Casual Info About Statement Of Earnings Hmrc Online

Hmrc statements can be viewed online through your personal tax account 1.

Statement of earnings hmrc online. This means the total sum of. Are you a uk business owner feeling overwhelmed by a statement of earnings from hmrc? My girlfriend needs to provide a statement of earnings for her new mortgage (1st mortgage) to the mortgage supplier as she gets paid cash.

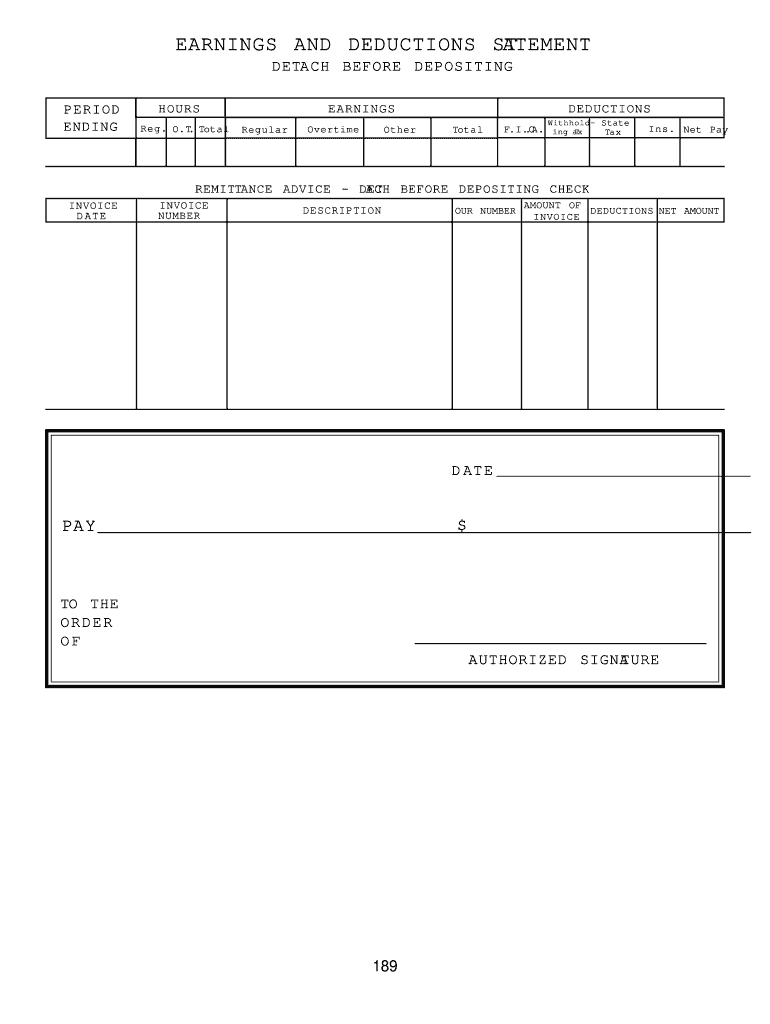

Your taxable income from all sources that hmrc knew about at the time that it was. A statement of earnings is completed by an employer, and includes details of an employee’s earnings, tax paid, and national insurance contributions. A statement of earnings is a document created by a business detailing the net income within a period of time.

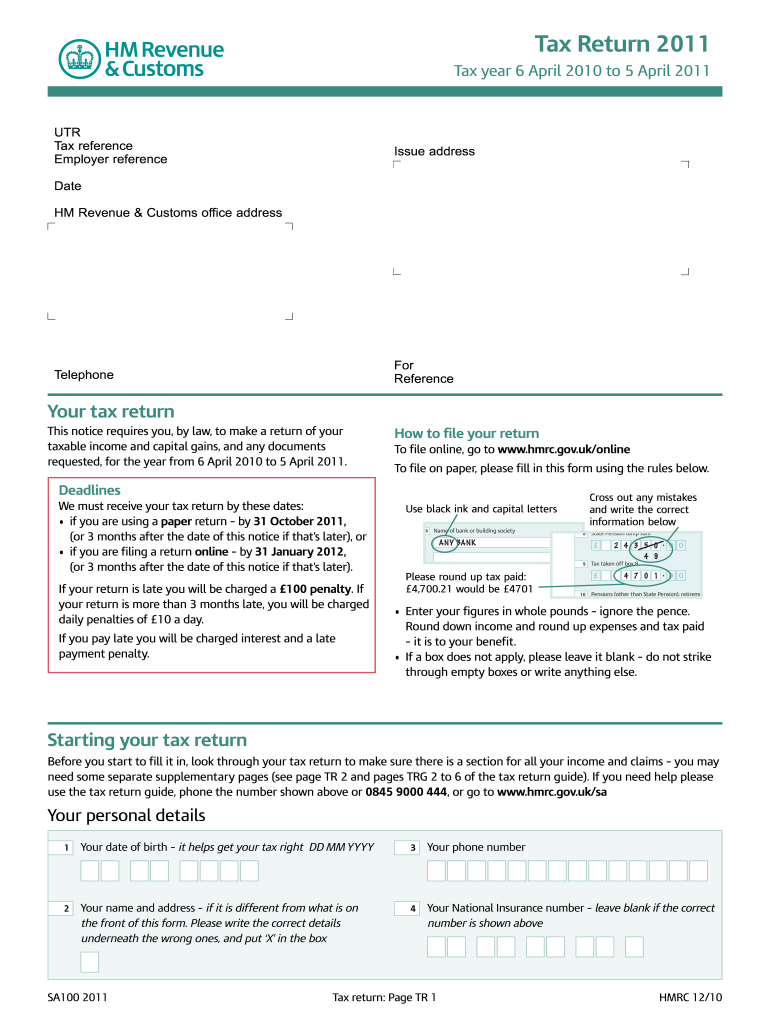

Check your tax code and personal allowance. If you are a member of her. Hmrc’s statement of earnings, also known as form l17, is an important document that all employers are required to submit.

Please ask your employer to fill in this form, stamp it with their stamp and return it to you. This report sets out how we have. Read guidance on preparing your confirmation statement.

Your personal tax account 2. The hmrcapp once you’ve signed in, you’ll need to navigate to your pay as you earn (paye) income tax records to get your employment history. Statement of earnings this form must be completed in ink.

It details how much money an. Login to your personal tax account 2. Hm revenue and customs (hmrc) deals with the tax and payments affairs of virtually every business and individual in the uk.

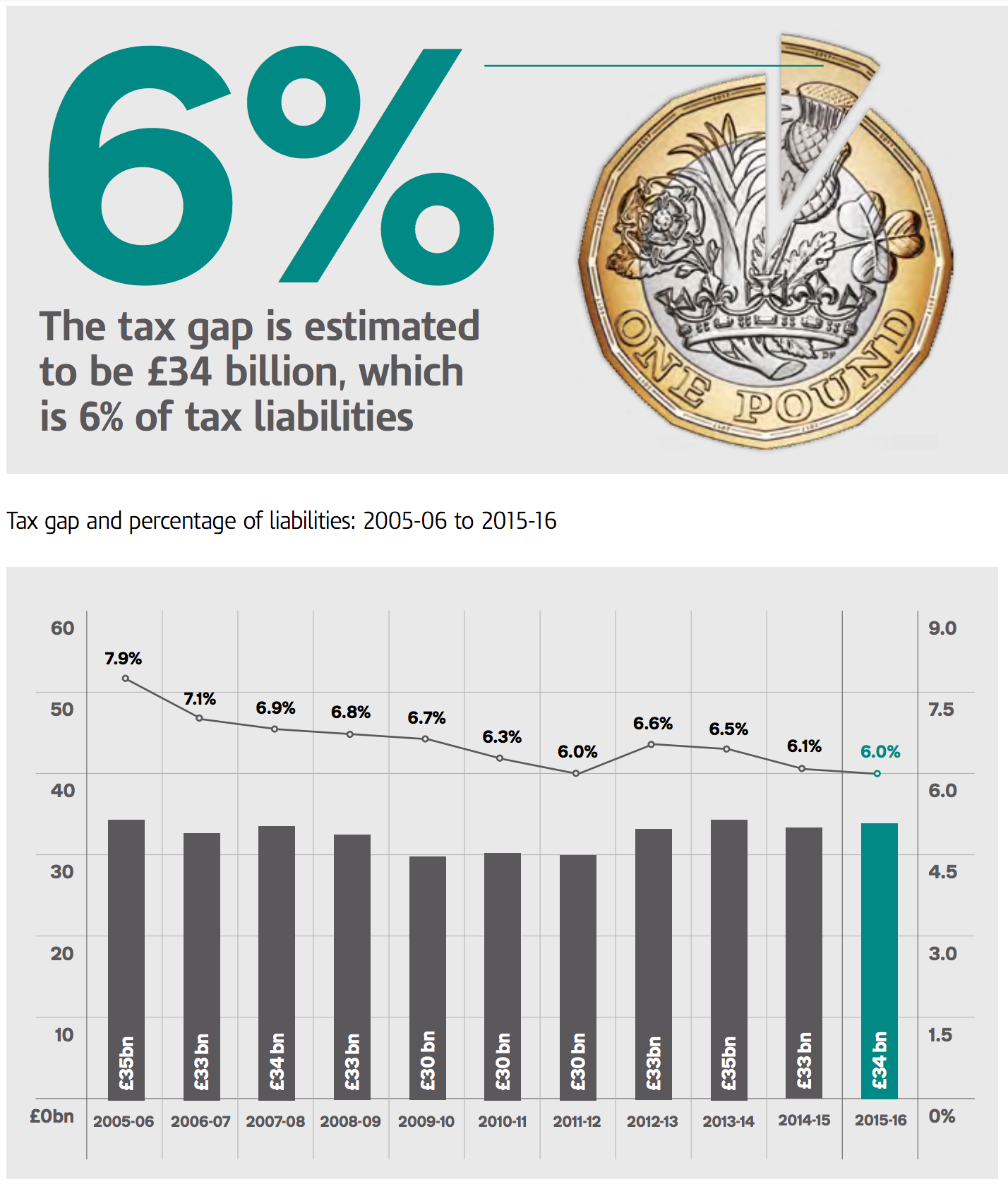

If you do not have these, you can. Use this service to view your annual tax summary. This is a joint release between hmrc and the office for national statistics (ons).

A statement of your earnings, including overtime, bonus or commission, for the last 3 months. You can get a record of the current and past 5 years’ employment using: If all you're doing is selling goods online, firms will only pass on data to hmrc automatically if you're selling 30 or more items a year or have total earnings.

The statement of earnings provides an oversight of. Yes, employers can provide the i17 statement of earnings electronically, such as through email or an online portal, as long as the employee has access to it and. This month includes a breakdown of payrolled employees and their pay by region.

You’ll need a companies house password and authentication code. Sign in or set up use your personal tax account to check your records and manage your details with hm revenue. Verify using one of the methods listed.