Outrageous Tips About Gaap Accounting For Unrealized Gains And Losses On Investments

Here's how companies should account for unrealized capital gains, according to gaap principles.

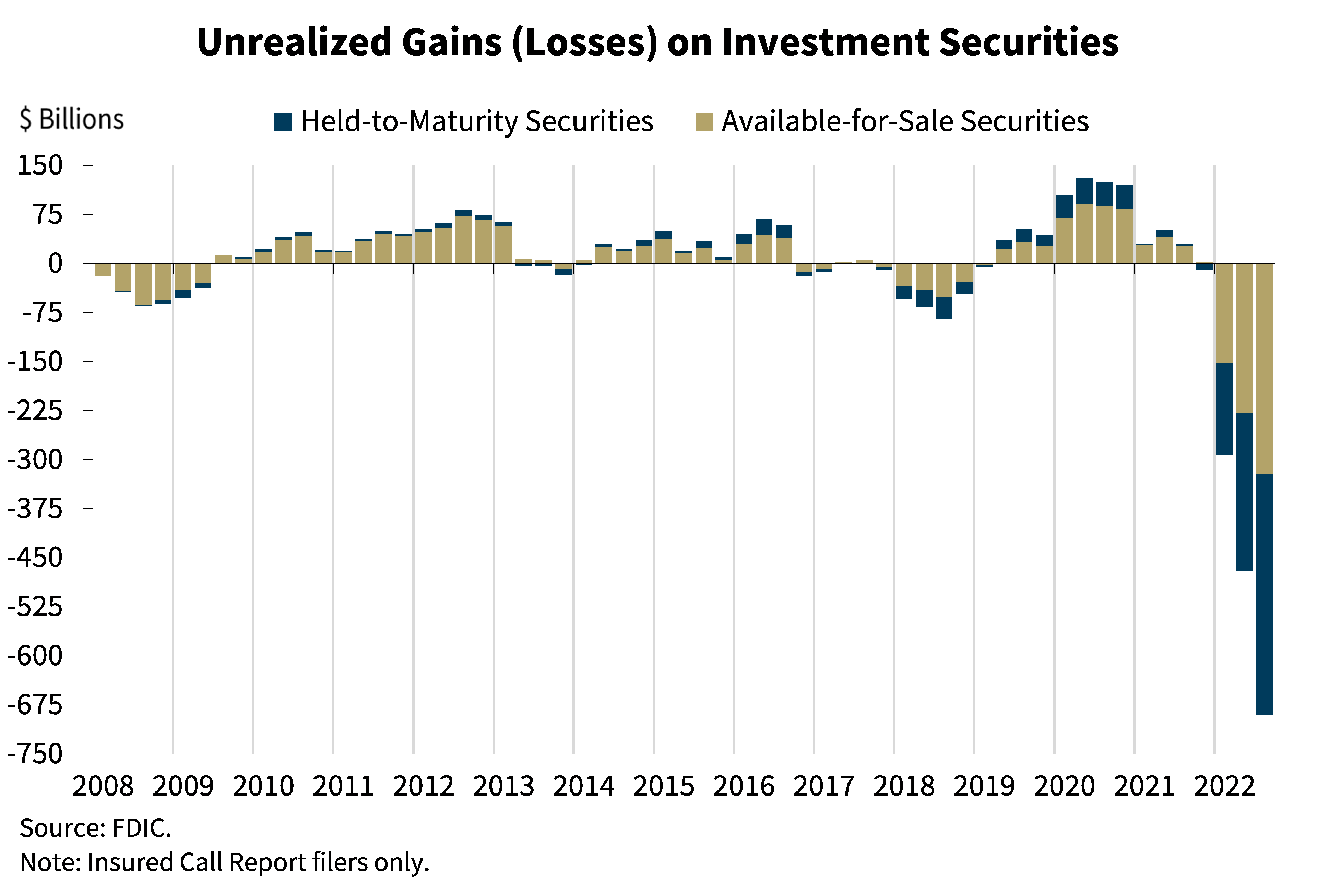

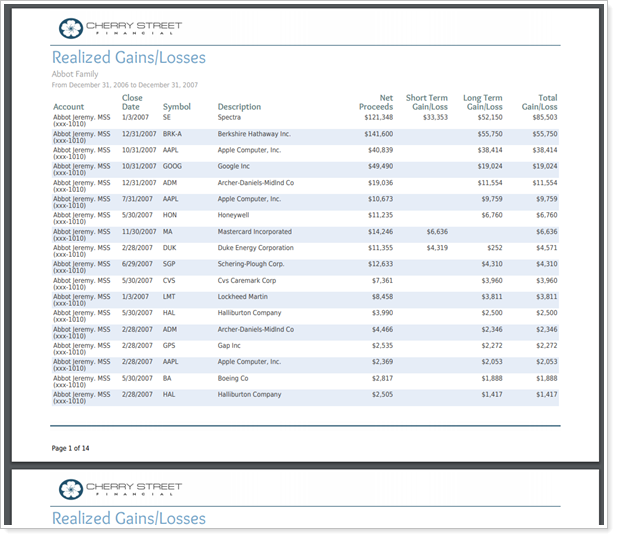

Gaap accounting for unrealized gains and losses on investments. View a — first report the unrealized gain or loss as a. Unrealized gains and losses accounting is a way for companies to account for their investments. Inclusion of realized gains (losses) on natural gas derivative instruments would have increased average price realizations by $0.06 per mcf for the fourth quarter.

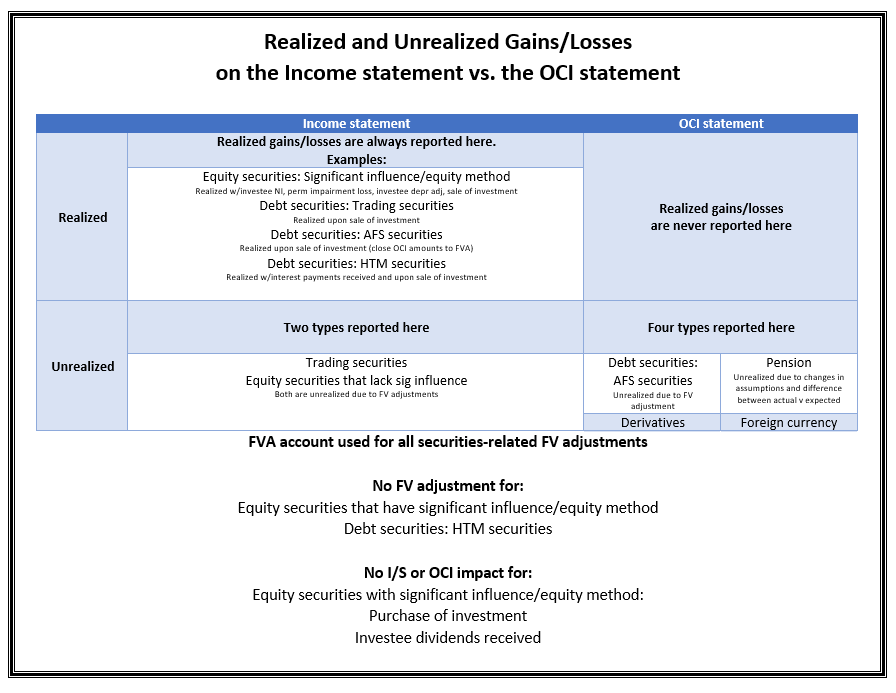

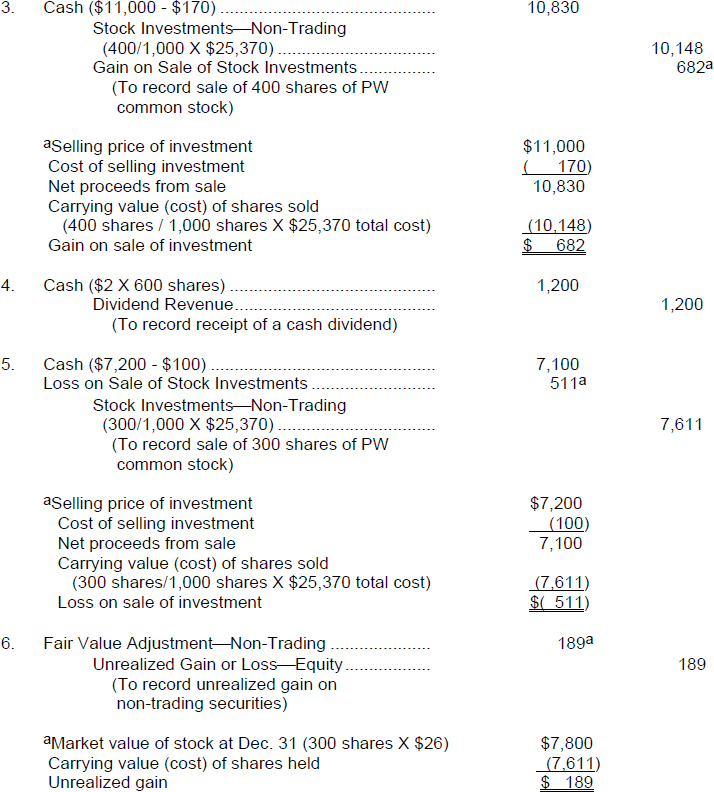

There are several different methods for achieving this under gaap, depending on what type. Journal entry for unrealized loss on investment. As “available for sale”, a portion of the investment return is reported in other comprehensive income after the performance indicator.

Generally accepted accounting principles (us gaap), which. Operating earnings remove the impact of realized and unrealized gains and losses that run through income statements, thus focusing on underwriting results and. Unless explicitly restricted by donor stipulation or by law, realized and unrealized gains.

