Unique Info About Preparation Of Combined Balance Sheet

In this article, we will demystify how to prepare consolidated financial statements.

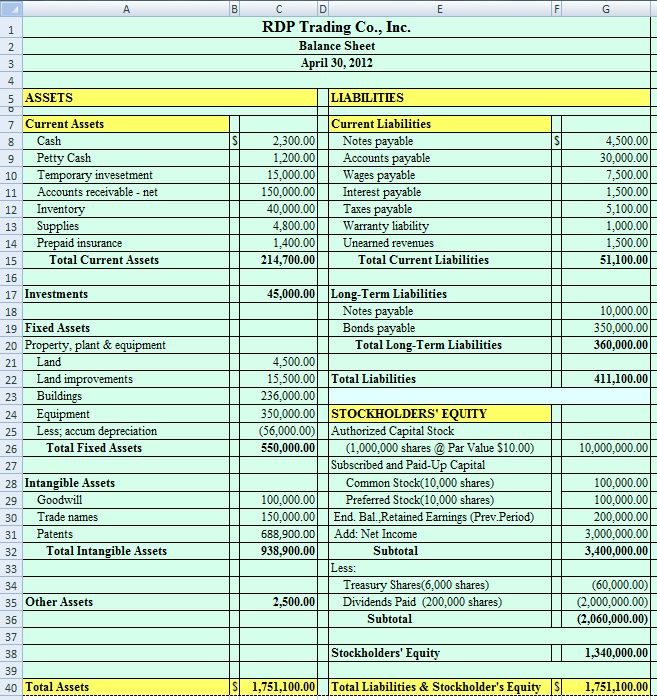

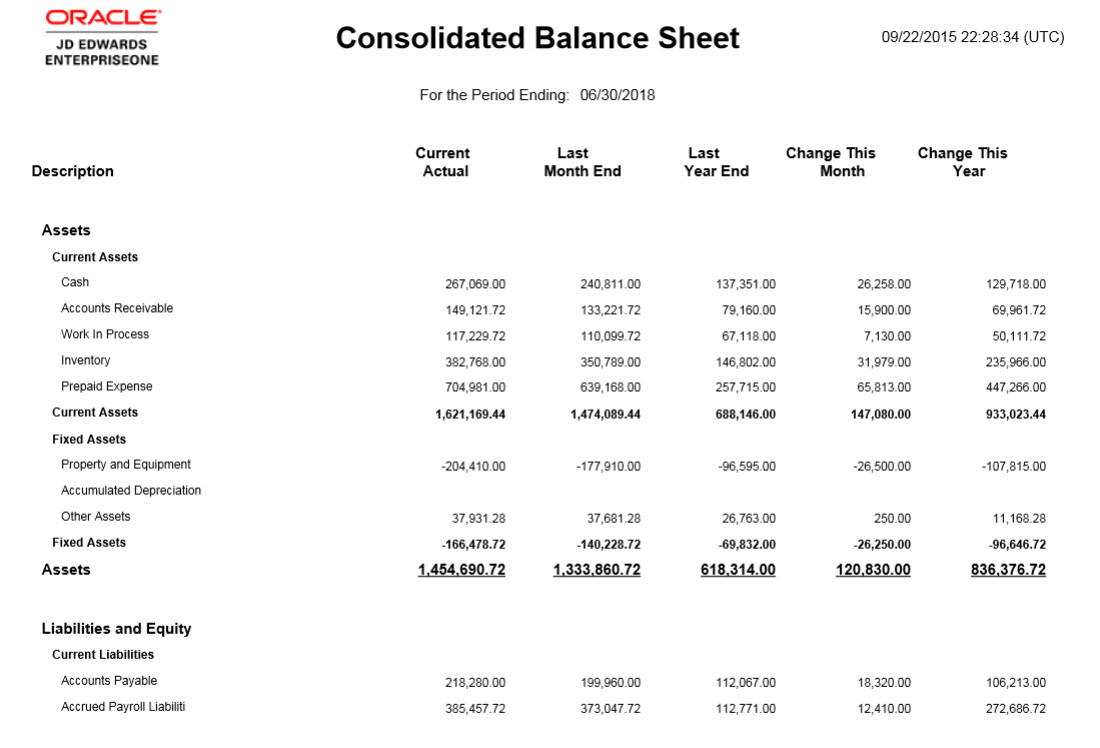

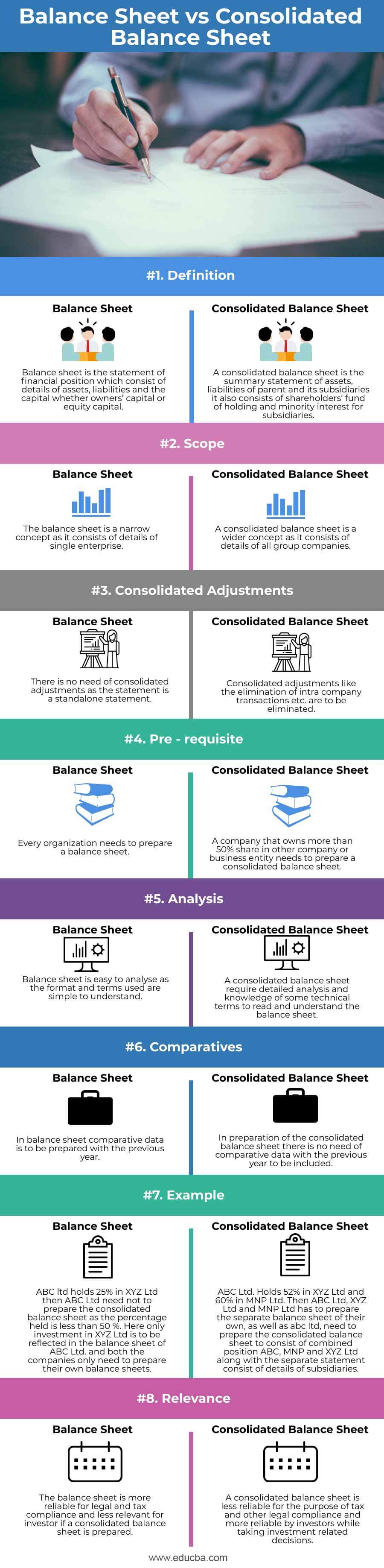

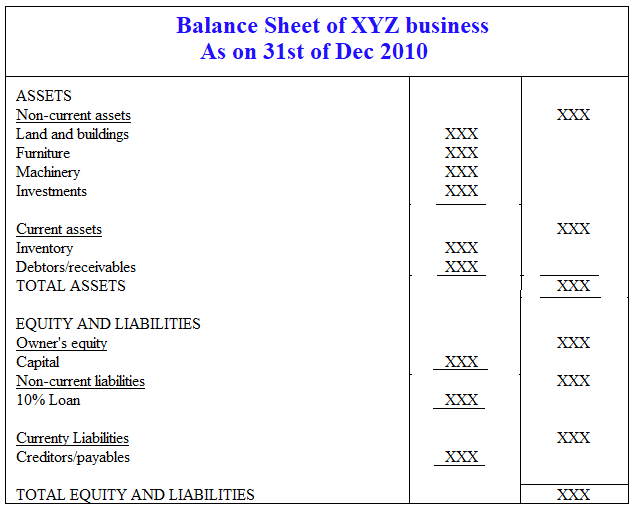

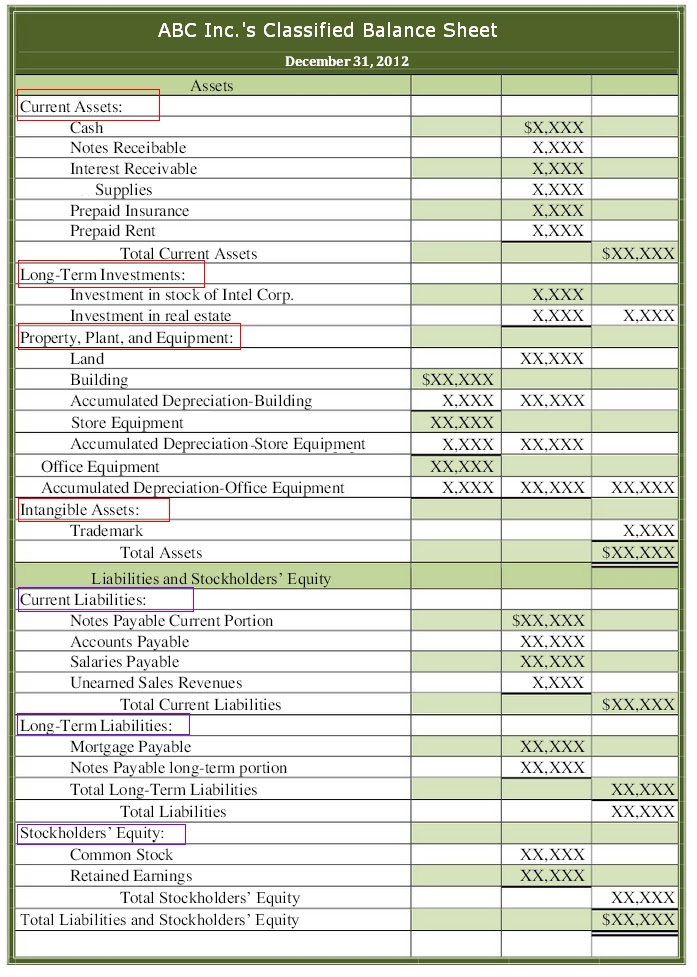

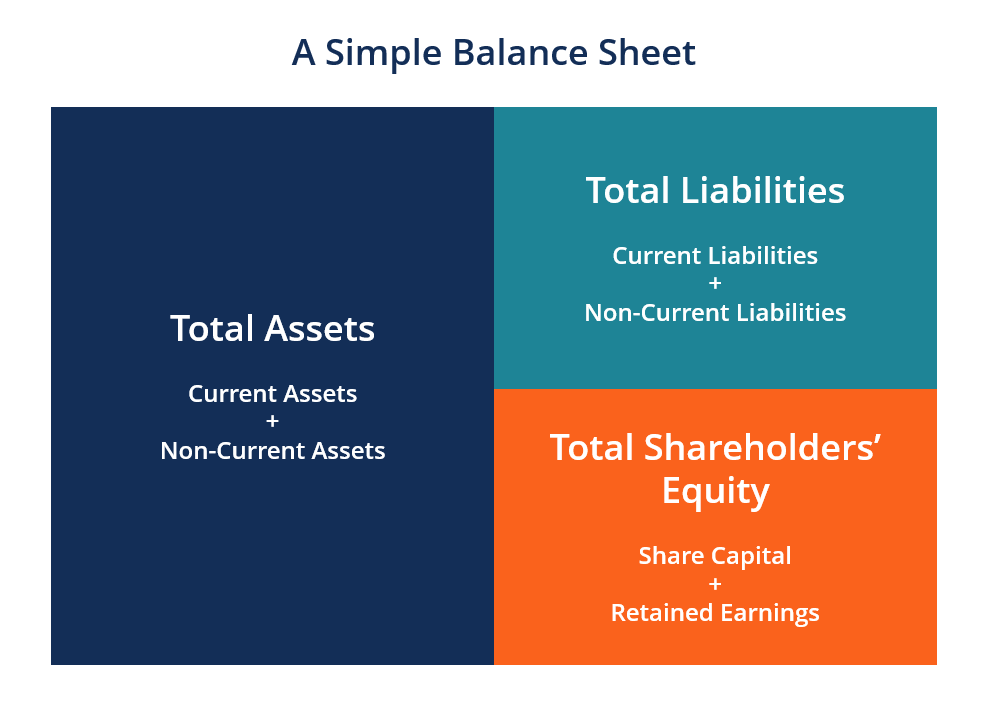

Preparation of combined balance sheet. The consolidated balance sheet is prepared by a company’s accounting department and disclosed by the management team to the company stakeholders and shareholders. Check all of your reference information before creating the actual consolidated balance sheet, you need to make sure that the rules and methods used to collect financial information regarding the parent company and its subsidiaries were consistently applied. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date.

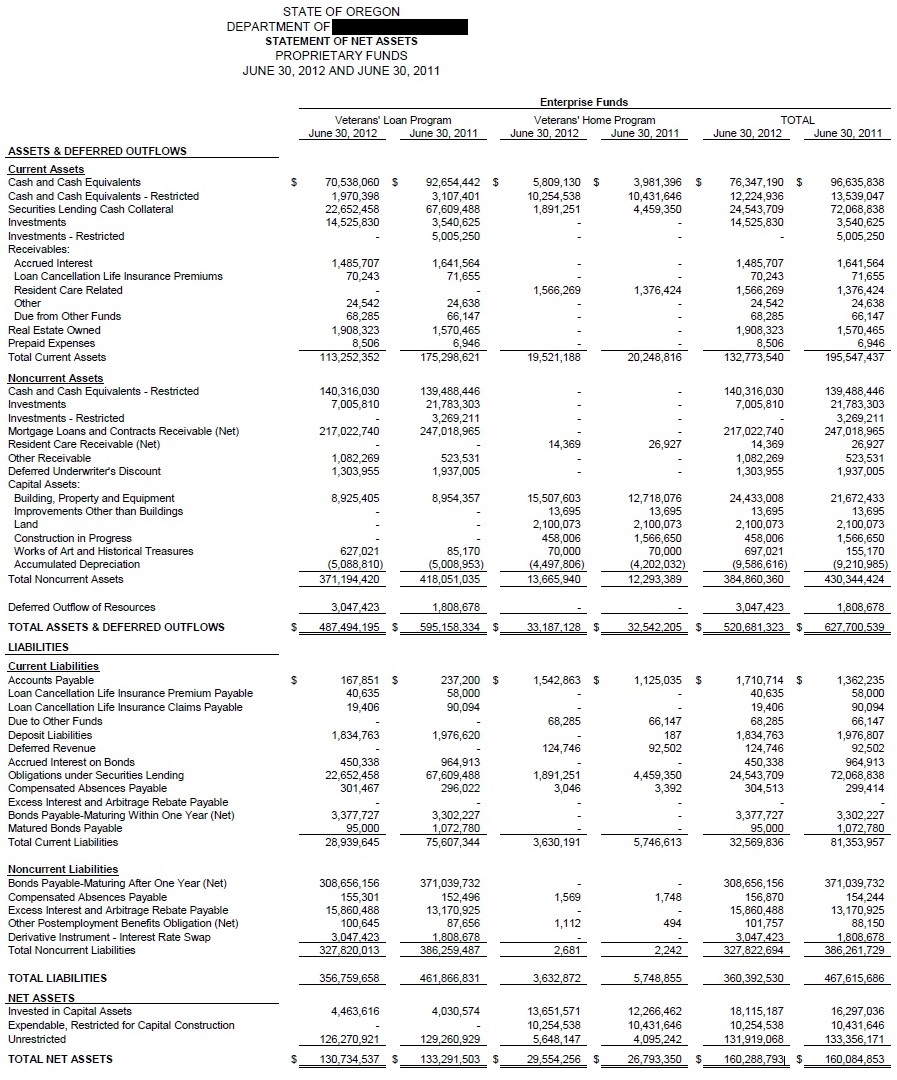

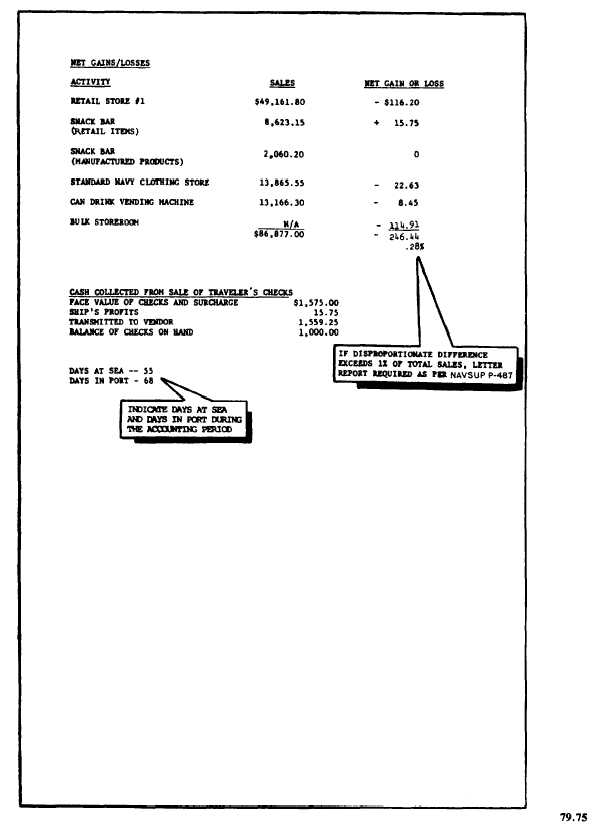

It is vital to track expenditures and profits separately as if each subsidiary were its own business. The combined financial statements comprise statement of comprehensive income, balance sheet, statements of changes in equity and cash flows and notes, prepared in accordance with international financial reporting standards as adopted by the eu, and further requirements in the danish financial It also highlights where there is consistency and diversity in applying ifrs standards and the approaches we have seen in practice.

The balance sheet is prepared using the following steps: Consider these steps when making a consolidated balance sheet: The preparation of consolidated financial statements is based on the assumption that a reporting entity and its consolidated subsidiaries operate as a.

In the case of a primary beneficiary of a vie, financial statements prepared in accordance with gaap would be consolidated financial statements. Additionally, a combined statement is logical in the case where two or more entities are under common control, but there is no parent company. Preparing a balance sheet requires expert knowledge to prepare a consolidated balance sheet as it involves many adjustments.

Often, the reporting date will be the final day of the accounting period. How do businesses prepare a consolidated balance sheet? Consolidate financial statements by creating a balance sheet that reflects a sum of net worth, assets and liabilities.

Determine a reporting date for the balance sheet. The accompanying basis for conclusions observes that combined financial statements may provide useful information in some circumstances, To prepare a combined financial statement, all entities/segments are under common control during the reporting period.

The financial statements of several firms within the same group are combined to portray the financial condition as a whole. The following definition of combined financial statements: Collect accounts that go on the balance sheet.

Remember that we have four financial statements to prepare: Determine the reporting date and period. A balance sheet determines the financial position of your.

The save plan ensures that if borrowers are making their monthly payments, their balances cannot grow because of unpaid interest. How to prepare a balance sheet. If a reporting entity concludes that consolidated financial statements are not required, it may still be appropriate to bring together the balance sheet, income statement, equity, and cash flow accounts of two or more affiliated companies into a single set of comprehensive financial statements (i.e., as a.

18.8 combined financial statements. It is normally presented as part of the consolidated financial statement of the parent or holding company and its subsidiaries. Recap on consolidated financial statements.

![Problem 33 Balance sheet preparation [LO32, 33] The following is a](https://img.homeworklib.com/questions/ed407e30-435c-11ea-87dd-89e7fcbab79e.png?x-oss-process=image/resize,w_560)