Beautiful Tips About Cash Inflow And Outflow Statement

A good cash inflow doesn’t necessarily mean you have higher profits.

Cash inflow and outflow statement. The cfs measures how well a. In the case of operations, cash outflow occurs when you are paying salaries to your employees and. Cash inflow is the money going into a business which could be from sales, investments, or financing.

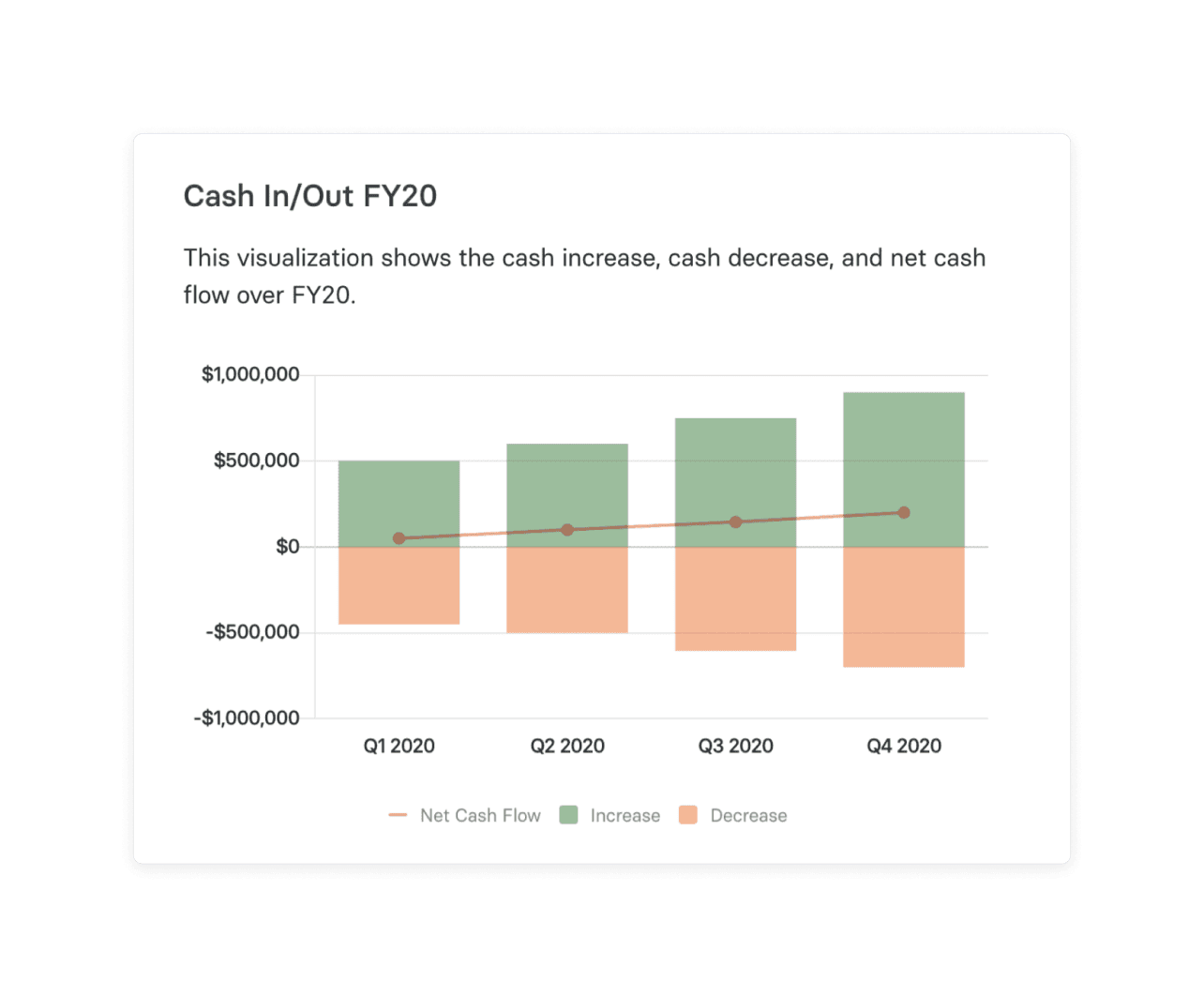

Cash inflow and outflow contribute to a company's changes in cash, which then adds to the opening balance for the cash flow statement's bottom line. It is defined as the movement of cash that contributes to the main costs associated with operations of the business, such as the purchase and sales of products and services. This analysis helps enhance financial performance.

A company’s ability to create value for shareholders is determined by its ability to generate positive cash flows. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period. The cash flow statement is typically broken into three sections:

A cash flow statement (cfs) is a financial statement that shows the inflow and outflow of cash in a company over a specified period. Understanding the difference between the two, and knowing how to calculate them, can help you make better decisions about spending, investments, and. Revenue and income) is enough to cover your financial obligations (i.e.

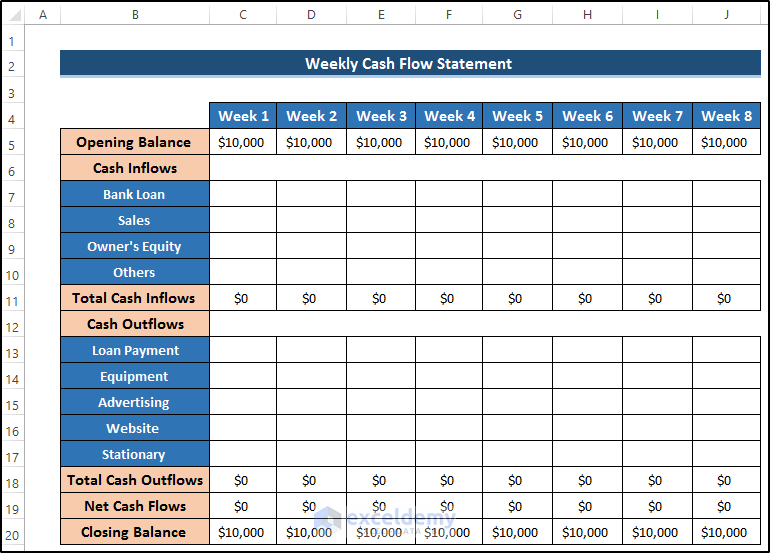

Cash received signifies inflows, and cash spent is outflows. Cash inflow defines the amount of money the company earns through any activity that leads to revenue generation. A cash flow statement should be generated to have a snapshot of the inflows and outflows of your company tools used for cash flow tracking

Payroll and other expenses) for a set period. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

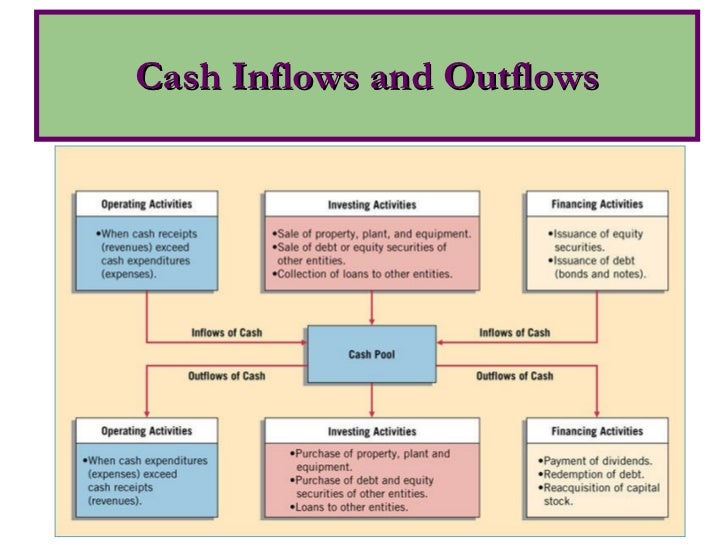

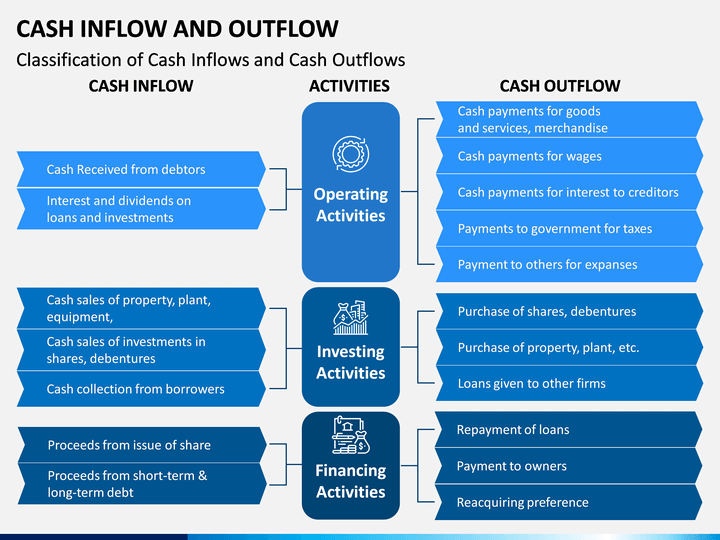

Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. They are the backbone of your company’s financial standing. A common example is the money generated from the sale of goods and services.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Cash inflow vs cash outflow: A cash flow statement is one of the quarterly financial reports publicly traded companies are required to disclose to the u.s.

Cash inflow is the exact opposite of cash outflow. There are three components of this formula: Cash inflows refer to receipts of cash while cash outflows to payments or disbursements.

By cash we mean both physical currency and money in a checking account. Securities and exchange commission (sec) and the. Cash inflow ensures your business doesn’t go bankrupt and can stay afloat.

-1.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)