Fabulous Tips About Employee Benefit Expenses In Balance Sheet

Recognise an expense when the entity consumes the economic benefit arising from the service provided by the employee.

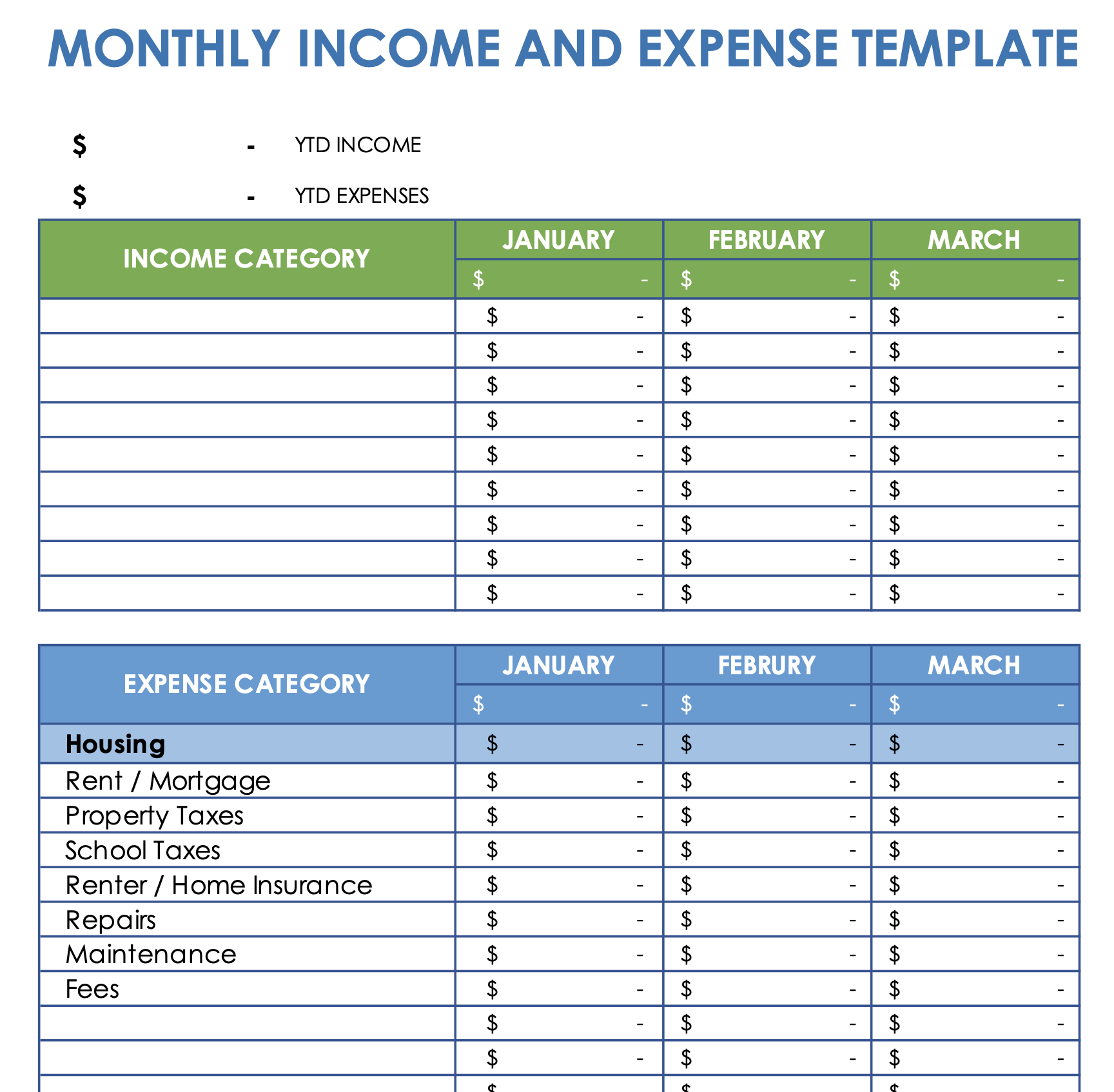

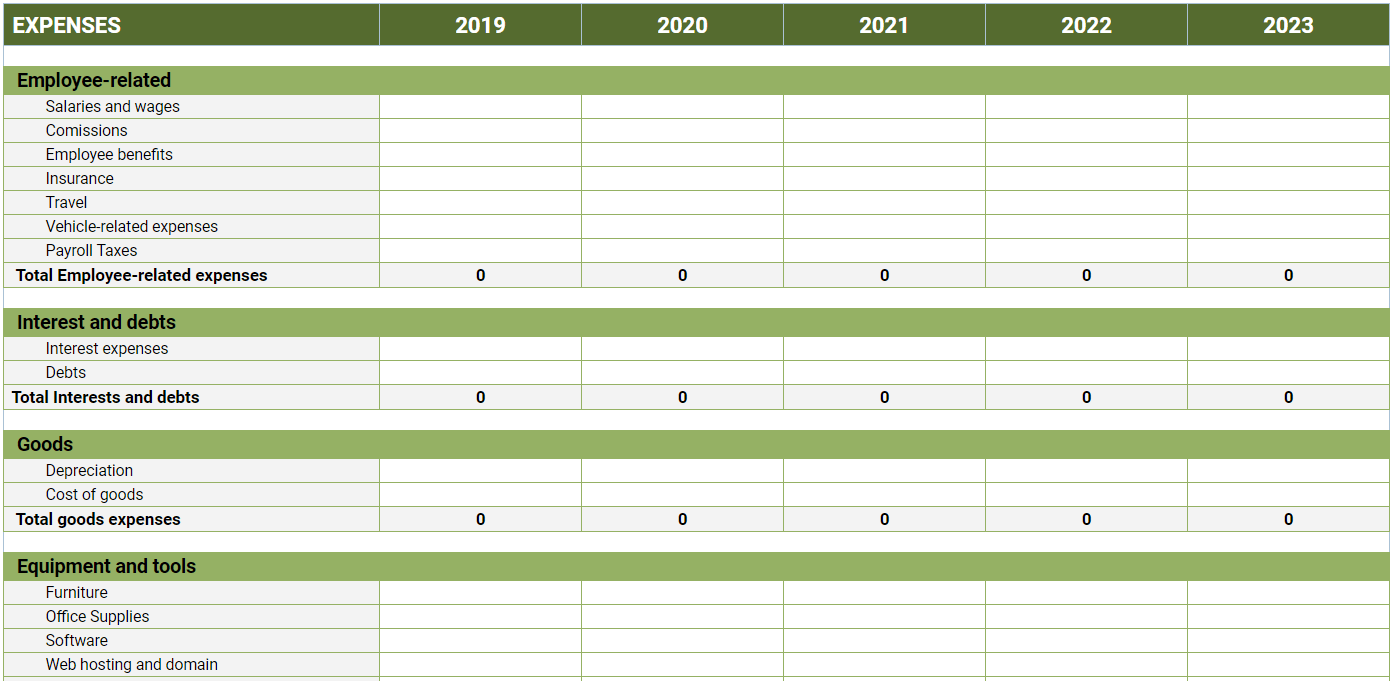

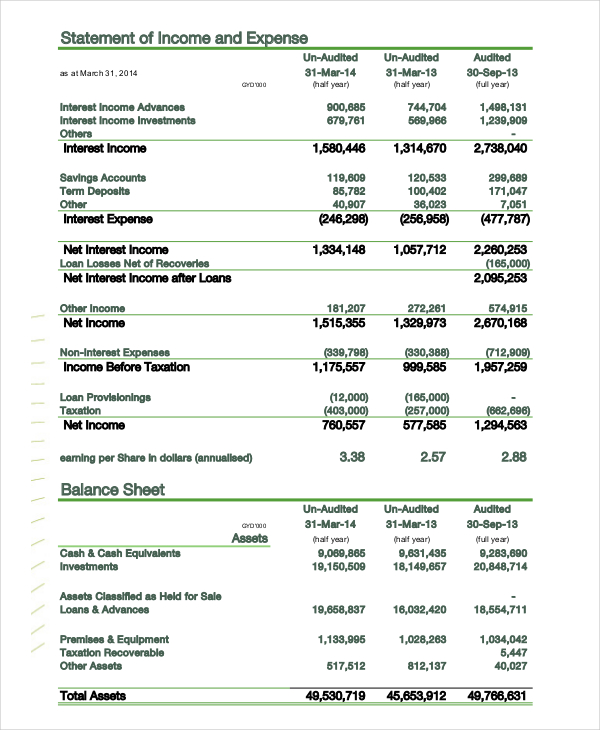

Employee benefit expenses in balance sheet. 30 nov 2022 us ifrs & us gaap guide there are a number of significant differences between us gaap and ifrs. Accounting standards as 15 employee benefits as 15 employee benefits updated on: Contractors costs include expenses related to contractor staff not on the company’s.

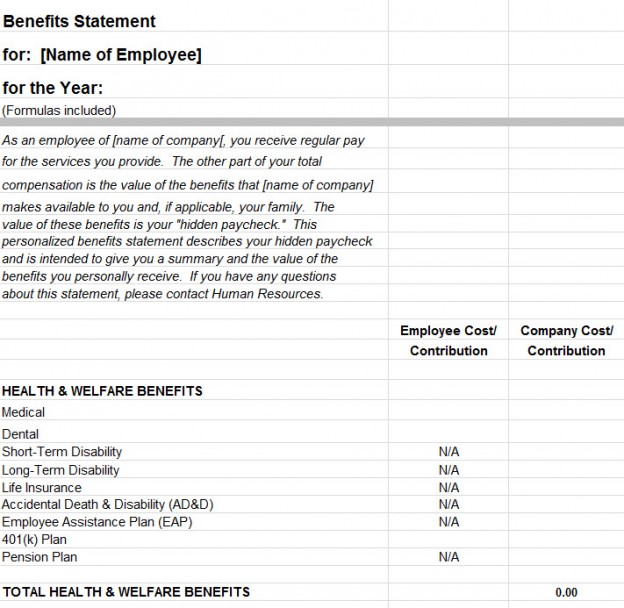

The amount to be recognized as a defined benefit liability in the balance sheet should be the net total of the following amounts: The amount recognised will be the following: Information with respect to employee benefits expenses are detailed as follows:

