Heartwarming Info About Shareholders Equity Balance Sheet Example

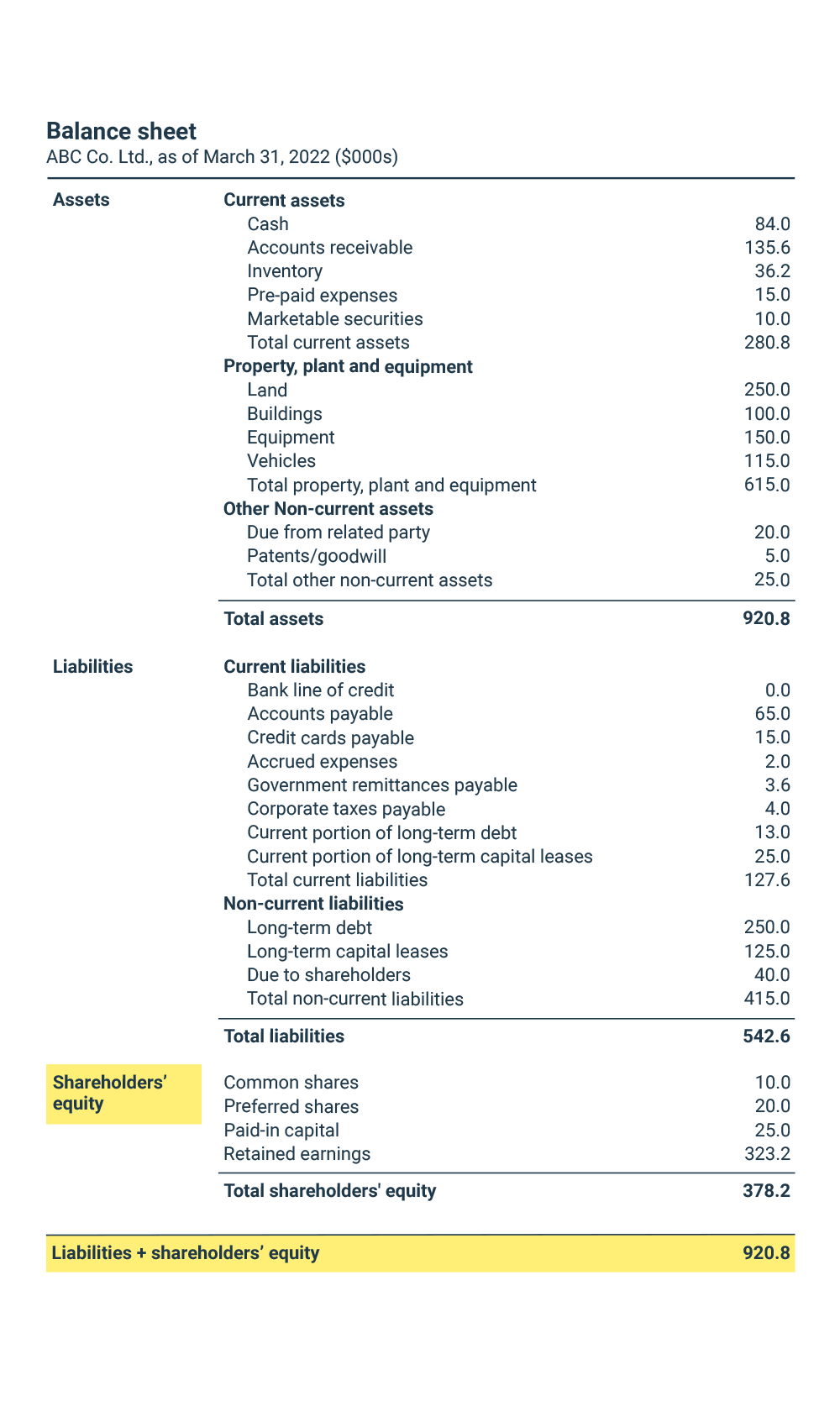

Abc company's shareholder equity is $1.68 million in this case.

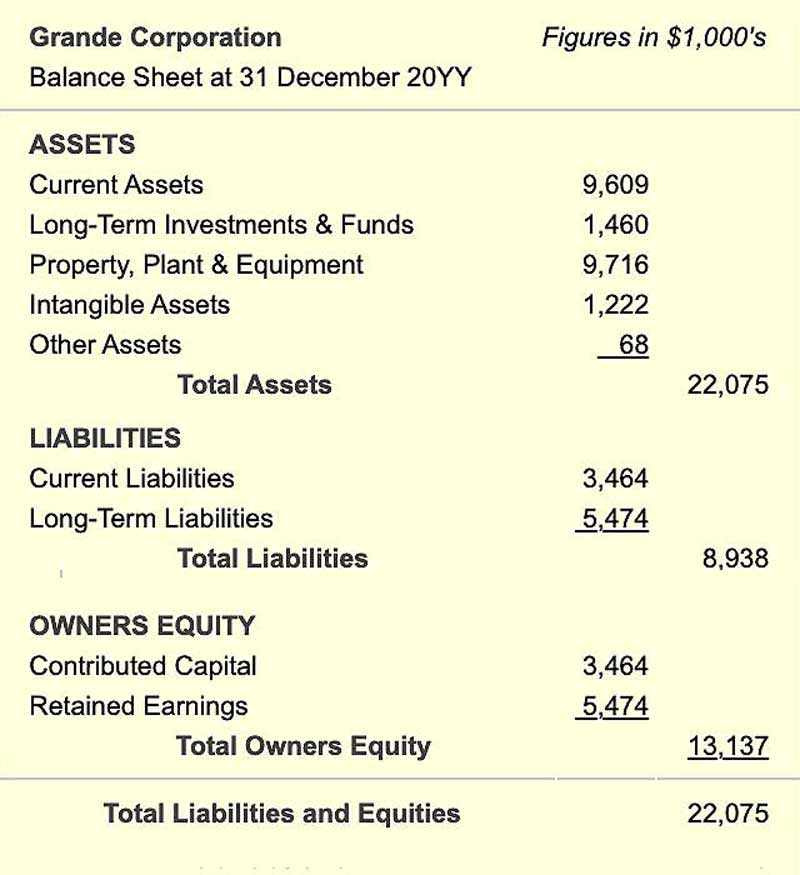

Shareholders equity balance sheet example. The way the business will present all that in its balance sheet will look something like this: The resources belonging to the company) must’ve all been funded somehow, and the two funding sources available. Assume abc company has $2.6 million in total assets and $920,000 in total liabilities.

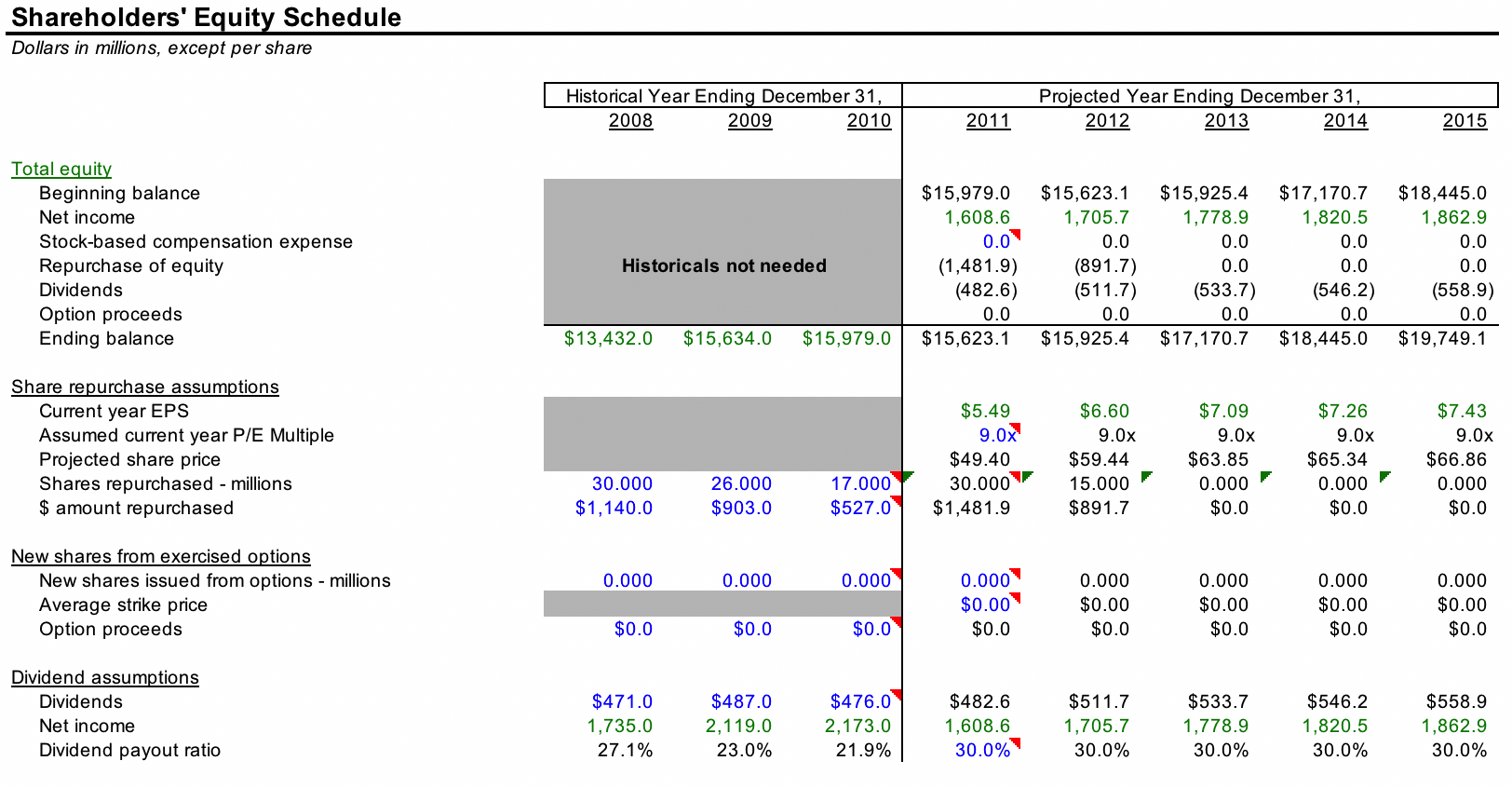

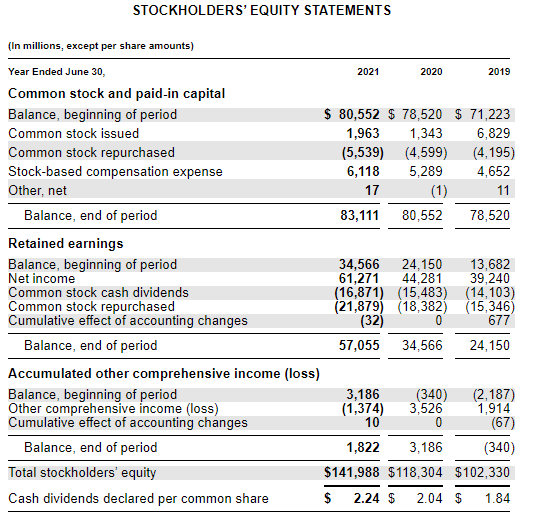

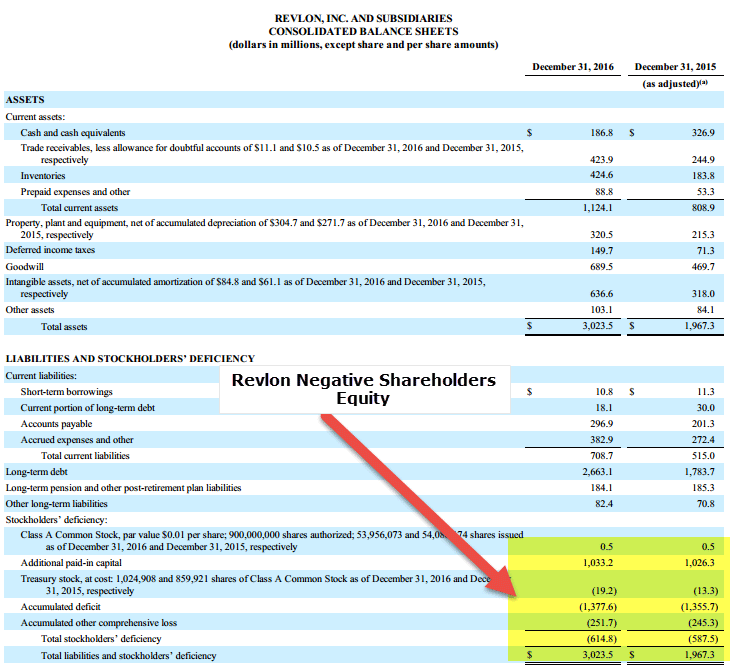

Shareholders' equity is listed on a company's balance sheet and measures the company's net worth. a screenshot below gives you a sneak peek of the template. Preferred stock, $100, $100 par (80,000 shares authorized, 10,000 shares issued) $1,000,000: Example of shareholders’ equity on a financial statement.

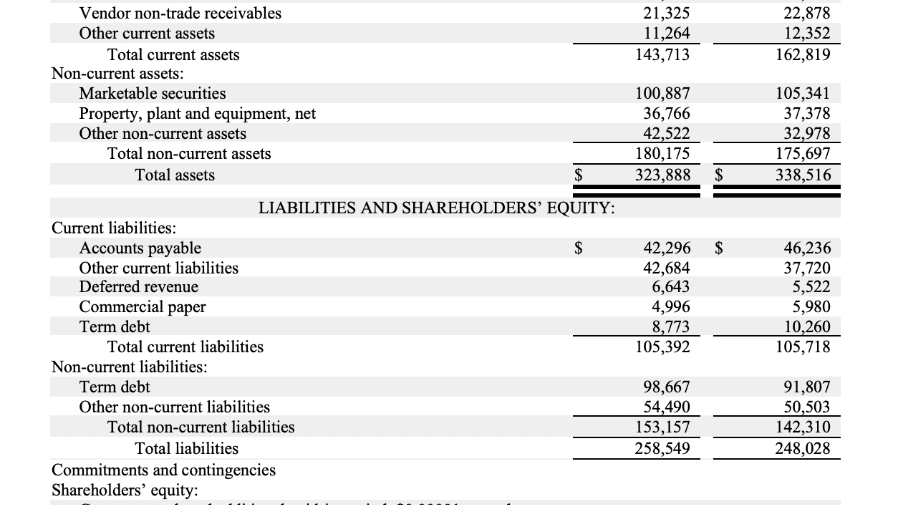

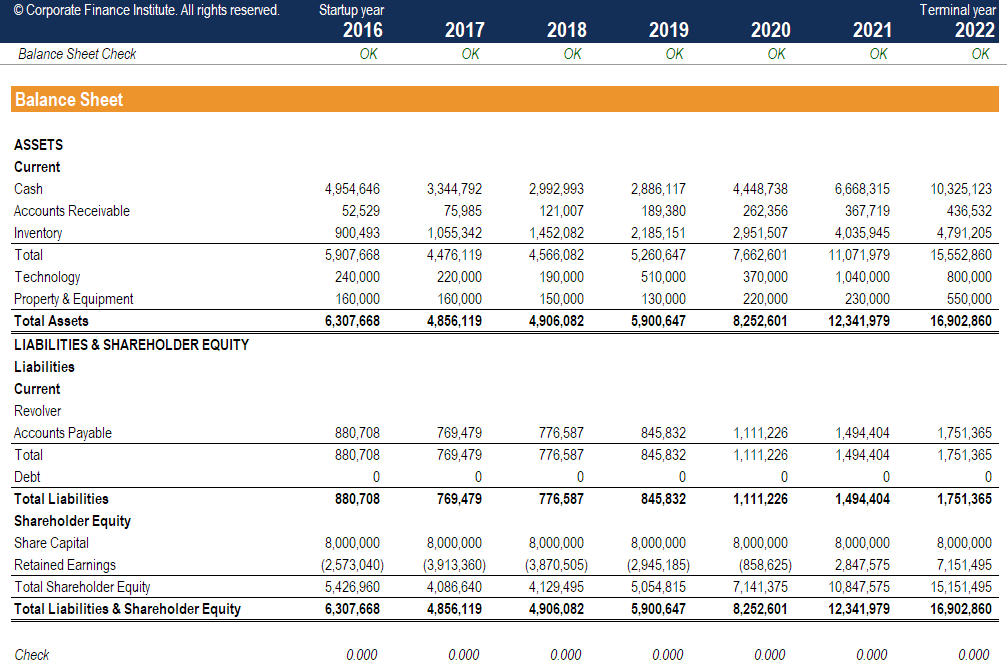

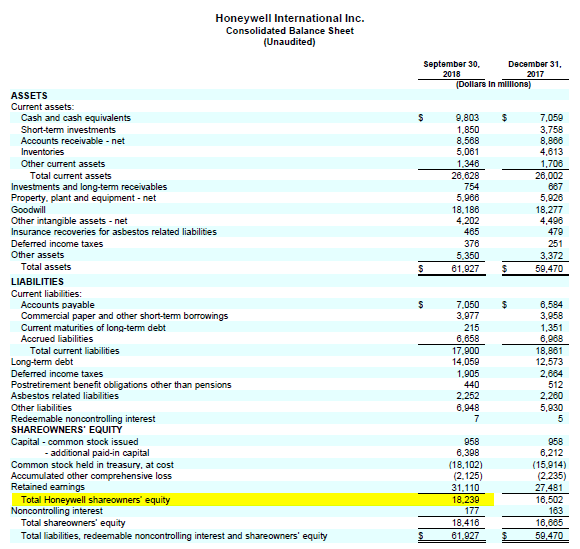

So, if a company had $2 million in assets and $1.2 million in liabilities, its stockholders' equity would equal $800,000. Equity, typically referred to as shareholders' equity (or owners' equity for privately held companies), represents the amount of money that would be returned to a company's shareholders. The balance sheet formula is a fundamental accounting equation that mentions that, for a business, the sum of its owner’s equity & the total liabilities is equal to its total assets, i.e., assets = equity + liabilities.

The formula for calculating se all the information needed to compute a company's shareholder equity is available on its balance sheet. View amazon’s investor relations website. Then, you would calculate total liability:

On the balance sheet below, shareholders’ equity has its own section, broken down into its four categories. That's because a company has to pay for all the. Everything you need to break into venture capital sign up to the insider's guide by elite venture capitalists with proven track records.

When added to liabilities, the total equals the value of the company’s assets. You can figure out the total se of a company using the. \text {assets} = \text {liabilities} + \text {shareholders' equity} assets = liabilities +shareholders’ equity this formula is intuitive.

Recommended articles key takeaways shareholder’s equity is the residual interest of the shareholders in the company, which indicates the extent of rights owners can exercise on the firm they have invested in. Balance sheet for a brand new business ltd as at this point in time You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios.

To find shareholders' equity, you would first calculate total assets: Here's an example of how shareholder equity works in practice. The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

Common stock, $25 par (50,000 shares authorized, 20,000 shares issued) 500,000: Includes common stock, preferred stock, and any paid in capital accounts including paid in capital for treasury stock. $500,000 (short term) + $1 million.

$2 million (current) + $1.3 million (fixed), which equals $3.3 million in total assets. The equity of the shareholders is adjusted to a certain amount on the balance sheet. Stockholders equity (b/s presentation, authorized, issued, outstanding shares, c/s & p/s) watch on the video explains we have 3 sections in stockholder’s equity:

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)