Beautiful Info About Non Cash Items In Flow Statement

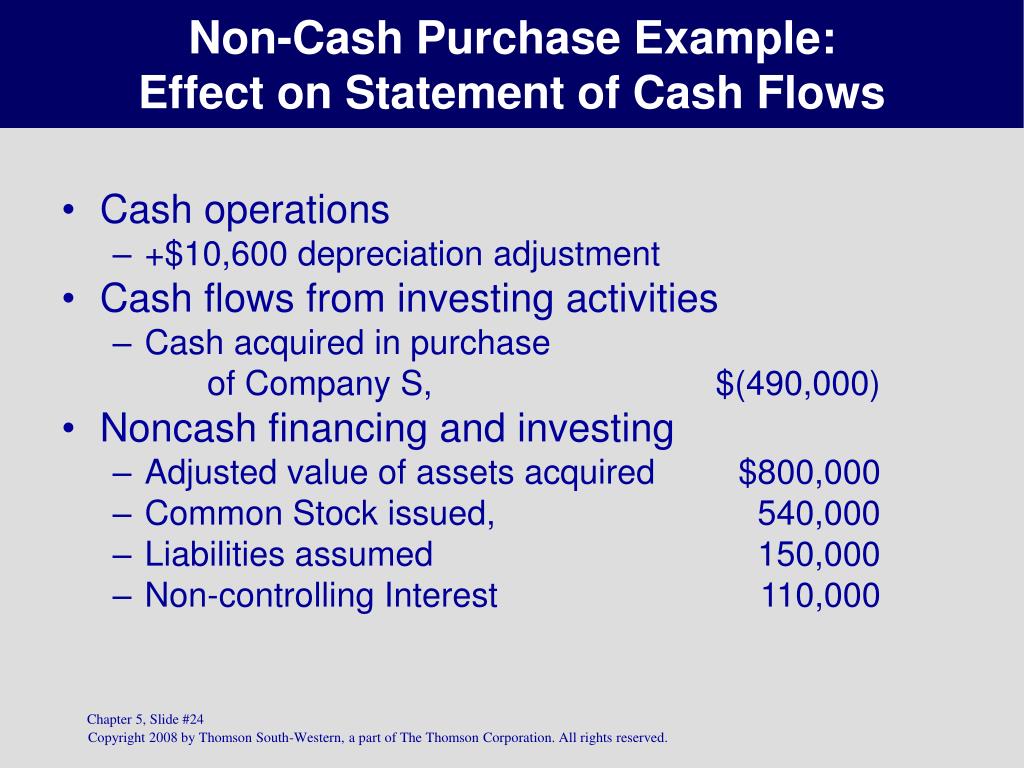

How should the equipment acquisition be reflected in fsp corp’s december 31, 20x1 statement of cash flows?

