Can’t-Miss Takeaways Of Info About Cost Accounting Income Statement

Within an income statement, you’ll find all.

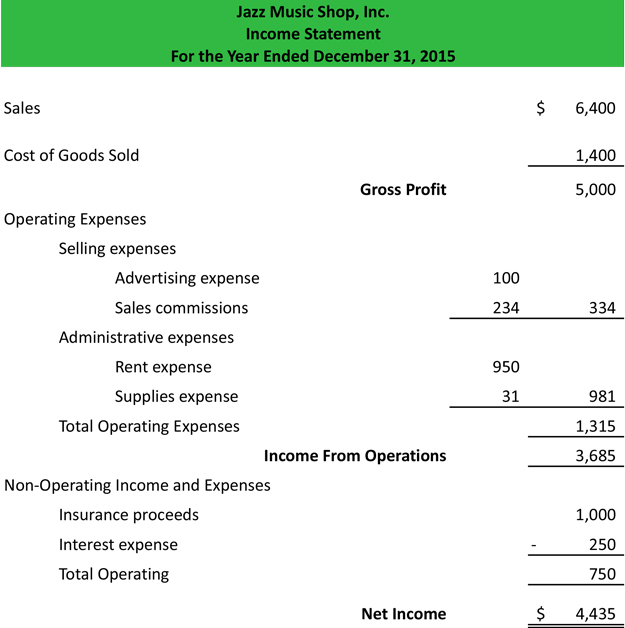

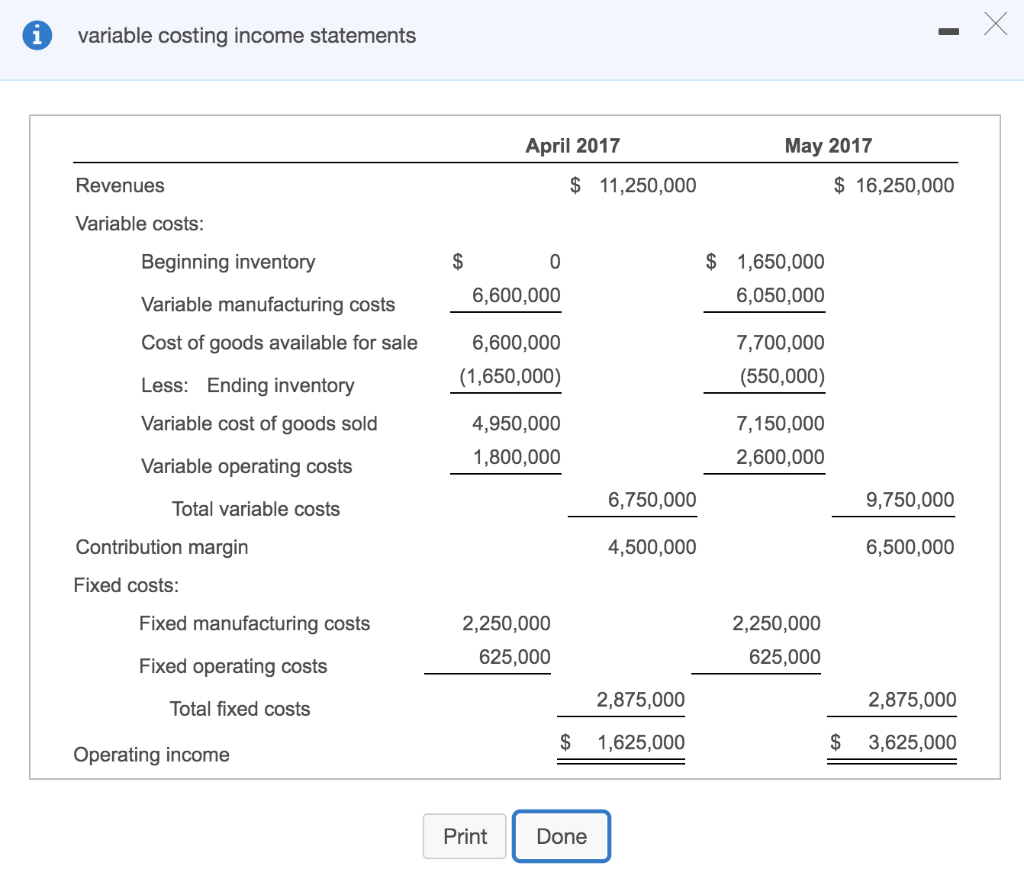

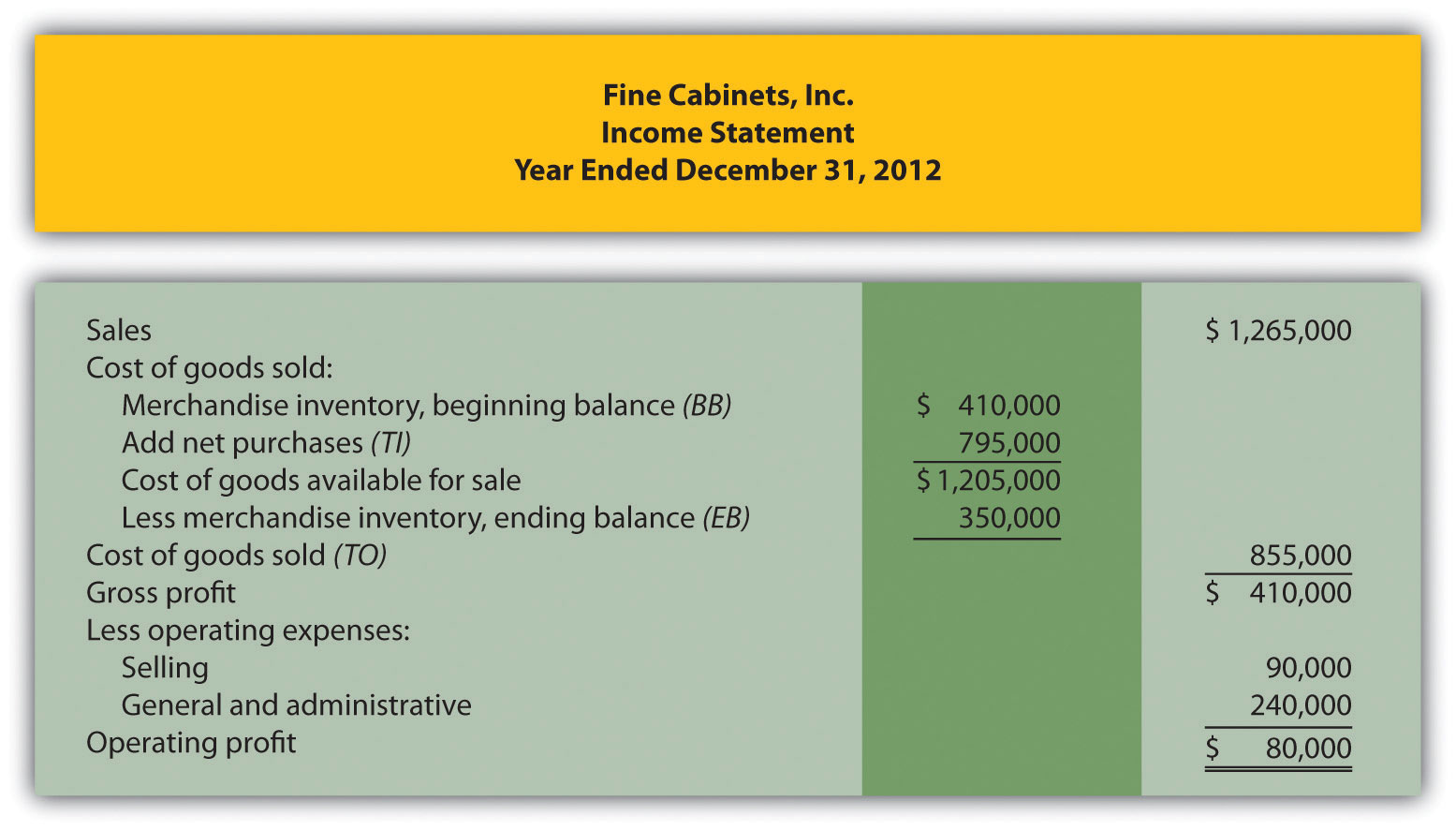

Cost accounting income statement. Trump to pay in his civil fraud trial might seem steep in a case with no victim calling for redress and no star witness pointing. This income statement looks at costs by dividing costs into product and period costs. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

The $355 million penalty that a new york judge ordered donald j. For example, in june a retailer purchased and paid for products at a cost of $6,000. Cost accounting is a form of managerial accounting that aims to capture a company's total cost of production by assessing the variable costs of each step of production as well as fixed.

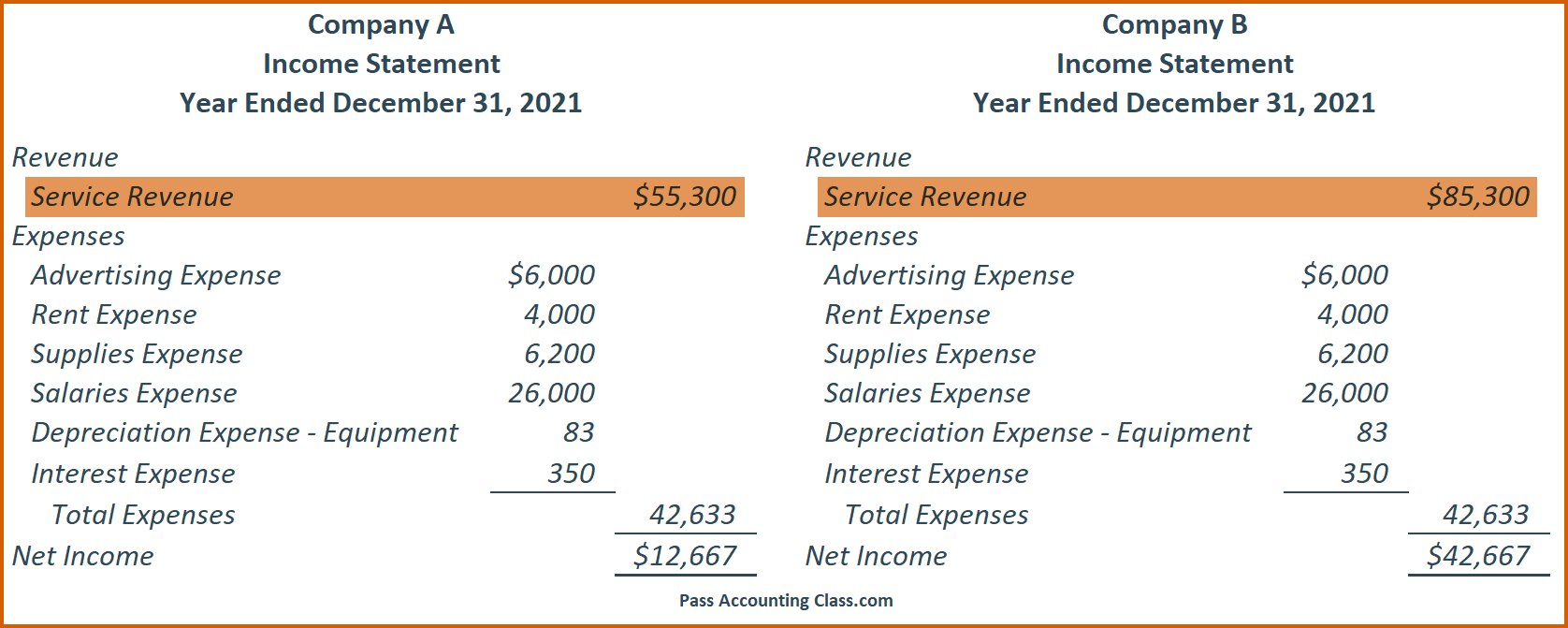

Many key fundamental ratios use information from the income statement. Companies can choose from several accounting methods to decide the cost of each item in cogs, and the method they choose can significantly impact cogs. The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period, as.

