What Everybody Ought To Know About Gifi Income Statement

All corporations (except for insurance.

Gifi income statement. You are not limited to using just these codes. Gulf island fabrication income statement. You can use this data to.

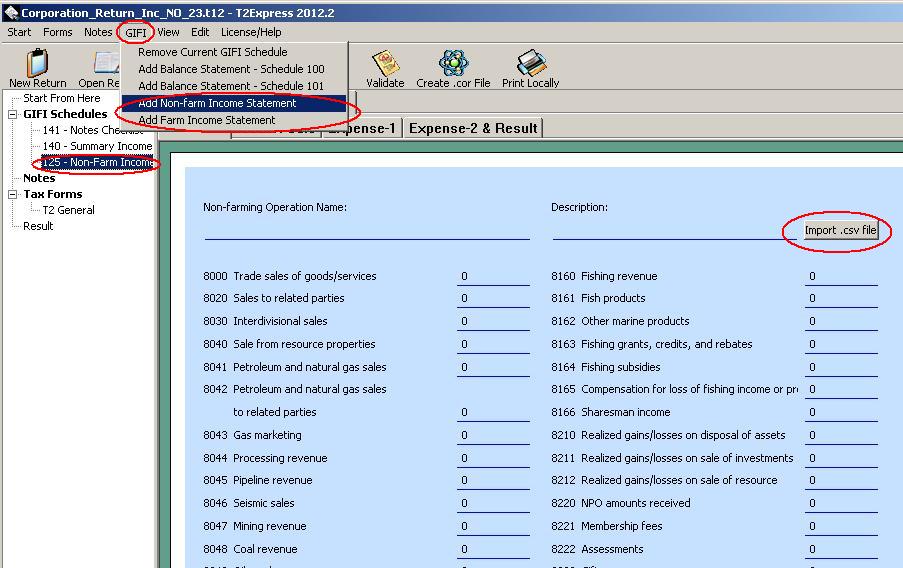

If you are a corporation that needs to file an income tax return, you may need to use the t2sch125 income statement information form. Complete the income statement or income statements; Sheet and income statement items.

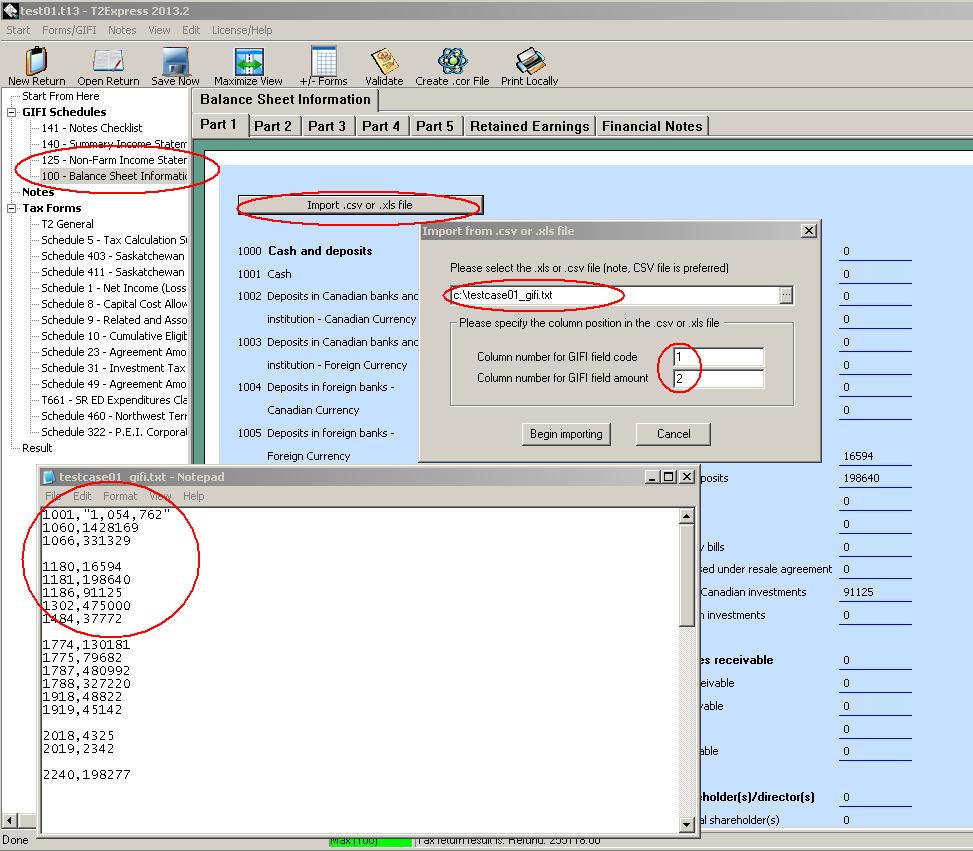

This form helps you report your. You must complete the bolded field codes. Transfer the gifi information to the tax return.

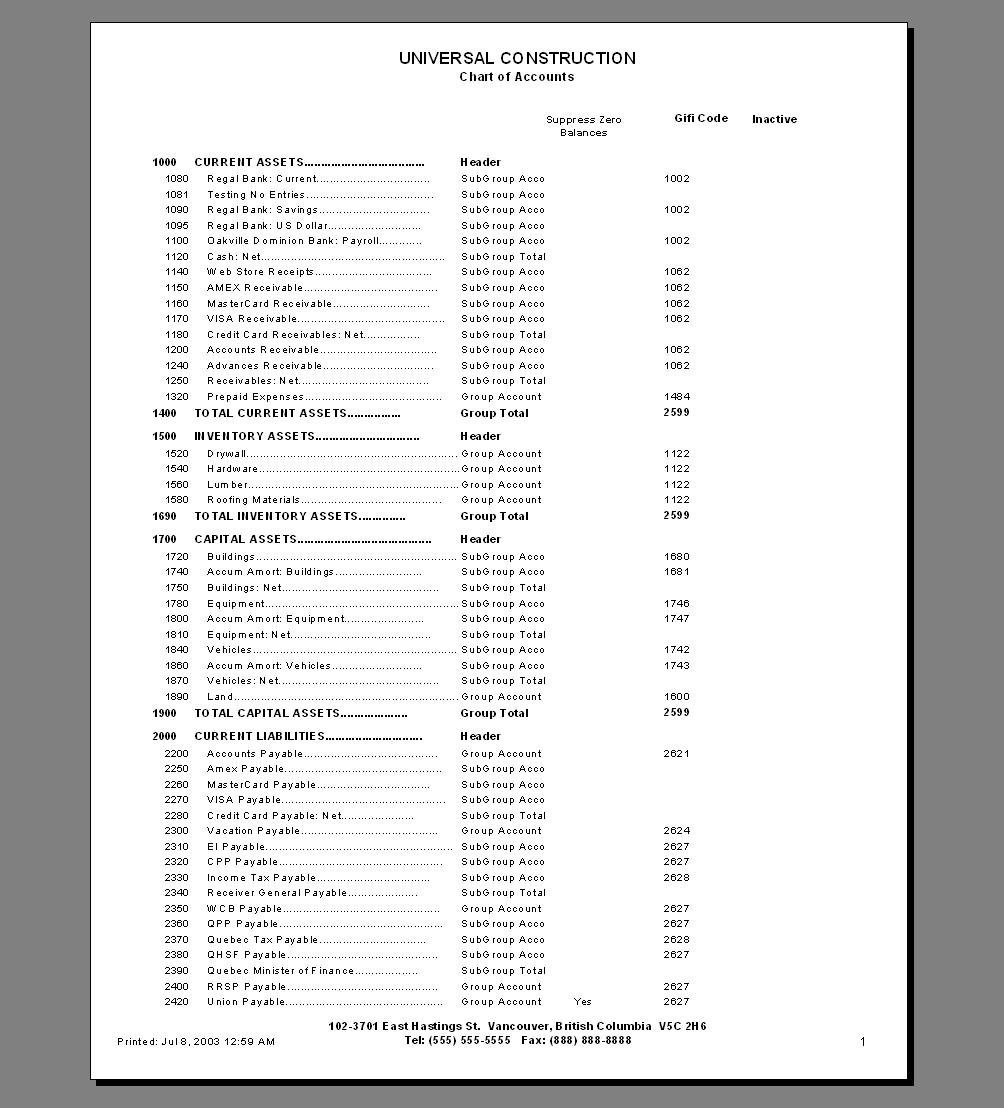

The gifi codes identify items that are usually found on a corporation’s financial statement (balance sheets, income statements, and statements of retained earnings). The gifi codes identify items that are usually found on a corporation’s financial statement (balance sheets, income statements, and statements of retained. Schedules t2sch100, balance sheet information, t2sch101, opening balance sheet.

If you use form t1178, you do not. A separate selection of income statement items that can be used by farming corporations is also included. For small business owners, the general index of financial information (gifi) is one of the most obvious differences between completing a t1 personal income tax.

The general index of financial information (gifi) is a standard list of codes that you use to prepare your financial statements. T2sch100 balance sheet information t2sch101 opening balance sheet information t2sch125 income statement information t2sch141 notes checklist. The gifi codes identify items that are usually found on a corporation’s financial statement (balance sheets, income statements, and statements of retained earnings).

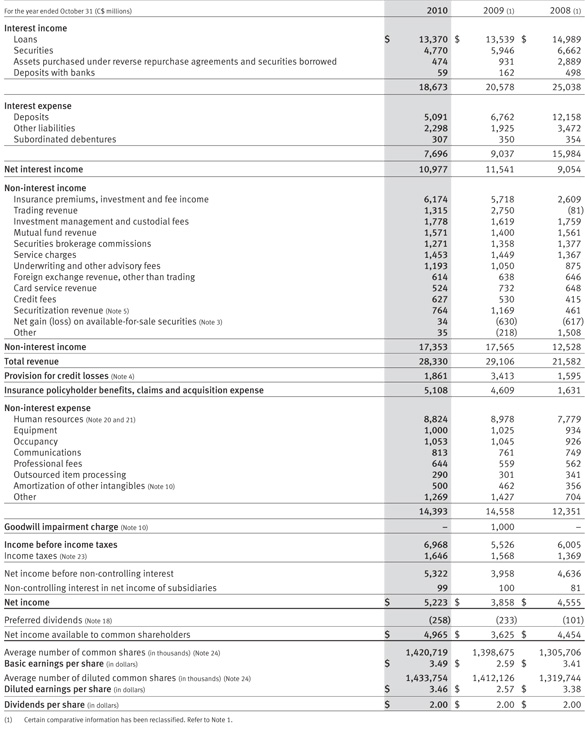

Review and correct the gifi diagnostics. Gifi schedules let you submit your opening and closing balance sheets and income statements, with spaces to enter the gifi codes and amounts for each line. Get the latest income statement from zacks investment research.

The following list contains commonly used gifi income statement field codes. If you use form t1178, you do not have to send your. Use this data to see the revenue and income for each quarter based on the data we have available.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)