Sensational Info About Pro Forma Report

They are most commonly used to show a company’s financial statements including the effects of a planned m&a deal, however, they can also be used in other scenarios.

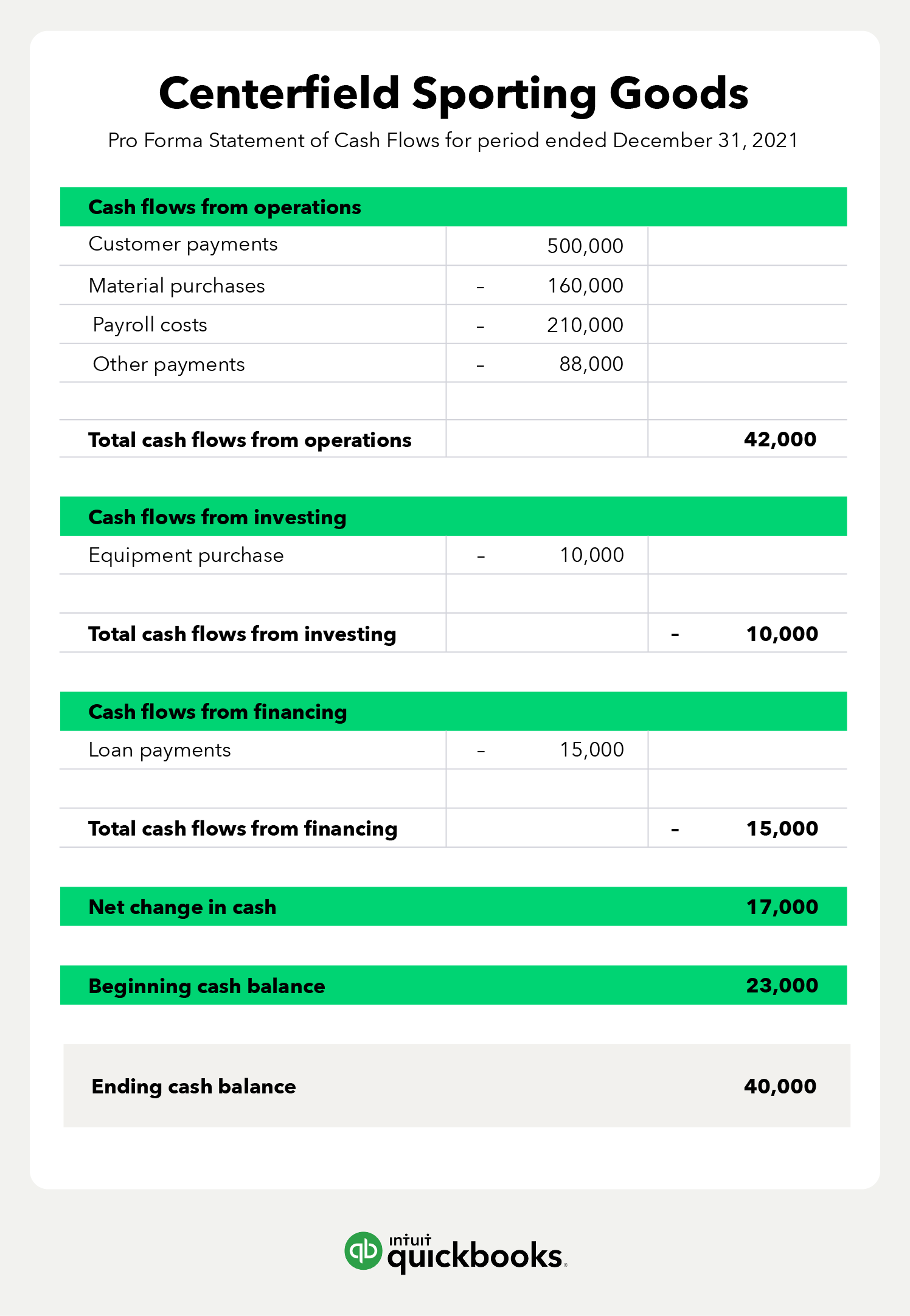

Pro forma report. If you’re considering adding a product line, opening a new location, or closing a company department, pro forma reports will project the outcome of your decision. Of pro forma financial information which complies with the requirements set out in annex ii of the pd regulation, pro forma financial information building block. There are three major pro forma statements:

Pro forma statements include adjustments made to gaap statements to provide a truer picture of the company's finances. Pro forma and financial reporting are two integral tools used in businesses to understand the performance of their finances. Effective when the presentation of pro forma financial information is as of or for a period ending on or after june 1, 2001.

