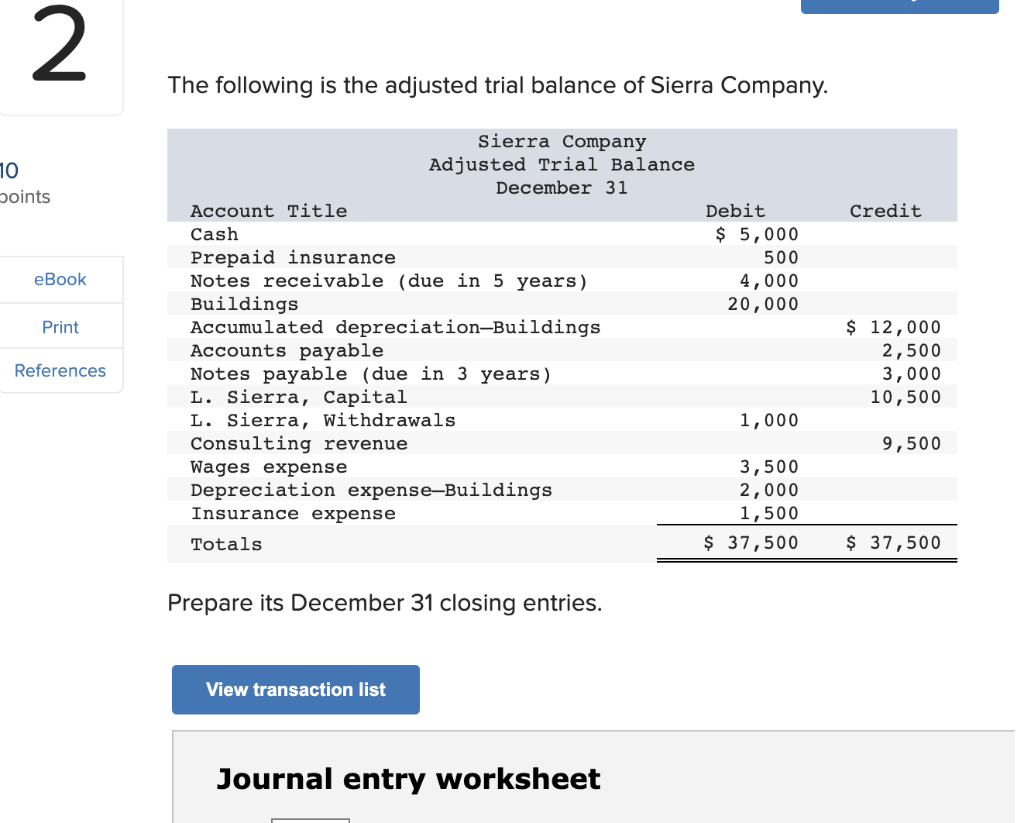

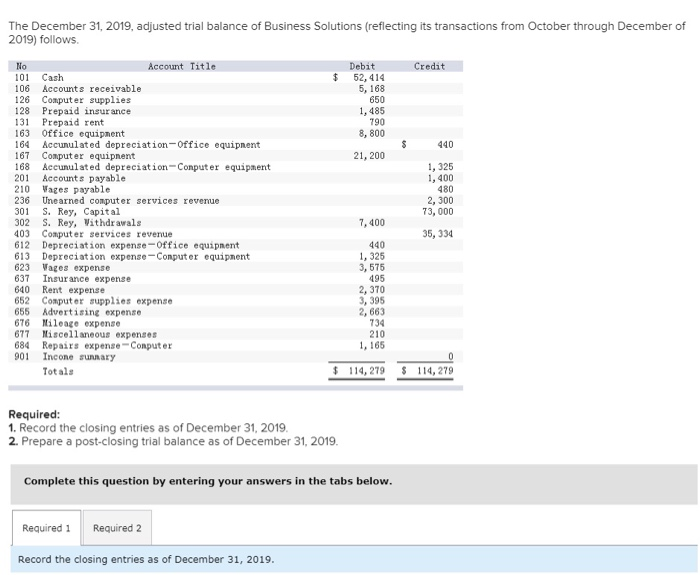

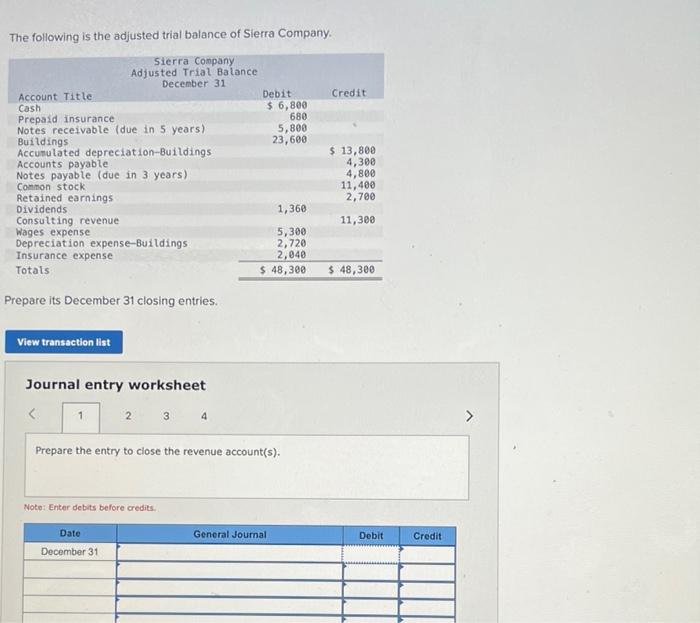

Prepaid insurance trial balance. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. And there is nothing to record in the income statement. Are shown in the trial balance on the debit side as they are initially an asset for the.

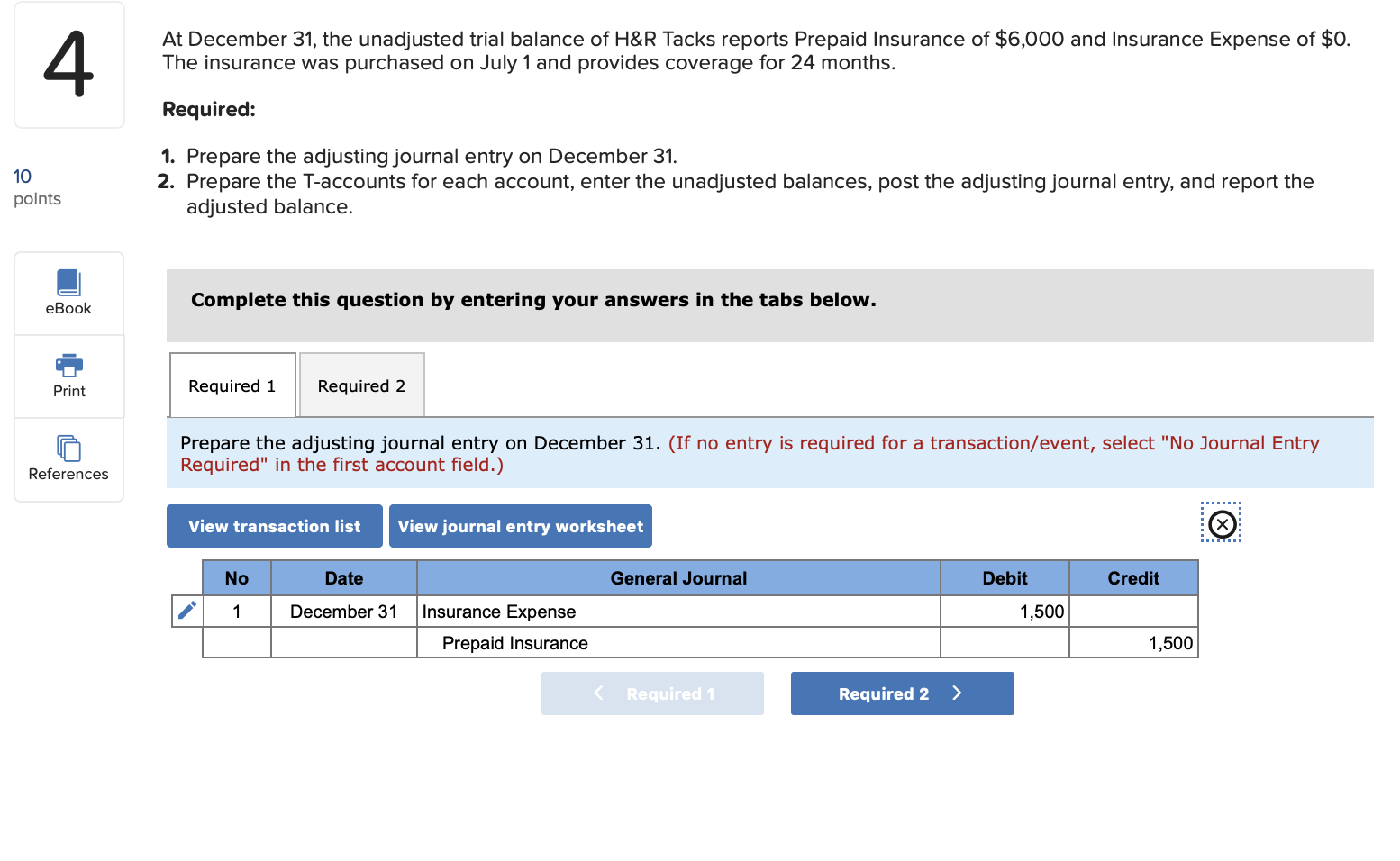

Accrual of income, accrual of expenses, deferrals, prepayments, depreciation,. A trial balance is a statement that lists all the general ledger accounts and their balances, showcasing the equality between debits and credits. However, after adjusting entry at the.

Prepaid insurance is the portion of an insurance premium that has been paid in advance and has not expired as. The balance in the prepaid rent account is for a. Key takeaways adjusting entries are prepared at the end of the accounting period for:

The correct insurance expenses for 2019 comprise 4/12th of $4,800 = $1,600. A trial balance is a list of all accounts in the general ledger that have nonzero balances. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

Prepaid expenses refer to the advance payment of goods or services the benefits of which shall be received in the future. Above), shows that $300 of that balance is not yet used. Of the prepaid insurance in the trial balance, $ 4,000 is for coverage during the months after december 31 of the current year.

Prepaid insurance appearing in the trial balance is shown: The prior balance in the unadjusted prepaid insurance account (excluding the insurance in item n. The recurring monthly adjusting entries are not changed.

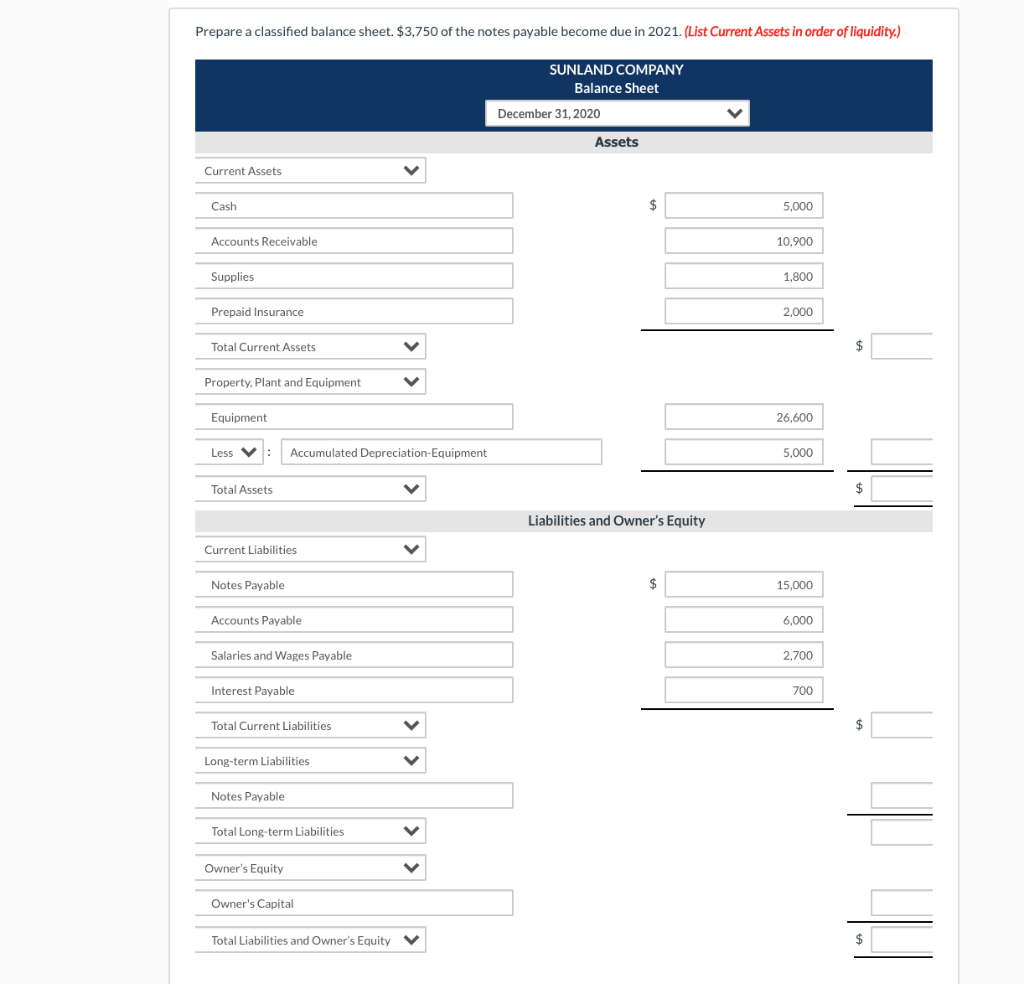

Prepare an adjusted trial balance statement (financial accounting tutorial #24) let’s look at the company we have been using in our examples microtrain. A) on the credit side of the trading account b) on the credit side of profit and loss account c) on the assets side of. At december 31, the balance in prepaid insurance will be a credit balance of $120, consisting of the debit of $2,400 on.

Expenses such as prepaid rent, insurance, etc. Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet. Service supplies expense now has a balance of $900.

In the second entry, prepaid insurance decreases (credit) and insurance expense increases (debit) for one month’s insurance usage found by taking the total $4,500 and. However, there is often confusion. Like other prepaid expenses, when insurance has been paid in advance, it will be recorded in the balance sheet under current assets and at the end of each month, the appropriate.

Initial journal entry for prepaid insurance: