Heartwarming Tips About Prepaid Insurance In Profit And Loss Account

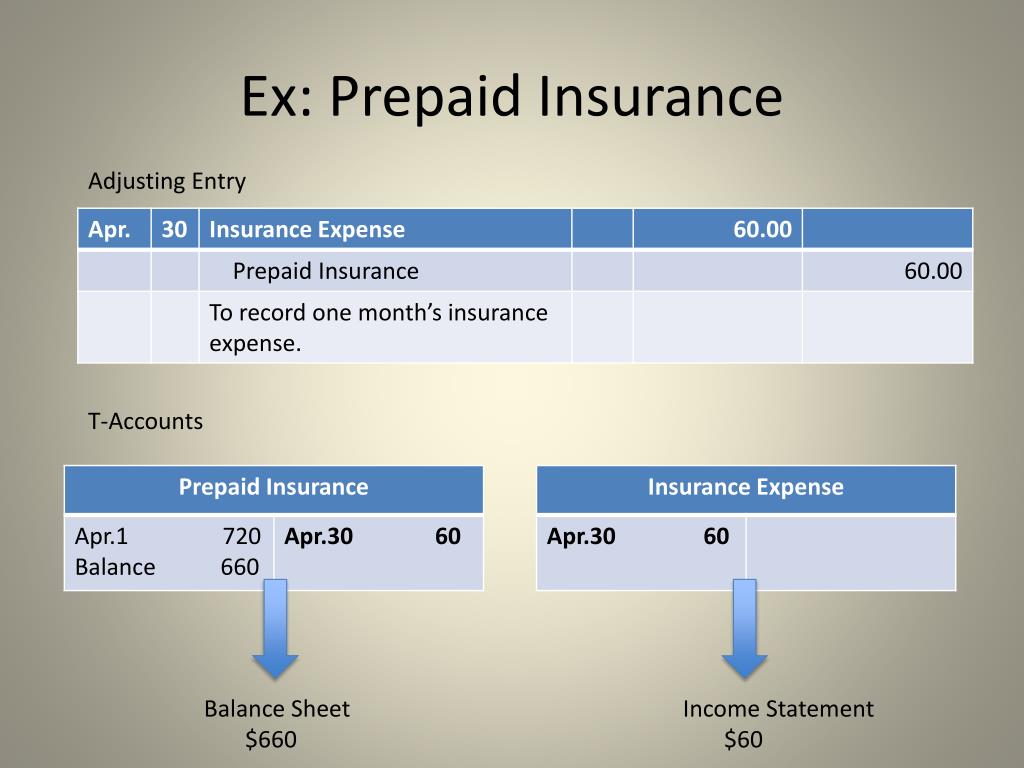

When the company makes an advance payment for insurance, it can make prepaid insurance journal entry by debiting prepaid insurance account and crediting cash account.

Prepaid insurance in profit and loss account. It may so happen that we may earn some incomes during the current accounting year but not receive them in the same year. Treatment of prepaid expenses in final accounts (or) financial statements. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet.