Us investment companies arm 9652.26. Instead, it’s a tool created by management to help project future performance and plan future events. Pro forma financial statements present the complete future economic projection of a company or person.

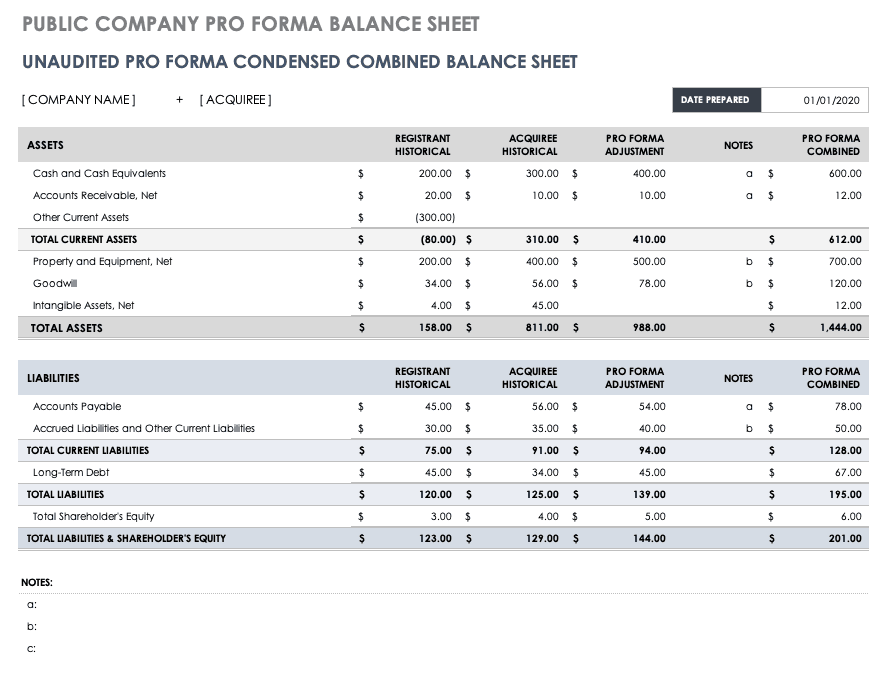

We will frequently be called upon to review the pro forma financial information. For example, create a pro forma balance sheet for 12 months in the future and populate the fields with projected asset values, liabilities, and. Key takeaways pro forma financial statements illustrate how a company’s financial position might change in the future.

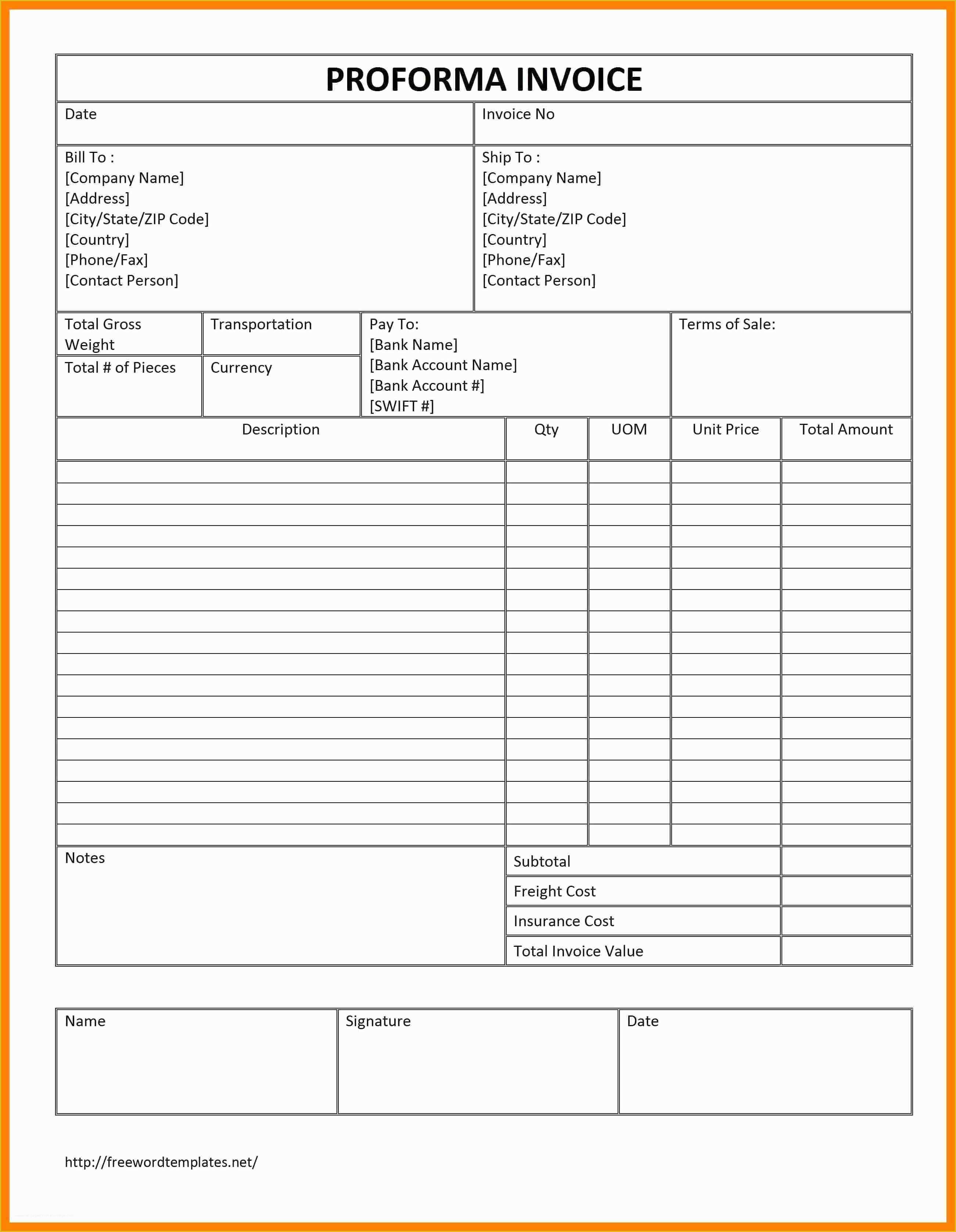

It includes an overview of the nature and purpose of pro forma financial information and when it should be presented, as well as. Often used to back up a lending or investment proposal, they are issued in a standardized format that includes balance sheets, income statements, and statements of cash flow. But under gaap, the company had lost $1 billion.

Pro forma statements can be used in risk analysis refers to the process of identifying, measuring, and mitigating the uncertainties involved in a project, investment, or business. A pro forma financial statement is a report prepared base on estimates, assumptions, or projections. Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future.

Pixel 6 and 6 pro. The term pro forma (latin for as a matter of form or for the sake of form) is most often used to describe a practice or document that is provided as a courtesy or satisfies minimum requirements, conforms to a norm or doctrine, tends to be performed perfunctorily or is considered a formality. Reporting on pro forma financial information source:

Agora, ele quer mostrar para as pessoas que estava errado. Pro forma statements are used to analyze the financial impact of a major business decision. Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions.

Pro forma statements are a projected version of a company's financials, based on the current financial situation, expected results, and various projections. This date is referred to as a “reporting date.” like a pro forma income statement, a pro forma balance sheet would be created by building a balance sheet for a given date based on projected values. If you are a developer with a supported google pixel device, you can manually update that device to the latest build for testing and development.

Pro forma income statements pro forma balance sheets Pro forma financial information must be accompanied by a report prepared by independent accountants or auditors. Builds are available for the following pixel devices: