Lessons I Learned From Tips About Dividend In Cash Flow Statement

The cash flow statement is a financial report that provides detailed information about a company's cash inflows and outflows over a specific period.

Dividend in cash flow statement. Find out where dividends are recorded and how they impact a company's financials. Here’s how the process works in a little more detail: Continuing with the earlier example, if the company pays the.

Declining prospects within cash flow statements can often be precursors to lower earnings or stalled dividend growth. Using a balance sheet and income statement. Dividends on the cash flow statement.

By doing this, a lender or investor reviewing the statement can. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of. Adding up the cash flow from preferred and common dividends tells you how much of the company's capital goes toward shareholders payments.

55 17 importance of the cash flow statement for dividend. Dividends are announced by the directors of the company. The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of.

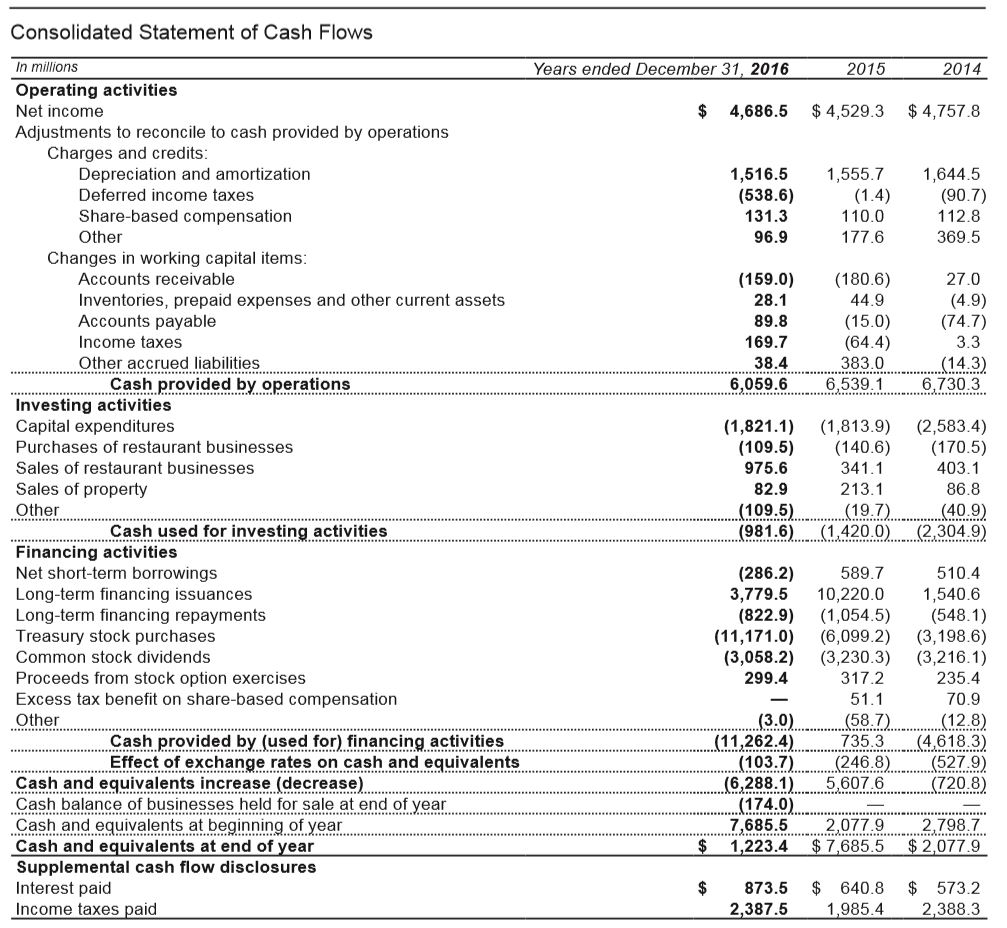

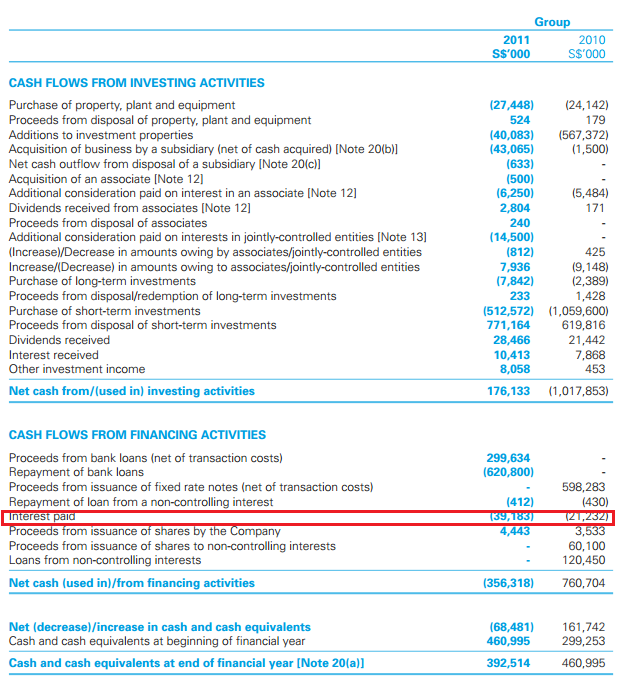

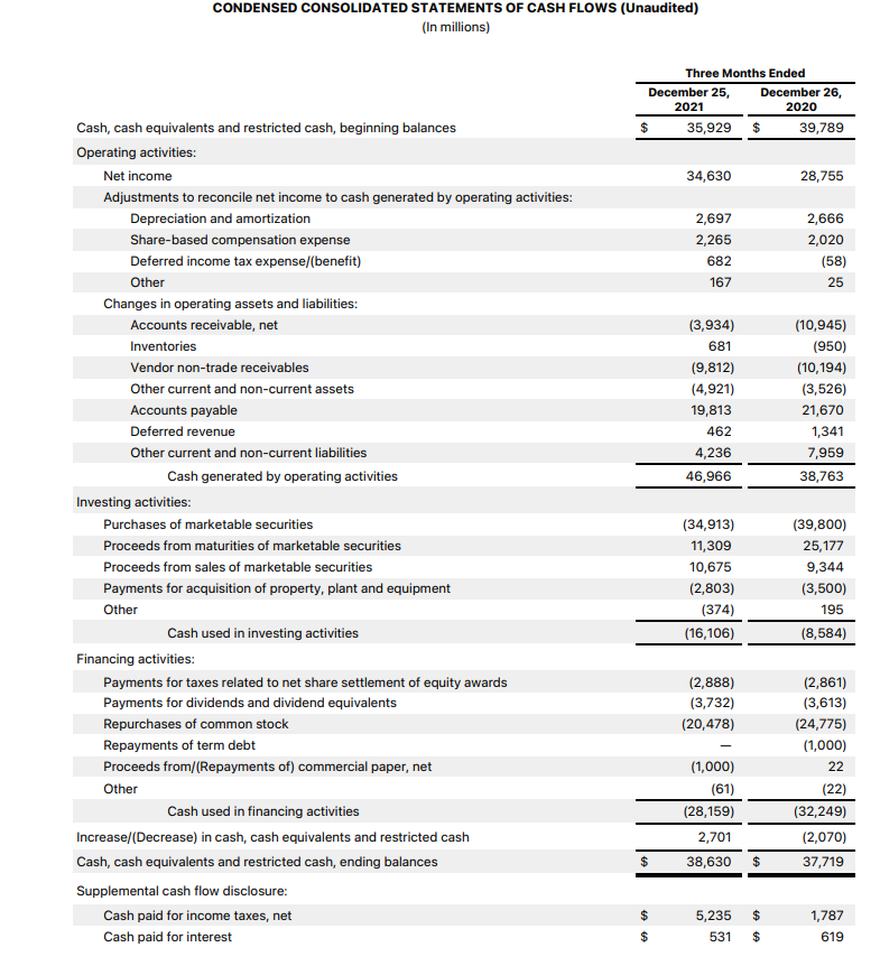

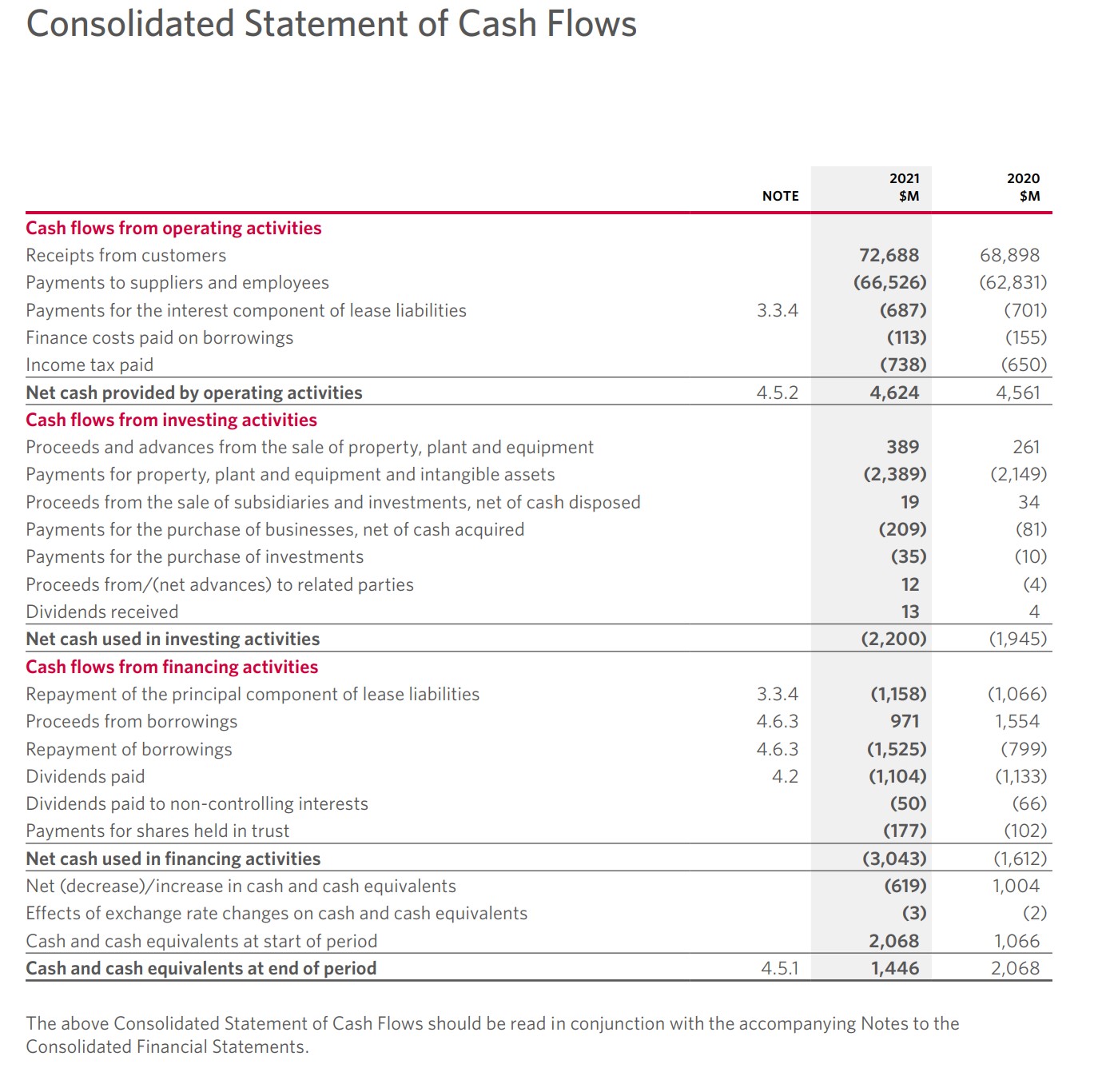

Dividends paid may be classified as a financing cash flow because they are a cost of obtaining financial resources. The above consolidated statements of cash flows should be read in conjunction with the accompanying notes. 1 4 6 7 10 13 16 reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency.

Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and. The financing activities section highlights. Dividends are typically found in the financing activities section of the cash flow statement.

On the balance sheet, your retained earningsare. Importance of the cash flow statement for dividend investors | stablebread 04 : Cash flow from financing (cff) activities is a category in a company’s cash flow statement that accounts for external.

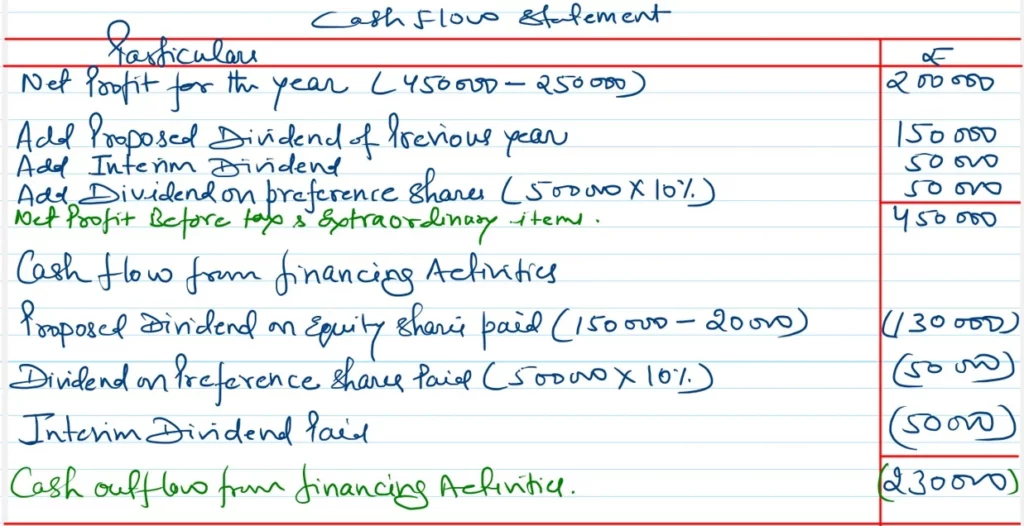

(a) requires entities to classify each type of cash flow (dividends paid, dividends received, interest paid and interest received) in a single section of the statement of cash flows;. Most companies report their dividends on a cash flow statement, in a separate accounting summary in their regular. This video shows how to calculate the amount of dividends for the financing section of the statement of cash flows.

A cash dividend is the distribution of funds or money paid to stockholders generally as part of the corporation's current earnings or accumulated profits. Alternatively, dividends paid may be classified as a. The amount of dividends can be determine.

Statement of cash flows example. Cash flow from financing activities: On the cash flow statement under financing activities, the company records:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)