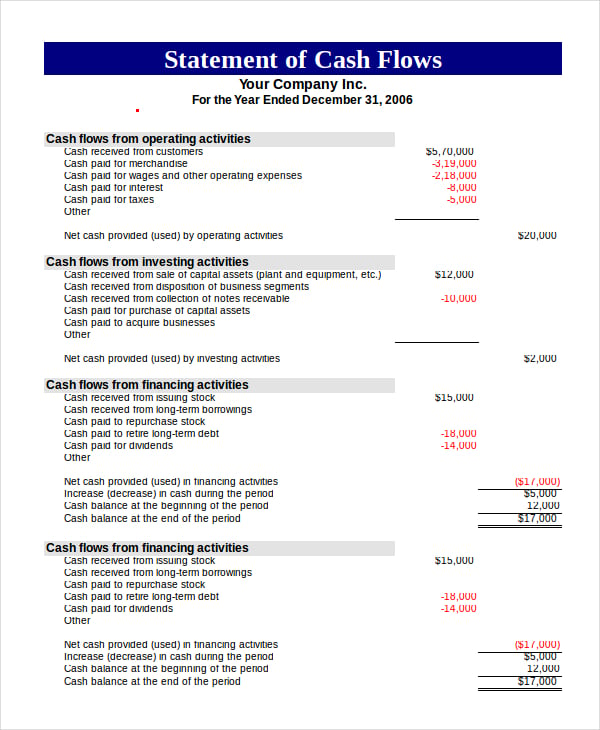

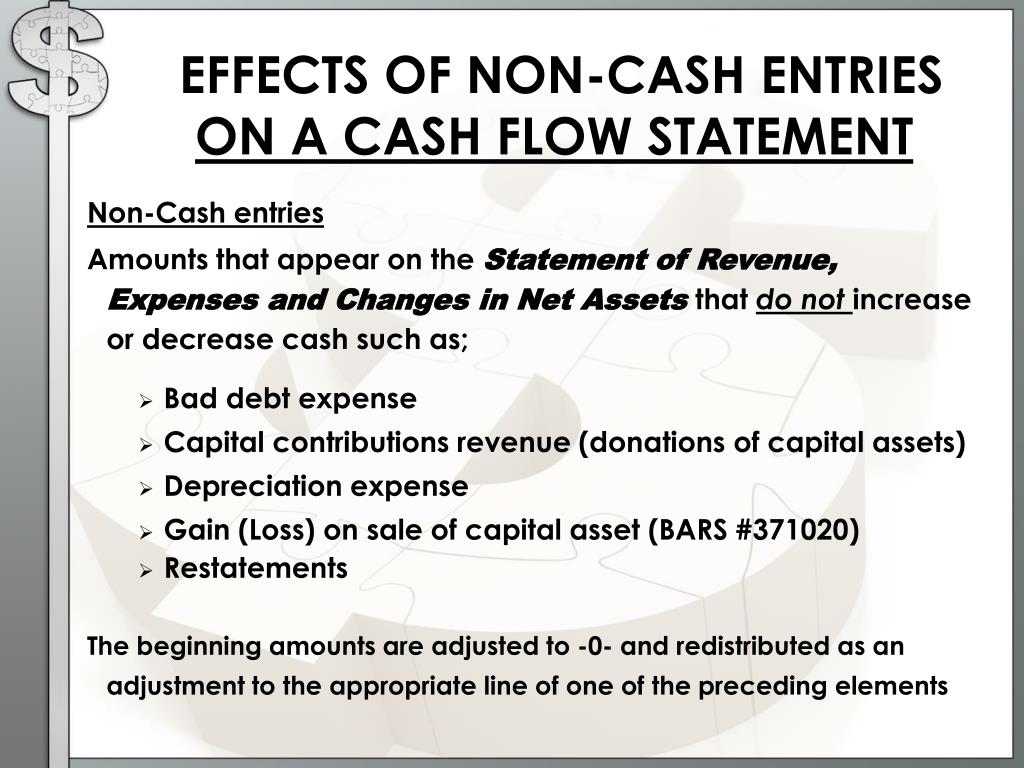

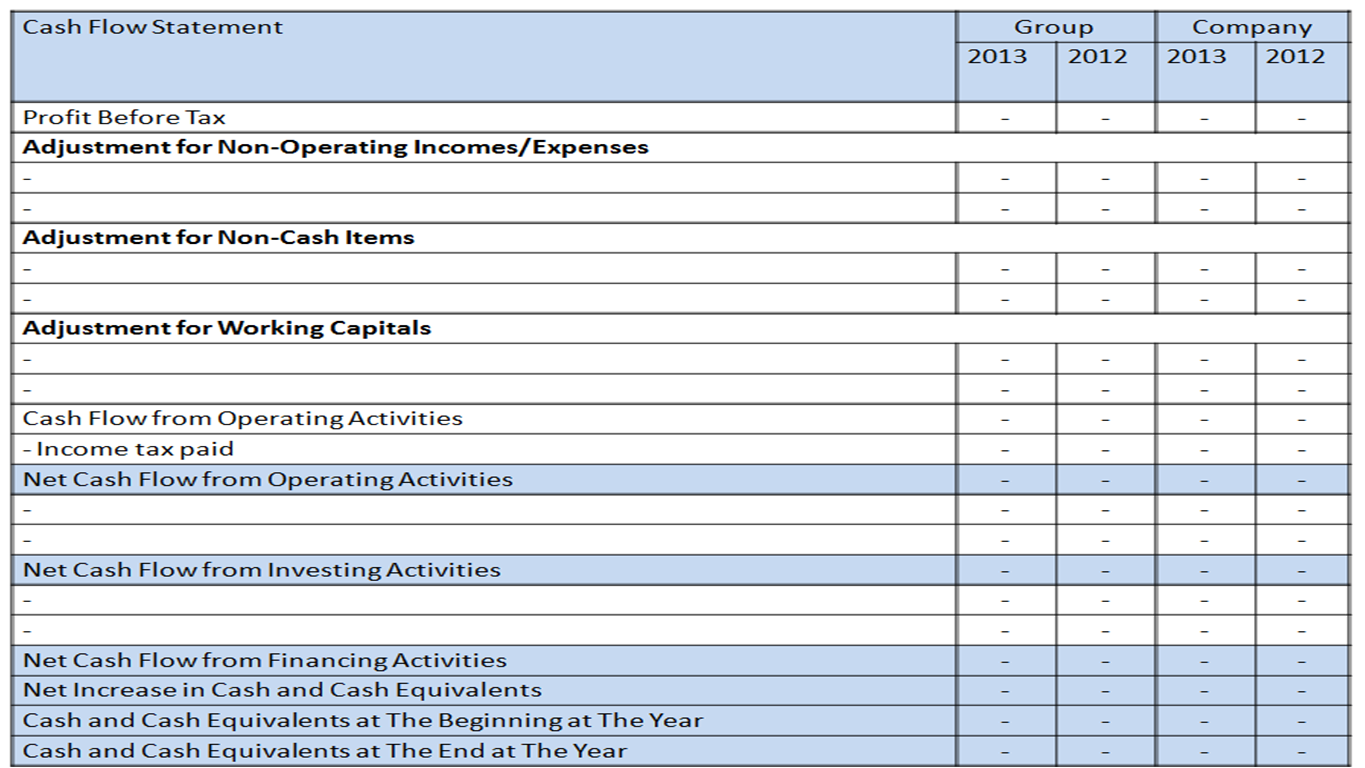

Non cash items in cash flow statement. These items are taken on the income statement in small increments called depreciation or amortization. Adjustments and correct terminology for each item (list all inflow/outflow activities). Cash flow definitions cash flow:

Still, it does not relate to the cash, i.e., they are not paid in cash by the company and include expenses like depreciation, etc. Subtract capital expenditure from operating cash flow. The company declared $20,000 of cash dividends and paid $18,000.

It encompasses items like depreciation, bad debts, and amortization, which affect the net. Analysis until fsp corp has made a cash payment related to the equipment, the equipment acquisition is a noncash activity that should not be reflected in the statement of cash flows. Streamline your financial management with our free cash flow statement template.

Net income for 2023 $40,000. If we purchase a new dump truck, we don’t take the entire purchase price as an expense. Property, plant and equipment resides on the balance sheet.

(a) the acquisition of assets either by assuming directly related liabilities or by means of a lease; In accounting, noncash items are financial items such as depreciation and amortization that are included in the business’ net income, but which do not affect the cash flow. Prepare a statement of cash flows for 2023 using the indirect method of calculating the net cash provided/used.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. These items are taken on the income statement in small increments called depreciation or amortization. The cfs measures how well a.

In other words, these are expenses that are listed in an income statement that do not involve cash payment. Cash flows exclude movements between items that constitute cash or cash equivalents because these components are part of the cash management of an entity rather than part of its operating, investing and financing activities. The business owes the money that is in accounts receivable but not received yet.

The cash flow statement reflects the actual amount of cash the company receives from its operations. Property, plant and equipment resides on the balance sheet. The income statement must record this amount.

Cash on hand and demand deposits (cash balance on the balance sheet). Easily compute key financial indicators to enhance fiscal strategy. Inflows and outflows of cash and cash equivalents (learn more in cfi’s ultimate cash flow guide ).

Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally.