Ace Info About Prepaid Advertising On Balance Sheet

How to find prepaid expenses on the balance sheet?

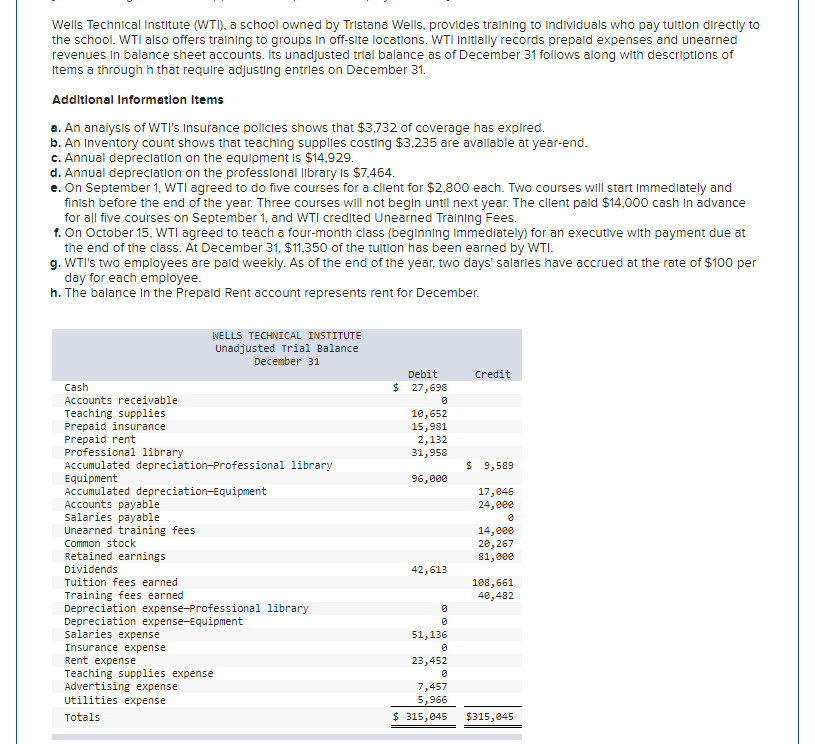

Prepaid advertising on balance sheet. Advertising costs are sometimes recorded as a prepaid expense on the balance sheet and then moved to the income statement when sales relate to those. A prepayment of advertising like any prepayment is an asset of the business and is included in the. Prepaid rent refers to the advance payment made by a tenant to a landlord for renting a property.

Likewise, there is no expense in. The gaap matching principle prevents expenses from being recorded. The prepaid advertising expense is recorded as an asset on the balance sheet until the advertising campaign starts, at which point it is recognized as an.

The concept most commonly applies to administrative activities, such as prepaid rent or prepaid advertising. It will increase the advertising expense $ 50,000 on income statement. In this journal entry, the prepaid advertising expense is a current asset on the balance sheet, in which its normal balance is on the debit side.

The journal entry for the prepayment of advertising would involve a credit to cash, as cash is paid out, and a debit to the prepaid advertising account. A prepayment of the cost of ads that will air in the future should be recorded in a current asset account such as prepaid advertising. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet.

Let’s say you prepay six month’s worth of rent, which adds up to $6,000. The cash a business pays for an advertising campaign that has yet to begin or is still running is considered a prepaid expense for the advertiser and reflected as an. Then, as the month goes by, the prepaid.

It is recorded on the balance sheet as an asset. On the balance sheet, prepaid rent is classified as a current asset and is presented under the “prepaid expenses” or “other current assets” section. When the ad is aired, the amount must be.

Prepaid expenses, also known as prepaid assets or deferred expenses, are payments made by a company in advance for goods or services that will be received in. Prepaid advertising is a current asset account, in which is stored all advertising that was paid for in advance but not yet consumed. Prepaid advertising, representing payment for the next quarter, would be reported on the balance sheet as a(n) a.

When you prepay rent, you record the entire $6,000 as an asset on the balance sheet. A marketing agency prepays for a digital advertising campaign, paying $10,000 in advance. When the advertising occurs the prepaid advertising is.

Facebook.com has been visited by 100k+ users in the past month Some of these examples are given below: Prepaid advertising definition a current asset that reports the amount paid for advertising that has not yet taken place.

The accounts payable $ 50,000 will be present on the balance sheet. It represents the portion of rent that has been paid in. Prepaid advertising is an asset that has been paid in advance.