Wonderful Tips About Operating Financing And Investing Cash Flows

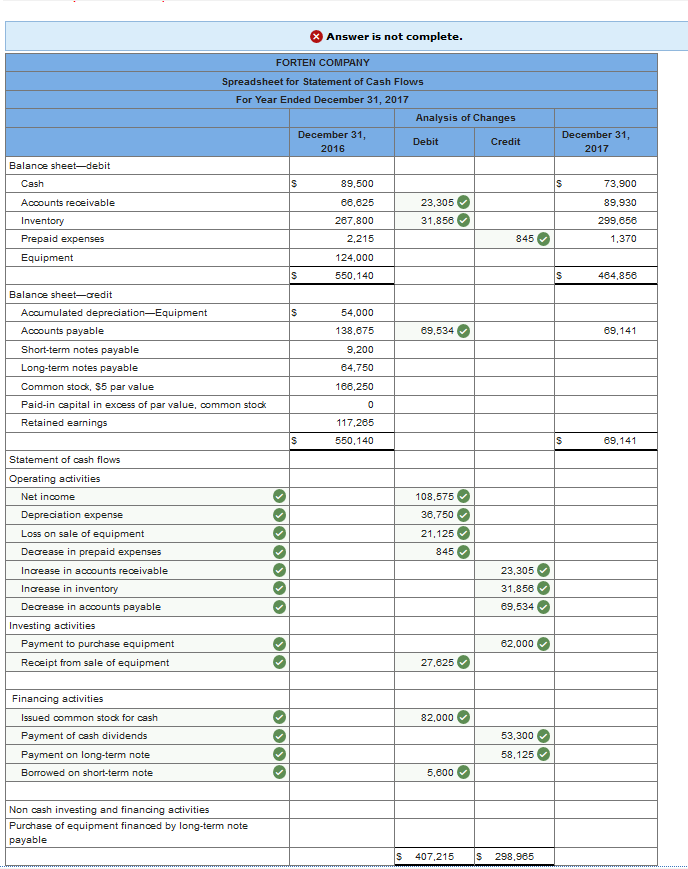

Net cash (used in) provided by investing activities (152) 1.

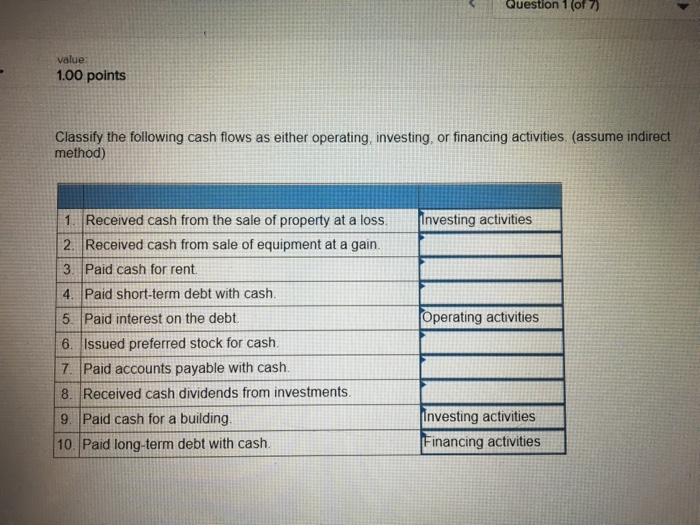

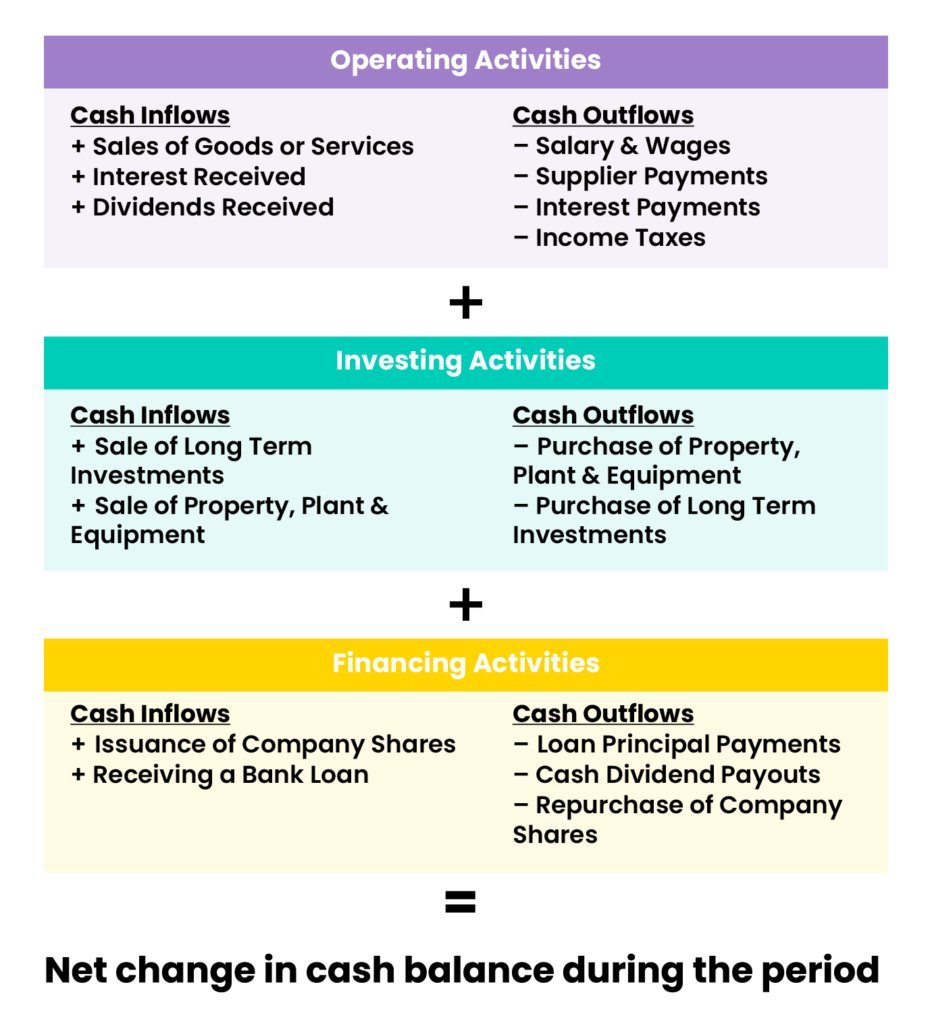

Operating financing and investing cash flows. Cash flows from investing and financing. Net proceeds from the exercise of stock options : Lo 14.2 differentiate between operating, investing, and financing activities mitchell franklin the statement of cash flows presents sources and uses of cash in three distinct categories:

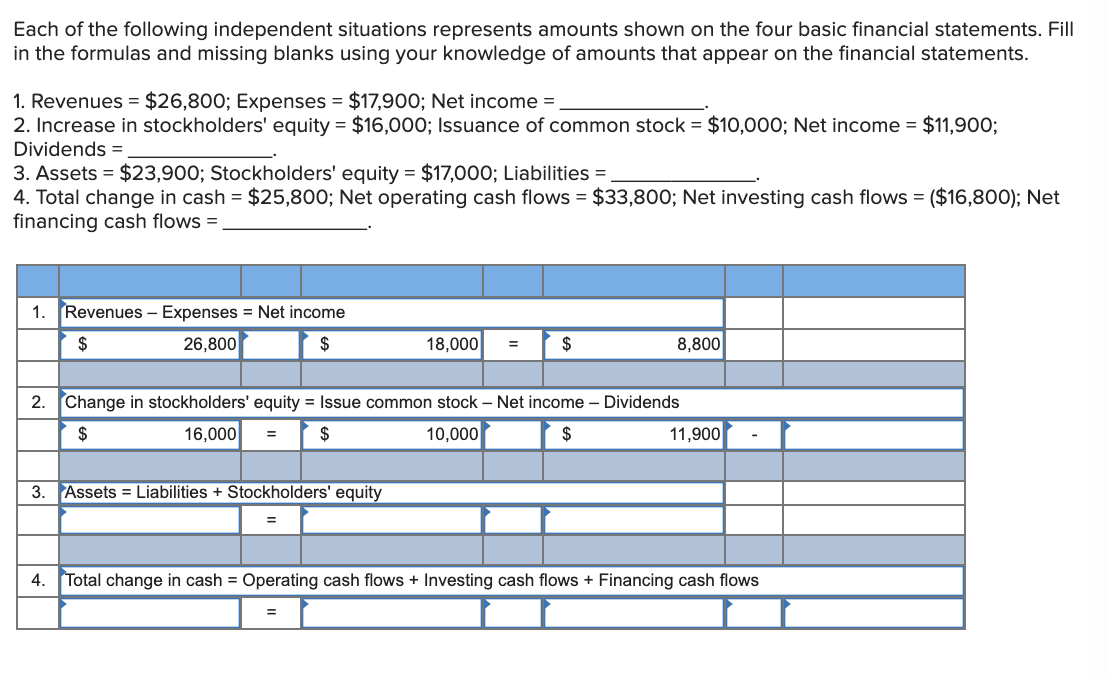

Below, we break down each type of cash flow and give the formula for each source. 4q23 earnings per share of ($0.19); Operating cash flows refer to the cash flow generated by a company’s primary operations.

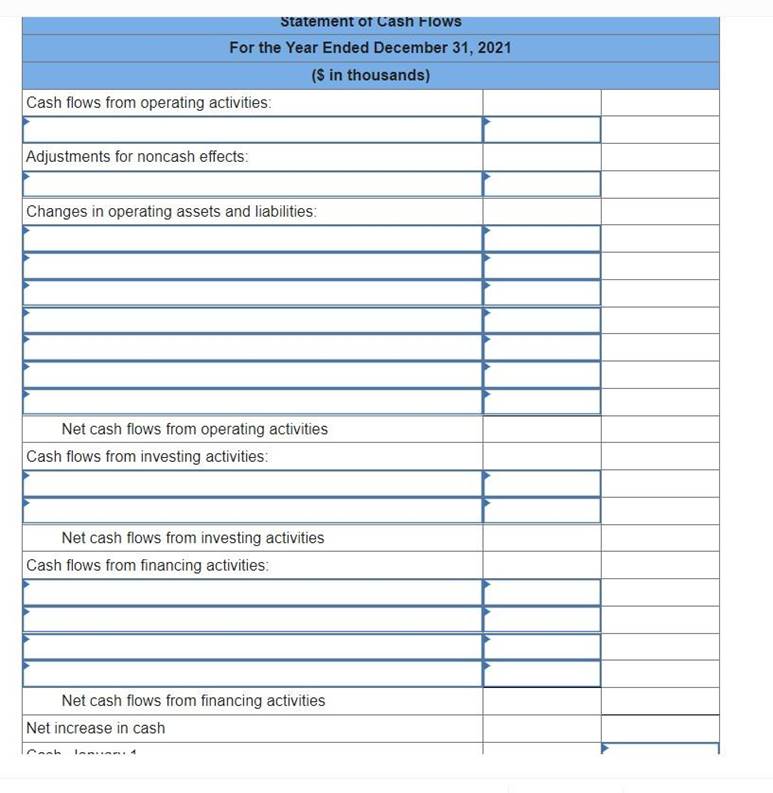

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. To put it simply, if we receive cash in the transaction we add the cash amount received and if we pay cash in the transaction we sutract the cash amount paid. Cash flows from financing activities:

Cash payments in hedge contracts when the hedged item is classified as an operating activity. Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. It is the cash flow that results from a company’s primary revenue source.

There are two methods for depicting. Reporting cash flows from operating activities from paragraph 1 4 6 7 10 13 16 reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency cash flows interest and dividends taxes on income 17 18 21 22 25 Solution the correct answer is c.

Operating cash flow; Operating cash flow is the first section depicted on a cash flow statement, which also includes cash from investing and financing activities. The key to making great decisions is found in managing your future budgets and forecasting future cash flow.

Net debt and financing as of december 31, 2023, safran’s balance sheet exhibits a €374 million net cash position (vs. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories. This is because it is related to the production activities of the company.

Learn how cash flows from operations, investing & financing, & the normal types of cash flows at different stages of a business. Cash payments or refunds of income taxes, unless specifically associated with financing or investing activities. For example, operating cash flows include cash sources from sales and cash used to purchase inventory and to pay for operating expenses such as salaries and utilities.

For example, operating cash flows include cash sources from sales and cash used to purchase inventory and to pay for operating expenses such as salaries and utilities. Key takeaways the cash flow. You can always hire a financial analyst to review your company’s cash flow.

Capital expenditures (11,464) (16,480) capitalized software (144,884) (156,284) proceeds from marketable securities — 2,507 : When you decide to make a new hire, launch a new marketing campaign. Step 1/5 1.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)