Present value of defined benefit obligations and current. Jun 7th, 2021 | 7 min read contents [ show] as 15. The amount recognised in the balance sheet could be either an asset or a liability.

Balance sheet recognition. Employee benefits are all forms of. For example, when an employee.

This is typically recognised as an expense, unless it. Expenses employee benefit expenses 14 91,814 85,952 cost of equipment and software licences 15(a) 1,462 1,905 finance costs 16 637 924 depreciation and amortisation. As the name implies, employee benefit expenses refer to expenses incurred by the company to benefit its employees.

5.1 expense recognition—employee benefits publication date: 22 rows ias 19 employee benefits (amended 2011) outlines the. Ias 19 employee benefits in april 2001 the international accounting standards board (board) adopted ias 19 employee benefits, which had originally been issued by the.

As a principle, assets are held externally. Interest expense or income will now be net interest on the net defined benefit liability (asset), calculated by applying the discount rate to the net. Wages, salaries and social security contributions;

The aicpa employee benefit plans audit quality center advisory, valuing and reporting plan investments, provides guidance regarding plan management responsibilities of.

![[Template] Benefícios Corporativos descubra a satisfação dos funcionários](https://s3-us-west-2.amazonaws.com/blog.convenia.com.br/wp-content/uploads/2019/03/20111238/employee-benefits.png)