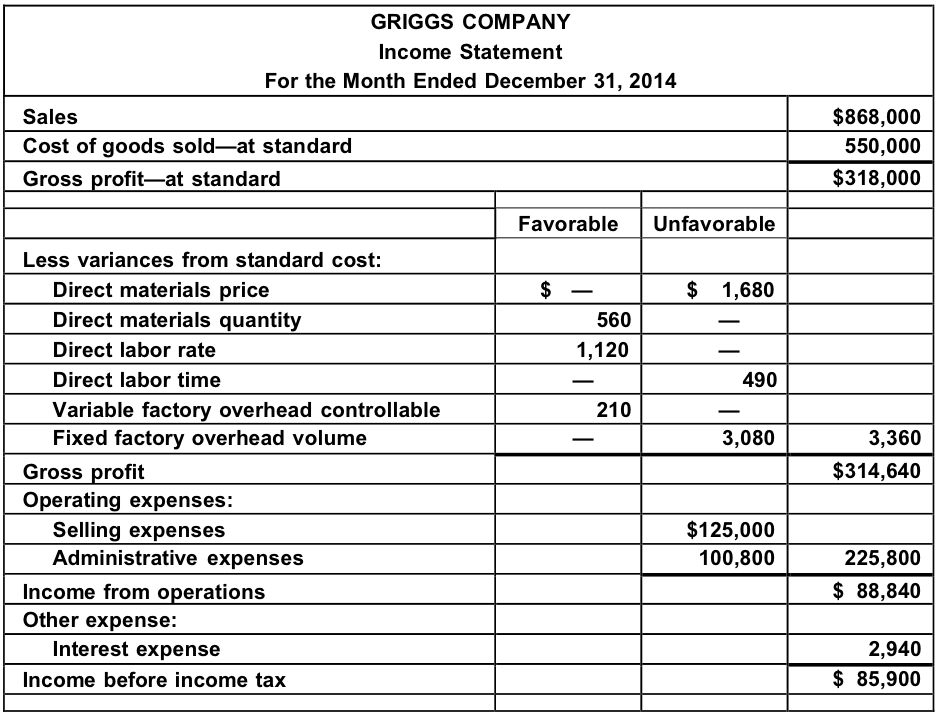

The traditional income statement, also called absorption costing income statement , uses absorption costing to create the income statement. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. Standard cost, spending variance, efficiency variance part 5

Expenses are the costs and expenses incurred to earn the company's revenues during the period of the income statement. Typical periods or time intervals covered by an income statement include: The three main elements of income.

Income statements or profit and loss accounts are financial statements used to calculate the financial health of the company. An income statement is a financial report detailing a company’s income and expenses over a reporting period. B from the company’s balance sheet at may 31.

Part 1 introduction to standard costing, sample standards table, direct materials purchased: The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. It tells the financial story of a business’s operating activities.

The income statement primarily focuses on a company's revenues and expenses during a particular period. Once expenses are subtracted from revenues, the statement produces a company's. A new york judge on friday handed donald j.

They often go first in income statements and cash flow statements. Year ended december 31, 2022 year ended june 30, 2022 nine months ended september 30, 2022 The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.

The income statement presents the financial results of a business for a stated period of time. What is an income statement? The concept of cost accounting organizes the costs involved in the production of goods and delivery of services, helping firms analyze the data and keep track of the income and expenditure of the company.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)