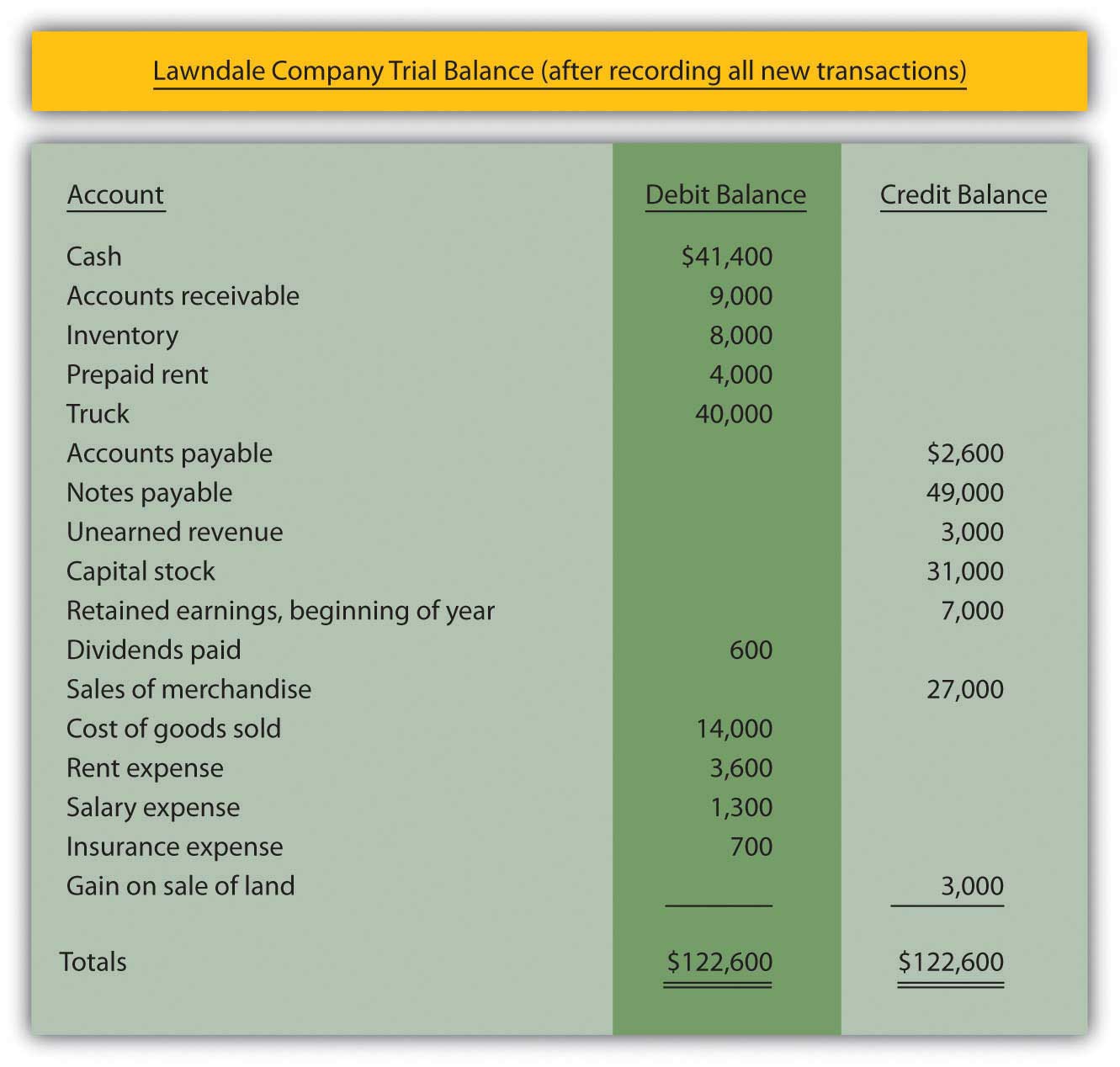

The prepaid expense is shown on the assets side of the balance sheet under the head “current assets”. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. Fact checked by marcus reeves what is prepaid insurance?

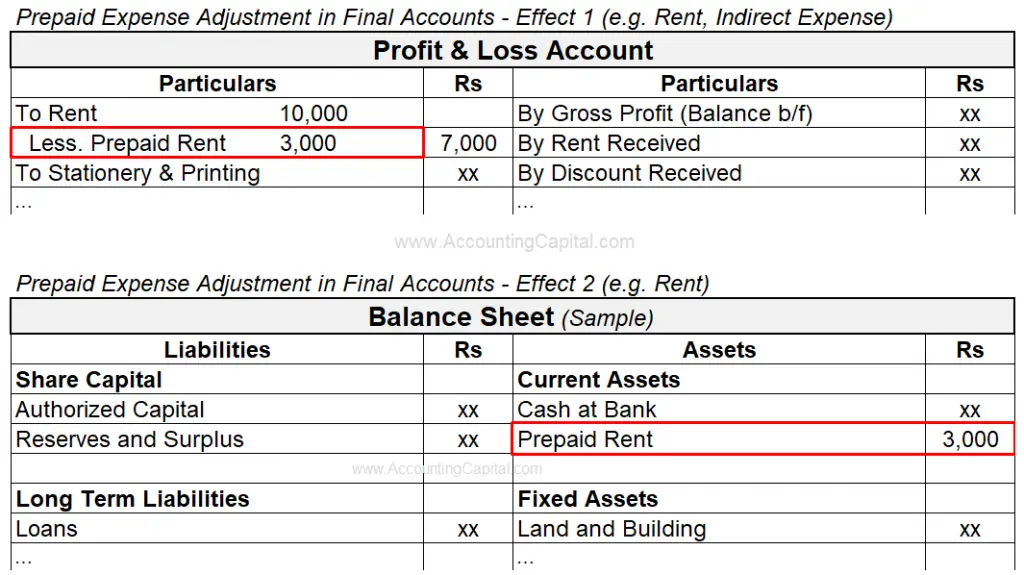

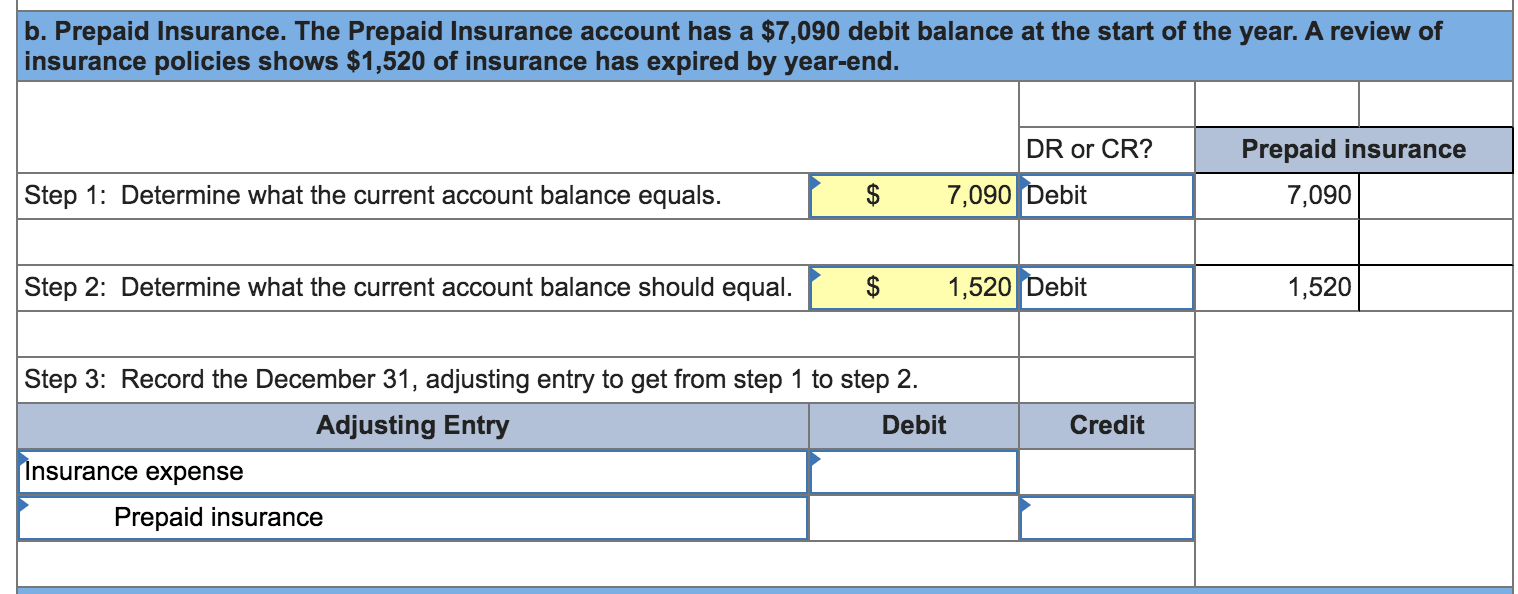

When preparing the profit and loss account, insurance expenses will amount to $1,600 ($4,800 less $3,200) when preparing the balance sheet, prepaid insurance, $3,200, will be shown as a current asset; The prepaid portion of the expense (unexpired) is reduced from the total expense in the profit & loss account. Prepaid insurance appearing in the trial balance is shown:

The term prepaid insurance refers to payments that are made by individuals and businesses to their insurers in advance for insurance. The insurance prepaid account is an “asset” and will appear in the balance sheet. The amount will appear in the asset side of balance sheet.

A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the. By crediting the insurance premium account by rs. The most common types of prepaid expenses are prepaid rent and prepaid insurance.

Prepaid expenses are treated as an asset by the business. 3,000 at which figure it will appear in the profit and loss account. The prepaid expense is deducted from the particular expense while preparing a profit and loss statement.

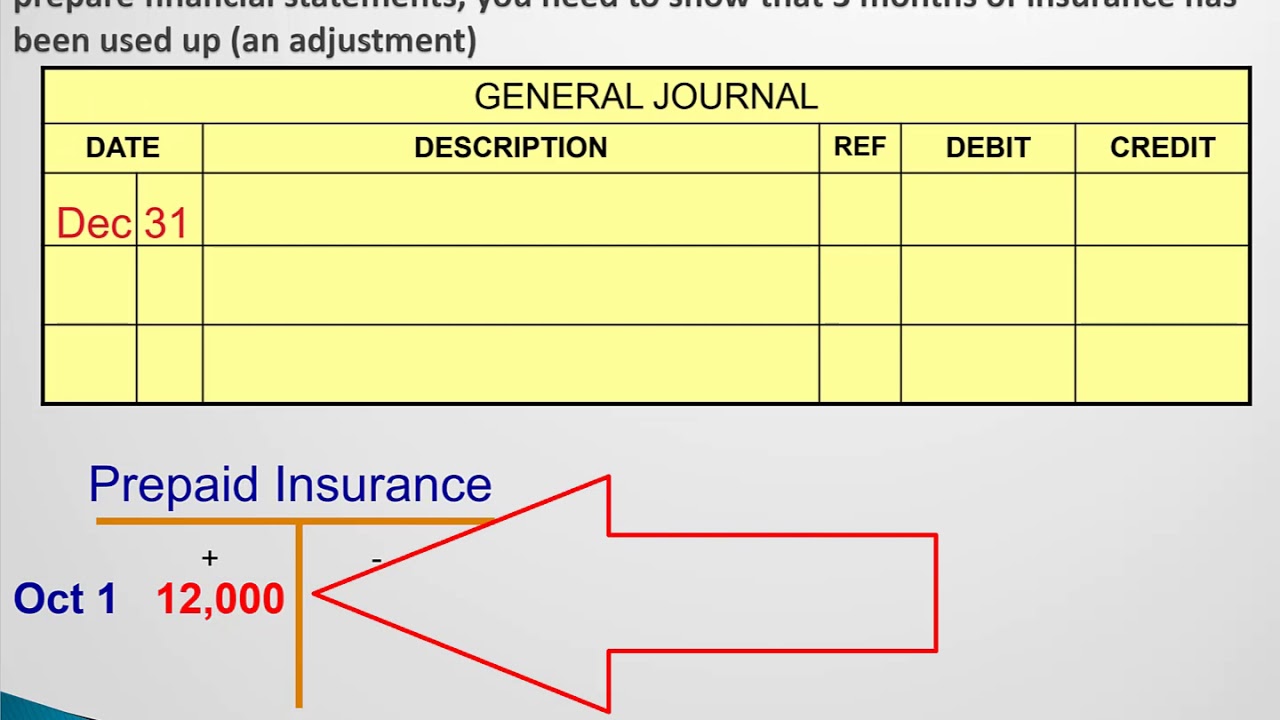

So, these expenses have to be adjusted, which have not been incurred in the current accounting period to know the true figure of profit/ loss. A profit and loss (p&l) account shows the annual net profit or net loss of a business. While preparing the trading and profit and loss a/c we need to deduct the amount of prepaid expense from that particular expense.

Therefore, it is treated as a current asset in the company’s balance sheet. The difference between the two sides of the revaluation account is either profit or loss. The prepaid expense a/c appears on the assets side of the balance sheet.

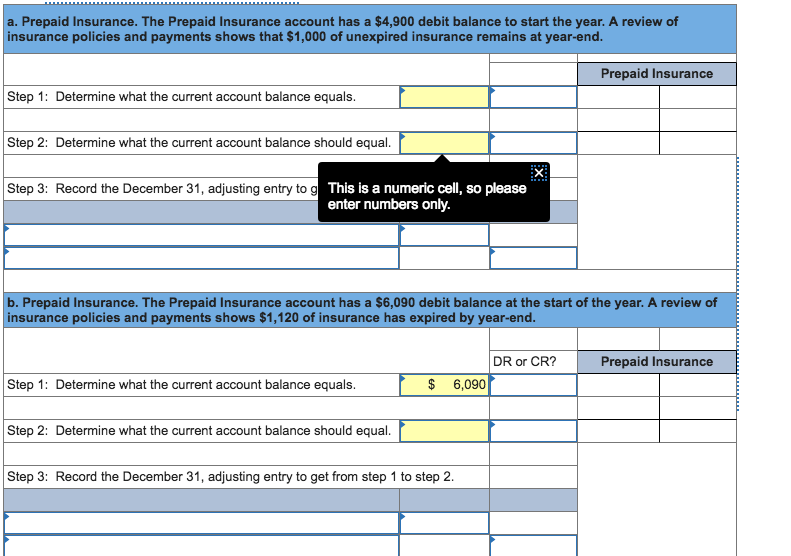

The amount of prepaid expense is deducted in the profit and loss a/c from the expense. Prepaid insurance journal entry. Conclusion meaning and overview prepaid expenses are those expenses which have been paid in advance and the related benefits are not received within the same accounting period.

Common reasons for prepaid expenses Accounting process for prepaid or unexpired expenses. Prepaid or unexpired expenses can be recorded under two.