For small investments by a small investment, we. The aggregate related fair value of investments with unrealized losses; Keep in mind that not all investments will have.

Unrealized (gains) losses on investments 252 (85) 173 20 unrealized losses (gains) on borrowings 44 101 102 (12) income available for designations $ 605 $ 237 $ 998 $ 167. If a company owns an asset, and that asset increases in value, then it may intuitively seem like the company earned a. | accounting & bookkeeping | accounting by jared lewis unrealized gains occur in the investment world when your investment gains in value but you don't cash it in.

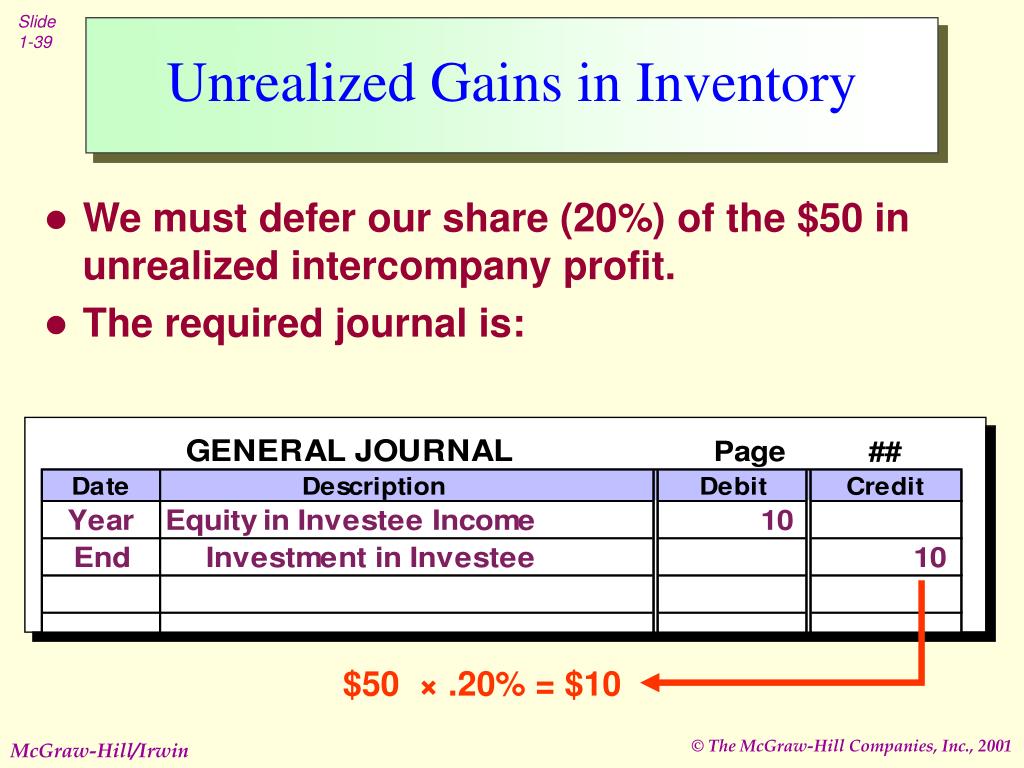

The aggregate amount of unrealized losses (that is, the amount by which amortized. There are two methods of accounting for an unrealized gain or loss on a security during the period in which it is sold. In other words, the fair value of the equity investments could be “parked,” with unrealized gains and losses not recognized in net income until the investments were.

They do not need to be reported on tax returns until. An unrealized gain is an increase in the value of an asset or investment that an investor has not sold, such as an open stock position. Fair value option —accepted accounting principles (“gaap”) now allows fair value accounting for bonds.

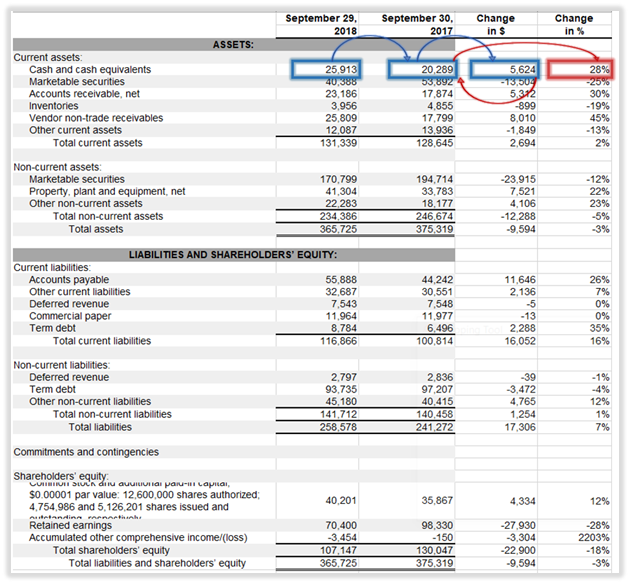

Investments 1,158,000 677,000 property and equipment, net 151,000 207,000.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)